Nasdaq Pivots Higher As Tech Selloff Cools

November's delayed jobs report took investors by surprise, sending stocks lower after the unemployment rate rose to 4.6%, the highest since September 2021. Meanwhile, though nonfarm payrolls ushered in a better-than-expected 64,000 monthly gain in November, the the Bureau of Labor Statistics (BLS) announced 105,000 jobs lost in October.

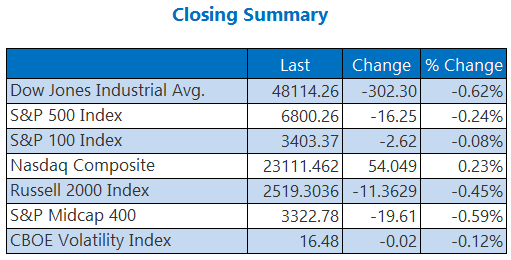

The Dow and S&P 500 marked their third-straight daily drops, the former suffering its worst fall in over two weeks. The Nasdaq climbed into the black by the close, snapping a three-day losing streak as the tech selloff eased. Elsewhere, WTI crude for January-dated contracts fell to their lowest mark in four years, and robotaxi buzz pushed Tesla (TSLA) to record highs.

CRUDE FALLS TO LOWEST MARK SINCE 2021

As mentioned above, developments in the Russian-Ukraine peace deal and production output concerns sent crude futures to their lowest mark since 2021. January-dated West Texas Intermediate (WTI) crude fell $1.64, or 2.7%, to close at $58.92 per barrel for the session.

Gold prices were higher for much of the session alongside unemployment numbers, as the U.S. dollar pulled back. However, the safe haven ended up inching lower for session, with February-dated gold down 0.1% to close at $4,332.30 per ounce.

More By This Author:

Dow, S&P 500 Eye 3rd-Straight Loss As Nasdaq Breaches 23K

Stocks Fumble Morning Gains As AI, Data Center Selloff Resumes

Dow Snags 3rd-Straight Weekly Win Despite Sour Session