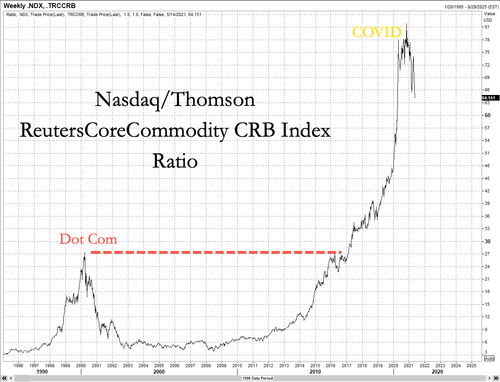

Nasdaq Versus Commodities: This Ratio Suggest Critical Juncture Ahead

With tech stocks tumbling in recent weeks amid surging inflation fears, at least the commodity sector appears safe from the global reflationary risk-off wave that swept across markets. Besides the ups and downs daily, the tech-laden Nasdaq Composite has been on a tear for the last five years. But since commodities began to outperform earlier this year, Nasdaq year-to-date gains are flat.

It appears tech outperformance has flipped while the Thomson Reuters/CoreCommodity CRB Index, boosted by solid gains in such commodities as crude oil, copper, corn, soybeans, has gained around 22%. The commodity index hit a six-year high and on track for one of the best years in more than a decade.

The Nasdaq/CRB ratio began to reverse to the downside on Nov. 11 and continues to make new lows. This may suggest the ratio is at an inflection point.

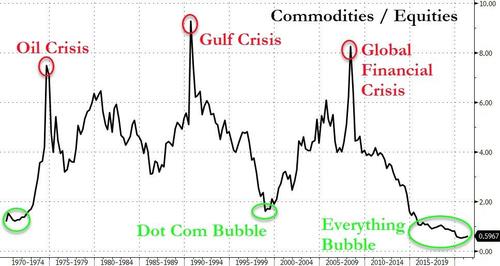

A similar pattern played out in the Dot-Com period where tech outperformed against commodities, catapulting the Nasdaq/CRB ratio to new highs from 1997 to March 2000.

The ratio reversed and collapsed as investors pivoted to commodities. The same could be happening today as Goldman Sachs strategists declared the start of a new commodity supercycle.

Many argue that the beginning of a monstrous inflationary commodities supercycle is here. Still, there are some dissidents to the commodity boom, such as ARK's Cathie Wood, who disagrees with Goldman and calls for a "very serious" correction in commodities.

... and why would Wood be wishing for a plunge in commodity prices?

Well, of course, continued inflation and a rise in commodities (especially oil) would likely lead to massive investor outflow of equities Wood has stocked her flagship ARKK fund

Nasdaq/CRB ratio appears to have reached an extreme. If the commodity boom persists and inflation remains rampant, then the tech unwind may continue.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more