Jensen Saves The Day: Nvidia CEO Sparks Market Meltup, Sends NVDA $250 Billion Higher

Image Source: Pixabay

After yesterday's lethargic sideways move, where traders sat on the sidelines waiting for the outcome of the triple main event of the past 24 hours, the presidential debate result, the CPI report and NVDA's presentation, the Wednesday market did not disappoint and there were both emotional lows and more recently highs.

The action over the past 24 hours can be roughly divided into three sections:

- i) the debate and its aftermath;

- ii) the CPI print and its immediate aftermath, and

- iii) comments from NVDA CEO Jensen Huang.

And visually

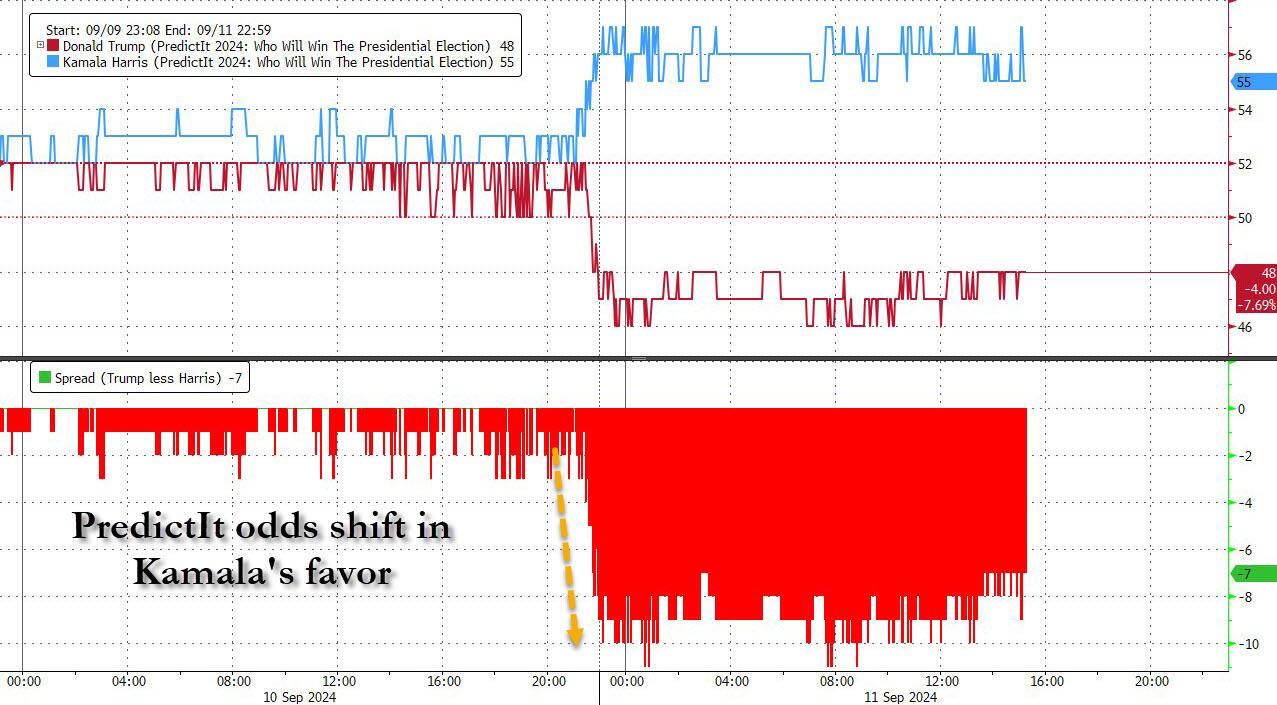

Starting at the top, the debate - which was really a 1-on-3 with Trump taking on not just Kamala but the ABC moderators as well, was seen as won by her, if only by online betting services such as predictit...

