Natural Gas Futures: Corrective Move In The Pipeline

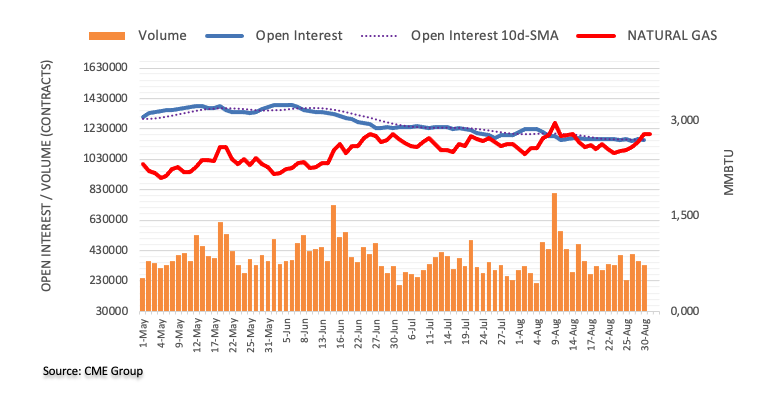

CME Group’s flash data for natural gas futures markets noted traders scaled back their open interest positions by more than 5K contracts on Wednesday, partially reversing the previous daily build. In the same line, volume dropped for the second consecutive session, now by around 25.4K contracts.

Natural Gas remains capped by $3.00

Prices of natural gas extended the uptrend for the fifth session in a row on Wednesday amidst diminishing open interest and volume. Against that, the continuation of the uptrend appears unlikely in the very near term, exposing some corrective moves instead. In the meantime, the commodity is expected to remain capped by the key $3.00 mark per MMBtu.

More By This Author:

EUR/USD Price Analysis: Extra Upside Now Targets 1.0970EUR/JPY Price Analysis: Next Stop At The 160.00 Mark

Natural Gas Futures: Further Advance In Store Near Term

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more