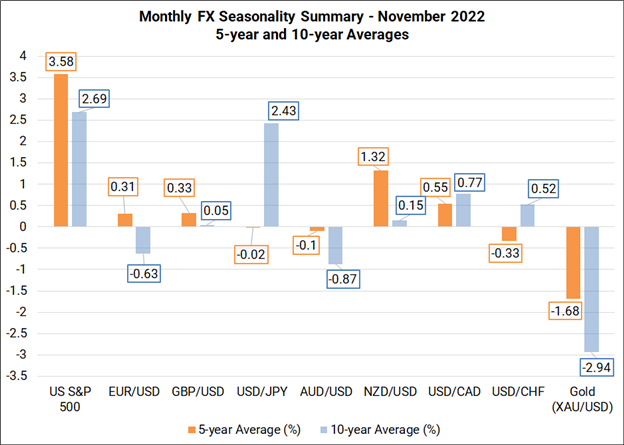

Monthly Forex Seasonality – November 2022: Stocks Rally, US Dollar Ranges, Gold Falls

The beginning of the month warrants a review of the seasonal patterns that have influenced forex markets over the past several years. For November, our focus is on the trailing 5-year and 10-year performances, both of which capture trading during the winddown of aggressive central bank intervention beginning with the 2008/2009 Global Financial Crisis – not dissimilar from the environment we find ourselves in now.

There remains the disclaimer for trusting seasonality data in 2022, however. This atypical environment has diminished the viability of using seasonality as a reliable guide for price action. Global supply chains are still in disarray – from energy to shipping as a result of Russia’s invasion of Ukraine and China’s zero-COVID strategy – while developed economies are inching ever closer toward stagflation.

Monthly Forex Seasonality Summary – November 2022

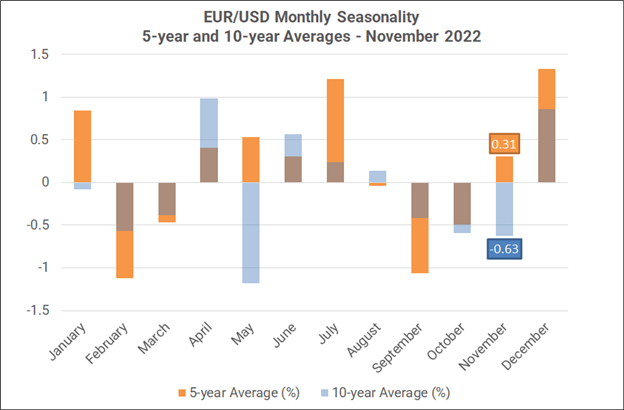

Forex Seasonality In Euro (Via EUR/USD)

November is a mixed month for EUR/USD, from a seasonality perspective. Over the past 5-years, it has been the sixth-best month of the year for the pair, averaging a gain of +0.31%. Over the past 10 years, it has been the second worst month of the year, averaging a loss of -0.63%.

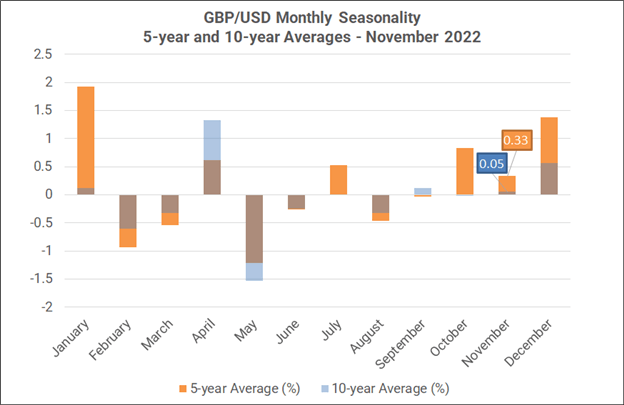

Forex Seasonality In British Pound (Via GBP/USD)

November is a slightly bullish month for GBP/USD, from a seasonality perspective. Over the past 5-years, it has been the sixth-best month of the year for the pair, averaging a gain of +0.33%. Over the past 10 years, it has been the fifth-best month of the year, averaging a gain of +0.05%.