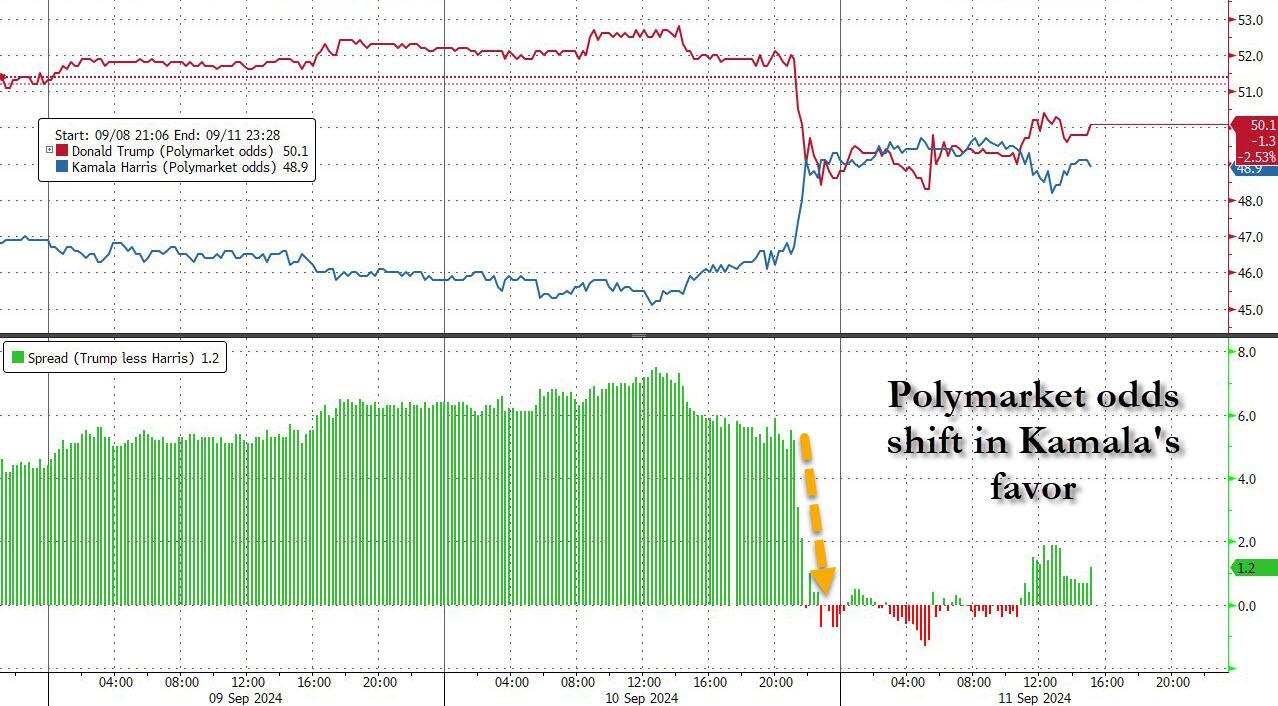

... and polymarket...

... where election odds shifting in her favor.

And yet, outside this easily manipulated echo chamber which can be rigged by a handful of wealthy accounts, who then use their money to set the media narrative and discussion in social networks, the reality is that a Kamala victory was far from a given, especially after reading the following poll from Reuters:

Kamala Harris was widely seen as dominating Tuesday's presidential debate against Republican former president Donald Trump, but a group of undecided voters remained unconvinced that the Democratic vice president was the better candidate.

Reuters interviewed 10 people who were still unsure how they were going to vote in the Nov. 5 election before they watched the debate. Six said afterward they would now either vote for Trump or were leaning toward backing him. Three said they would now back Harris and one was still unsure how he would vote.

