Natural Gas Futures: Rally Could Lose Traction Near Term

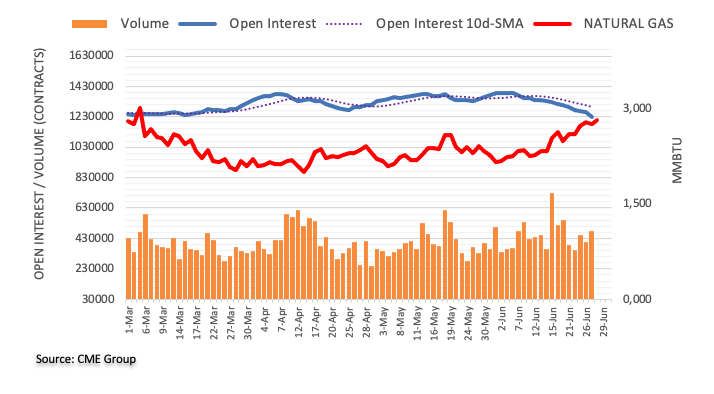

Considering advanced prints from CME Group for natural gas futures markets, open interest extended the downtrend in place since June 14 on Tuesday, this time dropping by around 30.5K contracts, the largest single-day drop so far this year. In the opposite direction, volume went up by around 71.2K contracts, reversing the previous daily pullback.

Natural Gas: Strong resistance emerges around $3.00

Prices of natural gas retreated modestly on Tuesday amidst the strong recovery in place since mid-June. The downtick was accompanied by a sharp drop in open interest, which suggests that a corrective move lies ahead in the very near term. On the upside, the March top just above the $3.00 mark per MMBtu continues to oppose decent resistance.

More By This Author:

USD Index Price Analysis: Further Weakness In Store Near TermCrude Oil Futures: Further Gains Not Ruled Out Near Term

EUR/USD Price Analysis: Minor Support Emerges Near 1.0840

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more