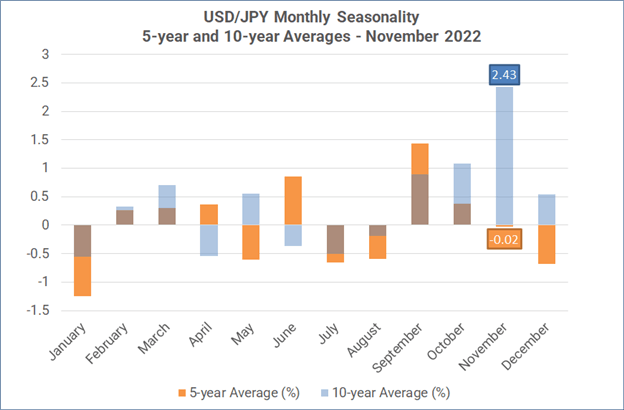

Forex Seasonality In Japanese Yen (Via USD/JPY)

November is a mixed month for USD/JPY, from a seasonality perspective. Over the past 5-years, it has been the sixth worst month of the year for the pair, averaging a loss of -0.02%. Over the past 10 years, it has been the best month of the year, averaging a gain of +2.43%.

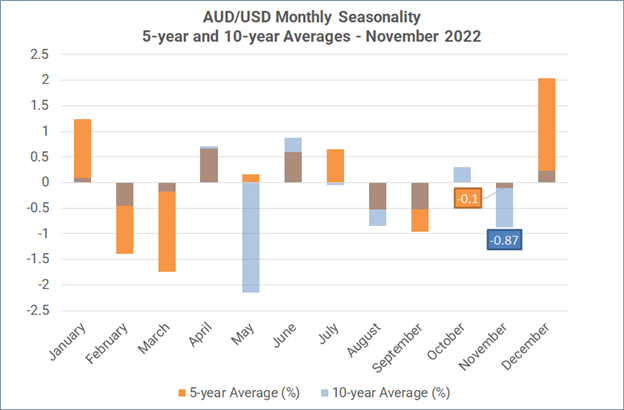

Forex Seasonality In Australian Dollar (Via AUD/USD)

November is a slightly bearish month for AUD/USD, from a seasonality perspective. Over the past 5-years, it has been the fifth worst month of the year for the pair, averaging a loss of -0.10%. Over the past 10 years, it has been the second worst month of the year, averaging a loss of -0.87%.

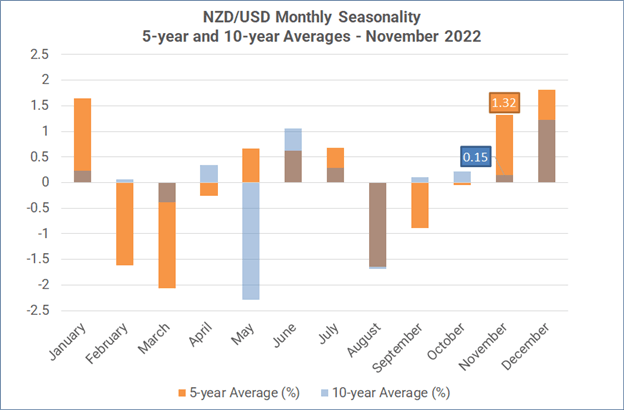

Forex Seasonality In New Zealand Dollar (Via NZD/USD)

November is a bullish month for NZD/USD, from a seasonality perspective. Over the past 5-years, it has been the third-best month of the year for the pair, averaging a gain of +1.32%. Over the past 10 years, it has been the sixth worth month of the year, averaging a gain of +0.15%.

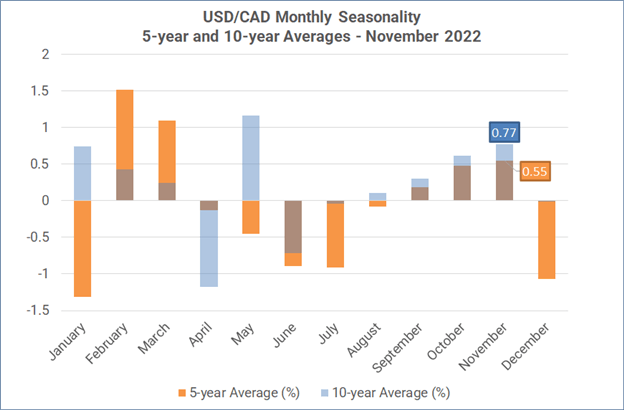

Forex Seasonality In Canadian Dollar (Via USD/CAD)

November is a bullish month for USD/CAD, from a seasonality perspective. Over the past 5-years, it has been the third-best month of the year for the pair, averaging a gain of +0.55%. Over the past 10 years, it has been the second-best month of the year, averaging a gain of +0.77%.