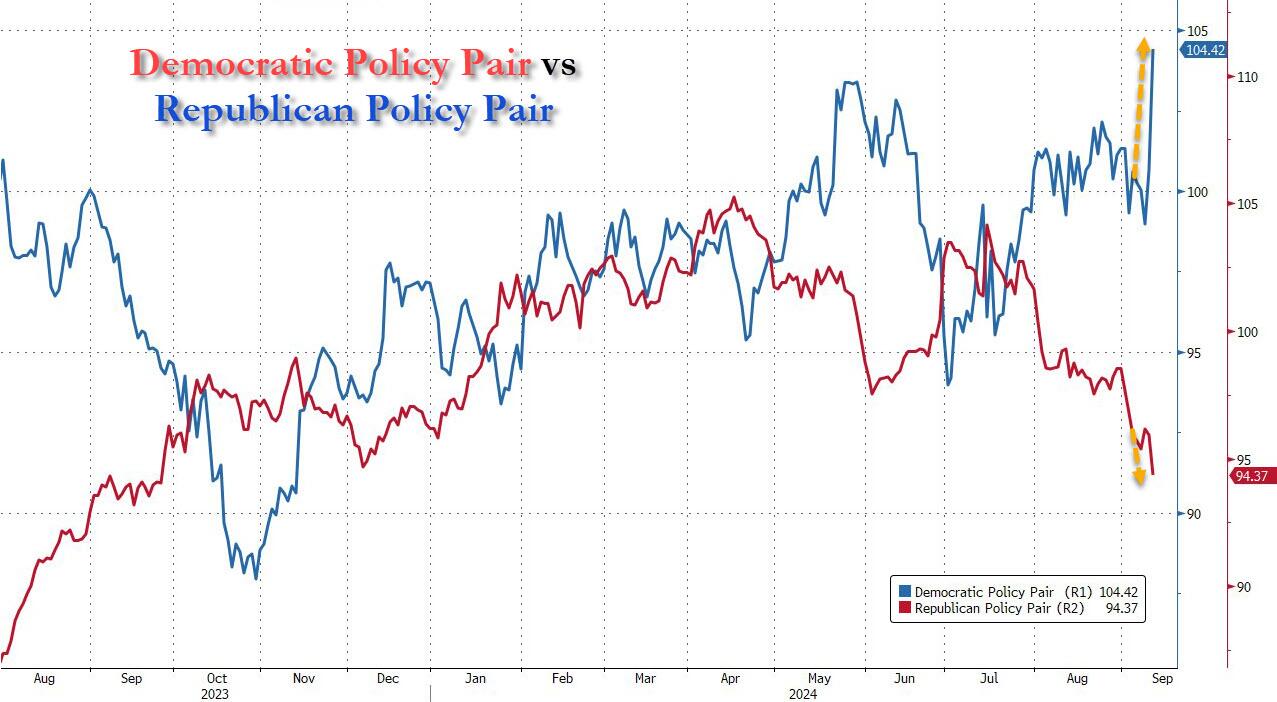

Alas, this was too nuanced, and certainly did not get any airplay from the liberal mainstream media, and the market moved accordingly, with Goldman's Democratic Policy Pair (GSP24DEM) surged +270bps to a new 2024 high, while the Republican Policy Pair (GSP24REP) tumbled -145bps (In HC specific, consistent with higher Kamala odds, seeing outperformance Medicaid, Exchanges, Hospital vs. Underperformance in Medicare).

Other assets which were hammered as the market (and its 3 second attention span) saw a looming Kamala victory, were the dollar, yields and crypto, at least initially: by the end of the day, most of the moves would be unwound.

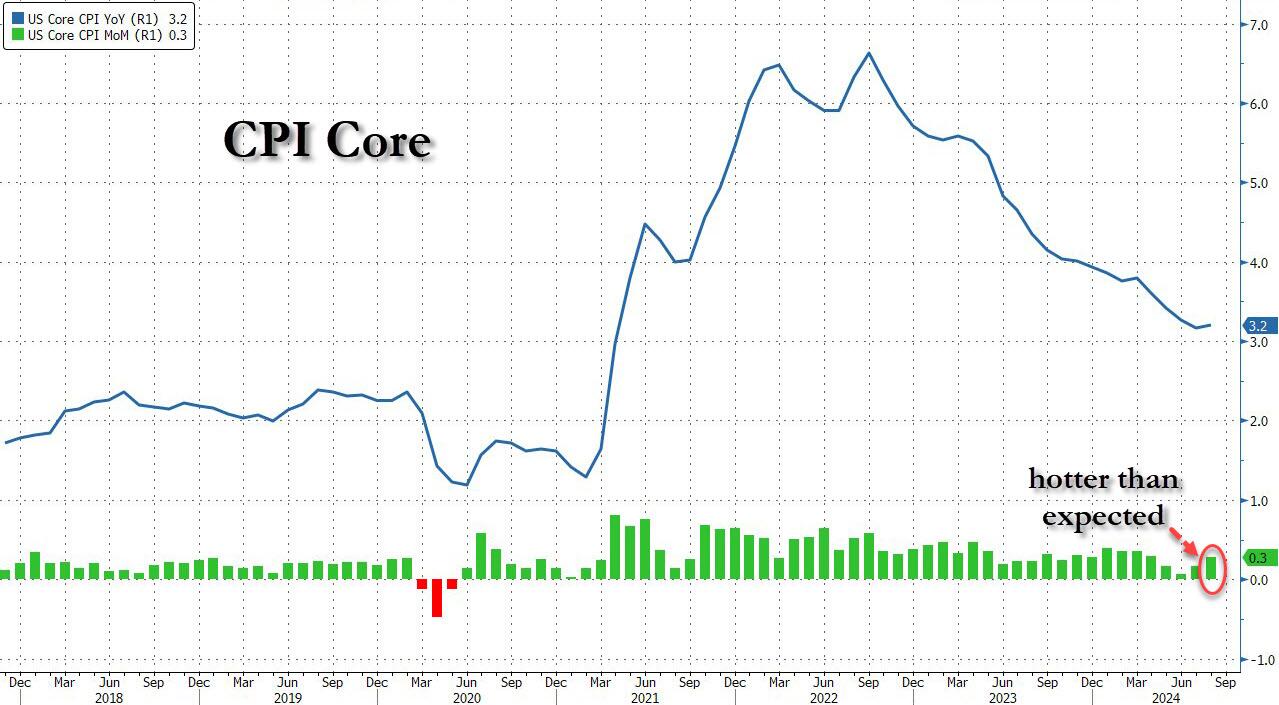

Which brings us to point 2: today's CPI report, which as discussed earlier, came in just hotter than expected on the MoM Core CPI print, which printed 0.3% vs exp. of 0.2%...

