Looking At Gold's And Miners’ Next Moves

Gold, silver, and mining stocks moved higher yesterday (Mar. 15), and they did so without the bullish push from the declining USD Index. Conversely, the USD Index ended yesterday’s session a bit higher. Is this strength an indication that a bigger rally in gold is on the horizon?

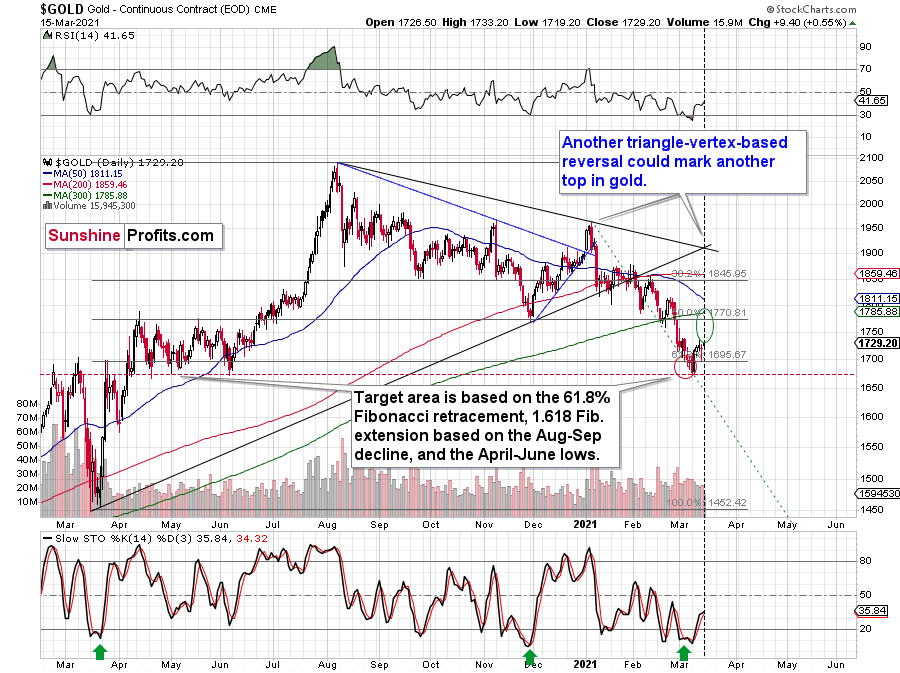

In my opinion, this is not necessarily the case. This kind of supposedly bullish action could still be a purely technical (emotional) development. This week’s triangle-vertex-based reversal is due more or less now (or it was due yesterday – more on that shortly), which means that the yellow metal is likely to reverse shortly or that it has already done so. If it’s about to reverse right now, and the next big move is going to be to the downside, it means that gold practically had to rally beforehand. Therefore, the fact that it did is relatively normal and neutral, not bullish.

Based on the above chart, the triangle-vertex-based reversal point was due yesterday. However, based on the chart below, it’s due today.

There might be slight differences between chart providers, which – if applied to relatively long-term lines – can distort the implications by a few pixels on the chart. These few pixels might mean a day (or so) of a difference in the case of the triangle-vertex-based formation.

Instead of going over charts of multiple providers on each day, it’s more useful to notice that the triangle-vertex-reversal points work on a near-to basis and thus expect a given reversal to take place close to the point suggested by the above technique, rather than going all-in based on the assumption that it will work perfectly. Every now and then it does work perfectly, but the “broad” approach is overall more useful.

At the moment of writing these words, I see that gold futures formed a small top just about $2 below the previous March high ($1,738). Consequently, both following scenarios would make sense in light of the current triangle-vertex-based reversal:

- Gold could decline right away as it doesn’t have to form a new high at the reversal point – just “a high”

- We could see another small, several-dollar rally, which would take gold to new monthly highs and make the triangle-vertex-based reversal work in a classic way, where it detects the final top for a given rally. The FOMC weeks tend to have higher intraday volatility, especially right before the interest rate decision is announced and during the press conference. This means that gold could move up and down in a quite volatile manner shortly.

Both scenarios seem quite possible and it’s hard to tell which of them is more likely. In both cases, it seems quite likely that another – big – decline will begin soon. Of course, I can’t promise that the rally is going to be completely over today, but this seems quite likely. And if not, it seems that it’s going to be over shortly, anyway.

And what about mining stocks?

