Macro Briefing - Tuesday, Nov. 25

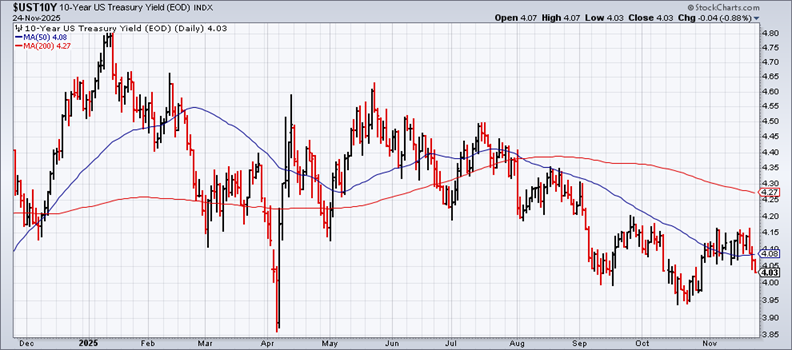

Fed Governor Christopher Waller on Monday said he favored cutting interest rates at the Fed’s Dec. 10 policy meeting. Since the last Fed meeting, “most of the private sector and anecdotal data that we’ve gotten is that nothing has really changed. The labor market is soft. It’s continuing to weaken,” he said. The 10-year Treasury yield on Monday fell to 4.03%, the lowest level so far this month.

(Click on image to enlarge)

BlackRock’s iShares bitcoin ETF sees record outflows as the cryptocurrency’s price tumbles. The fund has recorded $2.2 billion in outflows this month, as of Monday, FactSet data shows.

Texas manufacturing activity accelerates in November, according to the Dallas Fed’s Manufacturing Index. The production index, a key measure of state manufacturing conditions, rose 15 points to 20.5, indicating a notable pickup in output growth.

JP Morgan predicts the international crude benchmark, Brent, could drop into the $30s per barrel by 2027 due to an oversupplied market. Currently priced in the low $60 range, Brent has dropped 14% in 2025 due to weak Chinese demand and steady OPEC+ output.

US gasoline prices are near the lowest level in four years. The national average for a gallon of gas on Monday tallied at $3.07, which amounts to a slight uptick from a year ago, AAA data showed.

(Click on image to enlarge)

More By This Author:

Revived Expectations For Rate Cut Keep Bond Market HummingMacro Briefing - Monday, Nov. 24

Recession Risk Is Low, But Softer Labor Market Raises Red Flags