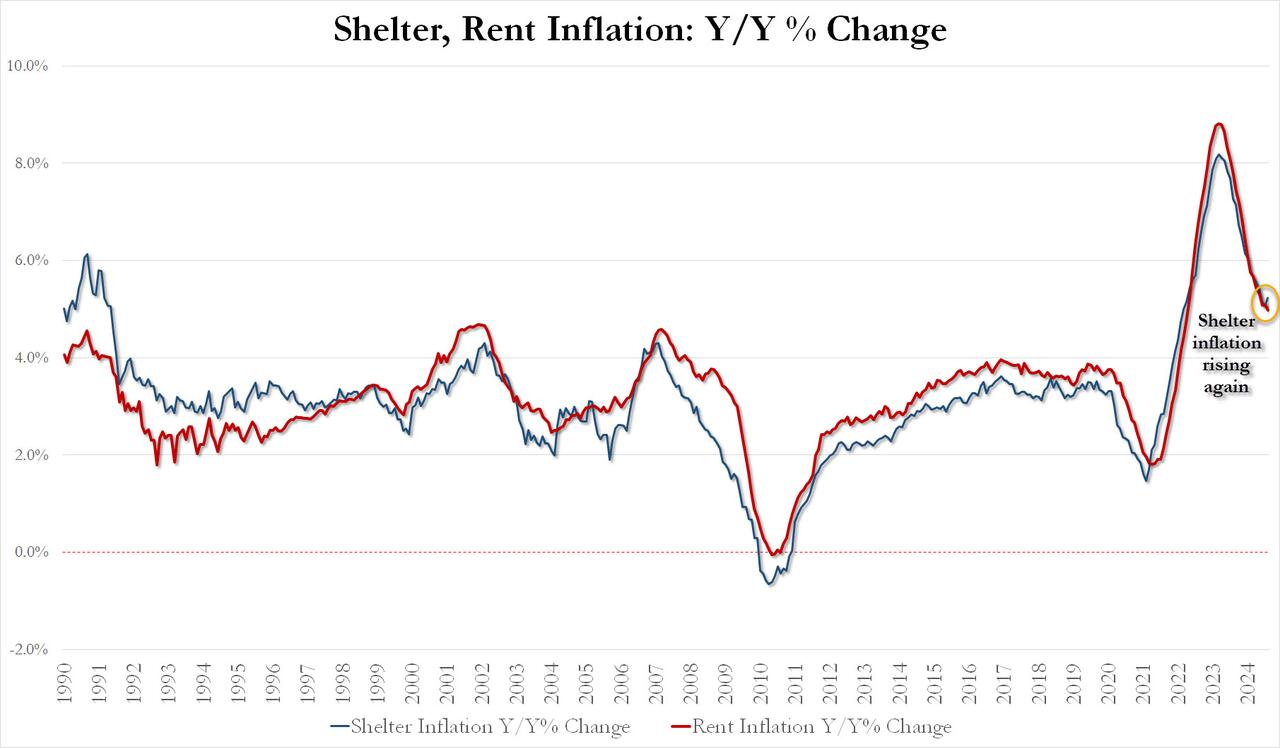

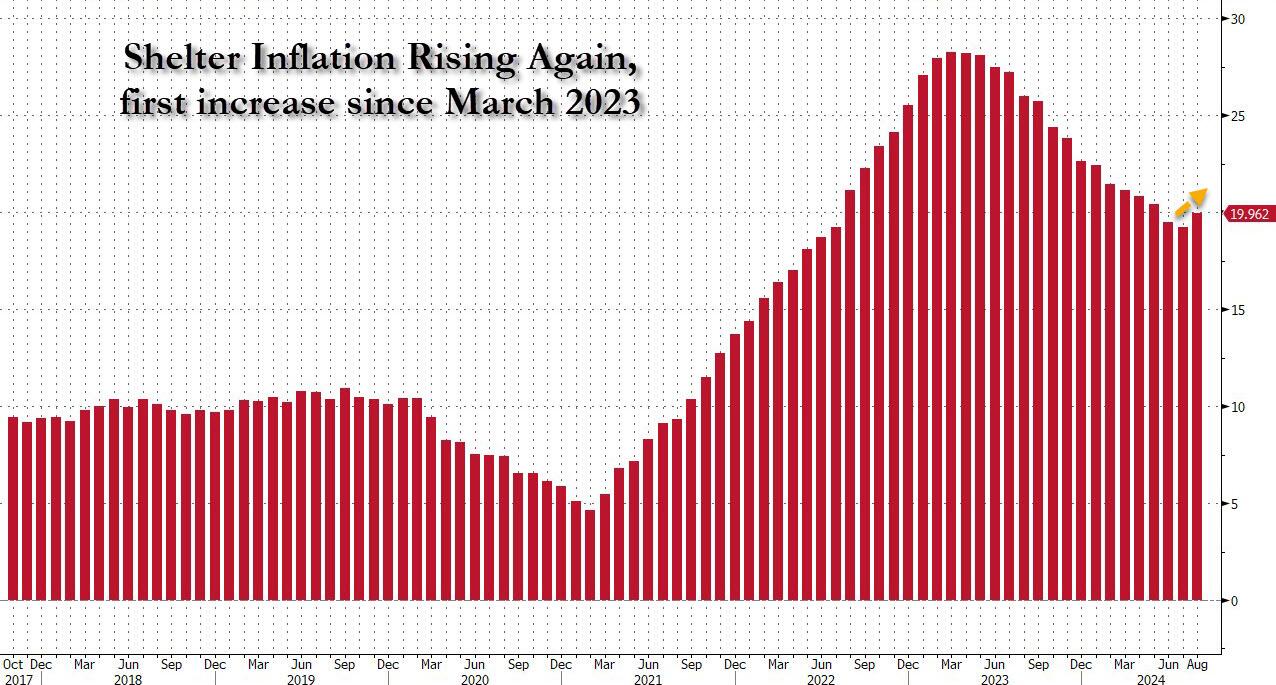

... where the biggest surprise was the unexpected heating up in shelter inflation, which ended its nearly 2-year stretch of declines...

... rising for the first time since March 2023.

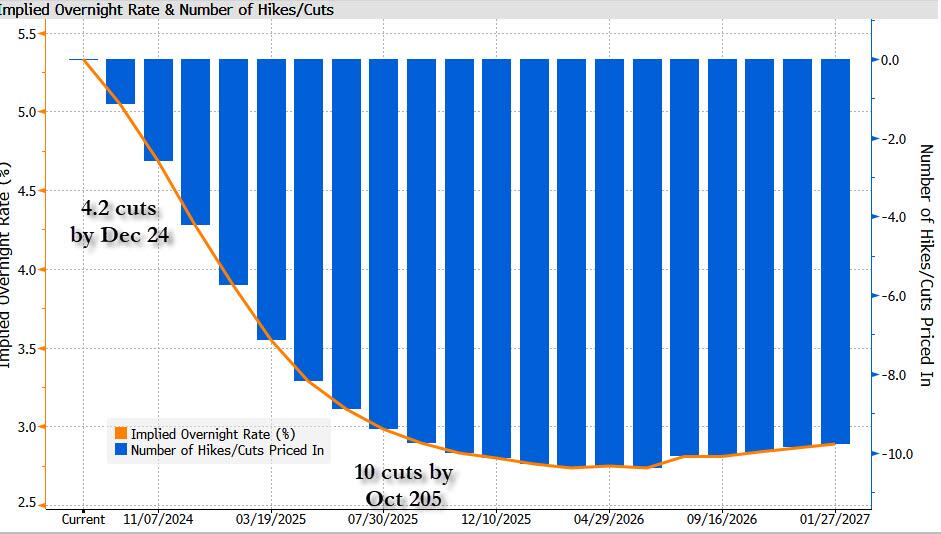

This begs the question: if housing inflation is already reversing higher with Fed rates at the highest they have been since the Volcker Fed, what happens when Powell cuts more than 4 times this year (or more than 100bps), as the market expects, and another 6 times one year from today (bringing total cuts to 250bps).

