Natural Gas Futures: A Corrective Move Appears In Store

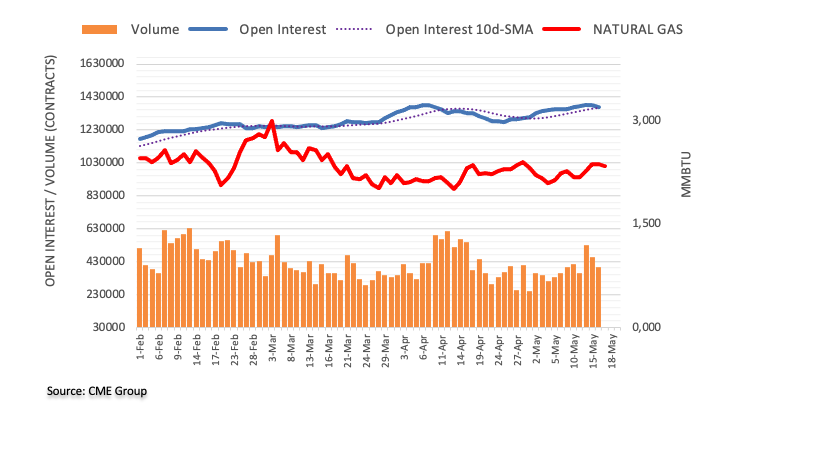

CME Group’s flash data for natural gas futures markets noted traders scaled back their open interest positions for the second session in a row on Tuesday, this time by around 14.1K contracts. In the same line, volume shrank for the second straight session, now by around 62.8K contracts.

Natural Gas: Gains remain capped near $2.50

Tuesday’s bullish move in natural gas prices faltered just ahead of the $2.50 level, eventually ending the session with marginal gains. The price action was in tandem with declining open interest and volume and leaves the door open to some near-term correction. So far, the $2.50 zone per MMBtu remains a key resistance area.

More By This Author:

EUR/JPY Price Analysis: Initial Resistance Comes Around 148.00Natural Gas Futures: Dwindling Bets For Further Gains

WTI Reclaims The Area Above The $70.00 Mark

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more