Let’s Give A Warm Welcome To Altcoins, The New Junior Miners

Just as demand for the GDXJ was based on an anti-establishment thrill, crypto altcoins are now even more appealing to many.

The rally might have just burnt itself out. And I don’t mean just the precious metals market, but stocks too.

Having said that, I would like to write a few words on stocks today as well. While it could be the case that we’ll see another short-term move higher (as we did previously after pullbacks), it seems to me that this might have been the final top for months to come.

The Market’s Rhythm

The markets are self-similar (which is another way of saying that they have a fractal nature), which generally means that while the history tends to rhyme, it also tends to rhyme in similar shapes of alike or various sizes.

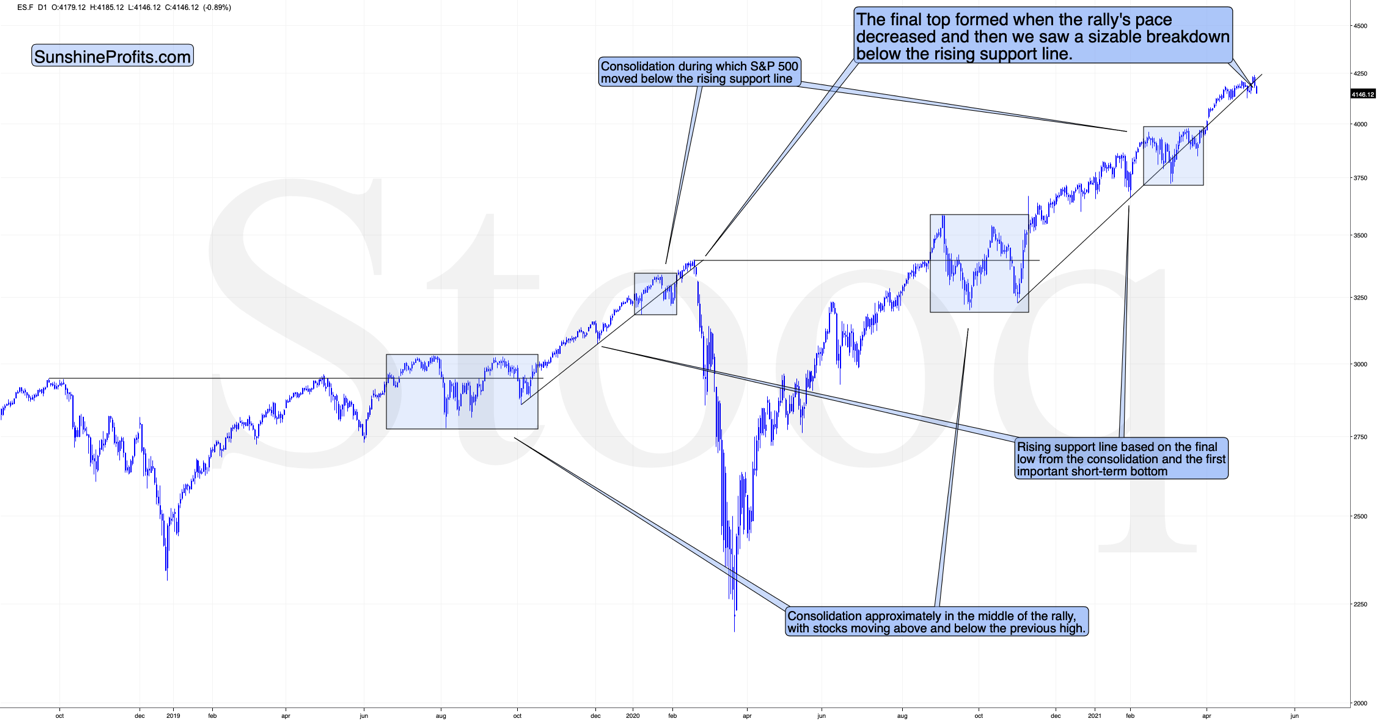

For example, the rally from 2018–2020 seems very similar to the rally from 2020 to the present.