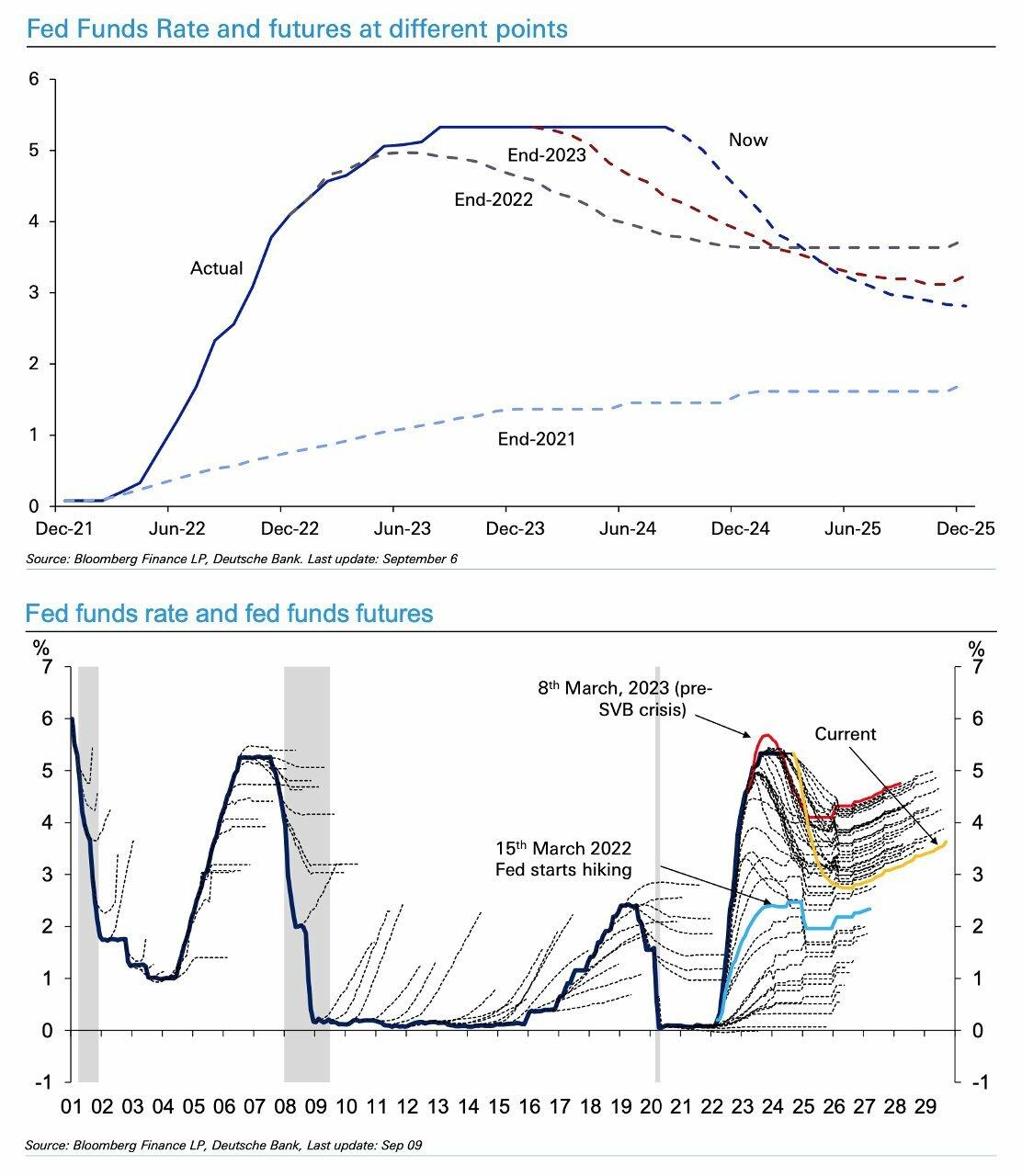

Of course, it wouldn't be the first time the market has expected huge rate cuts at the end of the calendar year... or the second time. In fact, this will be the third year in a row when stocks - having gone through a recession scare late in the year - price in multiple rate cuts. Only this time, the Fed appears willing to oblige. Still, as the following chart from DB shows, at the start of the year, market expectations were that the Fed would have already cut 100 bps by now.

One thing is clear: if we do get an inflation spike after the Fed cuts, the "stag" and the "flation" that Powell has been looking for so ardently will come looking for him, because if the Fed is indeed cutting rates just as inflation takes off again, well... everyone has seen this chart by now...

