Managed Money Ends 2023 On Bullish Note

Please note: the CoTs report was published on 12/30/2022 for the period ending 12/27/2022. “Managed Money” and “Hedge Funds” are used interchangeably.

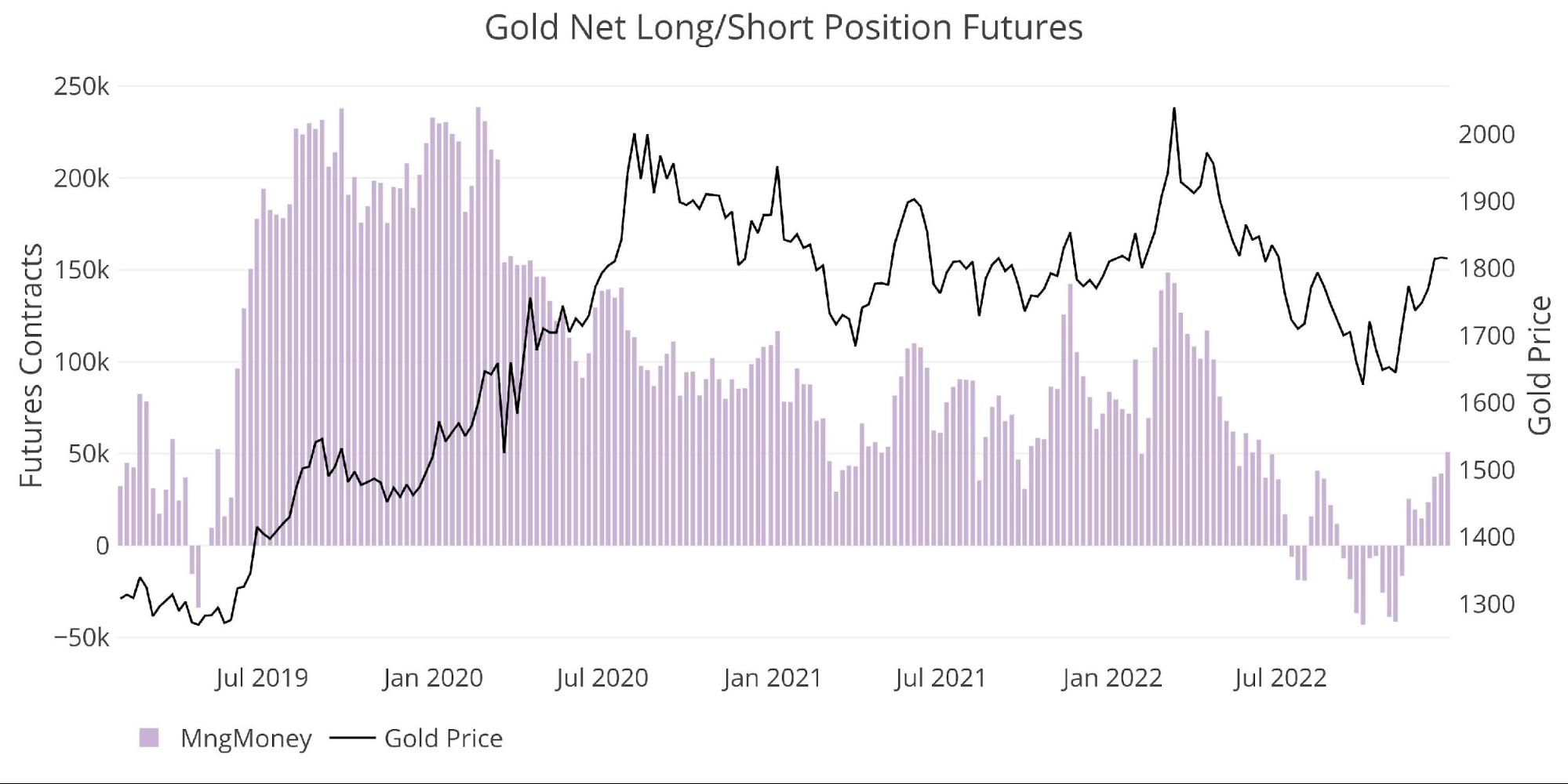

Gold finished the year on a strong note, with Managed Money reaching a net-long position of 50k. This is the largest net long position for Managed Money going back to June 2022.

GOLD

Current Trends

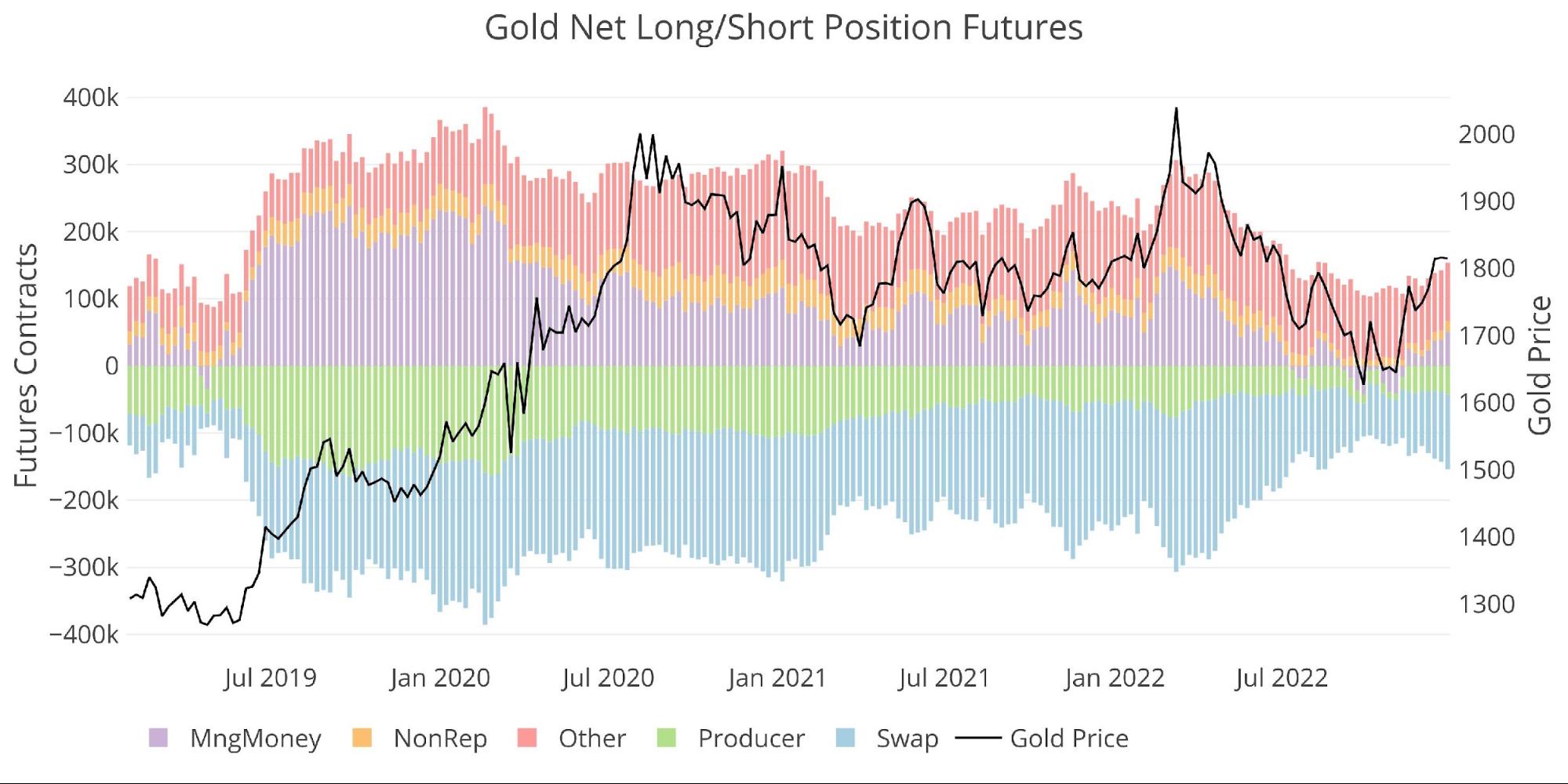

Swaps have been on the other side of this move, increasing their net short position.