Both rallies started after a sharp decline, and the first notable correction took the form of back-and-forth trading around the previous high. I marked those situations with big blue rectangles.

Then the rally continued with relatively small week-to-week volatility. I created rising support lines based on the final low of the broad short-term consolidation and the first notable short-term bottom.

This line was broken, and some back-and-forth trading followed, but it was only about half of the previous correction in terms of price and time.

Then, we saw a sharp rally that then leveled off. And that was the top. The thing that confirmed the top was the visible breakdown below the rising support line right after stocks invalidated a tiny breakout to new highs. That’s what happened in February 2020, and that’s what happened this month.

Combining this with the recent underperformance of the Nasdaq (which just moved to new monthly lows) and a specific situation in the recent “leader” – the GameStop stock – suggests that this might have indeed been the top.

GameStop just broke below two major support lines – the rising one based on the January and February lows and the lower border of the triangle pattern. This spells massive trouble for those invested in the stock.

That’s particularly interesting not only because of the technical pattern that we see above. It’s important because of when GameStop was strong – it attracted a lot of attention a few months ago when the stock market was already in the final stages of its rally (based on numerous fundamental valuations). This stock seems to be a nice proxy for the interest of the general public – which has already peaked. If the market got oversaturated with even the part of the market that goes in last, then what we saw in the S&P 500 can truly be the final top.

I will get back to this thought while discussing the GDXJ charts, but for now, let’s take a look at the USD Index – another key market for the precious metals investors to monitor.

The USD Index

What one might not notice at first sight, but what is very important, the USD Index just invalidated a small breakdown below the head-and-shoulders pattern, and it rallied back above its neckline. This is a classic buy sign and a sign that the breakdown below the rising support line will be invalidated shortly. But that’s not even the most bullish thing that we see right now.

While the self-similarity to 2018 in the USD Index is not as clear as it used to be (it did guide the USDX for many weeks, though), there is also another self-similar pattern that seems more applicable now. One of my subscribers noticed that and decided to share it with us (thanks, Maciej!). Here’s the quote, the chart, and my reply:

Thank you very much for your comprehensive daily Gold Trading Reports that I am gladly admitting I enjoy a lot. While I was analyzing recent USD performance, (DX) I have spotted one pattern that I would like to validate with you if you see any relevance of it. I have noticed the DX Index performing exactly in the same manner in a time frame between Jan. 1, 2021 and now as the one that started in May 2016 and continued towards Aug. 16. The interesting part is not only that the patterns are almost identical, but also their temporary peeks and bottoms are spotting in the same points. Additionally, 50 daily MA line is almost copied in. Also, 200 MA location versus 50 MA is almost identical too. If the patterns continue to copy themselves in the way they did during the last 4 months, we can expect USD to go sideways in May (and dropping to the area of 90,500 within the next 3 days) and then start growing in June… which in general would be in line with your analysis too.

Please note the below indices comparison (the lower represents the period between May-Dec 2016 and higher Jan – May 2021). I am very much interested in your opinion.

Thank you in advance.

And here’s what I wrote in reply:

Thanks, I think that’s an excellent observation! I read it only today (Monday), so I see that the bearish note for the immediate term was already realized more or less in tune with the self-similar pattern. The USDX moved a bit lower, but it doesn’t change that much. The key detail here would be that the USDX is unlikely to decline much lower, and instead, it’s likely to start a massive rally in the next several months - that would be in perfect tune with my other charts/points.

I wouldn’t bet on the patterns being identical in the very near term, though, just like the late June 2016 and early March 2021 weren’t that similar.

As soon as the USD Index rallies back above the rising support line, the analogy to 2016 will be quite clear once again –the implications will be even more bullish for the USDX and bearish for the precious metals market for the next several months.

What About Gold?

Having said that, let’s move to gold’s outlook.

