Lumber Prices Extend Plunge Amid Increasing Sawmill Capacity

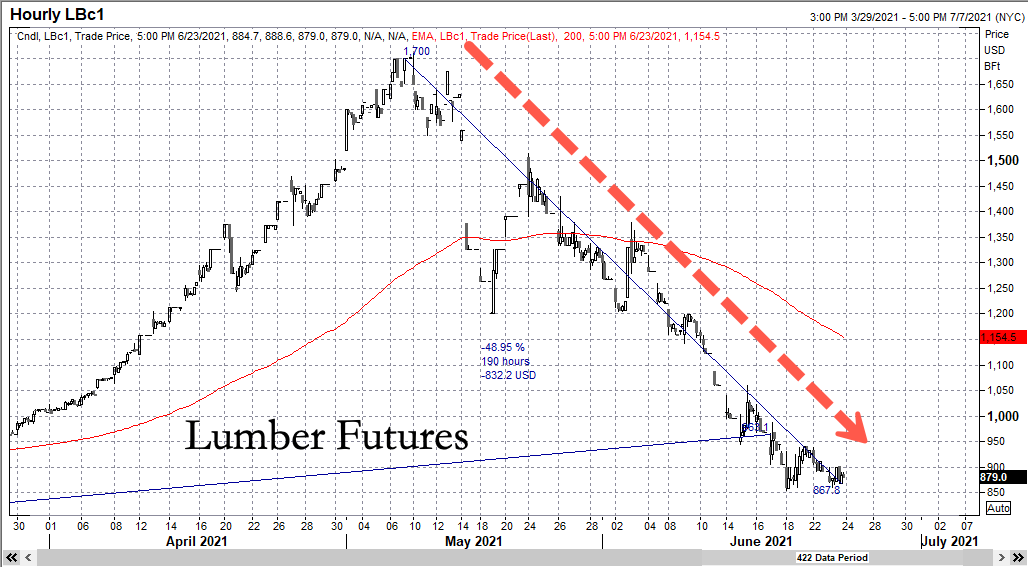

Lumber futures on Chicago Mercantile Exchange have been nearly halved in a matter of a month to $879 per thousand board feet from the all-time high in May of around $1,711. The reason for the latest downdraft is because sawmills are boosting output and domestic production is increasing, catching up with demand.

(Click on image to enlarge)

"High prevailing prices have already encouraged lumber mills to boost output, and we anticipate that domestic production will rise even further as labor shortages in the trucking and forestry sector dissipate," Samuel Burman, assistant commodities economist at Capital Economics.

Lumber, which is typically transported on one of three types of cars — center beams, boxcars, and bulkhead flatcars, has increased above 7,000 railcars for the first time in two years in May. He said besides "slipping back so far in June, they remain relatively high by past standards."

We wrote a note at the beginning of the month titled "Lumber Prices Slump As Historic Boom Hits A Wall," pointing out how "sawmills could be catching up amid the flurry of demand from North American homebuilders." At that time, lumber futures were trading around $1,300.

Shortly after that, about mid-month, lumber prices began to dive, experiencing one of the largest down weeks since 1986 and one year before the 1987 stock market crash.

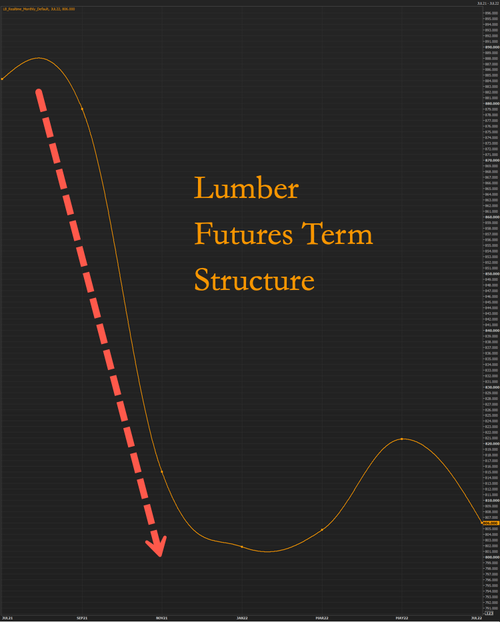

At the end of last week, we noted that price action in lumber futures resembles a "classic commodity blowoff top." We highlighted then, the curve for lumber futures is sloping downwards and suggests that "the market is looking for quite some weakness as we head into the autumn and winter months."

With the term structure of the futures market indicating falling demand and supply ramping up - Capital Economics released their forecast that prices may drop to $600 by the end of 2021. This is a relief from $1,700 prices but still, more than double the prices from pre-COVID levels of around $300.

Bloomberg notes 3,000 sawmills in the US are "all running extremely hard," and supplies are beginning to catch up with demand as summer begins.

As we've previously noted, homebuilders, stunned by skyrocketing costs of a new build, have halted new projects as they wait out the lumber price storm.

... and according got "Stinson," Twitter's lumber trading "expert," lumber futures at $600 "is still something like 50% higher than the 20-year average."

Stinson was recently on Bloomberg explaining the lumber shortage.

I spoke on this, briefly, on national TV 4 weeks ago. Somehow got it explained in 1:30 minutes.

— Stinson 🌲🪓 🏠 (@LumberTrading) June 21, 2021

This answer was spurred from a question about the #wrongtrees but if you focus on the right trees, lumber market action makes more sense. @tembalanco more Twitter, less YouTube https://t.co/ql9qG5syVc pic.twitter.com/NeuGIPr6zb

He added: "wait, is the 30 yr mortgage under 3% again? y'all, lumber will easily avg $1000 if that a thing 2nd half of the year."

The big takeaway here is even as sawmills are ramping up supply, prices returning to pre-COVID levels aren't in the playing cards this year. Enjoy higher lumbers, but oh wait, the Federal Reserve says this is all "transitory."

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more