(Click on images to enlarge)

Figure: 1 Net Position by Holder

The chart below always highlights the degree to which Managed Money drives the price of gold. Back in June when Managed Money exceeded 50k, the price of gold was around $1847. This is only a modest gap between the two periods.

Figure: 2 Managed Money Net Position

Weak Hands at Work

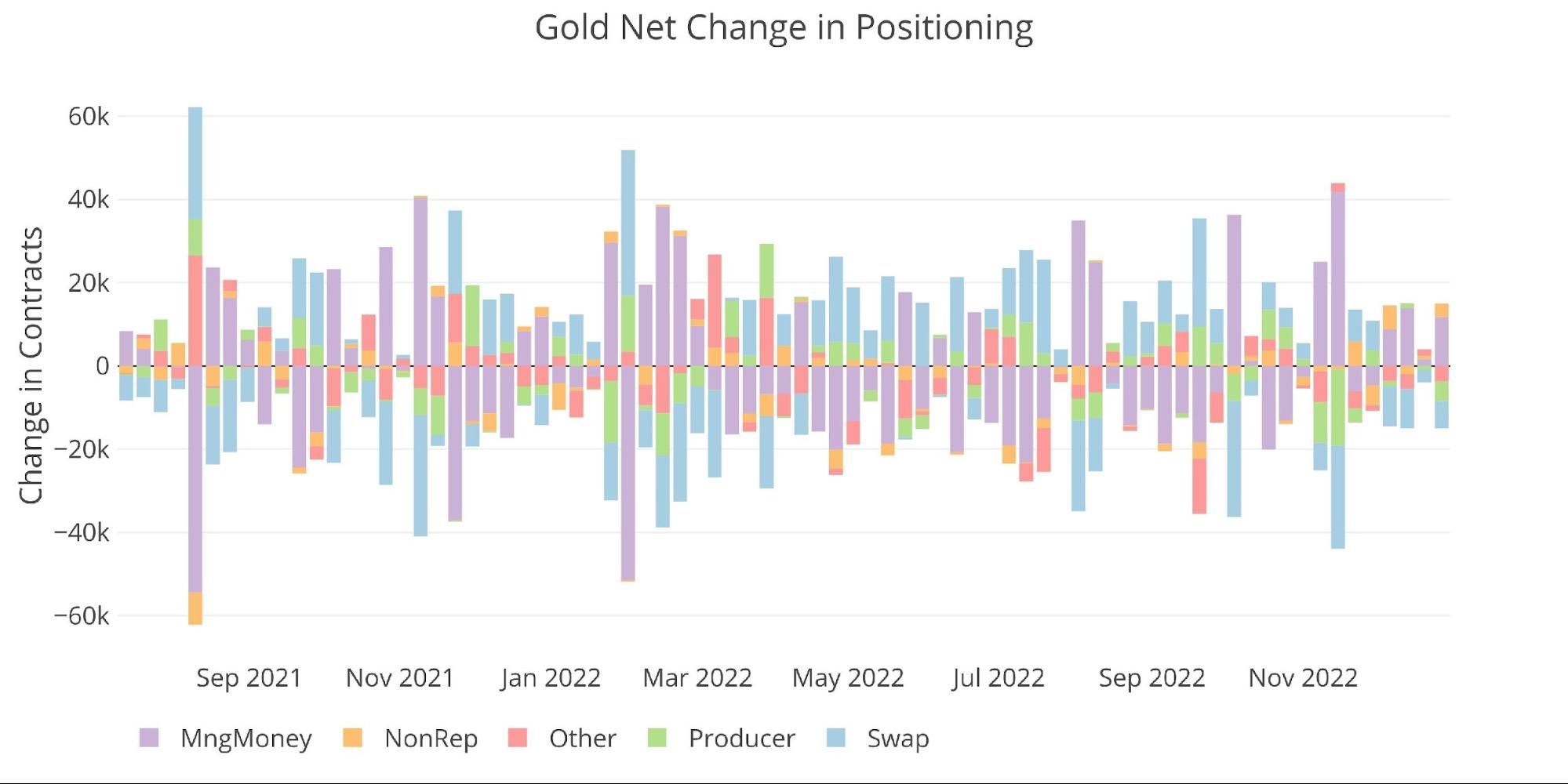

The chart below shows the weekly data. Managed Money is definitely becoming more bullish on gold, increasing net long in 6 of the last 8 weeks. This is on the heels of a 26-week stretch where net longs were only added in 8 weeks (30% vs 75%).

Figure: 3 50/200 DMA

The table below has detailed positioning information. A few things to highlight:

-

- Over the month, Managed Money change was driven on the long and short side

-

- Gross longs increased 21.5% while gross shorts decreased 23.5%

- The result is an increase in net longs of 245%

-

- Other actually increased gross shorts by 41% increasing from 25.8k to 26.5k

-

- This led to a 9.7% reduction in net longs for Other, from 95k to 86k

-

- Over the month, Managed Money change was driven on the long and short side

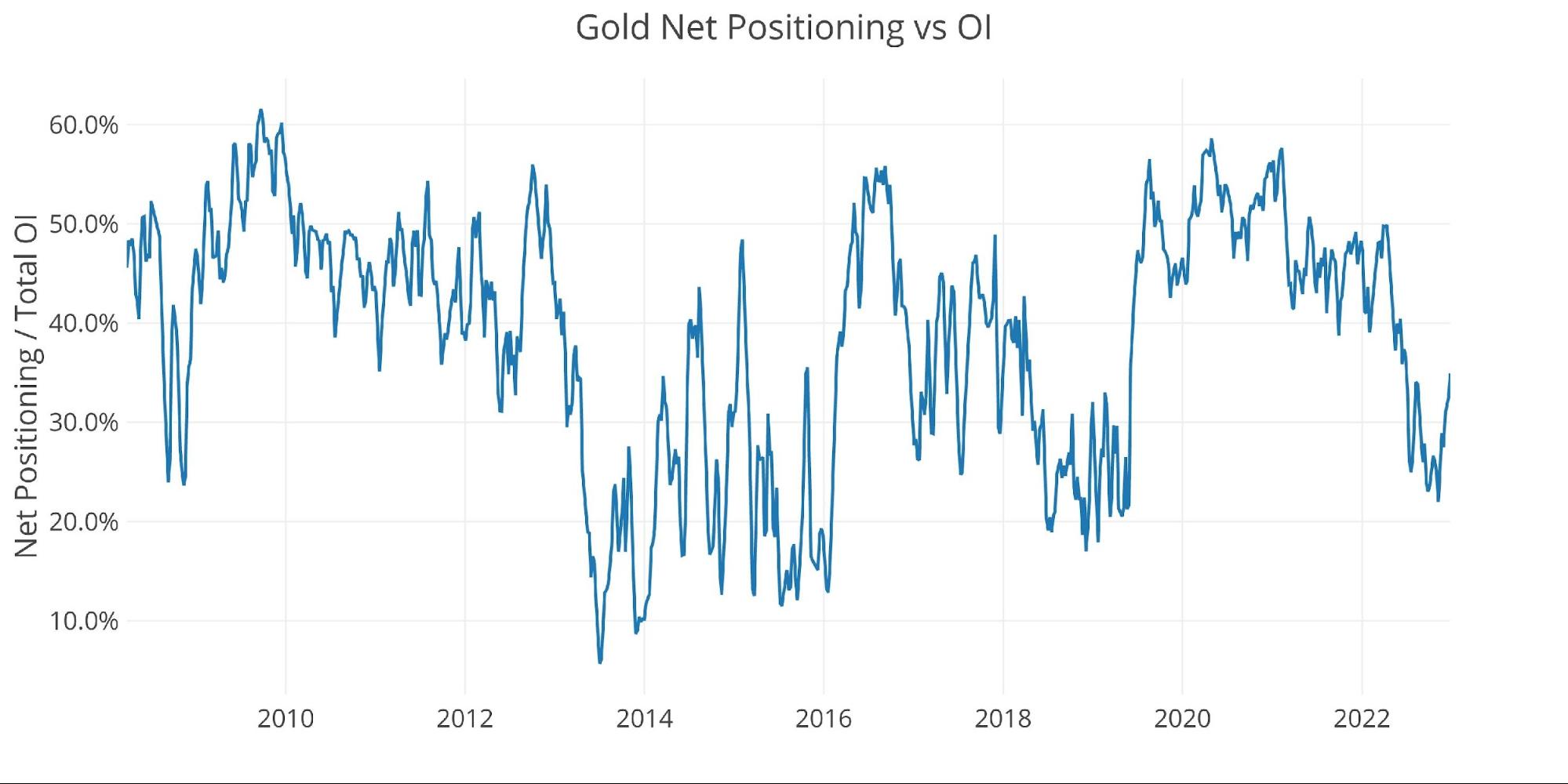

One more thing to note is that every participant has reduced their net positioning significantly over the last year, ranging from 27% to 48%. This shows an overall waning interest in the gold market as there is simply less aggregate open interest outstanding.

Figure: 4 Gold Summary Table

That said, despite the large contraction from one year ago, net positioning has increased from the November lows. It reached as low as 22% on November 8th and is now at 35%.

Figure: 5 Net Positioning

Historical Perspective

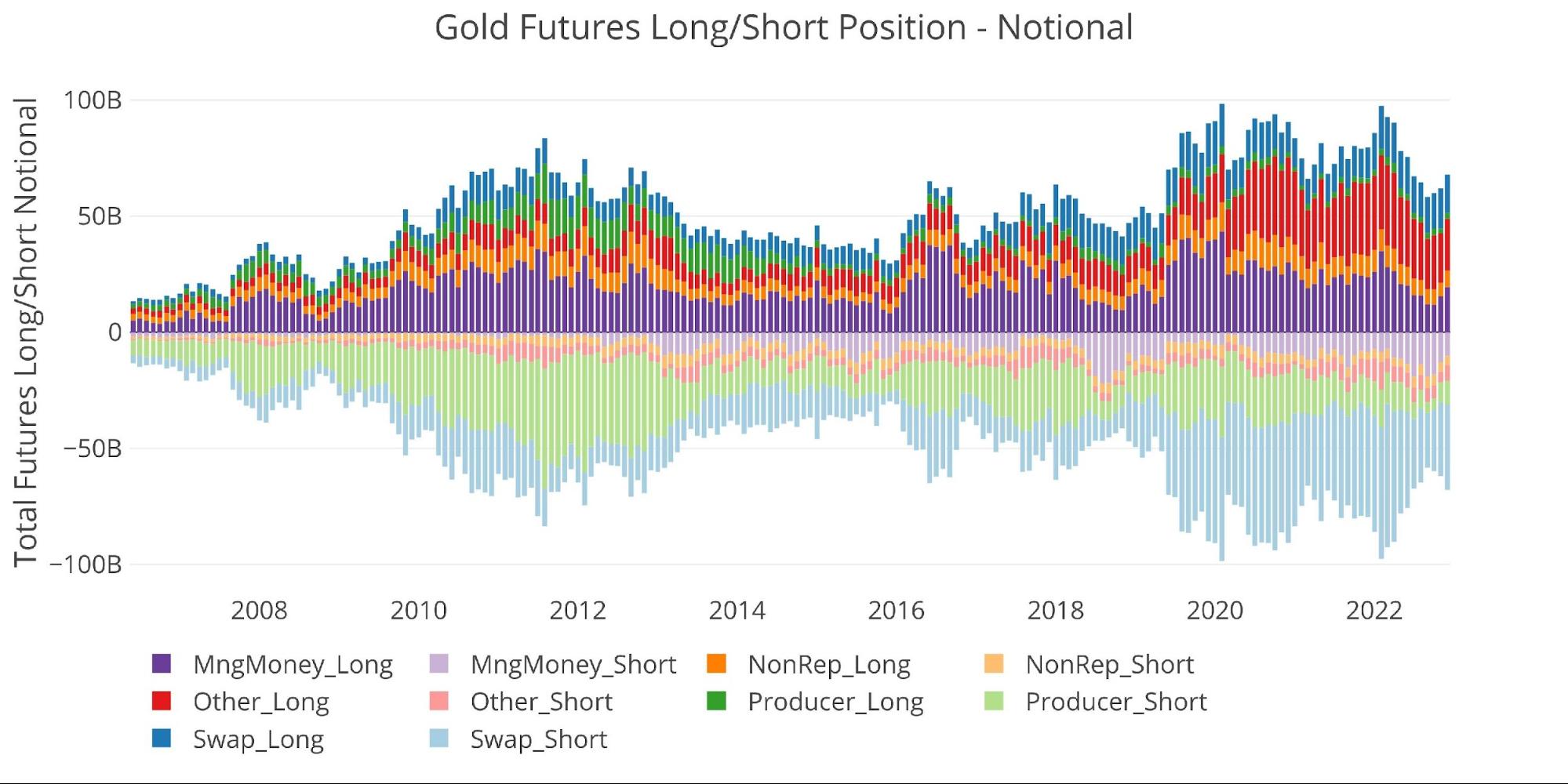

Looking over the full history of the CoTs data by month produces the chart below (values are in dollar/notional amounts, not contracts). Gross positioning topped out just shy of $100B in Feb 2022 and then crashed to $58B as of Sept 2022. It has since rebounded to $68B in December. This suggests plenty of dry powder on the sidelines waiting for the moment to pile back into the market.