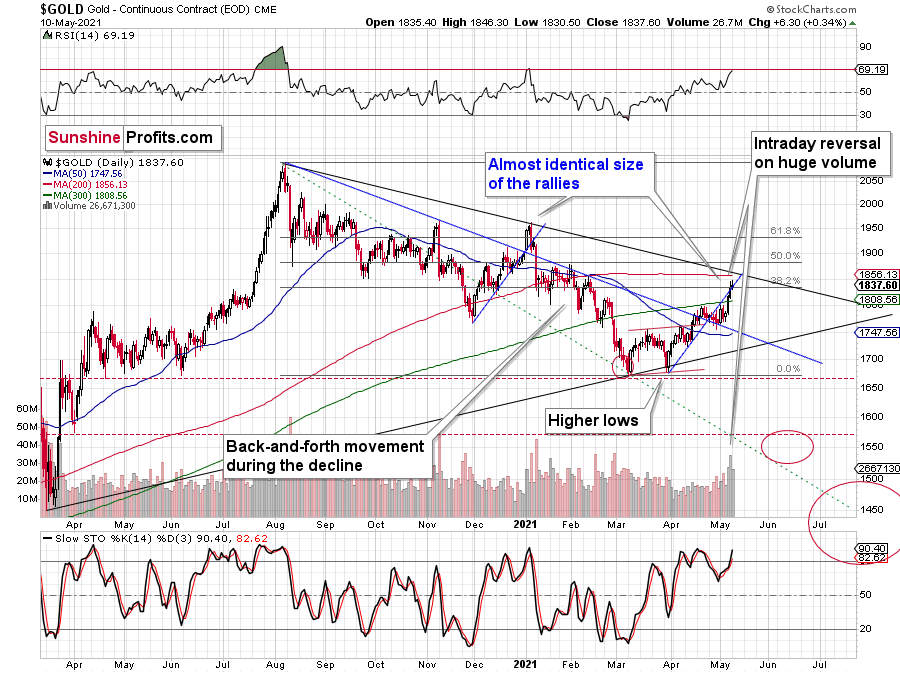

The yellow metal ended yesterday’s session higher yesterday (May 10), but – just like on the previous day – it reversed before the end of the day.

This, plus high volume, plus the RSI very close to the 70 level (classic bearish gold trading signal) and the broad analogy to what happened in 2011-2013 make the current outlook for gold very bearish for the next few months.

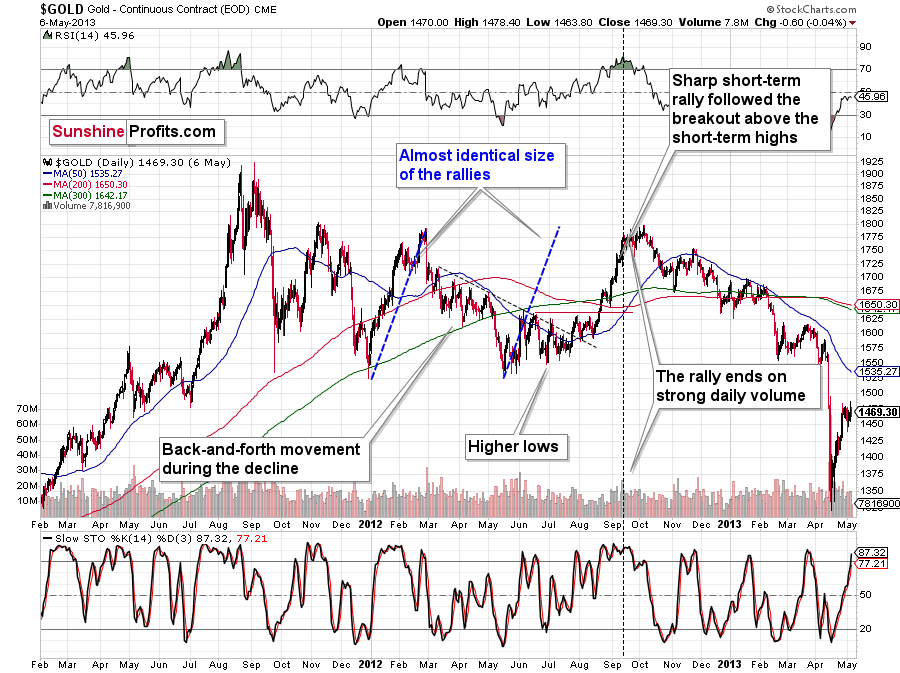

“What analogy to 2011-2013?” you might ask. Well, the shapes of the rallies and declines were quite similar.

