Noise, Myths And Mechanics In The Silver Market

Image Source: Pixabay

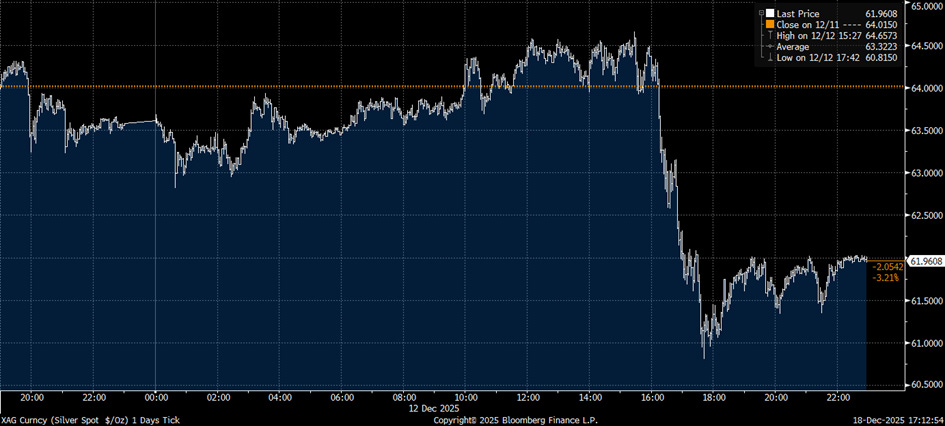

There was a huge outcry when the price of Silver plummeted by almost 6% in less than two hours last Friday – after previously reaching a new all-time high of US$64.65. As is so often the case, voices were raised accusing the market of manipulation. As a result, we were inundated with emails and inquiries. Reason enough for us to take a closer look at the recurring rumors of market manipulation in this issue.

(Click on image to enlarge)

The so-called bullion banks are those institutions that play a central role in the trading, storage, and financing of precious metals at the LBMA in London. These include JP Morgan, UBS, HSBC, Deutsche Bank, and others. There is no question that some of these banks have been convicted of market manipulation on several occasions in the past. The relevant cases are well documented – see here, here, and here.

If you have physical precious metals and the owners do not demand physical delivery, there are numerous opportunities to generate additional income from them: through derivatives, swaps, lending transactions, synthetic products, and the like. However, this model only works as long as control over the physical metal is guaranteed. With the exploding demand for physical Silver from China and India, this source of income is increasingly drying up.

When people talk about “paper Gold” – or, analogously, paper Silver – they usually mean the COMEX (CME, Chicago Mercantile Exchange) in New York. Options, futures, and other derivative products are traded there. The trading volume of these paper products can be ten times that of physical trading – which makes perfect sense, as transporting and storing physical metal is costly.

Of course, the bullion banks from the London trade are also active on the CME. And, just as naturally, good money can be made with derivatives in New York and the underlying metal in London. However, the often-expressed theory that banks sell futures in order to deliberately push down the price makes little sense. Selling pressure – which leads to a lower price – only arises at the moment of sale itself. After that, the seller is obliged to deliver if requested – something that very few market participants strive for. If you sell futures with the intention of buying them back later at a lower price (i.e., as a short position), you expose yourself to the risk of rising prices and potentially massive losses until that time. We at Pretiorates have been or are currently active as traders at various international banks and do not know of any institution that would take such a risk over a longer period of time and on a large scale. Professional traders are generally hedged – either through derivatives or synthetic structures.

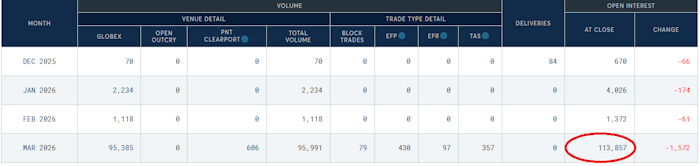

Looking at the current CME data on open Silver contracts for March 2026, the number of open positions is indeed exceptionally high. However, it would be wrong to conclude that these are predominantly short positions. Mining companies also sell their future production via futures in order to secure their margins and maintain financial planning security.

A single contract corresponds to 5,000 ounces of Silver. The current open interest of nearly 114,000 contracts thus represents an impressive 569 million ounces of Silver – around two-thirds of global annual production. At the same time, however, it should be noted that several hundred million ounces of Silver are traded daily on COMEX.

Of course, there are investors who speculate on falling prices by selling futures and come under considerable pressure when prices continue to rise. If they cannot deliver the corresponding Silver, they will sooner or later have to cover their positions – which in extreme cases can lead to a so-called short squeeze. At the same time, however, there are also numerous professional investors operating in the market who engage in arbitrage and are hedged accordingly.

The high volatility in Silver trading in recent months is a veritable El Dorado for arbitrageurs and intraday traders. Price differences between different exchanges, but also between futures and options, are often exploited simultaneously. For example, there may be a profitable spread between the purchase of call options and the simultaneous sale of a futures contract. Today, these strategies have long been taken over by computers and algorithms. Open positions in both futures and options are increasing, but sooner or later they will be closed out or settled in cash. This has little lasting impact on actual price formation in the spot market.