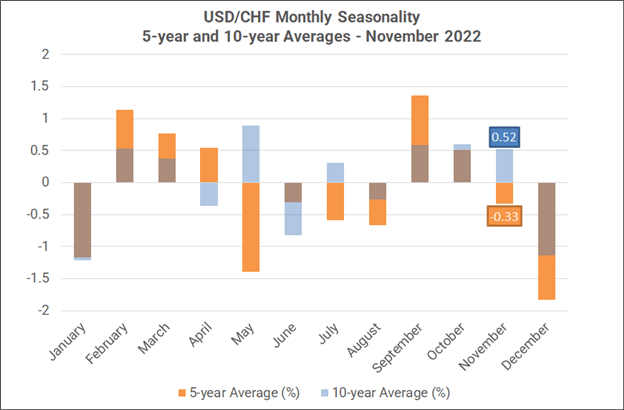

Forex Seasonality In Swiss Franc (Via USD/CHF)

November is a mixed month for USD/CHF, from a seasonality perspective. Over the past 5-years, it has been the sixth worst month of the year for the pair, averaging a loss of -0.33%. Over the past 10 years, it has been the fifth-best month of the year, averaging a gain of +0.52%.

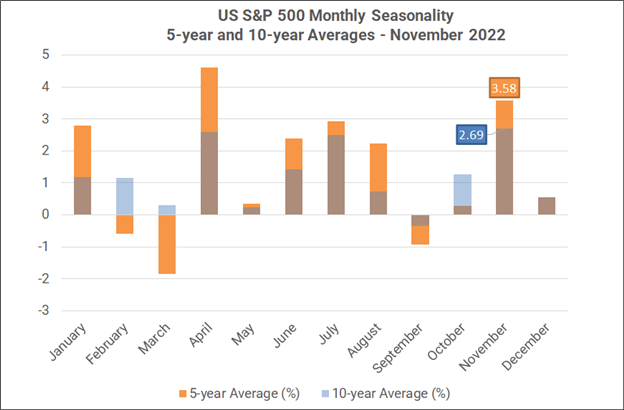

Forex Seasonality In US S&P 500

November is a very bullish month for the US S&P 500, from a seasonality perspective. Over the past 5-years, it has been the second-best month of the year for the index, averaging a gain of +3.58%. Over the past 10 years, it has been the best month of the year, averaging a gain of +2.69%.

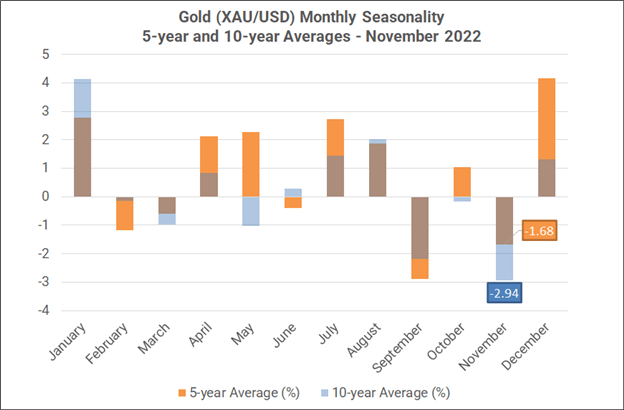

Forex Seasonality In Gold (Via XAU/USD)

November is a very bearish month for gold (XAU/USD), from a seasonality perspective. Over the past 5-years, it has been the second worst month of the year for the precious metal, averaging a loss of -1.68%. Over the past 10 years, it has been the worst month of the year, averaging a loss of -2.94%.

More By This Author:

Central Bank Watch: Fed Speeches, Interest Rate Expectations Update; November Fed Meeting Preview

FX Week Ahead: BoE, Fed, RBA Rate Decisions; Canada Jobs Report; US NFP

Why Do Stocks Suffer When Interest Rates Rise?