This time, we have lower highs and lower lows, while in 2011 and 2012 we had a horizontal consolidation. However, as I discussed yesterday, just as the situation is similar to what we saw after the 2011 and 2008 tops, the gold market’s recent reactions are the average of both previous reaction types.

While I had previously thought that we were already in the final decline, it has likely turned out that this was still the consolidation stage – just like what we saw in the first half of 2012 – but one in which gold would be slowly declining anyway.

I previously wrote that the situation is similar to 2008 in a way and to 2012-2013 in a slightly different way. When I’m looking at it now, it’s quite normal that the gold market is mixing both previous performances. But it’s always easy to see things with the benefit of hindsight.

In 2008, before the final slide, we had clearly lower lows as well as lower highs. During the 2012-2013 consolidation we had a more or less horizontal pattern that was then followed by the final slide. Right now, we have something in between – we have lower highs and lower lows, but it’s not as clear as it was in 2008.

Back in 2008, it took gold 29 weeks to move from the initial (March 2008) top to the final (October 2008) top.

Back in 2011-2013, it took gold 55 weeks to move from the initial (September 2011) top to the final (October 2013) top.

The arithmetic average of the above is 42 weeks, and last week was the 39th week after the August 2020 top. If gold stops here or shortly, it will be almost right in the middle of the similarity between both periods.

Mining Stocks and Crypto Assets

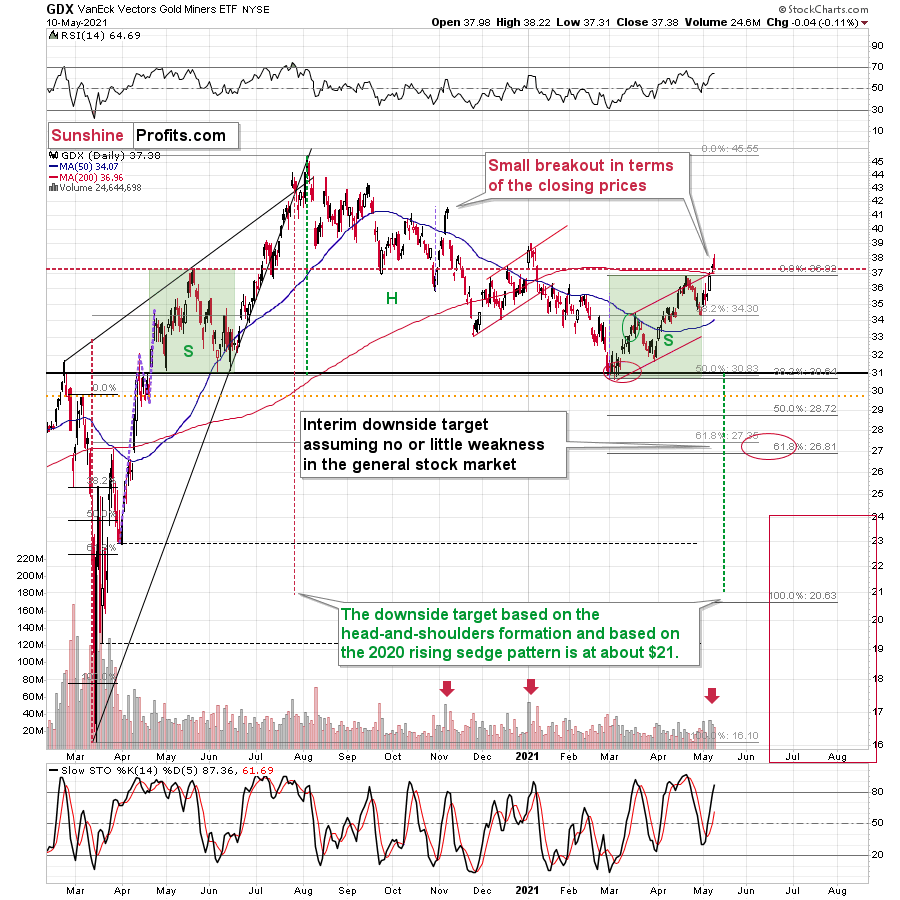

Keeping the above indication for gold in mind, let’s take a look at the mining stocks.

