Markets Totally Disconnected From The Real Economy

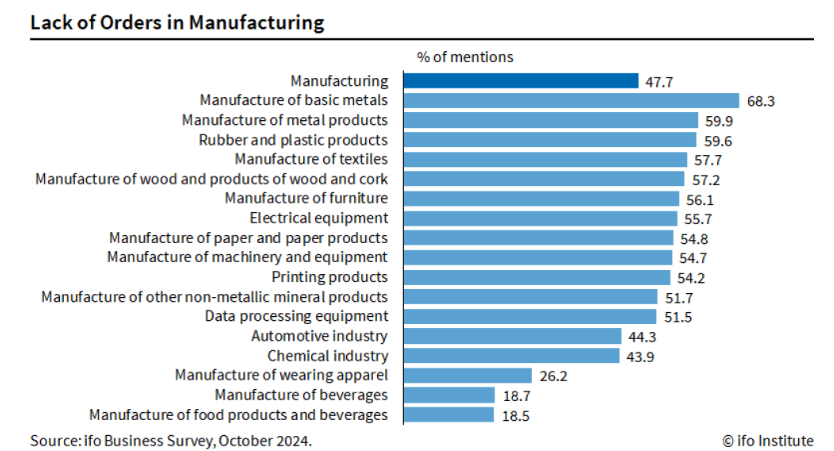

According to IFO economic institute, order shortage in Germany continues to worsen, hindering economic development and affecting almost all sectors.

In October, 41.5% of companies reported a lack of orders, up from 39.4% in July. That’s the highest level since the 2009 financial crisis. Hardly any industry has been spared. Nearly half of all manufacturing companies (47.7%) are affected, in particular 68.3% of basic metal manufacturers and 59.9% of metal product producers. Key sectors such as the automotive and chemicals industries have around 44% of companies facing a lack of orders. The trade sector reached its highest level since 2006, with 65.5% of companies affected, including 56.4% in the retail sector.

Paradoxically, this fall in demand comes at a time when the DAX, the German stock market index, has just reached an all-time high:

(Click on image to enlarge)

The German market is benefiting from the general momentum of world markets, stimulated by the soaring US markets, which are reaching new heights.

This craze is largely fuelled by the fear of "missing the boat" on the upside, the so-called FOMO (Fear of Missing Out). Investors are afraid of missing out on the market boom.

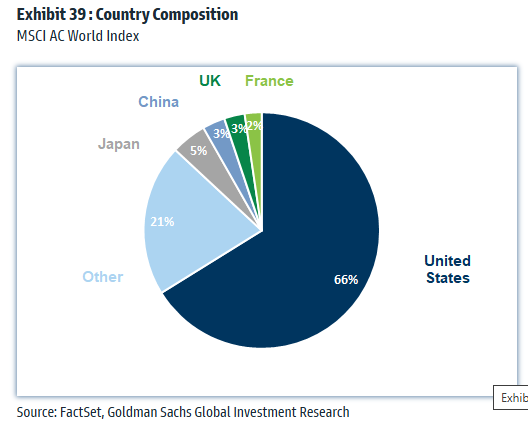

This upward wave is benefiting above all the US markets, which continue to capture the bulk of the world's savings.

The MSCI World index is now made up of 66% American companies, a record level since its creation:

In any case, this rush to buy shares is not affecting insiders, who remain largely on the sidelines.

Not since the bear market began in 2021 have S&P 500 executives bought so few shares:

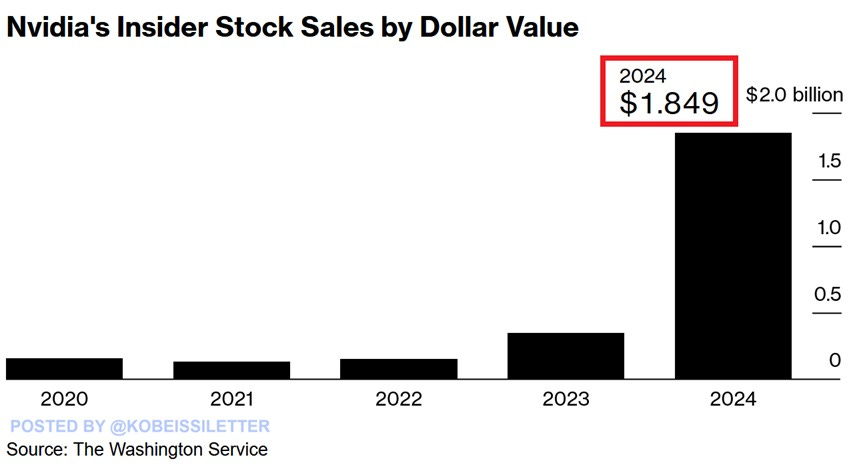

On the contrary, the rush to the American market represents an excellent opportunity for insiders, who have skilfully taken advantage of this exuberance to sell their shares at advantageous prices.

Nvidia insiders take advantage of rising share prices to sell.

Nvidia's major shareholders have liquidated an impressive $1.85 billion worth of shares, or around eleven million shares, since the start of the year, a record since at least 2020. In 2024, these internal sales are five times higher than in 2023, when they amounted to just $350 million. CEO Jensen Huang recently finalized the sale of six million shares in the company as part of a predefined sales plan, while board member Mark Stevens plans to sell three million shares after already selling 1.6 million this year:

No doubt they feel that their company's earnings forecasts do not reflect the value of their shares at all.

Nvidia shares boast a P/E ratio of around 70, well above the technology sector average of around 25-30, highlighting the huge premium paid by investors. With a market valuation close to $3.7 trillion, the market is anticipating exceptional revenue growth, particularly in the AI sector. In other words, at this level, even a 5-10% slowdown in sales could cause a significant correction in share value.

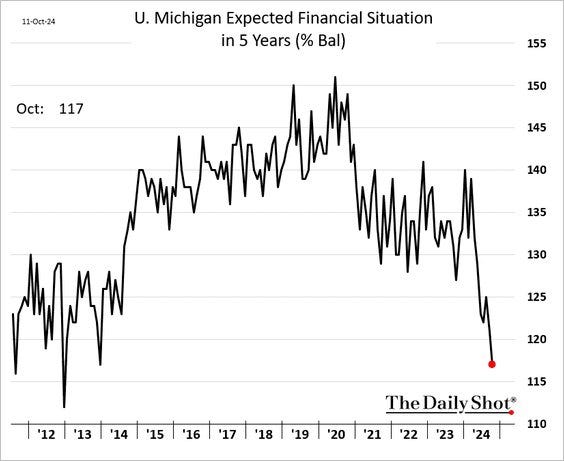

This correction could be triggered by a future weakening in US consumer activity. If household spending begins to slow, this could directly affect the revenues of demand-dependent technology companies, particularly in the consumer products and video games segments, where Nvidia is heavily involved. In effect, a drop in consumer activity would reduce sales of computer hardware and graphics cards, which account for a significant proportion of Nvidia's revenues. This decline in consumer activity, combined with rising interest rates and persistent inflation, could create a less favorable economic environment for consumer-dependent companies, leading to a correction in share prices. The dream of artificial intelligence should not overshadow the threats to the real economy, often overshadowed in this period of market exuberance. While AI is arousing unbridled enthusiasm, concrete risks, such as slowing consumer spending and pressure on businesses, could cloud this optimistic picture.

The University of Michigan's Consumer Sentiment Index, which measures US consumers' expectations of their personal financial situation over the next twelve months, fell sharply in October.

Crushed by debt repayments that have become too burdensome, American consumers are beginning to resign themselves:

Faced with this threat, smart money is beginning to take cover, anticipating an imminent market downturn.

