Most Commodities Valued In U.S. Dollars Are Experiencing Inflation

Fundamentals

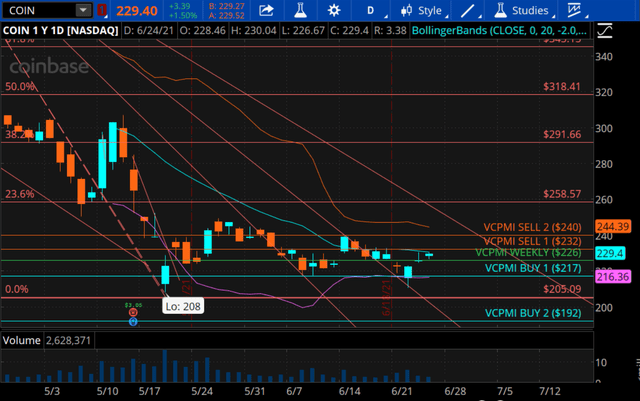

New economic numbers came out for unemployment claims. The number was 411,000 for those filing for unemployment, which was higher than the estimated number of about 380,000. In reaction, gold is trading at $1784. Silver is trading up about 8 cents at $26.19. Copper is slightly down about three cents at $4.29. COIN is up $1.98 at $228. The Grayscale Bitcoin Investment Trust is trading at about $28.86.

Courtesy: ema2trade.com

Based on our proprietary Variable Changing Price Momentum Indicator (VC PMI), for gold the daily average is $1783. We are in a neutral zone again. There is no buy or sell signal for day traders. Gold is trading around the average price. It has activated a bullish price momentum. If it trades around the average price, there is a 50/50 chance of gold going up or down. We wait for a market to reach extremes above or below the mean in order to place the highest probability trades. For gold, that means the market coming down to $1769 or $1760, which are the VC PMI Buy 1 and 2 levels. Or if there is a rally up to $1793 to $1805, which are the VC PMI Sell 1 and 2 levels. The buy and sell levels have 90% and 95% probabilities of the market reverting from those levels back to the mean; 90% for the Sell 1 and Buy 1 levels, and 95% for the Buy 2 and Sell 2 levels. The VC PMI allows us to focus on what the market is telling us, instead of being emotionally affected by all the chatter in the media.

Courtesy: ema2trade.com

We like to trade real money, gold, and silver. Gold and silver have been a currency of value for thousands of years. Comparing them to Bitcoin and virtual currencies is a mistake, given the vast difference in the time frames during which they have been valued. Since the pandemic struck, gold has changed from being a commodity to being a currency. The US dollar fell as gold rose. If you hold US dollars, you are losing money over time as the dollar loses value. The pandemic hastened the advent of a virtual economy. We had been playing with remote work, online buying and selling, and other aspects of a virtual economy, including virtual currency. The pandemic just sped up that transition on all fronts. The US dollar as a fiat currency, and other fiat currencies, appear to be far less desirable in the new virtual economy. Most commodities valued in US dollars are experiencing inflation. Virtual assets, such as Bitcoin, have become far more desirable to investors.

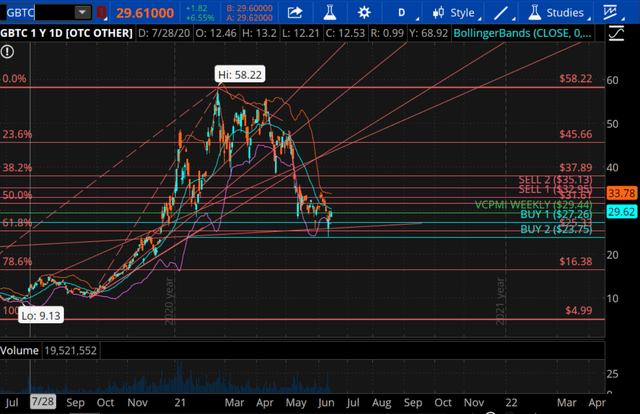

Courtesy: TDAmeritrade

There has been a lot of discussion about the future of Bitcoin and virtual currencies. Most people can only trade a limited number of products. We focus on precious metals, and the Grayscale Bitcoin Investment Trust. In a way, we don’t worry about the future of Bitcoin; we focus on what the market tells us about where Bitcoin is going each day, week, month or year. Bitcoin itself is unregulated, so we feel more comfortable trading the GBTC, which is regulated. GBTC and Coinbase are great tradable assets. As Coinbase’s volume increases, it will become an even better asset to trade. Once we establish the bottom in Bitcoin and Coin, they will be interesting markets later this year. Bitcoin has a great track record now, going back about 10 years. It is highly speculative, but a great asset to trade.

Courtesy: TDAmeritrade

Disclosure: I am/we are long GBTC.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold, and silver, check us out on more