Natural Gas Technical Analysis: Preparing To Attack Resistance

Spot natural gas prices (CFDS ON NATURAL GAS) rose in the recent trading at the intraday levels, to achieve daily gains until the moment of writing this report, by 0.84%. It settled at the price of $9.411 per million British thermal units, after its rise during Friday’s trading by 1.02 %. During the past week the price achieved gains for the second week in a row, by 5.35%.

Russia's state-owned energy exporter Gazprom said Friday that it will shut down Nord Stream's natural gas pipeline to Germany for three days for maintenance later this month. I am giving prices a boost after last Tuesday's settlement topped a 14-year high.

Eastbound gas (UNG) flows through the Yamal pipeline to Europe to Poland from Germany rose on Monday, operator data showed, while flows through the Nord Stream 1 pipeline from Russia remained flat.

The price increase came despite record production and ongoing outages at the Freeport LNG export plant in Texas, which has left more gas in the US for utilities to pump into storage for the coming winter.

So far this year gas futures are up 150%, as prices in Europe and Asia continue to demand US LNG exports. Global gas prices soared due to supply disruptions and sanctions linked to Russia's invasion of Ukraine on February 24.

Natural Gas Technical Outlook

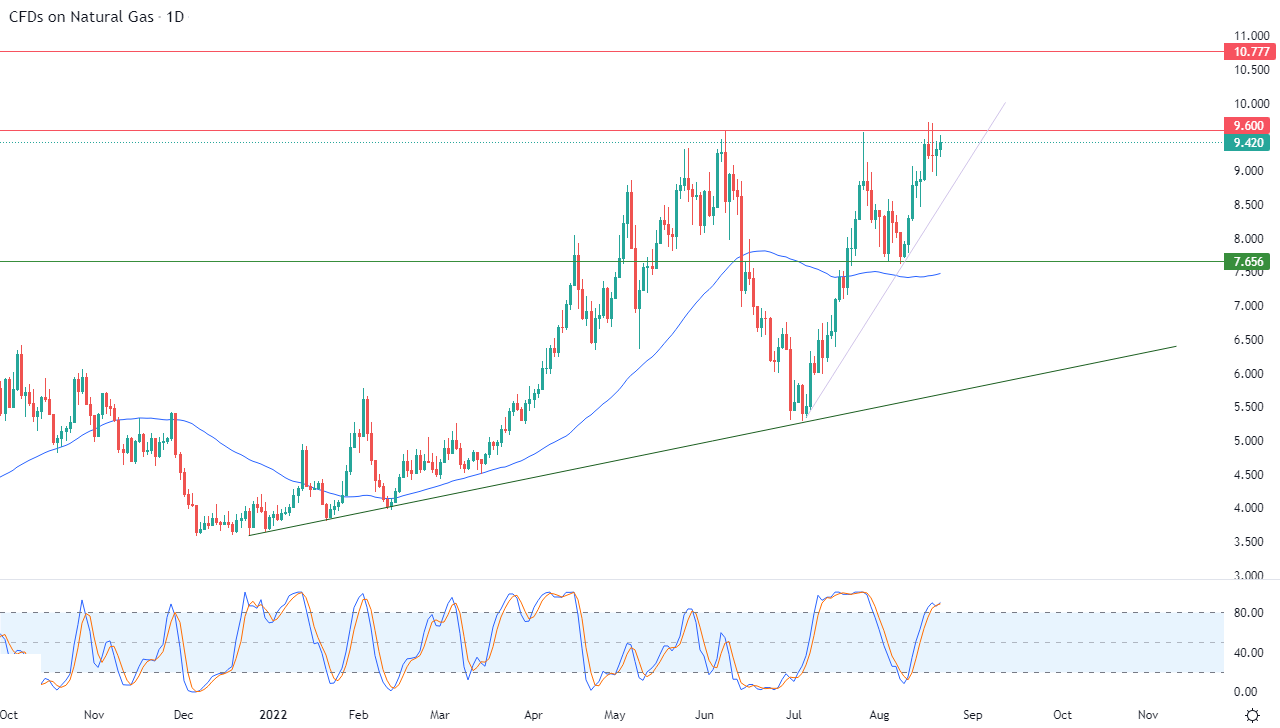

Technically, the price is now preparing to attack the pivotal resistance level 9.600, in light of the dominance of the main bullish trend in the medium and short term along a slope line. This is shown in the attached chart for a (daily) period, with the continuation of the positive support for its trading above its simple moving average for the previous 50 days. In addition, we notice the continuation of positive signals on the RSI indicators, despite reaching overbought areas.

Therefore, our expectations indicate more ascent for the spot price of natural gas during its upcoming trading, provided that it first breaches the resistance level 9.600, and then targets the resistance level 10.70.

More By This Author:

Forex Today: Greenback Firm, Stocks Weak

Pairs In Focus This Week – GBP/USD, NZD/USD, Natural Gas - Sunday, Aug. 21

EUR/USD Forex Signal: Euro Is Set To Hit Parity This Week

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more