Figure: 6 Gross Open Interest

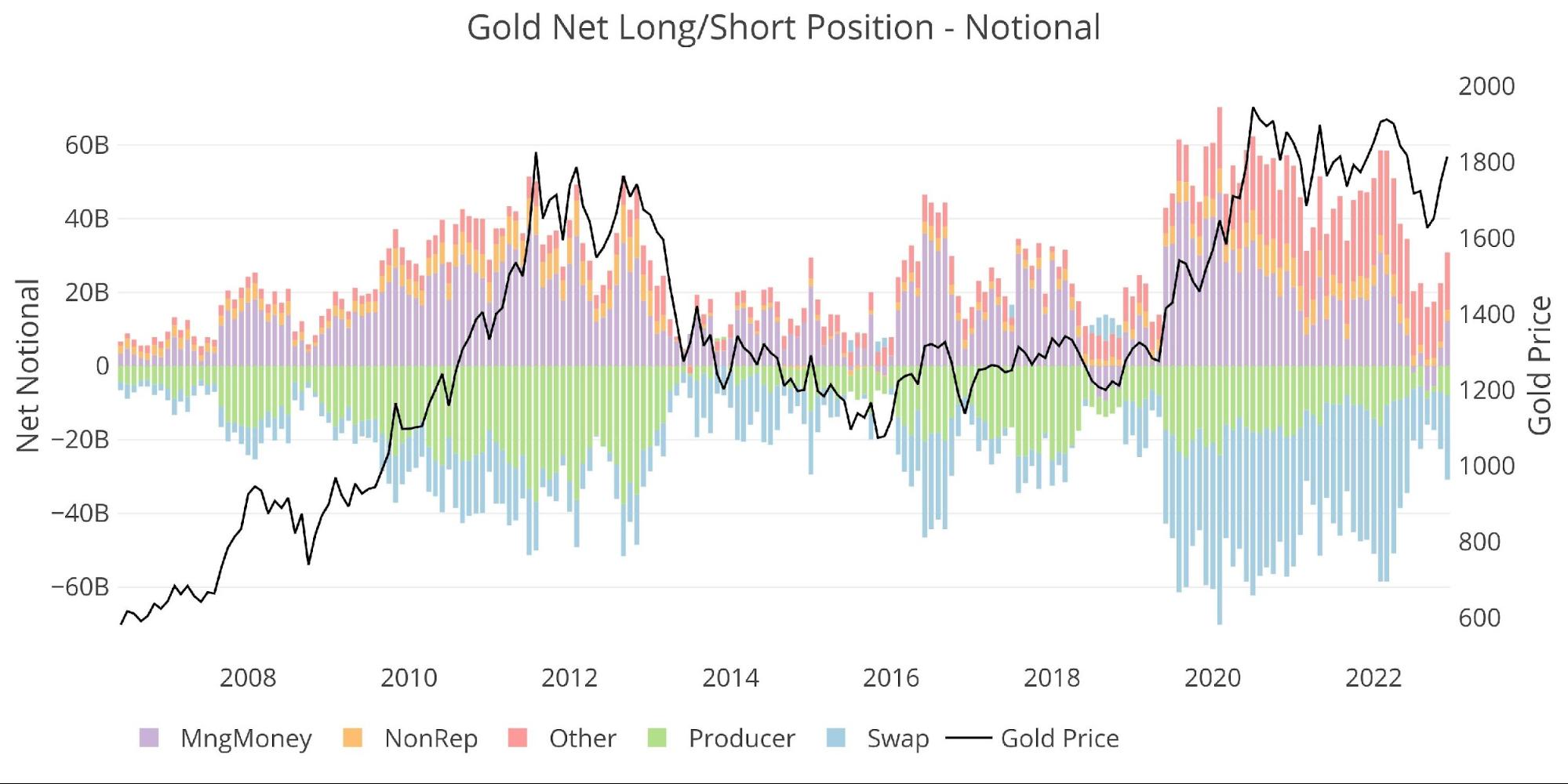

The market had come under immense selling pressure into September as Managed Money went net short for the first time since November 2018. The price held up extremely well though, only dropping to $1626 at the low vs a price of $1222 back in Nov 2018.

Figure: 7 Net Notional Position

Managed Money interest in the option market is also increasing. Gross longs have reached almost $3B, up from $710M in September. A 322% increase in 3 months and the highest value since April 2022! Producers remain on the sidelines in the options market.

Figure: 8 Options Positions

Managed Money is inching its way back into the market. The price of gold is already high enough that it will not take much to propel the yellow metal to new all-time highs. Doug Casey suggested 2023 could be the year for gold and the positioning of Managed Money combined with the technical picture clearly confirms that possibility.

SILVER

Current Trends

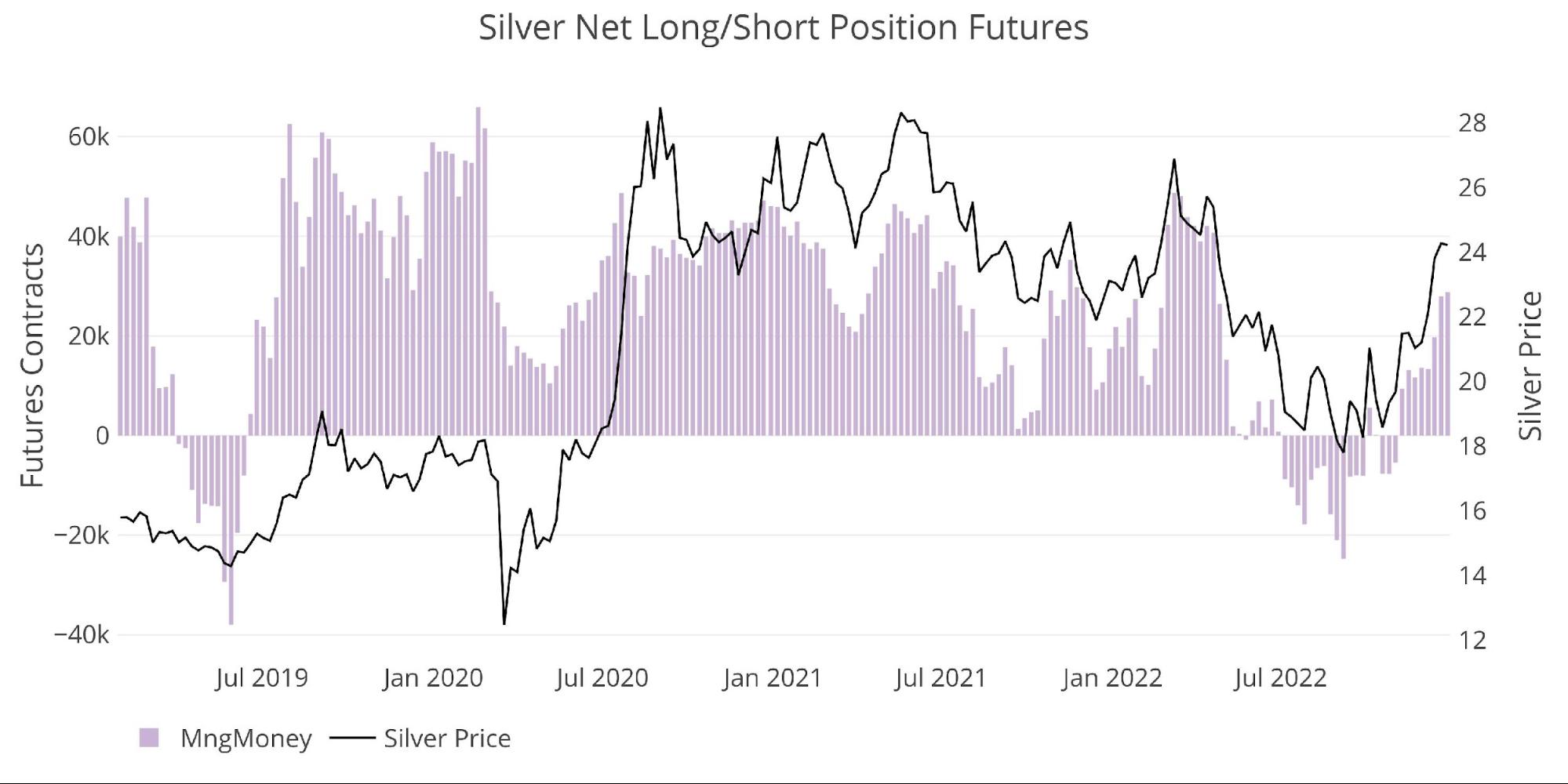

Managed Money has returned in a big way to the silver market and the current price is reflecting the move. Managed Money closed out 2023 with a net long position of 28k contracts the largest net long since April of 2022.

