Oil And Natural Gas: We Got The Significant Jump Here

- During the Asian trading session, the price of oil made a significant jump from $84.00 to $86.70 level.

- During the Asian trading session, the gas price recovered after falling to $7.70.

- The United States has announced that it does not expect progress in restarting the 2015 Iran nuclear deal.

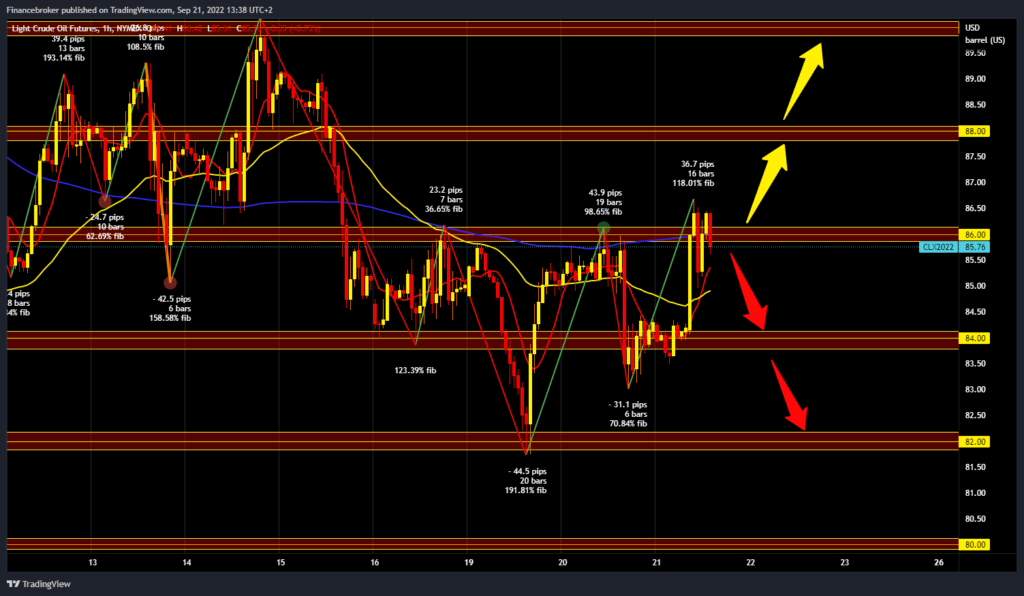

Oil chart analysis

During the Asian trading session, the price of oil made a significant jump from $84.00 to $86.70 level. Now we are trying to find support there so we can continue our recovery. Additional support was found in the MA200 moving average. The price of oil could now continue to recover with further positive consolidation. Potential higher targets are $87.00 and $88.00 levels. We need a pullback below the $86.00 support level for a bearish option. Then, with the continuation of the negative consolidation, we could expect further withdrawal of the price to lower support levels. And we could meet again at the $84.00 support level. A break below the price would open up space for us to fall towards the $82.00 level.

(Click on image to enlarge)

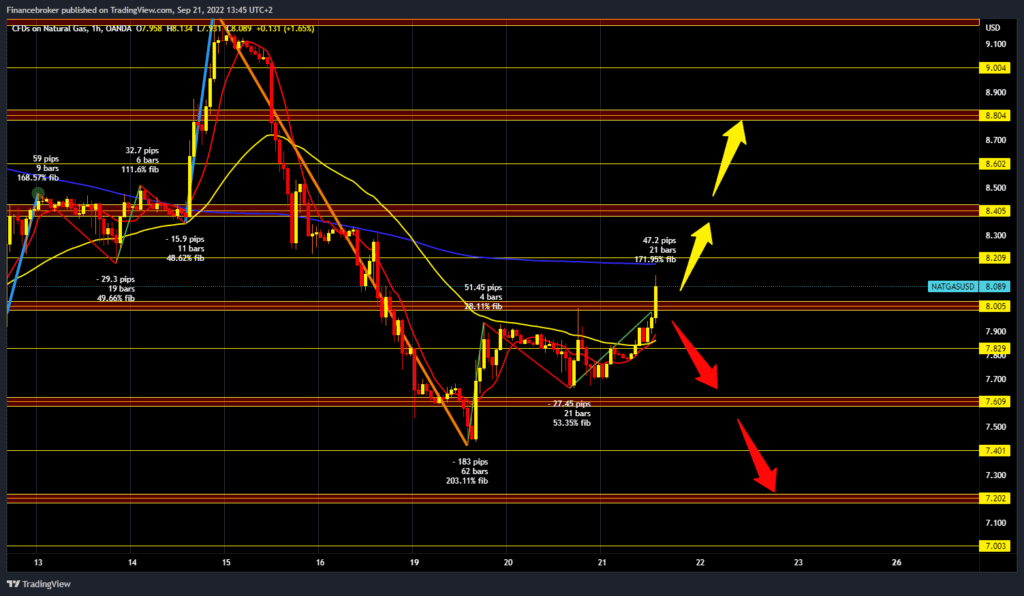

Natural gas chart analysis

During the Asian trading session, the gas price recovered after falling to $7.70. First, the price rose above $7.80, and soon it was above $8.00. We can expect the next obstacle at the $8.20 level because we have additional resistance in the MA200 moving average. If we could manage to climb above, we could hope for further price recovery. Potential higher targets are $8.40 and $8.60 levels. We need a new negative consolidation and a drop below the $8.00 support level for a bearish option. The price of gas could then drop again to the $7.80 level. And if it doesn’t find support there either, the decline could continue to the $7.60 or $7.40 support level.

(Click on image to enlarge)

Market Overview

The United States has announced that it does not expect progress in restarting the 2015 Iran nuclear deal. Such a scenario reduces the prospects for the return of Iranian oil to the international market. OPEC+ is currently lagging behind its production targets. The oil shortage highlights the limited supply on the market. According to data from the American Petroleum Institute, crude oil and fuel stocks in the US increased by about 1 million barrels in the previous week.

More By This Author:

The Ethereum Merge’s Post-Merger EffectsChinese Yuan Hit A 26-Month Low While The U.S. Dollar Rallied

Meta And NFT Rentals: What’s happening?

Disclaimer: Finance Brokerage and its workforce cannot, and do not, absolute warrant the accuracy, relevancy, reliability, consistency, and completeness of any information and materials in the ...

more