Natural Gas Technical Analysis: Price Is Settling Lower After

Spot natural gas prices (CFDS ON NATURAL GAS) settled on a decline in recent trading at intraday levels. By the moment of writing this report, it recorded slight daily losses of 0.08%, settling at the price of $7.876 per million British thermal units. This happened after it slightly increased by 0.69% during yesterday’s trading.

The price of natural gas in the United States is holding at its lowest level in six weeks. This is due to expectations of lower demand over the next two weeks than previously expected as production approaches its record level.

Prices also fell further on expectations that exports will fall further next month when the Cove Point LNG plant in Maryland will shut down for two weeks for maintenance in October.

US gas exports have already been cut for several months due to the ongoing outage at the Freeport LNG export plant in Texas, which has left more US gas for utilities to pump into storage next winter.

But despite the recent declines, gas futures are still up about 109% so far this year, as higher prices in Europe and Asia keep demand for US LNG exports strong. Global gas prices soared due to supply disruptions and sanctions linked to Russia's invasion of Ukraine on February 24.

Natural Gas Technical Analysis

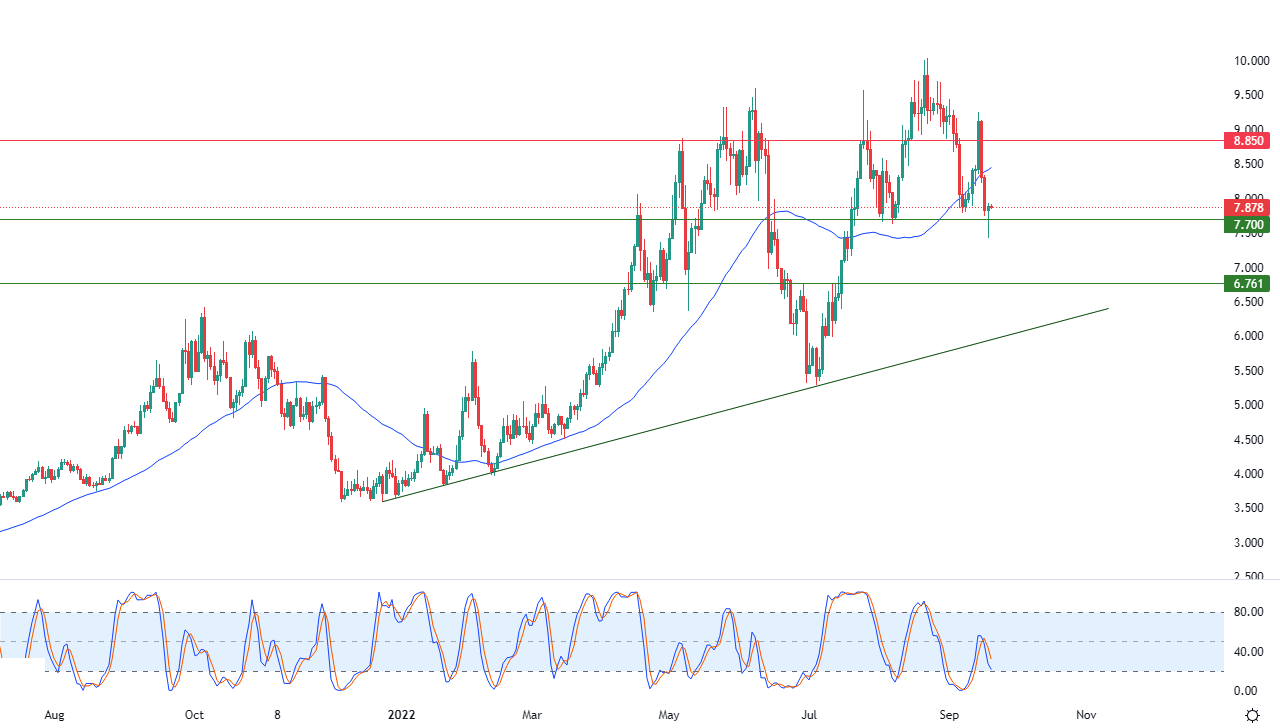

- Technically, in yesterday’s trading, the price reached the important support level of 7.700.

- This is a support that we had referred to in our previous reports, which gained it some positive momentum that helped it rebound,

- This turned those early losses into profits at the end of the session, trying to compensate for part of what it incurred from previous losses.

This comes considering the dominance of the bearish corrective trend in the short term. Negative pressure is continuing for its trading below the simple moving average for the previous 50 days, as shown in the attached chart for a (daily) period. In addition, we notice the return of negative signals on the relative strength indicators.

Therefore, our expectations indicate a decline in natural gas during its upcoming trading, especially if it breaks the 7.700 support level, targeting the 6.76 support level after that.

(Click on image to enlarge)

More By This Author:

USD/JPY Technical Analysis: Limited Trading With Bullish MomentumEUR/USD Forex Signal: Looking Weaker

EUR/USD Technical Analysis: Bears’ Control Continues

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more