Natural Gas Futures: Scope For A Near-Term Knee-Jerk

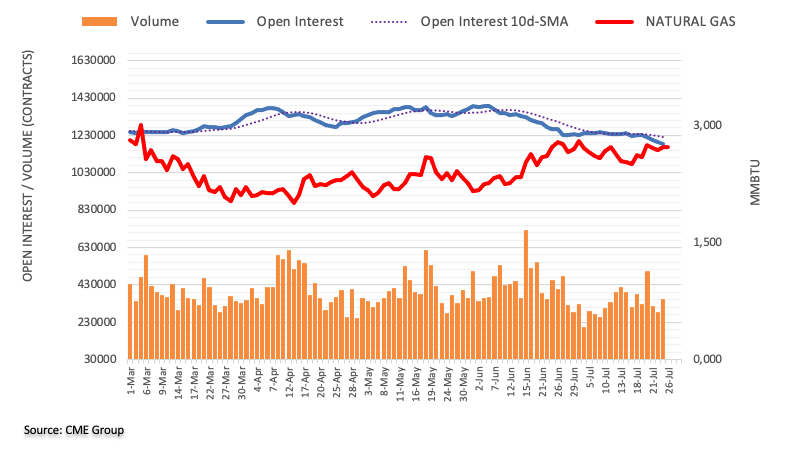

Considering advanced prints from CME Group for natural gas futures markets, open interest shrank for the 5th consecutive session on Tuesday, now by around 9.5K contracts. On the other hand, volume left behind two consecutive daily pullbacks and rose by around 68.7K contracts.

Natural Gas: Immediately to the upside comes $2.80

Tuesday’s uptick in prices of natural gas was on the back of shrinking open interest, which hints at the idea of a corrective move in the very near term. Looking at the broader picture, prices of natural gas seem to have embarked on a gradual recovery since early April. Against that, the next target now emerges at the weekly high near $2.80 per MMBtu seen on July 20.

More By This Author:

Natural Gas Futures: Probable Rebound In StoreNatural Gas Futures: Downward Pressure Appears Temporary

EUR/USD Price Analysis: The Loss Of 1.1100 Could Spark A Deeper Drop

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more