Gold’s Share Of International Reserves Surges Dramatically

Image Source: Pixabay

The global currency reserve numbers are in for 2025 Q1!

The research has been compiled by gold analyst Jan Nieuwenhuijs of Money Metals, who is widely recognized for his deep research on central bank gold reserves and global monetary trends.

Video Length: 00:00:57

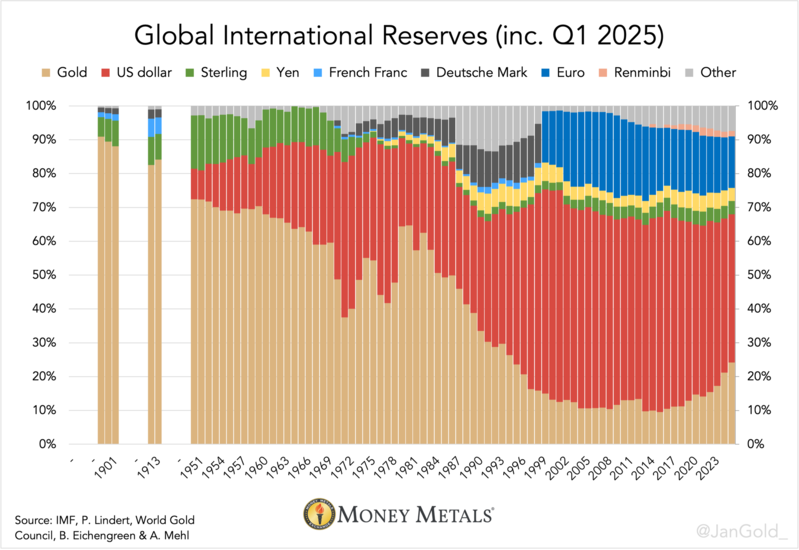

As of the end of 2024 Q4, the Federal Reserve Note dollar remained the number one reserve currency in central banks around the world at 45.55%, with gold firmly in second place at 21.20%, the euro in third place at 15.63%, and all other currencies making up the remaining 17.62%.

At the end of 2024 Q4, December 31, 2024, the spot price of gold was around $2,606.72, and by the closing of 2025 Q1, March 31, 2025, the gold spot price was around $3,089.58, indicating an increase of 18.52%.

This indicates that gold continued to see healthy global demand on the free market, while much of the gold price has been directly influenced by international central bank purchases.

Since 2024 Q4, central banks have continued to demand more gold while trading their U.S. Treasuries for the shiny metal.

With uneasiness about US monetary policy, insurmountable national debt, Trump’s vacillating tariffs, Federal Reserve induced inflation, unpredictable interest rates, metastasizing consumer debt, and growing military tensions, many countries are choosing to de-dollarize through the process of selling their fiat U.S. Treasuries for more gold sound money.

This has been exacerbated by the even simpler fact that gold is outperforming Treasuries, S&P 500, Nasdaq, and most other currencies, including popular cryptocurrencies such as Bitcoin and Ethereum, year-to-date.

So, central banks are choosing less risky options than U.S. Treasuries for their reserves, while often choosing the more stable and sound option of gold.

According to research by Jan Nieuwenhuijs, since 2024 Q4 and the closing of 2025 Q1, USD still remains as the number one reserve currency in the world at 43.79%, gold in second place at 24.16%, the euro in third at 15.21%, and other currencies making up around 16.84%.

This demonstrates a 1.76% decrease in USD’s share of global reserves and an increase of 2.96% in gold’s relative holdings by central banks around the world.

Since March 31, 2025, the price of gold has continued to increase, making up about an 11% boost. Many leading banks, investors, gurus, and experts around the world are predicting that the price of gold will continue to rise through 2026 Q2.

This suggests that if things continue in the same direction, central banks are likely to be enticed to continue to de-dollarize by selling their U.S. Treasuries for more gold, pressuring for further accelerated de-dollarization. The consequence of such would imply a weakening U.S. dollar and a strengthening gold price.

Will gold reclaim its historic seat as the number one reserve currency in the world?

We will have to wait and see.

In the meantime, it does not appear as though the USD will strengthen anytime soon against other fiat currencies, and the price of gold will likely continue to rise, especially in relation to the USD’s purchasing power.

More By This Author:

Gold’s Historic Race To Reclaim Role As Preeminent Reserve Currency

Why Bitcoin Is Not Equal To Gold

The Untold History Of Gold Rushes In The United States