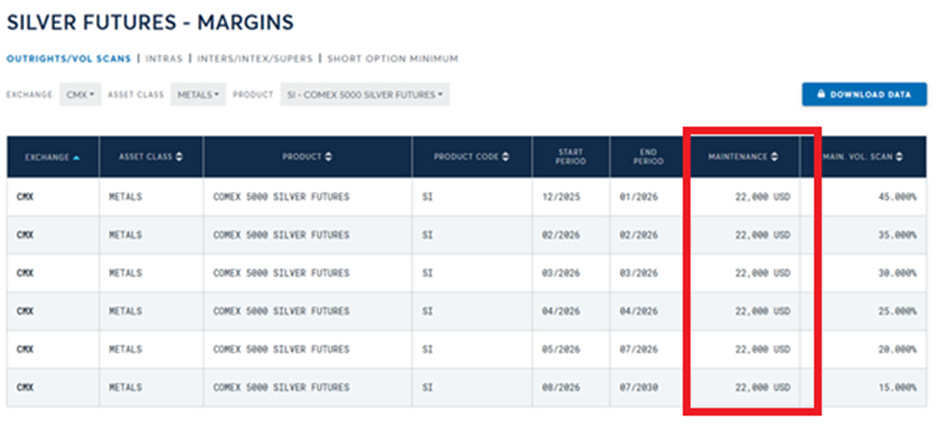

Investing in futures has the advantage of requiring significantly less capital. A Silver future of 5,000 ounces currently represents a value of around US$325,000, but only around US$22,000 needs to be deposited as collateral. If losses exceed this margin, the broker issues the infamous “margin call” – with a request to inject additional capital or close the position.

The exchange itself can adjust the level of these margins at any time. If the price or volatility of the underlying asset rises too sharply, the requirements are increased. The investor must then provide additional capital or reduce their position – in extreme cases, liquidate it completely. This is exactly what happened last Friday when the CME announced that it would raise the margin per Silver contract from $20,000 to $22,000.

(Click on image to enlarge)

This margin increase was the immediate trigger for last Friday’s sharp correction. In addition, numerous traders are likely to have amplified the movement. Within a single trading day, a trader may well sell first and then buy back later, ideally at lower prices.

So-called “cross-market trades” are prohibited. These are strategies in which futures are first sold and then targeted sales are made in the spot market in order to push down the price. As the futures price follows this decline, the contracts can be bought back at a profit. Whether the trader makes little or no profit when buying back in the spot market is irrelevant.

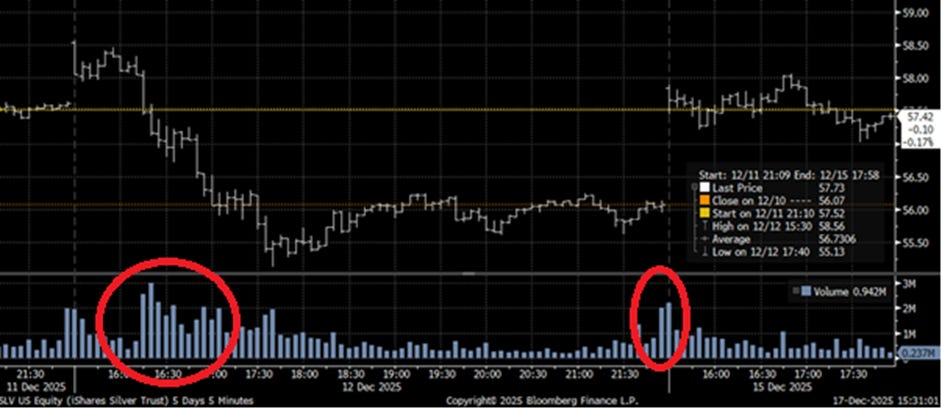

It was striking that during the price pressure last Friday, the iShares Silver ETF saw unusually high trading volumes both at the start of trading and shortly before the close of trading. This could fuel suspicions of cross-market trades. However, this can only be proven by an in-depth investigation by the stock exchange supervisory authority. If such transactions are carried out across multiple trading venues, however, various supervisory authorities are involved – which pushes monitoring to its limits.

