Markets Do Not Repeat, They Don’t Even Rhyme

“Davidson” submits:

Understanding investment markets requires a historical perspective of past events. It is a combination of historical review of innovations, their associated human responses and subsequent pricing through market psychology. Once one has performed this type of analysis, it should be evident that innovation impacts human behavior and market psychology which in turn impacts future innovations in ways one could not have predicted. The Innovation-Response Cycle illustration summarizes this process. The key message is that innovation is always a surprise and always has surprising outcomes which leaves investors always scrambling to capture returns after-the-fact. In every instance, investors become overly optimistic. If one studies market history, every investment cycle is characterized by literally thousands of individual situations becoming over-valued at some point. Developing investment acumen requires recognition that one can only treat investing as a work-in-progress. A good analogy is that investing is much like reading an epic novel as it is being written with unexpected plot twists and introductions of unexpected main and minor characters with the reader trying to guess the outcome.

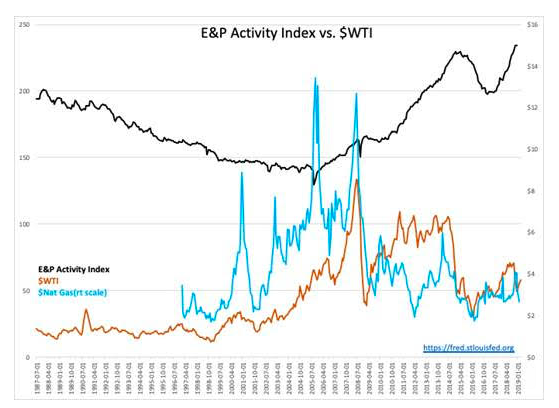

One can identify innovation in every industry. A useful example is the energy Exploration&Production(E&P) sector. ‘Fracking’, a prominent innovation in oil and gas extraction the past 10yrs, had its beginnings in 1860 when explosives were used to stimulate well production. ‘Fracking’ first became innovative in natural gas extraction/production when it was coupled to another significant innovation, controlling drilling direction and the advent of horizontal drilling. It required a rise in natural gas prices in the first years of the 21st Century as demand grew for low carbon emission fuels and raw materials for plastics. This stimulated the search for more efficient natural gas exploration. ‘Fracking’ proved a success by 2005 and the number of drilling rigs dedicated to natural gas discovery grew to ~10x oil rigs(oil rigs ~10% of total rigs utilized).

The subsequent rise in oil prices and a period of fear that global supply of oil would end, “Peak Oil”, stimulated using ‘Fracking’ to raise US oil production. Many individuals added to this innovative approach. “The Frackers”, 2013 by Gregory Zuckerman highlights key contributors. The capital that poured into exploration resulted in over-supply that saw a correction in 2008 as oil prices declined during the Sub Prime Crisis. 2009 saw rising gas production with early results of oil well stimulation helping to drive prices lower. Capital injected into exploration driven by high oil and gas prices and anticipation of high returns drove the US rig count over 2,000 (2018 rigs in operation Sept 2008). 3 charts document the changing themes from July 1987 to Present.

As success in gas exploration translated to oil exploration, the oil rig count exceeded the rigs used in natural gas exploration, June 2011. Every new discovery in oil produced additional natural gas supplies making oil exploration the more profitable energy source. Eventually the rig count once again exceeded 2,000 (2,008 rigs in operation Dec 2011), but this time oil rigs exceeding gas rigs. Oil rigs were ~60% of total rigs in operation. Innovation continued relentlessly. Since Dec 2011, US oil production has risen from ~5.8mil BBL/Day more than 2X at 12.2mil BBL/Day with the April 4, 2019 Energy Information Administration(EIA) report while total rigs utilized fell to half of earlier peaks levels, 1,006. Oil rigs have increased to ~88% as a percentage of total rigs. US oil and natural gas production continue to exceed records. The US became a net exporter of refined products for the first time in 2011 and has the potential to become a net exporter of crude oil should current trends continue. The rise in crude oil discovery and production in the face of a sharp decline in the rig count speaks to a dramatic lowering of costs through efficiencies with additional innovation.

Doing more with less is the ‘Lean Processes’ theme which has gradually embedded itself in US production. An innovation in business operations and employee engagement, Lean Thinking’ is at the heart of many efficiencies beginning in the mid-1980s at Toyota’s and Danaher’s manufacturing facilities. The goal is creating a climate of sustained competitiveness. Using the E&P industry as an example is instructive because most observers at first glance deem it a classically-unimaginative business sector. The evolution in E&P demonstrates the dramatic revitalization which has occurred in many US industries and serves as a lesson to investors. Innovation is unpredictable. Yet, it drives profitability and additional unpredictable innovation. The investment process cannot rely on past experience to predict future outcomes. Investors must constantly assess and reassess investing themes rather than assume the past is likely to repeat.

Investing is not as much predicting the future which is forever unpredictable as it is identifying current innovations and paying close attention to their impact on society and market psychology. Even as mundane an industry as E&P has dramatic innovation.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more