New Gold Apex Pattern – How Will The U.S. Fed Rate Decision Affect This?

My research shows a new Gold Apex pattern is set up for September 11~15. Around September 11 or after, Gold will attempt to reach this new Apex level near $1766. This price pattern is important because the US Fed rate decision date is September 20~21, and a host of economic data reporting comes out the week before the Fed decision.

My educated guess is Gold & Silver will begin a volatile breakout move, possibly rolling lower to retest support near $1672, before attempting to move higher as global fear starts to elevate. I believe the current lower support level is critical to understanding the opportunities in Gold. If the $1672 level is breached to the downside, it means that Gold has lost a critical support level and will likely trend lower.

Given the statement by Powell last Friday, it seems the US Fed will not pivot and will do what is necessary to tame inflationary trends. Recently I posted two articles about Gold and the Fed that you should review as we move toward the September 11~15 dates.

- August 9, 2022: GOLD-TO-SILVER RATIO HEADING LOWER – SETUP LIKE 1989-03

- August 3, 2022: SHOULD WE BE PREPARED FOR AN AGGRESSIVE U.S. FED IN THE FUTURE?

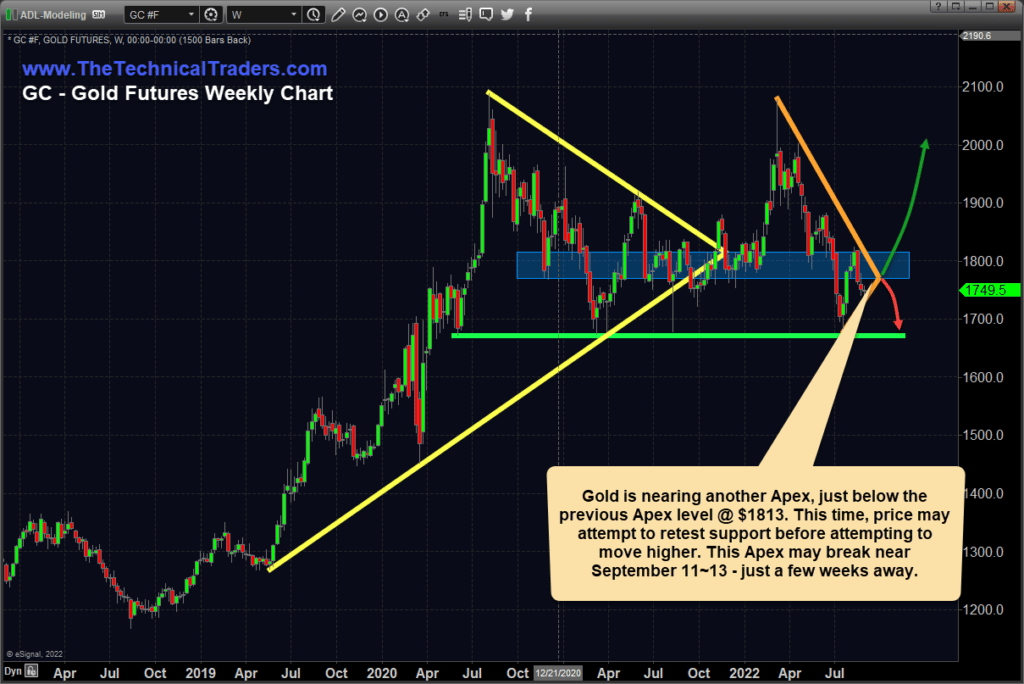

WEEKLY GOLD CHART

I suspect the $1766, the current Apex level, will play a critical role as new support/resistance going forward. The strength of the US Dollar should have weakened Gold more aggressively, but Gold is holding up quite well in the face of an ever-stronger US Dollar.

Some major event may occur near September 11~15 – just before the Fed rate decision on September 20~21.

(Click on image to enlarge)

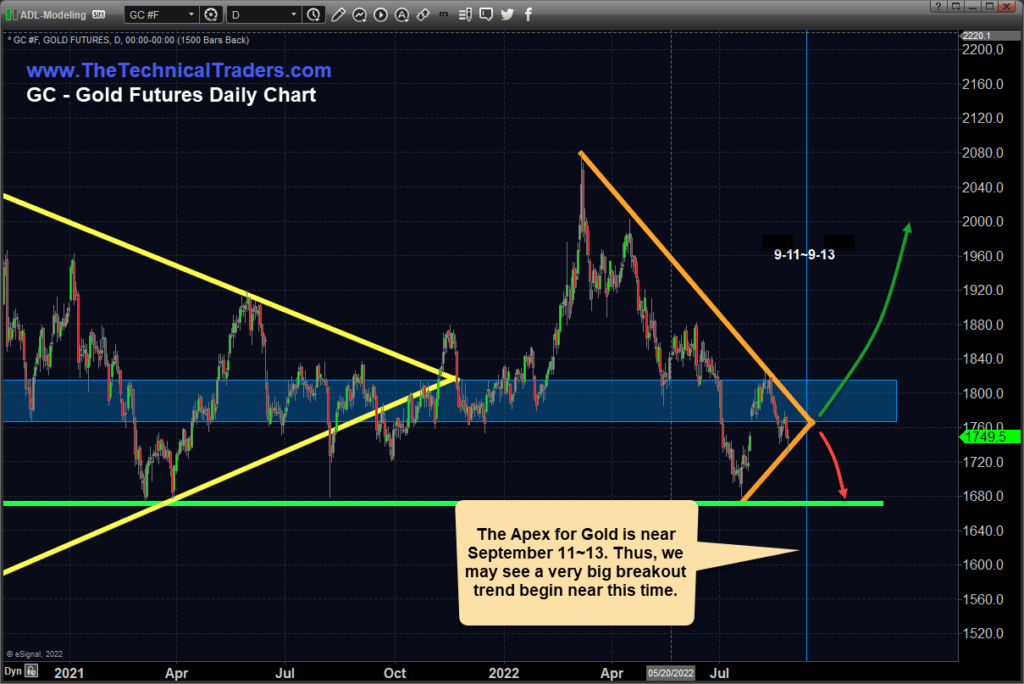

DAILY GOLD CHART

Price Apex patterns, like this one in Gold, usually resolve with an aggressive volatility event before establishing any new trends. I often term these events a “washout rotation.”

For example, look at the Apex of the previous (YELLOW) Flag/Pennant formation. A price neared the Apex, but it stayed low compared to the lower yellow boundary. Then, a price reached the true Apex, and a broad 6.5% price rotation took place, eventually settling near $1780.

What happened next was price settled into a rally phase originating near $1780 and continuing up to $2077 – a +17.75% rally.

(Click on image to enlarge)

CONCLUDING THOUGHTS

I can’t predict the future any better than you can. But I do understand Flag/Pennant formations. I believe the current Pennant formation in Gold will resolve to the upside – possibly launching Gold into another significant rally phase.

I continue to warn my followers that Gold and Silver must initiate a new upward price trend to break free of the current downward price trend. Yes, we saw a strong rally attempt in early 2022, but that topped out and slid down over the past 4+ months. Now, as we resolve the current Price Apex, we’ll need to see a substantial price rally above $1828 to confirm any potential for a new bullish rally phase in Gold.

More By This Author:

Are The US Markets In Stage #4 Of The Excess Phase Peak Pattern?

Discovering The World Of Options – Buying Or Selling

Crude Oil Prices – Will They Hold Above Key Support Level Or Begin To Unwind?

If you want to know where the market is headed each day and week, well in advance then be sure to join my Pre-Market Video Forecasting service which is more