(Click on image to enlarge)

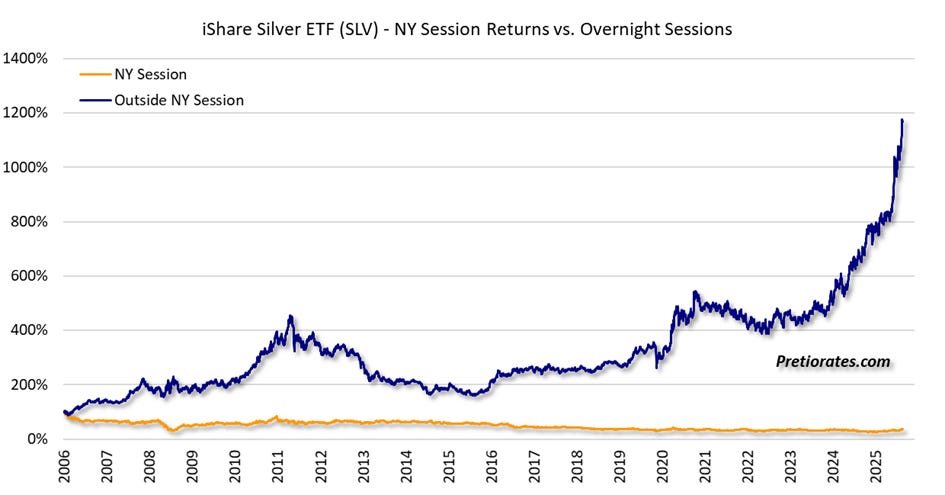

It is undisputed, however, that US Silver trading has been subject to a certain degree of price suppression for years. We became aware of an analysis by Goldchartus.com and analyzed it ourselves using the iShares Silver ETF (SLV). The ETF clearly correlates with the price of Silver. Looking at the cumulative daily percentage movements during US trading hours since its launch in April 2006, an investor would have lost around 65%. Outside US trading hours – i.e., from the close of trading to the next opening – the same investor would have achieved a cumulative performance of no less than 1,165% !!!

This can be explained in part by the fact that a large proportion of Silver demand comes from Asia and is active during trading hours there. However, the Chinese in particular have not been strong buyers since 2006. As early as 2011, the outperformance was over 400% at times.

(Click on image to enlarge)

So does it make sense to focus intensively on short positions in the Silver or Gold market? In our opinion, no. These rumors have been circulating on the markets for over 30 years. They are rarely proven and are energy-intensive. It is striking when large sell orders are placed in an extremely short period of time – often even in illiquid, off-exchange phases – causing the price to plummet abruptly. The motive in such cases is obvious: price pressure. However, it is equally obvious that supervisory authorities will continue to uncover new abuses in the future. In all asset classes.

Regardless of this, Silver is becoming increasingly scarce due to massive industrial demand. Whether in the solar industry or solid-state batteries, demand is growing steadily. The mining industry can hardly respond to this: new mines take many years to develop, and around three-quarters of Silver is only produced as a by-product of Gold, Copper, or other mines anyway. Long-term industrial demand will continue to rise, while bullion banks are losing their traditional sources of income due to dwindling access to physical stocks.

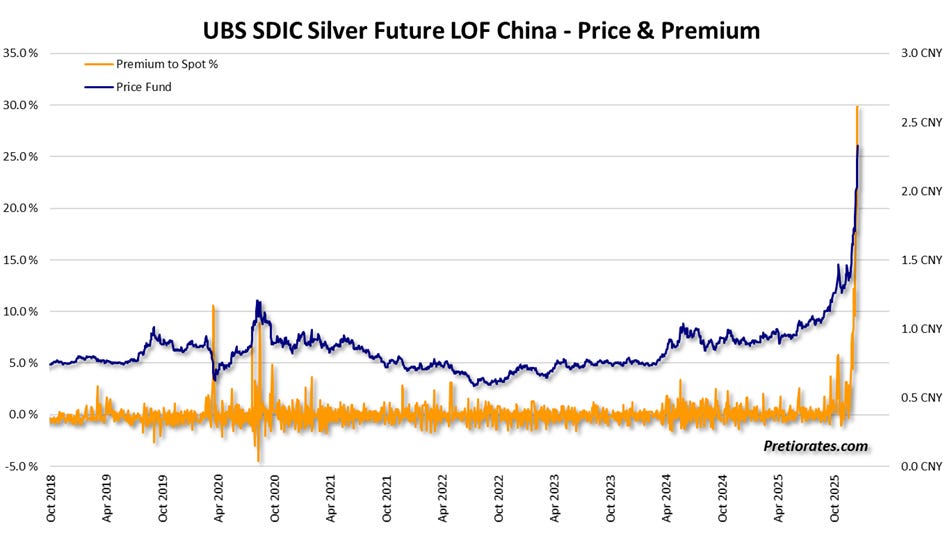

Large price increases therefore remain entirely possible – perhaps even sooner than many expect. The media will probably call it a “short squeeze” because it’s a simple explanation. In fact, long-term upward trends in precious metals almost always end in euphoria and parabolic movements. Western investors remain significantly underinvested in precious metals. In China, on the other hand, a veritable buying frenzy can already be observed: the premium on the purchase price of the only Silver ETF on the Shanghai Stock Exchange recently rose to an irrational 30%.

(Click on image to enlarge)

More By This Author:

When Silver Runs Hot And Platinum Smells OpportunityThe Silver Awakening

Is The US Treasury Market In The Right Boat?

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more