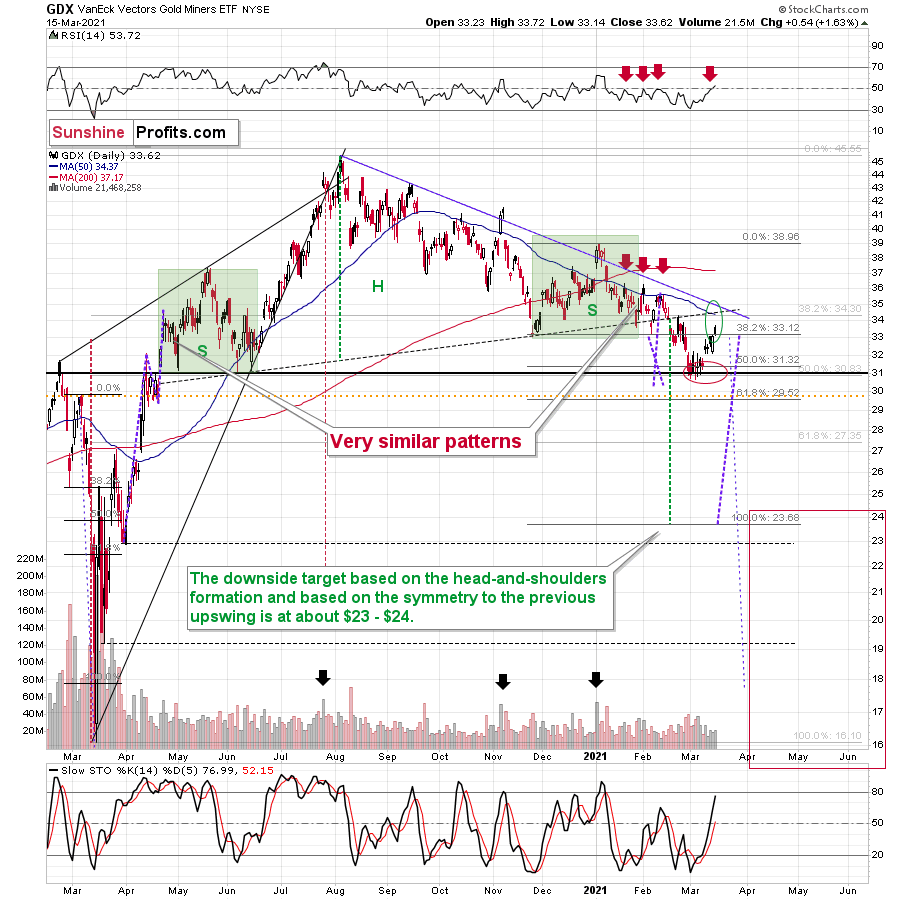

The mining stocks remain in my upside target area, which means that they could have already topped, or that they could top a bit higher. Regardless, based on all the reasons that I discussed yesterday, and also based on the above comments on gold’s reversal, it seems that the days of this rally are numbered (and it’s not a big number, either).

The neck level of the previously broken head and shoulders pattern, the declining blue resistance line, the 50-day moving average, the late-February high – they all create a very strong short-term resistance not far above yesterday’s closing price. But does it mean that the mining stocks have to move higher from here, or that such a rally would be likely?

Not necessarily. While miners managed to close yesterday’s session above the November low, they didn’t manage to close the day above the January and early-February lows in terms of the closing prices. About a month ago, the GDX tried to invalidate the breakdown below these levels, and this move failed – it was followed by a decline to new yearly lows. Will we see the same thing once again? It seems very likely in my view – the history tends to rhyme.

But how low could the GDX ETF go? My previous comments on that matter remain up-to-date, but I would like to stress that just because the downside target area is relatively far, it doesn’t mean that we will necessarily hold our positions until it’s reached. If we see signs of strength that seem reliable (like miners refusing to decline even though gold moves lower combined with gold reaching an important support level while the USDX encounters resistance), I might write about temporarily closing this position – and perhaps even going long one more time – and we might be able to reap additional profits on the corrective upswing, just as I did earlier this month.

Our final downside target area ($15 – $24.5) is quite broad, because a lot depends on what the general stock market will do. I’ll be looking at gold for the key signs along with a few other factors (including the Gold Miners Bullish Percent Index) and determined the buying opportunity based on them – not necessarily based on the price of the GDX or GDXJ by itself.

Yes, this target is quite low, and thus might appear unrealistic, but let’s consider the following:

- Miners are slightly above their early-2020 high – just like gold.

- Gold is likely to decline to its 2020 lows or so

- General stock market might have just topped.

Considering all three above factors it’s clear that a move to even the 2020 lows is not out of the question.

And this means that junior miners might decline more than senior miners. A move from the current levels to the 2020 would imply a decline by about 50% in the case of the GDX, and by about 60% in the case of the GDXJ.

Disclaimer: All essays, research, and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

Is there a price or time point that validates or invalidates your position?

None that would be useful as near-term a stop-loss, if that's what you mean. A bigger rally from here would make me re-evaluate everything, though. The change in my outlook will depend on more factors than just the price of gold.

Love your work...Just signed up as a subscriber. Fascinated by your use of the Apex triangle. Read you explanation of the website. Can you point me to more information on its use? Thanks in advance

Thank you and welcome aboard! I'm very happy to read that you're enjoying the results of our work. As for the triangle-vertex-based reversals, I think there was something about them also on Thomas Bulkowski's site http://thepatternsite.com but I can't find the exact page right now. I'm also (still) fascinated by this technique. Just like Fibonacci extensions, it doesn't seem (logically) to make that much sense for them to work... But they do - over and over again.