Figure: 9 Net Position by Holder

The price has actually performed better, reaching $24.22 compared to only $23.54 at the end of April. The chart below also shows just how much Managed Money dominates the silver market, pushing the price around.

Figure: 10 Managed Money Net Position

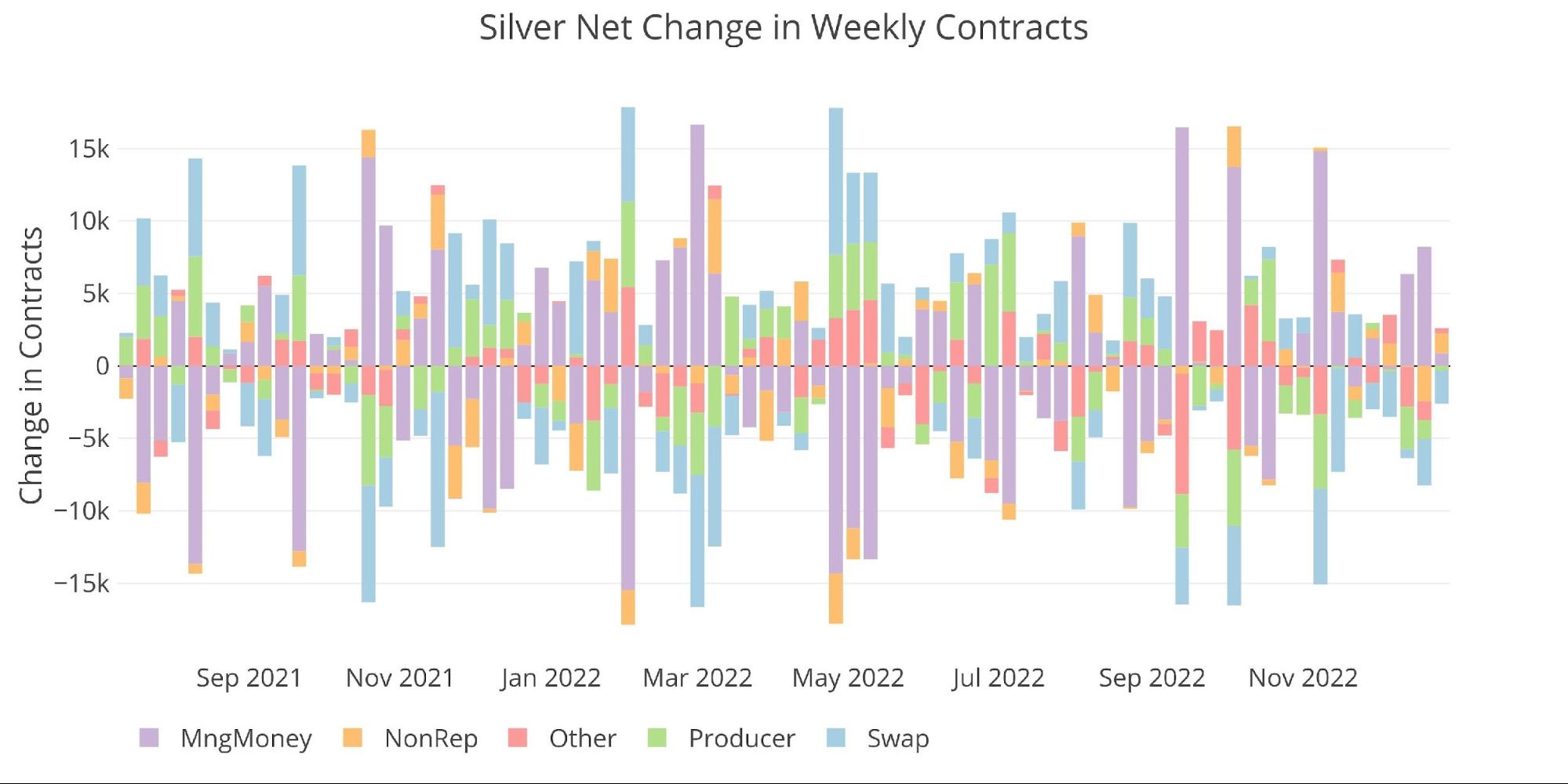

The volatility in silver is almost entirely explainable from the weekly positioning of Managed Money and the choppiness in their activity.

Figure: 11 Net Change in Positioning

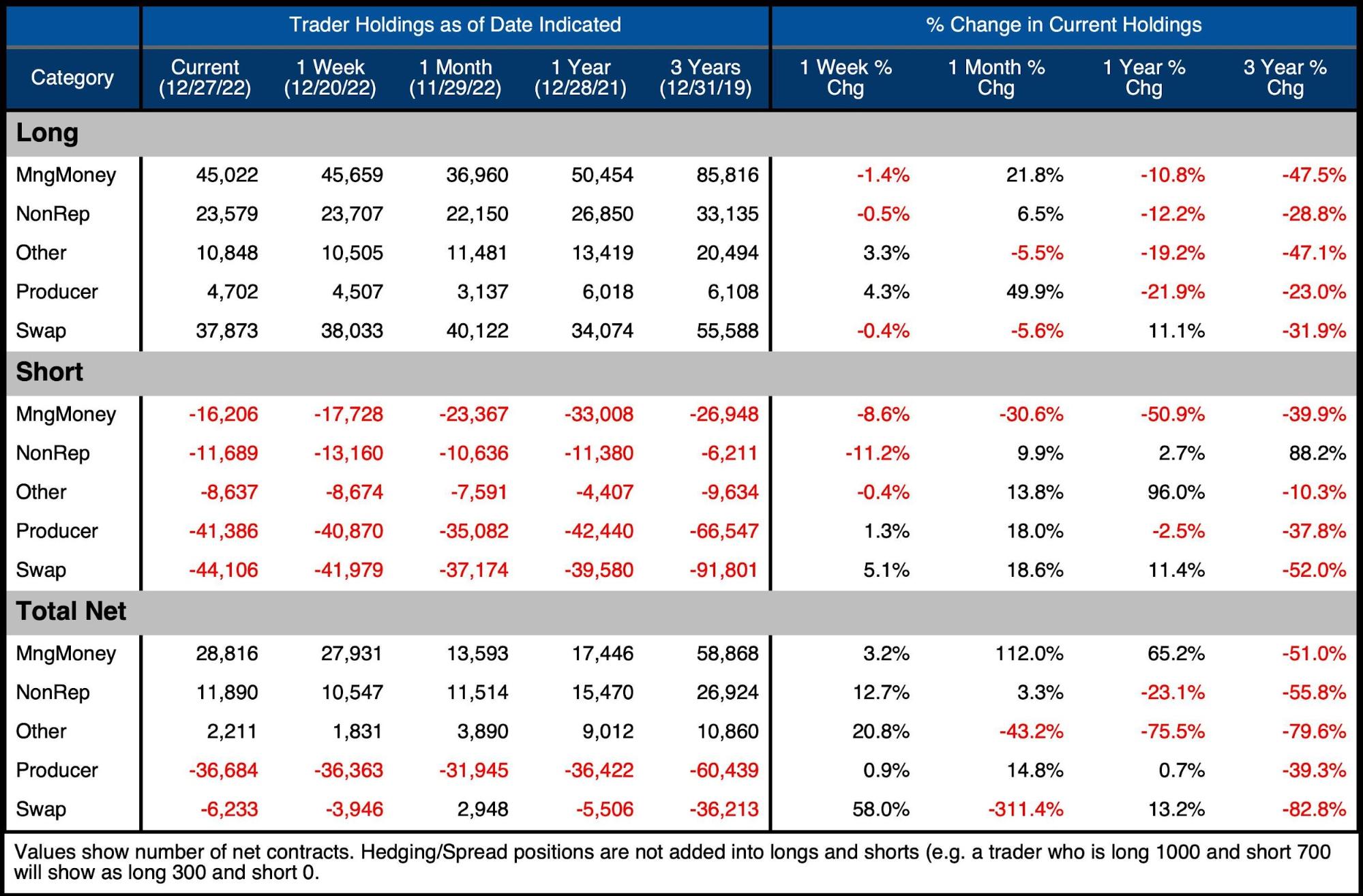

The table below shows a series of snapshots in time. This data does NOT include options or hedging positions. Important data points to note:

