Mild Fed Meeting Minutes Boost Stocks Ahead Of Holiday

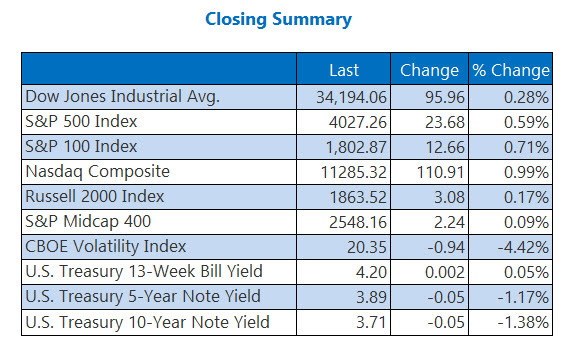

Stocks took home another win on Wednesday, as investors gear up for tomorrow's market closure due to the Thanksgiving holiday. Markets will resume activity on Friday, with an early 1 p.m. ET closure. The Dow settled the day with a near 96-point pop, while the S&P 500 and Nasdaq notched comfortable gains of their own. The Fed's November meeting minutes had traders cheering after the central bank signaled that it's seeing some progress in its attempts to beat back inflation, and foresees smaller rate hikes through the ends of 2022. Meanwhile, Treasury yields continue to fall, with the 10-year dropping to 3.717%

The Dow Jones Industrial Average (DJI - 34,194.06) gained nearly 96 points or 0.3% for the day. Walt Disney (DIS) paced the gainers with a 2.8% win. Amgen (AMGN) led the laggards with a 1.3% loss.

The S&P 500 Index (SPX - 4,027.26) added 23.7 points, or 0.6% for the day, while the Nasdaq Composite Index (IXIC - 11,285.32) added 110.9 points, or 1%.

Lastly, the Cboe Volatility Index (VIX - 20.35) shed 0.9 points or 4.4% for the session.

GROUP OF SEVEN MEET OVER RUSSIAN OIL'S PRICE CAP

Oil prices took a step back amid talks between the Group of Seven (G-7) regarding price caps on Russian oil, which could range anywhere from $60 to $70. The now front-month, January-dated crude shed $3.01 cents, or 3.7%, to trade at $77.94 per barrel.

Gold prices rose, settling higher ahead of the release of today's Fed meeting minutes as investors digested a slew of economic data, including a rise in new home sales and durable goods orders. December-dated gold added $5.70 or roughly 0.3%, to settle at $1,745.60 an ounce.

More By This Author:

Stocks Spring Higher As "Fear Gauge" Sputters

Dow Rallies Nearly 400 Points As Optimism Returns To Wall Street

Stocks Move Higher As Wall Street Eyes China Lockdowns