Lithium: A Booming Sector Set Up For Continued Strength

Image Source: Pixabay

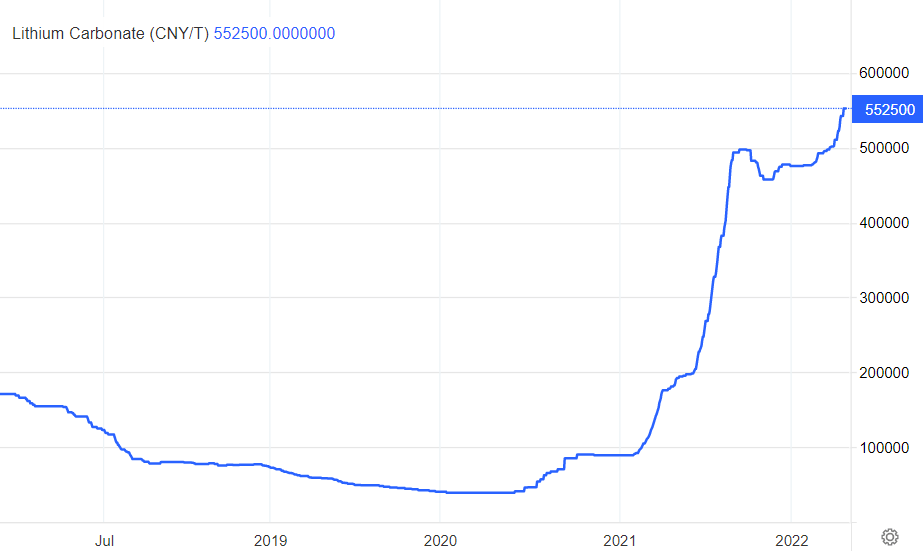

The one sector that stands out is lithium. The price of lithium continues to rise. Several lithium stocks trade higher in 2022, but not all of them. We expect that most of the sector is going to get a boost eventually, once broad market conditions stabilize. As said in one of our latest annual 2023 forecasts we expect lithium stocks in 2023 to be very bullish. The lithium price breakout in mid-October was the writing on the wall.

Interestingly, the price of lithium continues to make new highs. In fact, it is the only commodity that broke out to new ATH since May/June which is when the rate of inflation peaked. Commodities came down substantially since then, with the exception of the price of lithium as well as graphite.

The price of lithium broke out to new ATH around mid-October.

Lithium stocks drivers

That said, how comes not all lithium stocks are rising?

The answer is that there are 3 drivers for lithium stocks:

- The price of lithium. Think of it as ‘spot lithium.’ We discuss the lithium price chart in the next paragraph.

- The supply deficit in the lithium market. This one speaks for itself. We dedicate a section to this topic.

- Broad markets. Once broad markets confirm a bottom and start calming down, after a violent 2022, we see momentum return into the lithium market.

With the price of lithium on the rise and the supply deficit well underway, the question is when broad markets will stabilize and confirm a bottom.

We believe that the bottom was set on June 17th. Indexes like the S&P 500, Dow Jones, and Russell 2000 did not violate those levels. With ‘violation’ or ‘breakdown’ we mean that they trade for more than 5 full days below those June levels.

In other words, we expect 2023 to be a good year for lithium stocks.

The leaders

If we look at 2022, despite awful price action in markets, several lithium stocks are now trading much higher than at the start of the year. One such example is Pilbara Metals, trading in Sydney:

(Click on image to enlarge)

Lithium producers are benefiting from the rising lithium price as opposed to near-term producers or explorers. When the market is dominated by turbulence investors tend to prefer to invest in cash-generating companies. Consequently, when broad market conditions improve we can reasonably expect the laggards in the lithium market to get a bid.

We believe lithium investing requires a long-term approach.

Look at Patriot Battery Metals, a stock that went up 20x in the last 12 to 18 months. It is possible to hit multi-baggers in the lithium space, however, it requires being selective.

(Click on image to enlarge)

Lithium stocks: the upside potential

If we look at LIT ETF, a proxy for the broad lithium sector (not purely lithium miners though) we see a really nice double-bottom setup in 2022 with a higher low in October (against June/July). Provided this double bottom holds we believe that this sector is set for a great 2023.

(Click on image to enlarge)

We just published our latest lithium stock selection after a very thorough analysis of the lithium market and its dynamics. The research note “Lithium & Graphite top stock selection” is available in the restricted area of Momentum Investing members (published: October 21st). We identified the dynamics that the lithium market is following and identified our top selection in each segment.

We believe that it’s worth speculating on near-term producers. It’s a bet with the potential for asymmetric returns. It’s worth the risk.

More By This Author:

A Beautiful Development In MarketsShould Investors Choose Precious Metals Or Crypto In 2023?

Lithium Price Breaking Out Aggressively, Lithium Miners Will Follow Suit

Disclaimer: InvestingHaven.com makes every effort to ensure that the information provided is complete, correct, accurate and ...

more