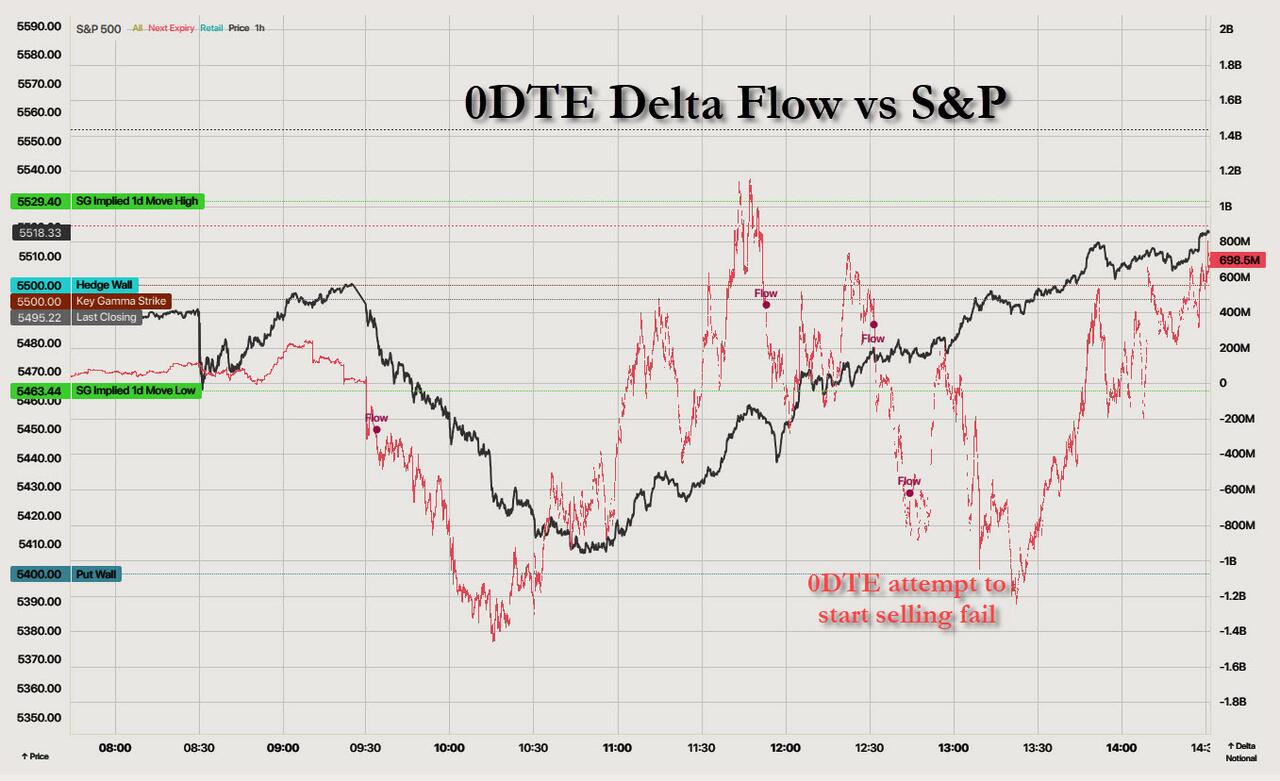

... and so have the algos, which is why stocks dumped immediately after opening, with the S&P sliding as low as 5400, and just shy of the key 100DMA support level, which is at 5391, below which CTAs would be active sellers of $6bn S&P futs, and supply would double below the key 5343 level which is medium term momentum threshold.

That's why a some Hail Mary was urgenly needed, and it emerged shortly after Jensen Huang start speaking at 10:20am ET at the Goldman tech conference in San Fran, when the Nvidia CEO said that “the demand [for chips] is so great, and everyone wants to be first and everyone wants to be most." that “we probably have more emotional customers today. Deservedly so. It’s tense. We’re trying to do the best we can.”

That was all the market needed to hear, to unleash a buying spree first in NVDA, whose stock soared by $10 to $117 or about $250billion in market cap, making a mockery of other pennystocks (speaking of which Gamestop plunged 13% after Roaring Kitty failed to spark another short squeeze after yet another dismal earnings report), while the S&P soared alongside it, not only erasing all losses but actually closing more than 1% higher...

So powerful was today's face ripper of a rally sparked by Huang that not even several attempts by the 0DTE crew to spark a delta flow selloff had any chance.

