Natural Gas Futures: Near-Term Correction Likely

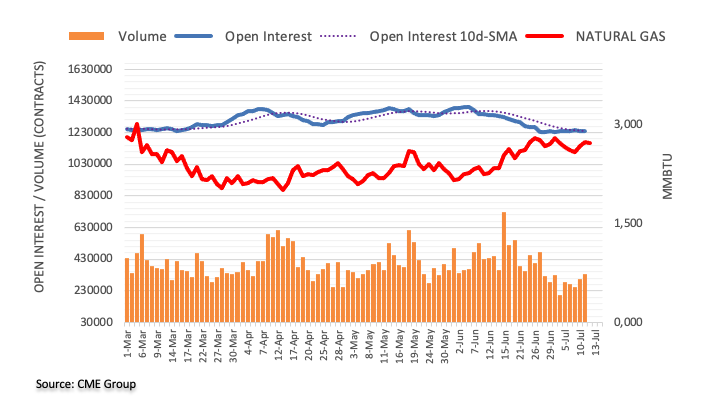

CME Group’s flash data for natural gas futures markets noted traders scaled back their open interest positions for the second session in a row on Tuesday, this time by around 3.7K contracts. Volume, instead, went up for the second consecutive day, now by around 34.2K contracts.

Natural Gas remains supported around the $2.50 zone

Prices of natural gas maintained the optimism and climbed to multi-session highs past the $2.70 zone on Tuesday. The move, however, was on the back of shrinking open interest, which should remove some strength from the weekly rebound. In the meantime, the $2.50 region per MMBtu continues to hold the downside for the time being.

More By This Author:

EUR/USD Price Analysis: Above 1.1030 Comes The 2023 PeakNatural Gas Futures: Probable Knee-Jerk Near Term

EUR/JPY Price Analysis: Further Losses Target The 154.00 Area

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more