Key Support For Gold

Precious metals haven’t basked in glory days since 2011, over a full decade ago. Earlier this year, due to the Ukraine war, gold had a brief day in the sun, but it has tumbled about 15% in the past four months. Precious metals seem to be good for just one thing, and that is to disappoint investors. Our present days would seem to be made custom-created for gold’s prosperity, but the price action says otherwise.

(Click on image to enlarge)

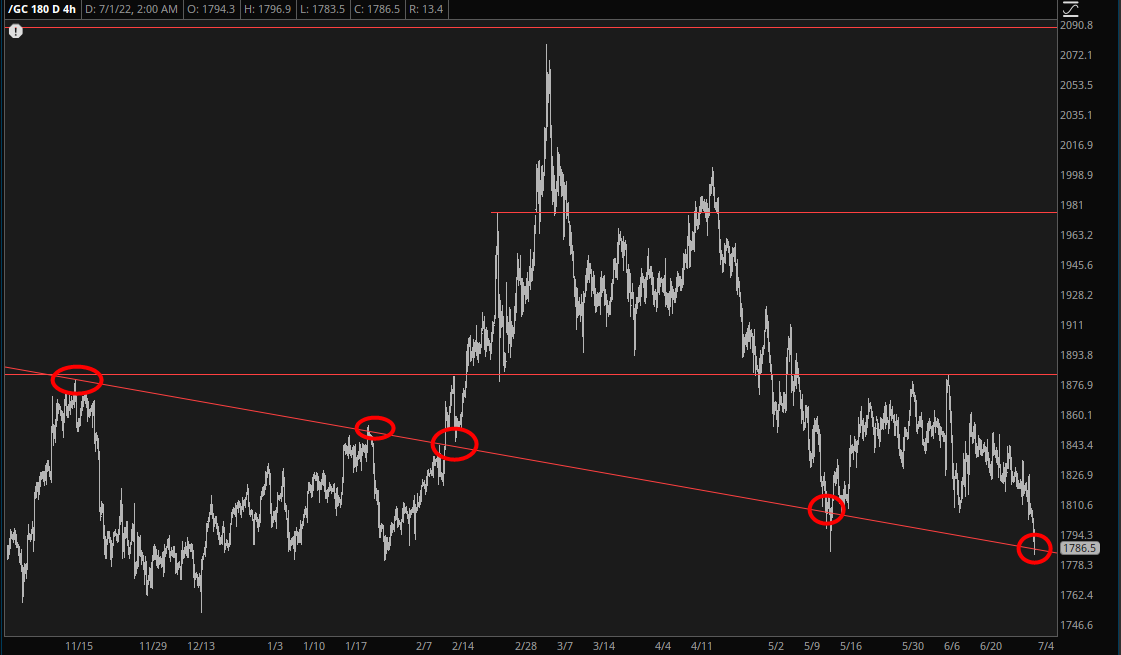

As the circled areas of the chart suggest, the price does seem to have a meaningful relationship to the price. I think gold still stinks, but at least it has a chance for a brief reprieve.

(Click on image to enlarge)

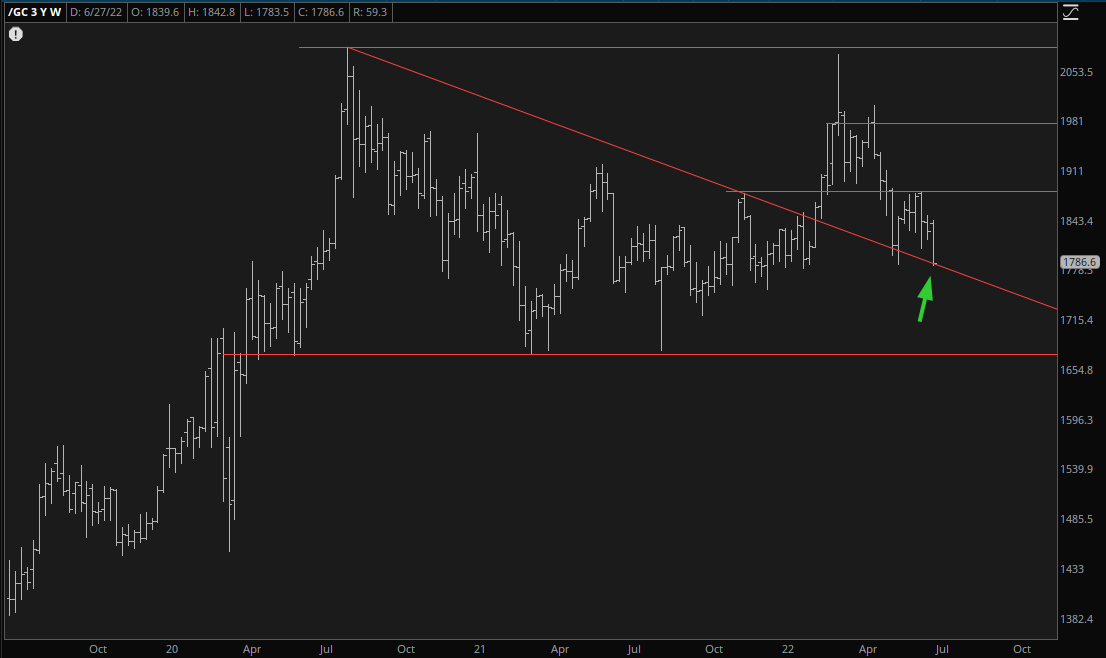

The long-term continuous contract shows the same thing; of course, should that supporting trendline get broken, things could go from bad to worse. I know folks with so much faith in gold that they’ve put a meaningful portion of their net worth in the stuff, and they’ve got to be hopping mad that in this madcap world of countless tens of trillions of dollars being printed out of thin air, that gold just flops around like a dying fish.

(Click on image to enlarge)

Here is the much longer term view; if gold is going to bounce, it sure better do so quickly, or else even this long-term pattern breaks down.

(Click on image to enlarge)

Anyway, welcome to the second half of the year. I think this quarter is going to be tremendous, with July having particularly good prospects for trading action, since this earnings season is bound to be epic.