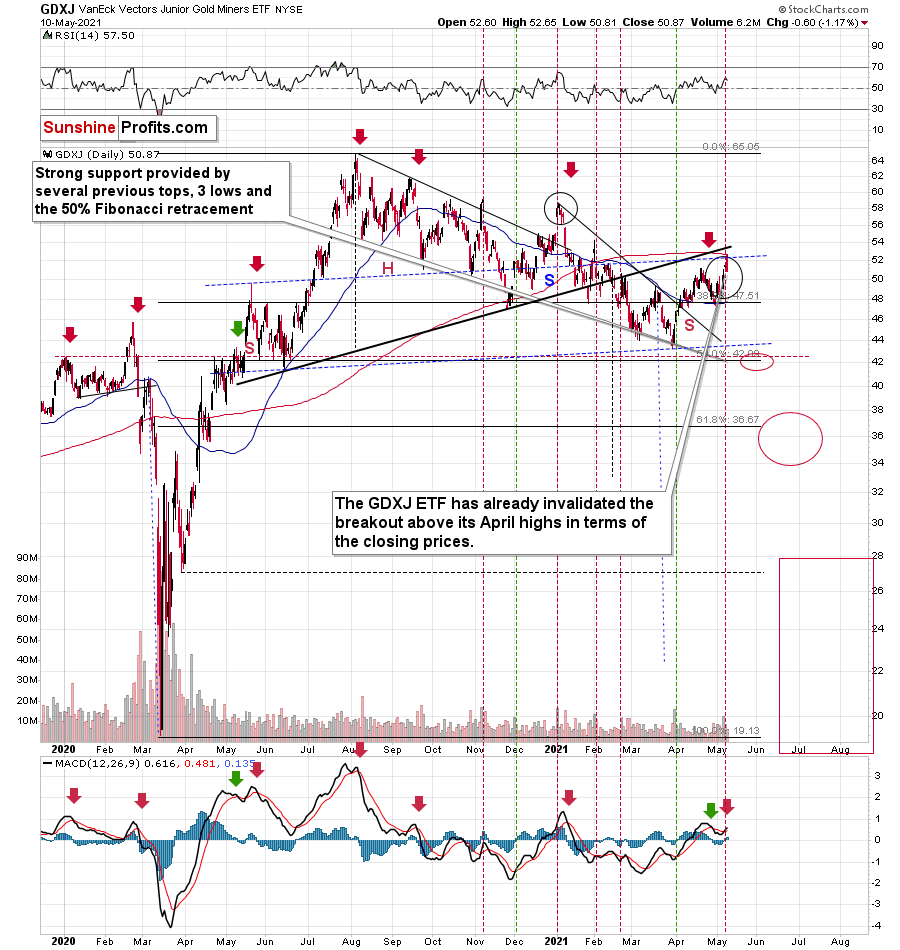

The GDX ETF declined yesterday – by a mere 0.11%, but still, it was a daily decline on a day when gold ended higher.

And while the GDX ETF declined by just 0.11%, the GDXJ ETF declined by 1.17%. The GDXJ ETF once again declined more than the GDX.

In fact, unlike the GDX, the GDXJ closed back below its April high, thus invalidating the small breakout. This serves as another sell sign.

To be clear, it’s no wonder that junior mining stocks (the GDXJ ETF serves as a proxy for them) declined so much – they are highly correlated with the general stock market, so the fact that the latter declined visibly was more important for juniors than for seniors.

And as I emphasized previously, juniors have been weak even despite the stock market’s strength.