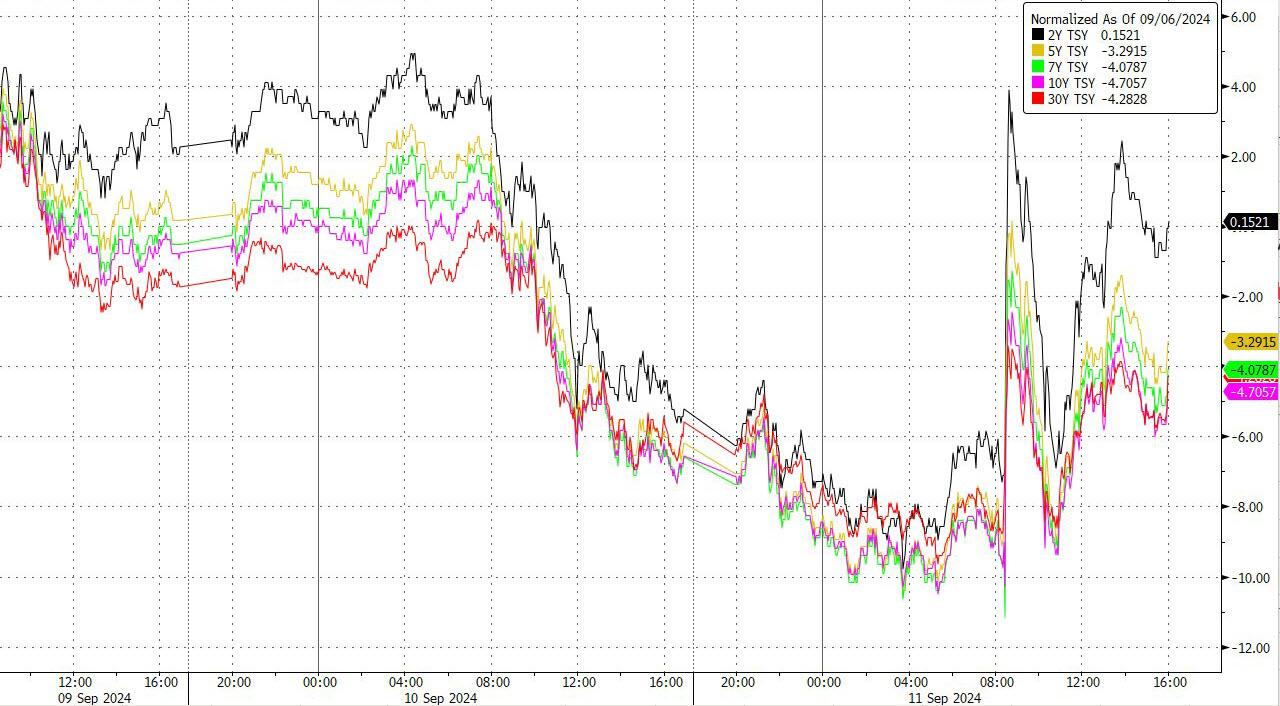

So powerful was today's risk rally that even bonds, which are now convinced a recession is imminent and ignored one of the strongest 10Y auctions on record, finally sold off...

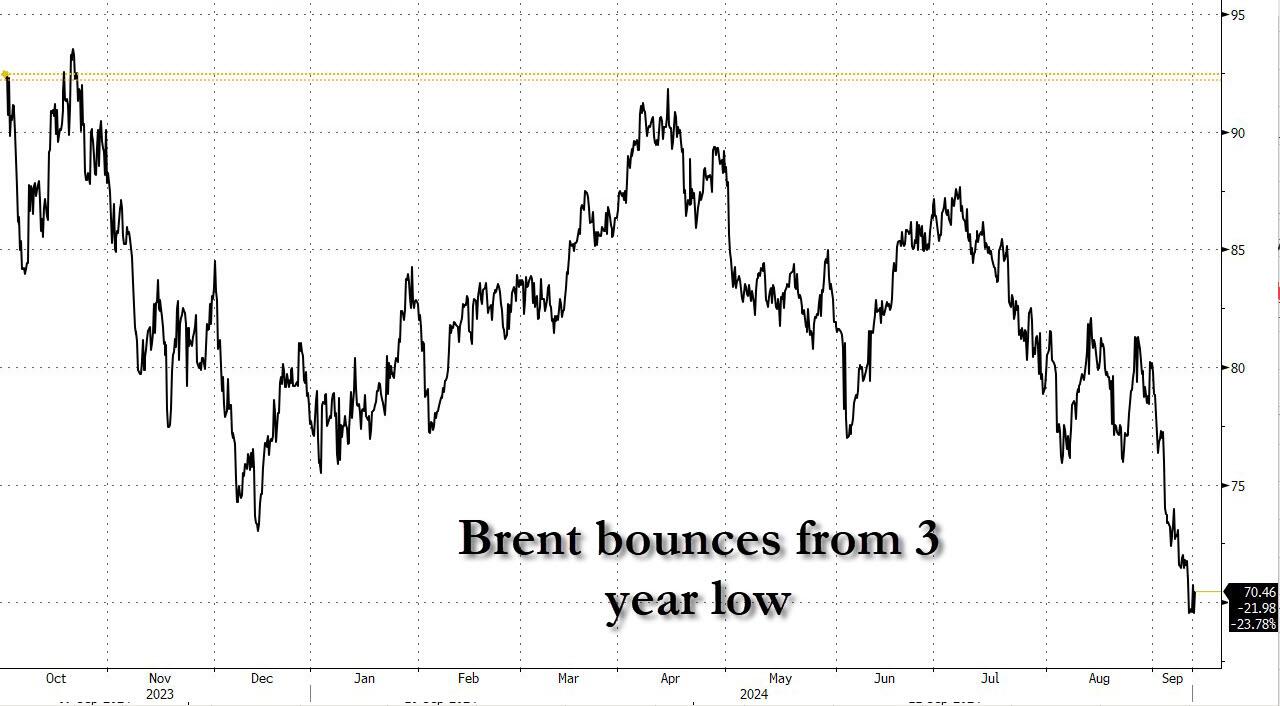

... and even oil, where sentiment is most negative on record, managed to find a bid.

Of course, with cross-asset confusion raging, with bonds and oil certain a hard-landing is inevitable, while stocks - and AI in particular - confident there will be no landing, it means that there is no local equilibrium and tomorrow we will go through this rollercoaster all over again.

More By This Author:

Oil Facing Physical Shortage Crisis: API Crude Draws 9 Of Past 10 Weeks As Cushing Hits Tank BottomsVolkswagen Declares War On Unions, Scraps Three-Decade-Old Job Protections

General Mayhem

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more