Thursday, June 1, 2023 4:07 AM EST

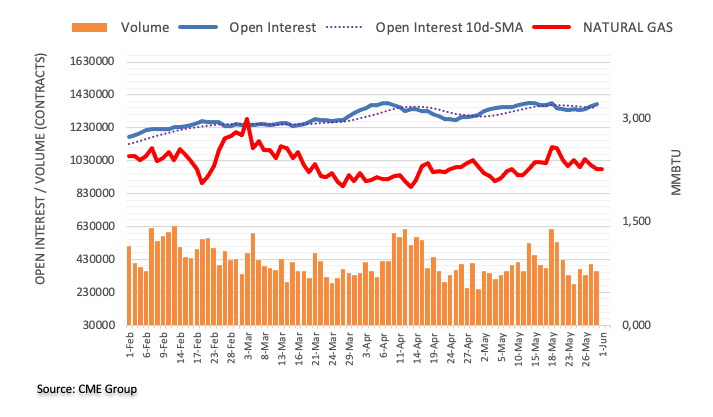

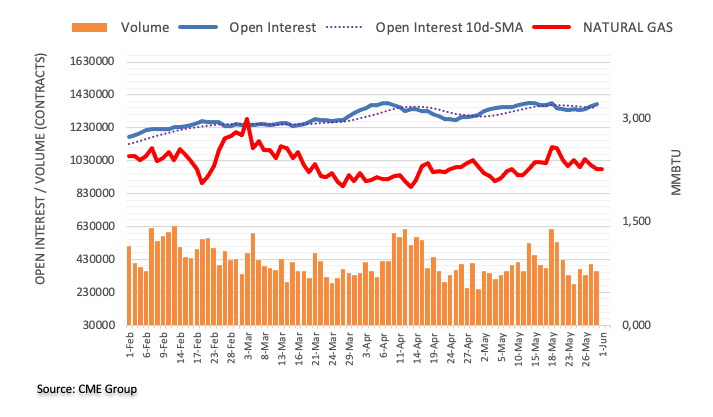

Considering advanced prints from CME Group for natural gas futures markets, open interest increased for the third session in a row on Wednesday, now by around 15.5K contracts. Volume, instead, remained erratic and shrank by around 42.7K contracts.

Natural Gas remains supported by $2.00

Wednesday’s downtick in prices of natural gas was amidst increasing open interest and is supportive of extra losses in the very near term. The persistent choppiness in volume, in the meantime, seems to underpin the multi-week consolidation still in place. So far, the commodity is expected to meet decent contention around the $2.00 mark per MMBtu.

More By This Author:

EUR/USD Price Analysis: Downward Bias Could Extend To 1.0516 EUR/USD Dips To Fresh 2-Month Lows Near 1.0660 Crude Oil Futures: Door Open To Extra Weakness

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

less

How did you like this article? Let us know so we can better customize your reading experience.