-

- The change in Managed Money came from both longs and shorts

-

- Gross shorts fell by 30% or more than 7k contracts

- This resulted in a net long increase of 112%

-

- Other is very close to going net short for the first time since 2020

-

- Other net long stands at 2.2k down from 9k a year ago (down 75.5%)

-

- Swaps are net short again going from 2.9k net long to 6.2k net short

- The change in Managed Money came from both longs and shorts

Figure: 12 Silver Summary Table

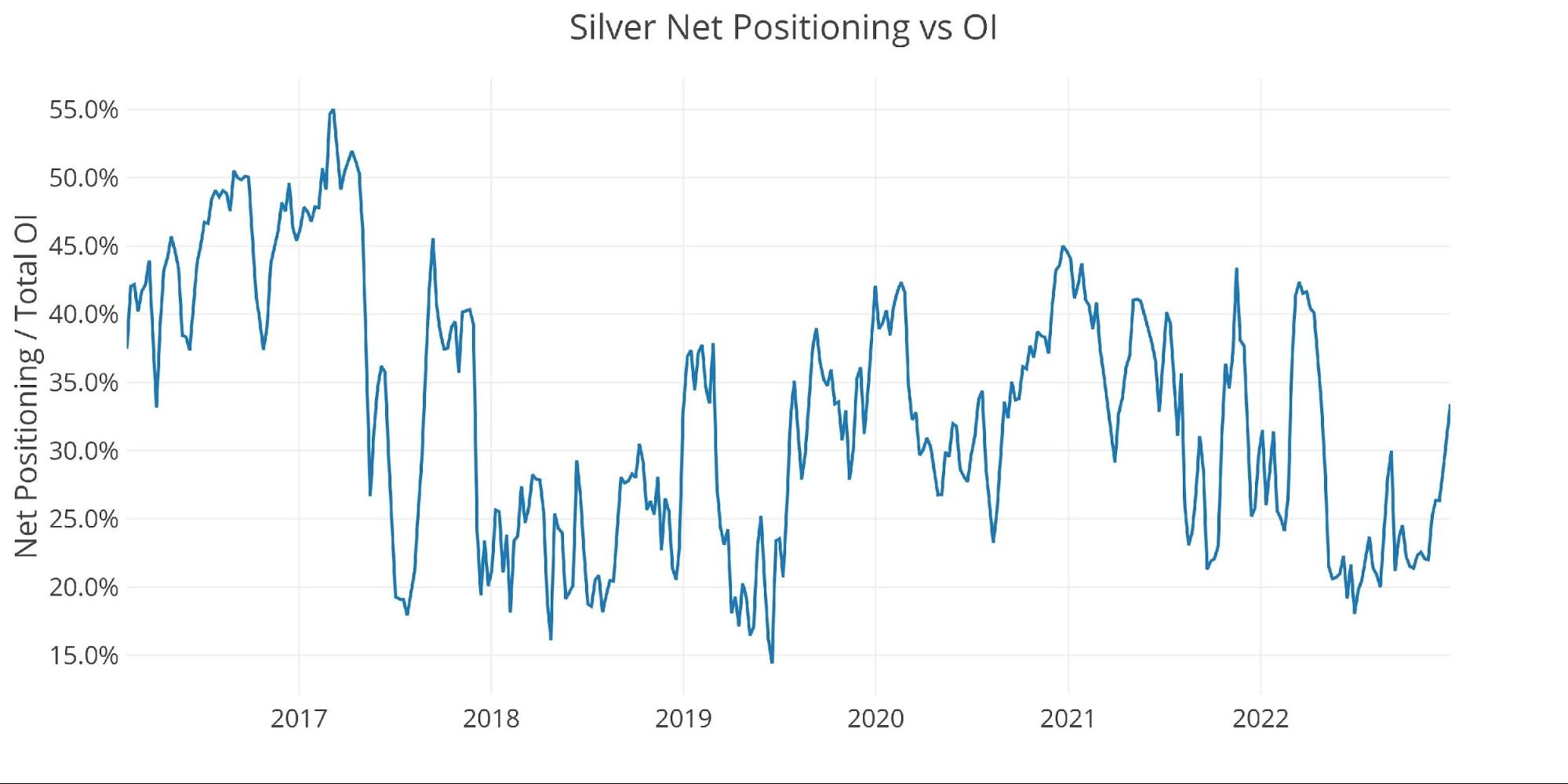

Net positioning in silver has rebounded in a big way. It has reached 33.4% after getting as low as 18% in June. It was recently at 22% in November.

