Tuesday, October 17, 2023 4:34 AM EST

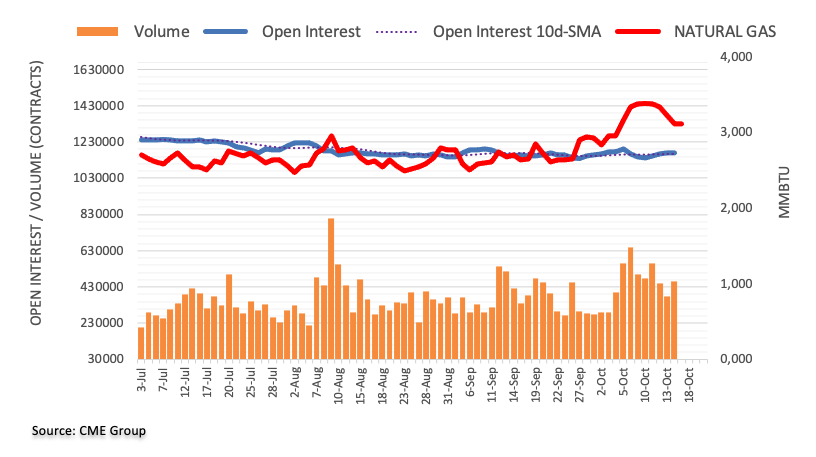

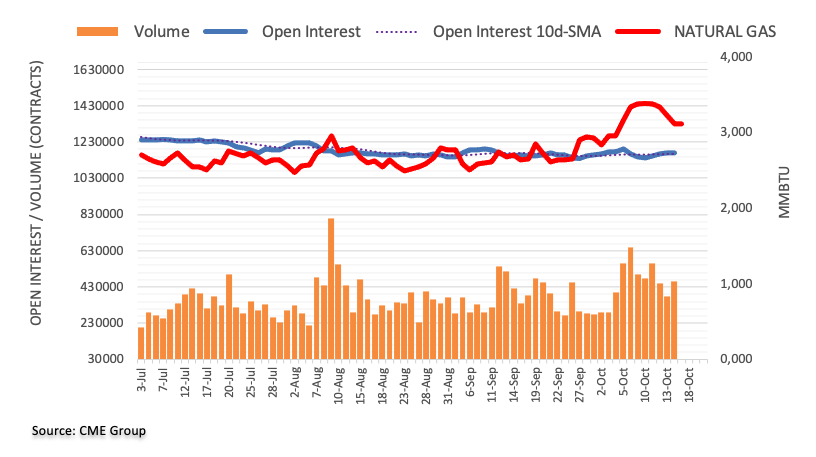

Considering advanced prints from CME Group for natural gas futures markets, open interest increased for the fourth session in a row at the beginning of the week, now by around 2.5K contracts. In the same line, volume reversed two daily drops in a row and rose by around 81.1K contracts.

Natural Gas: Initial support emerges around $3.00

Monday’s decline in prices of natural gas was in tandem with rising open interest and volume, which is indicative that extra retracements remain in store for the commodity in the very near term. In the meantime, there is a decent contention around the key $3.00 mark per MMBtu.

More By This Author:

Crude Oil Futures: Extra Pullbacks Not Favoured EUR/USD Price Analysis: Immediately To The Upside Comes 1.0640 EUR/JPY Price Analysis: Firm Resistance Remains Around 158.60

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

less

How did you like this article? Let us know so we can better customize your reading experience.