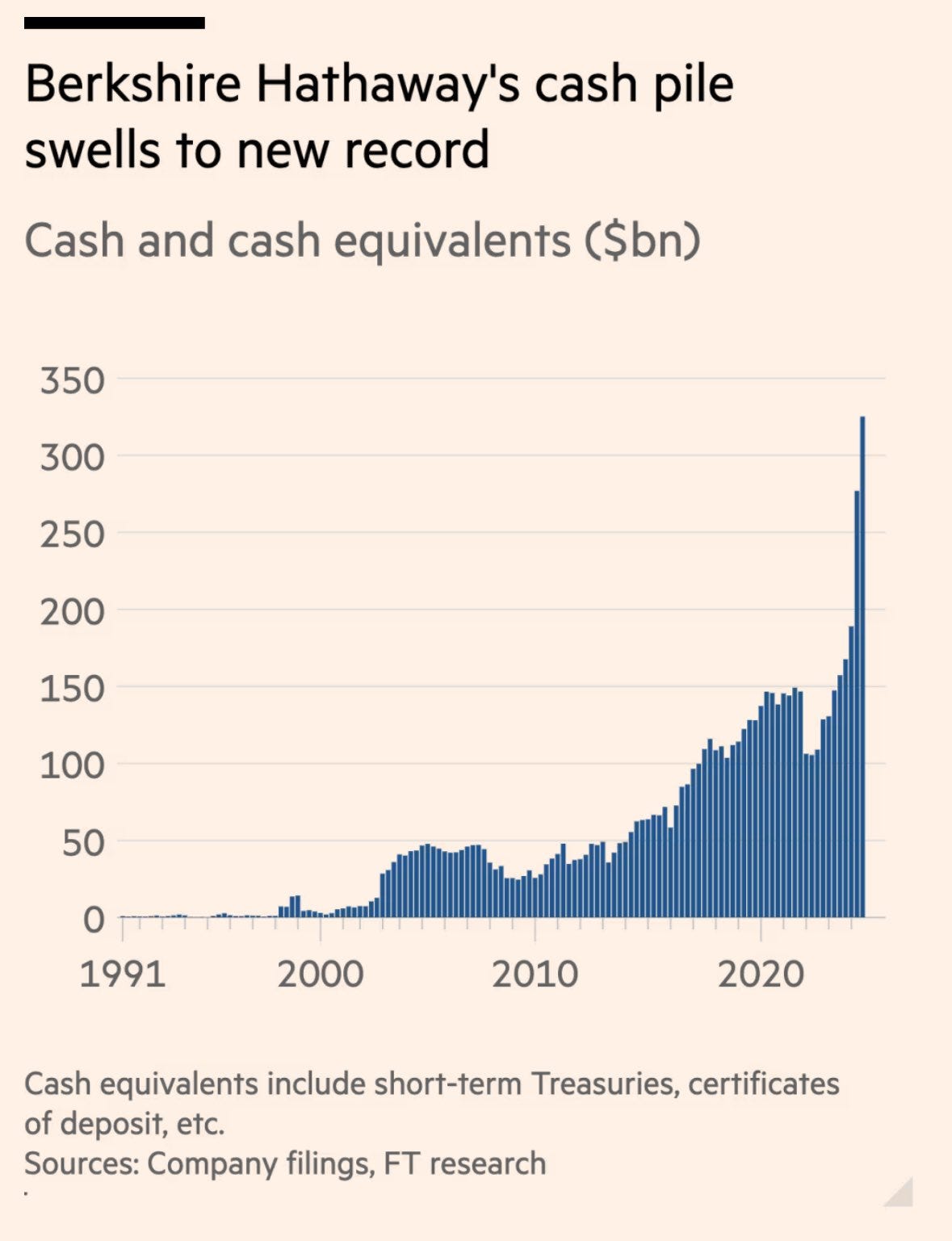

Berkshire Hathaway has boosted its cash reserves to a record level, topping $350 billion, mainly through a series of asset sales and divestments. This level of cash reflects less an increase in shareholdings than an active divestment strategy. Warren Buffett and his team seem to have favored asset sales, freeing up funds by reducing their positions in certain stocks, rather than accumulating more shares:

While institutions such as Berkshire Hathaway are increasing their cash positions, central banks are continuing their gold purchases.

Weekly data from the Reserve Bank of India reveal that its gold reserves rose by around 27 tons in October, marking the biggest monthly increase since November 2009, when it acquired 200 tons from the IMF. Cumulative purchases for the year amount to 78 tons, bringing total gold reserves to 882 tons.