Figure: 13 Net Positioning

Historical Perspective

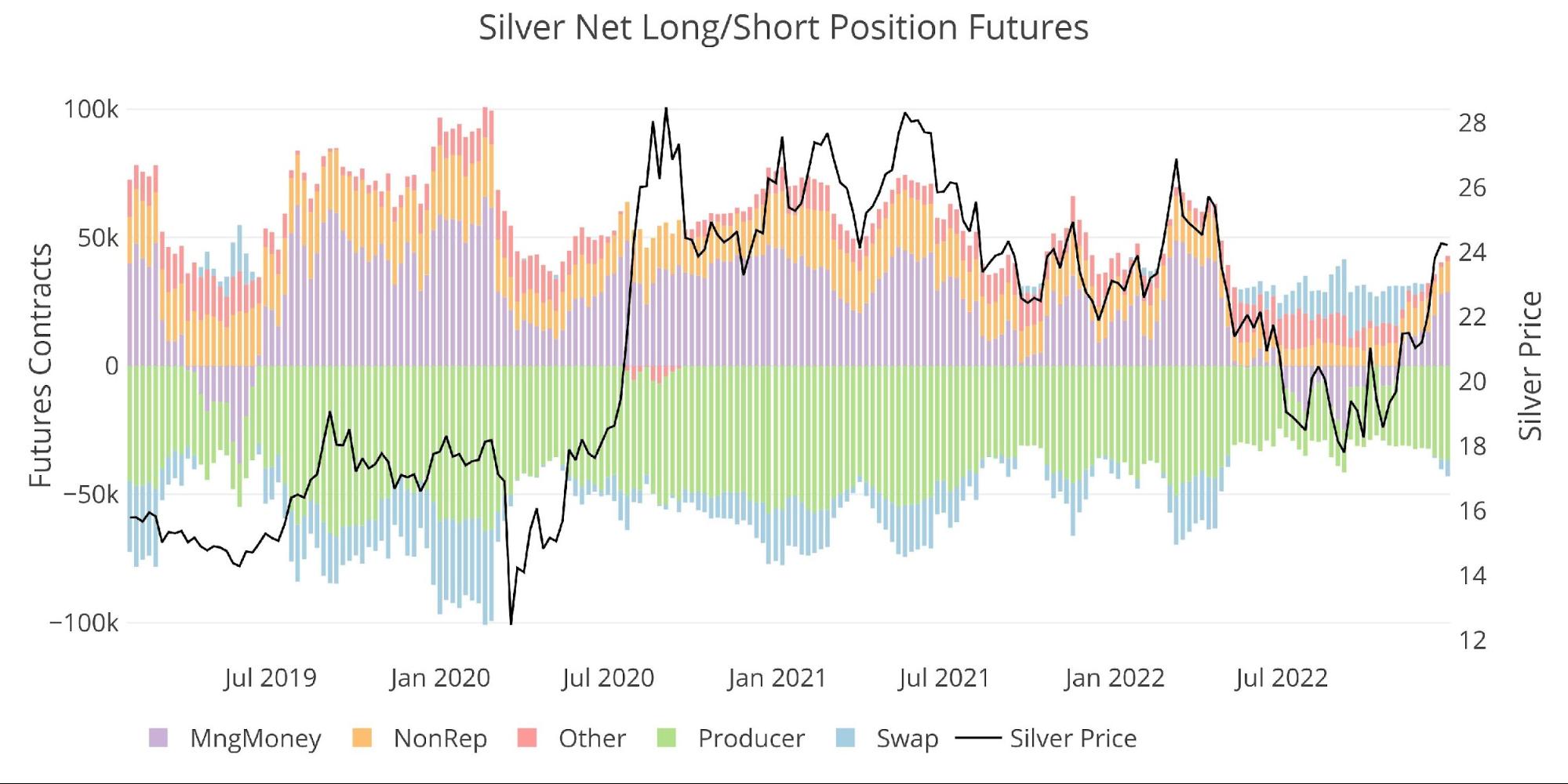

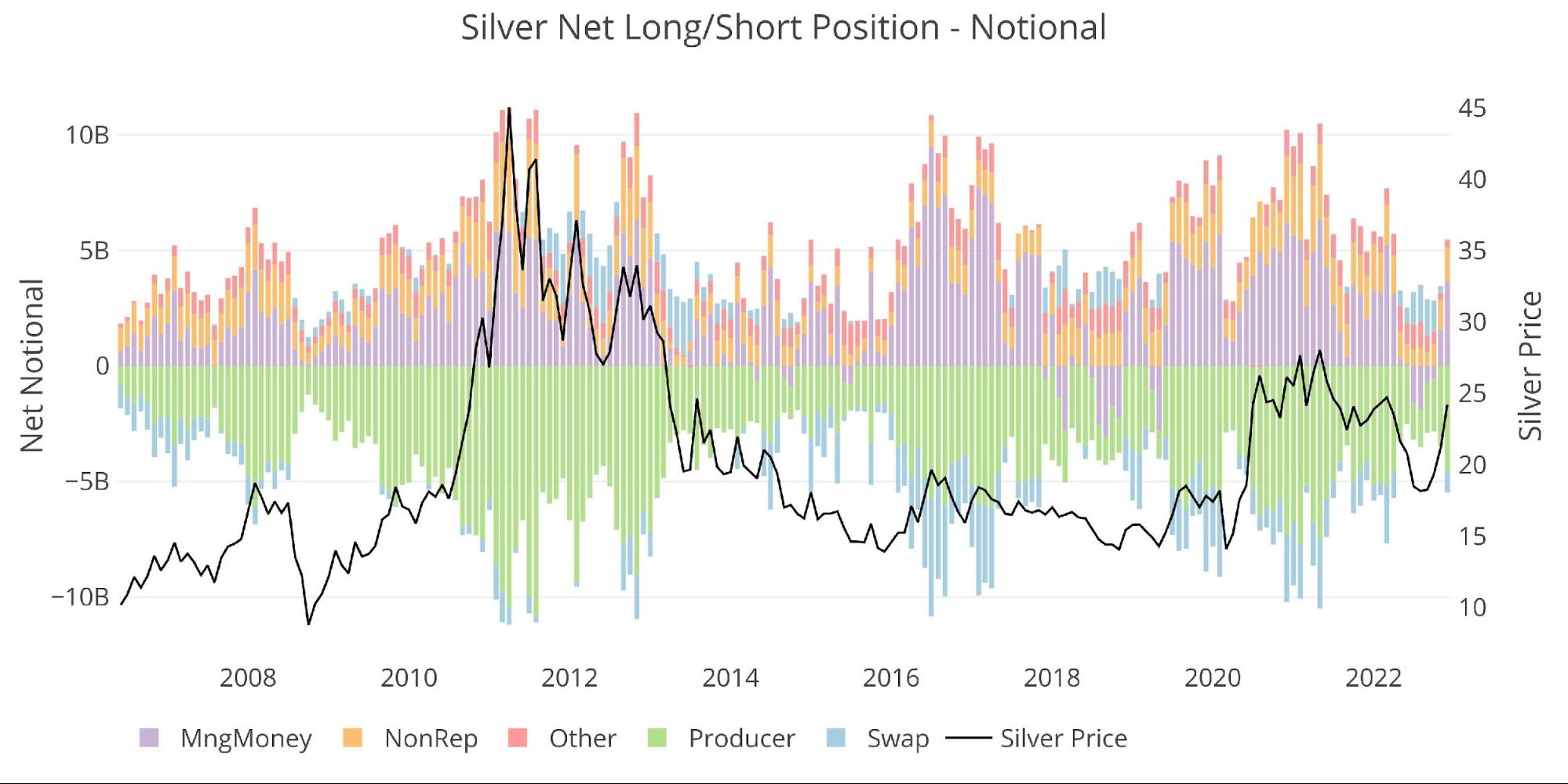

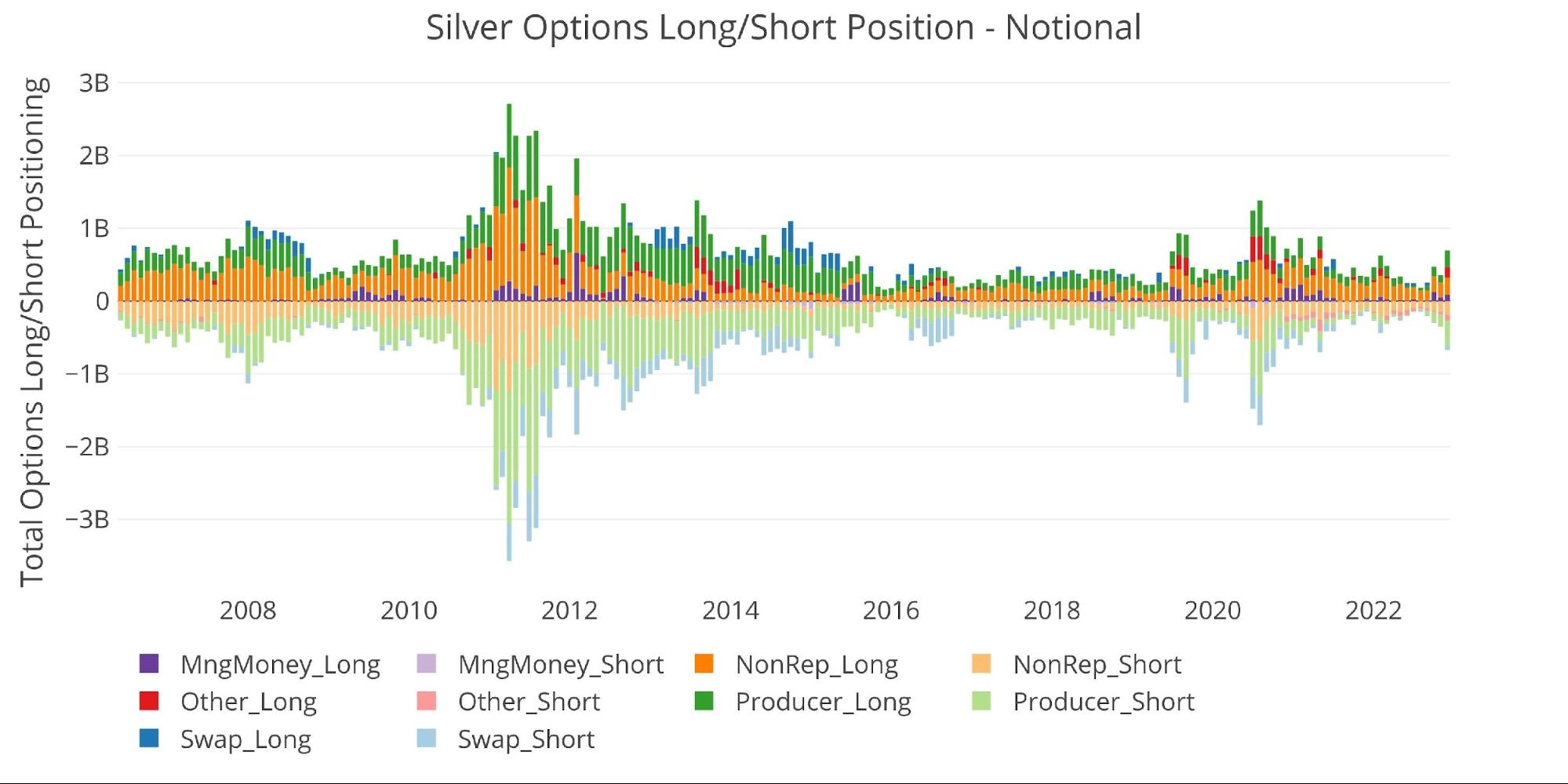

Looking over the full history of the CoTs data by month produces the chart below. The overall market has been contracting in recent months to multi-year lows but does seem to have bottomed in September. December saw a massive rebound compared to November, mainly driven by Managed Money and the price advance in silver.

Figure: 14 Gross Open Interest

Managed Money has reversed quickly from its net short position, which ended on November 1st. The massive rebound in the market can be seen in the latest month. This was driven by $1.5B increasing to $3.6B in Managed Money net longs.

Figure: 15 Net Notional Position

A similar rebound has occurred in the options market, with Other longs showing up with $150M, up from $0 the month before. Producers also increased longs and shorts in the options market by over 100% on both sides.

Figure: 16 Options Positions

Conclusion

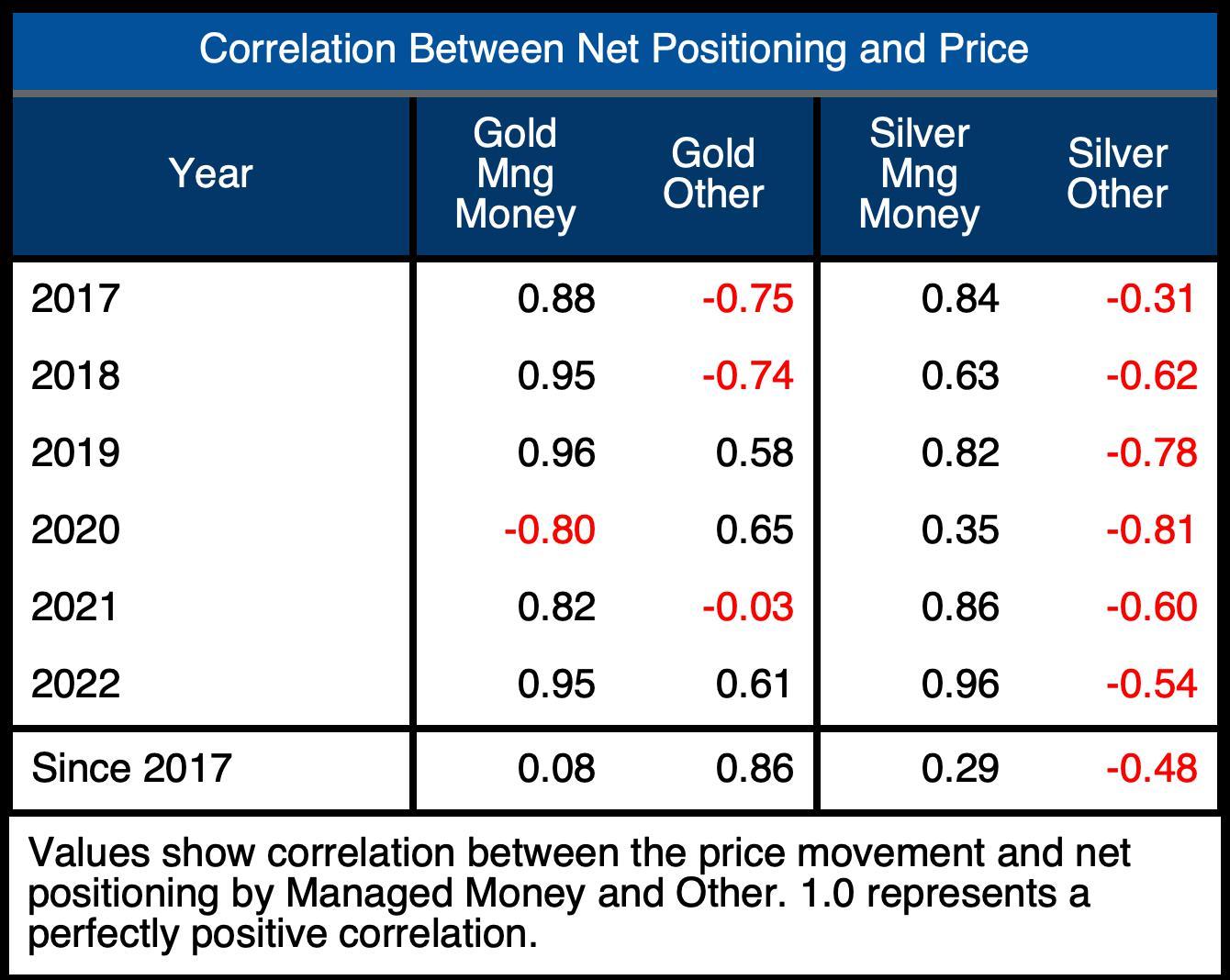

Managed Money continues to dominate control over the market. Looking at the correlation table below shows gold at .95 and silver at an incredible .96 for all of 2022. This was the strongest correlation in silver ever where gold saw .96 in 2019 and .95 in 2018.

Figure: 17 Correlation Table

Managed Money is clearly re-entering the market after reaching peak pessimism in Q4. The activity in silver has been leading the gold market. This likely aligns with the peak hawkishness of the Fed perceived by the market around the same time.

The market now recognizes that the Fed is nearing the end of its tightening cycle even while it still talks a big game. More than likely, something is going to break in early 2023 and the Fed will pivot hard. When this happens, Managed Money could come flooding back into the long side to drive gold to new all-time highs. Silver might need to wait a bit longer to breach the $50 all-time high, but with the incredible physical demand, this does not seem impossible in the not-too-distant future.

Data Source: https://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm

Data Updated: Every Friday at 3:30 PM as of Tuesday

Last Updated: Dec 27, 2022

Gold and Silver interactive charts and graphs can be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

More By This Author:

Slow Pace Of Balance Sheet Reduction Calls Into Question Fed’s Commitment To Inflation FightThe Fed Can’t Win

The Cost of Easy Money Is Now Coming Due