Key Downside Levels In Gold And Silver

Image Source: Unsplash

The move higher in bond yields and real interest rates on the back of a stable economy (for now) is causing heavy selling in Gold & Silver.

Although two weeks remain in August, Gold’s monthly candle chart shows a clear bearish engulfing candle.

The next strong support is the long-term monthly moving averages in the low to mid $1800s. There is monthly lateral support around $1820.

(Click on image to enlarge)

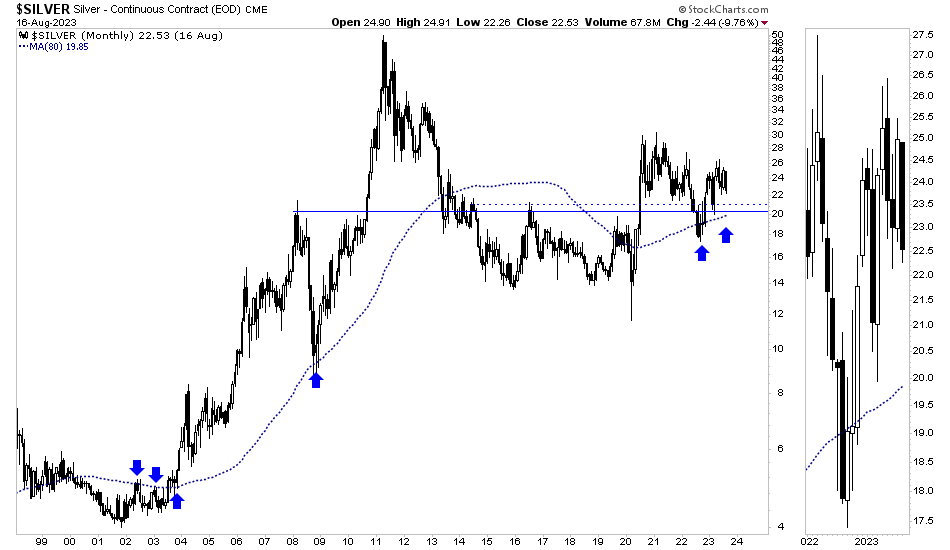

Silver is also dealing with a bearish engulfing candle on its monthly chart.

The next strong support for Silver comes in at around $20.50. The 80-month moving average (arrows), which has been quite significant for over 20 years, should surpass $20.00 before the end of the year.

(Click on image to enlarge)

Higher rates and higher bond yields hurt precious metals, but if and when they trigger a recession, and the S&P 500 loses its 40-month moving average, it will ignite a new secular bull market in precious metals.

It was not the first wave of inflation that derailed the S&P 500 secular bull market of the 1950s and 1960s but, more so, the accelerated rise in the 10-year yield.

The gains in the S&P 500 slowed after the early 1960s as bond yields followed inflation higher. After surpassing 5.00% in 1966 and causing a near recession, the 10-year yield fell to 4.50% in 1967. Then it surged to almost 8.0% by the end of 1969. The secular bull ended in late 1968.

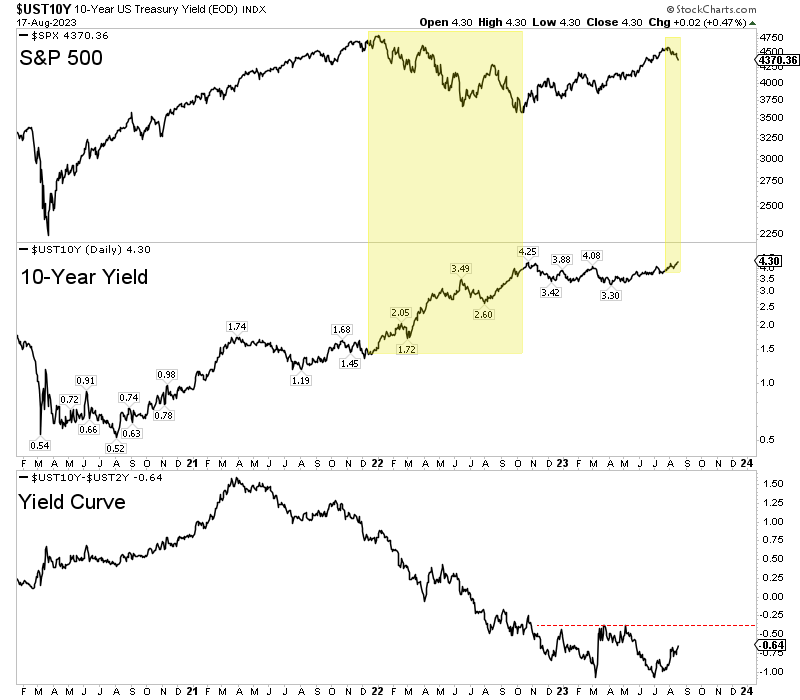

The S&P 500’s 27% decline in 2022 coincided with the 10-year yield rebounding from 1.35% to 4.25%. The S&P 500 rebounded as the 10-year yield retreated and stabilized.

However, the 10-year yield rebounded and closed Thursday at a new 15-year high. The stock market is showing weakness again, and the yield curve (bottom of the chart) is steepening.

(Click on image to enlarge)

Before precious metals can begin a new bull market and Gold can break $2,100/oz, the economy and stock market must run into problems.

The catalyst for these problems sometimes causes some initial pain in precious metals.

It is early, but if the 10-year yield continues to rise, it could cause more selling in precious metals but lead to the bullish catalyst (recession) that this sector desperately needs.

Gold and gold stocks are very oversold on a short-term basis, so a bounce is possible. However, mind the technical damage created from recent selling.

This is a time to research companies poised to benefit from the inevitable bull market and breakout in Gold.

More By This Author:

3 Charts That Show Gold Still In Secular Bear

Gold Volatility Dip: What Investors Need To Know

Look For Gold & Silver Bounce At $1900 & $22.00

Disclosure: None