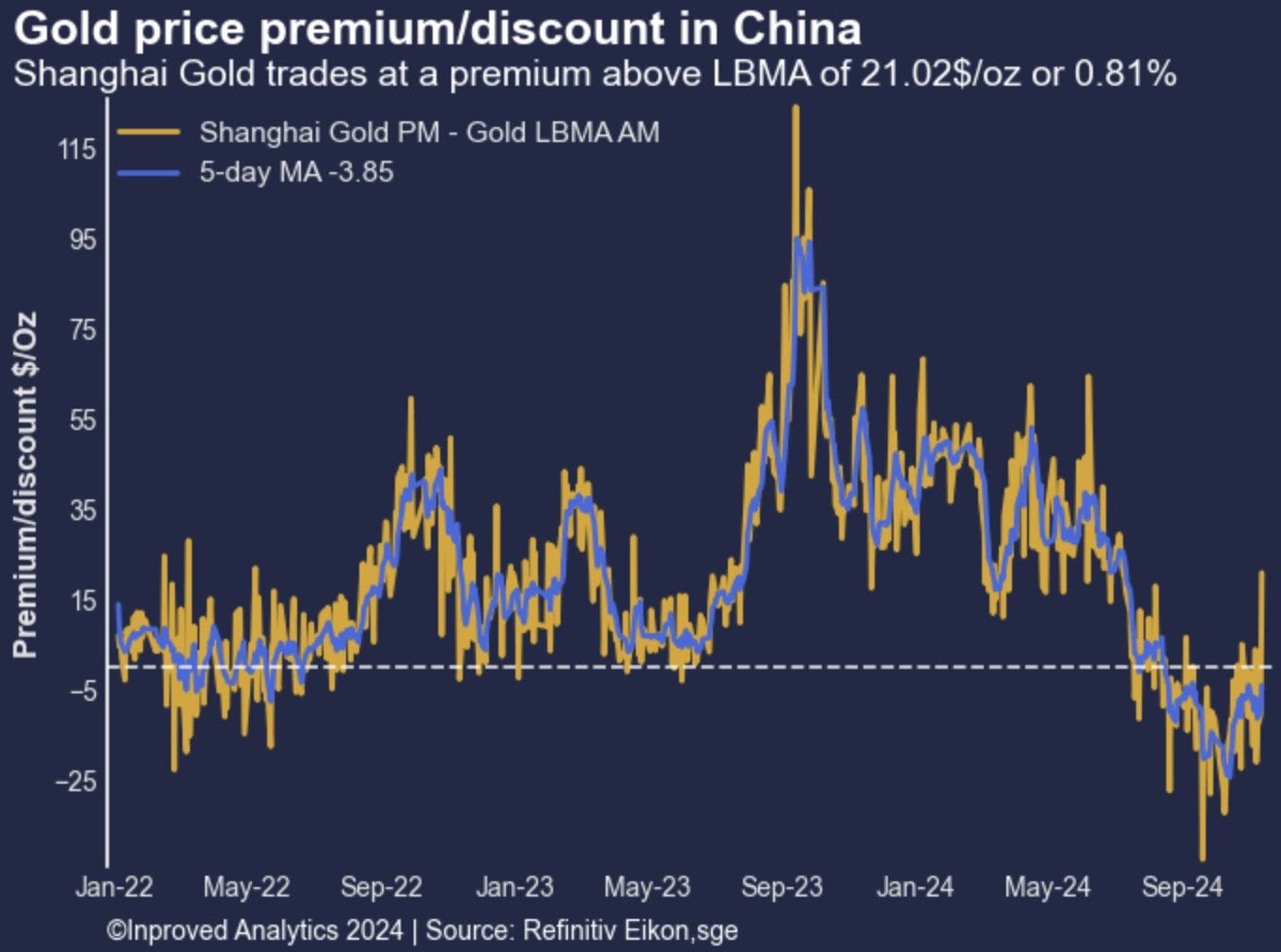

The current gold correction, linked to Trump's election, has in any case re-established a positive premium on the metal spot price in China over that in London, creating new arbitrage opportunities that have supported gold prices since 2023:

More By This Author:

France Suffers Record Capital OutflowsThe Golden Road To $20,000 And Dow's Lost Decades Ahead

Gold Correction After Trump's Election: Why 2024 Is Not 2016

Disclosure: GoldBroker.com, all rights reserved.