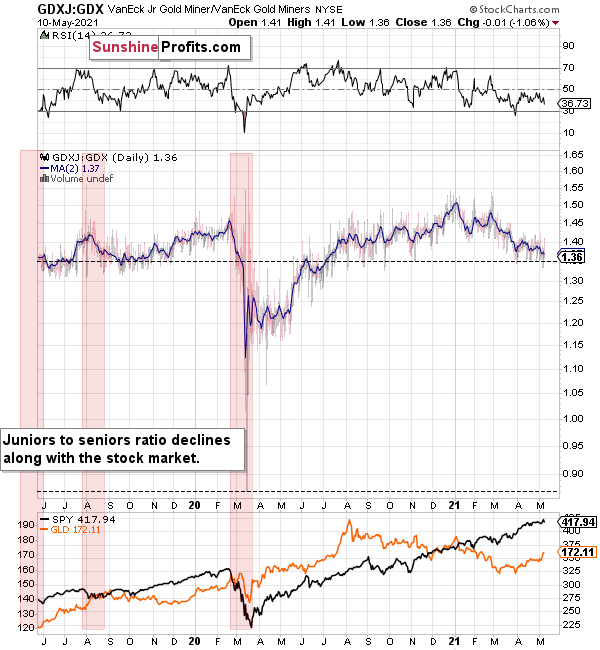

You can see this on the above chart – the GDX to GDXJ ratios have been declining this year, despite continuous strength in stocks. But why has this been the case? I think I have an explanation for this phenomenon.

I previously wrote that I would get back to the stocks like GME while discussing juniors, and this is the part of the analysis when I deliver.

But does GME have anything to do with junior miners? It does. And so does Dogecoin and many other altcoins. Heck, even the Polish stock market. Yes, all of them can provide useful gold trading tips — really.

The common denominator of all this is the stage at which the market finds itself, and in particular, the part of the market that is currently dominant as buyers.

I previously mentioned several times that the insiders are now heavy sellers of their company shares. But who’s buying those shares (and many other assets)? The investment public! The people “armed” with cash from various stimulus programs and encouraged by the ubiquitous gains on the stock market.

Here's where it gets really interesting. While the professionals tend to stick to the main, historically tested assets with great liquidity (partially because they want those conservative holdings as they are well-researched, and partially, because smaller markets are too small for really big institutions to enter), the investment public goes into cheap, alternative, and less known assets as it seems to them that these parts of the market will now outperform (simply because they are cheap relative to the rest).

As various markets have gotten well ahead of themselves, we see that the final parts of the markets have been booming. Bitcoin is being outperformed by altcoins. The sound stocks were outperformed by GameStop and “alikes”. Silver soared relative to gold. Smaller and not so well-performing markets (e.g., the Polish stock market) have even outperformed the S&P 500 recently. All this indicates major reversals across the board (likely accompanied by a soaring USDX).

But what about juniors? Why haven’t they been soaring relative to senior mining stocks? What makes them so special (and weak) right now? In my opinion, it’s the fact that we now – unlike at any other time in the past – have an asset class that seems similarly appealing to the investment public. Not to everyone, but to some. And this “some” is enough for juniors to underperform.

Instead of speculating on an individual junior miner making a killing after striking gold or silver in some extremely rich deposit, it’s now easier than ever to get the same kind of thrill by buying… an altcoin (like Dogecoin or something else). In fact, people themselves can engage in “mining” these coins. And just like bitcoin seems similar to gold to many (especially the younger generation) investors, altcoins might serve as the “junior mining stocks” of the electronic future. At least they might be perceived as such by some.

Consequently, a part of the demand for juniors was not based on the “sympathy” toward the precious metals market, but rather on the emotional thrill (striking gold) combined with the anti-establishment tendencies (gold and silver are the anti- metals, but cryptocurrencies are anti-establishment in their own way). And since everyone and their brother seem to be talking about how much this or that altcoin has gained recently, it’s easy to see why some people jumped on that bandwagon instead of investing in junior miners.

This tendency is not likely to go away in the near term, so it seems that we have yet another reason to think that the GDXJ ETF is going to move much lower in the following months – declining more than the GDX ETF. The above + gold’s decline + stocks’ decline is truly an extremely bearish combination, in my view.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more