Natural Gas Hits Its Final Target. The Luck Of St. Patrick’s Day?

St. Patrick’s Day is historically considered one of the best trading days. Apparently, it brought some luck to natural gas this time.

The second target hit – BOOM! Yesterday, on St. Patrick's Day, the opportunity to bank the extra profits from my recent Nat-Gas trade projections (provided on March 2) finally arrived. That trade plan has provided traders with multiple bounces to trade the NYMEX Natural Gas Futures (April contract) in various ways, always depending on each one’s personal risk profile.

To get some more explanatory details on understanding the different trading ways this fly map (trading plan) could offer, I invite you to read my previous article (from March 11).

To quickly sum it up, the various trade opportunities that could be played were as follows (with the following captures taken on March 11):

The first possibility is swing trading, with the trailing stop method explained in my famous risk management article.

(Click on image to enlarge)

Henry Hub Natural Gas (NGJ22) Futures (April contract, hourly chart)

The second option consisted of scalping the rebounds with fixed targets (active or experienced traders). I named this method “riding the tails” (or the shadows).

(Click on image to enlarge)

Henry Hub Natural Gas (NGJ22) Futures (April contract, 4H chart)

The third way is position trading – a more passive trading style (and usually more rewarding).

(Click on image to enlarge)

Henry Hub Natural Gas (NGJ22) Futures (April contract, daily chart)

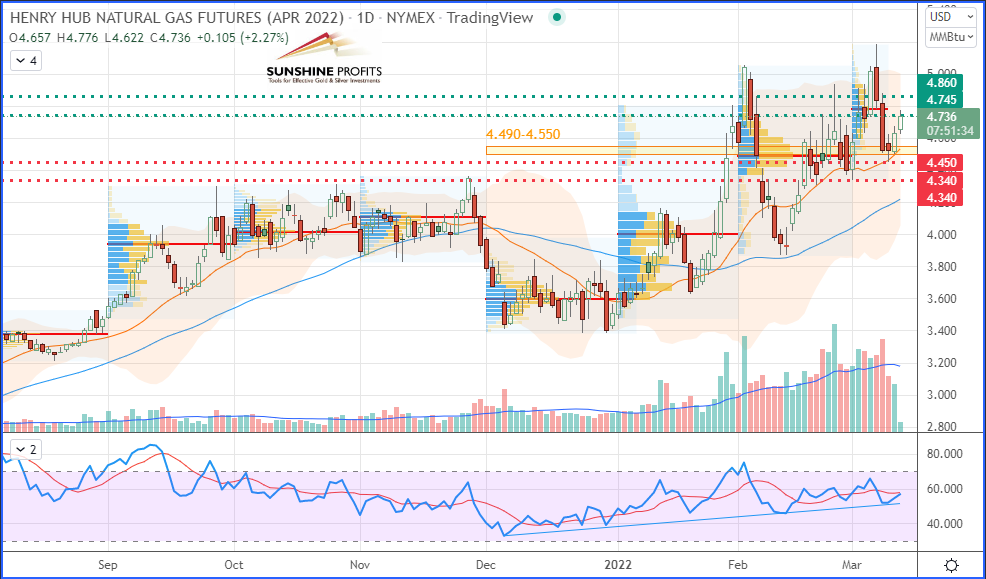

The chart below shows a good overall view of NYMEX Natural Gas hitting our final target, $4.860:

(Click on image to enlarge)

Henry Hub Natural Gas (NGJ22) Futures (April contract, daily chart)

(Click on image to enlarge)

Henry Hub Natural Gas (NGJ22) Futures (April contract, 4H chart)

As you can see, the market has provided us with multiple entries into the same support zone (highlighted by the yellow band) – even after hitting the first target, you may have noticed that I maintained the entry conditions in place – after the suggestion to drag the stop up just below the new swing low ($4.450). The market, still in a bull run, got very close to that point on March 15 by making a new swing low at $4.459 (just about 10 ticks above it). Before that, it firmly rebounded once more (allowing a new/additional entry) and then extended its gains further away while consecutively hitting target 1 ($4.745) again. After that, it finally hit target 2 ($4.860)!

Disclaimer: All essays, research and information found in this article represent the analyses and opinions of Sunshine Profits' associates only. As such, it may prove wrong and be ...

more