It Looks Like They're Front-Running The Silver Market

.webp)

Photo by Zlaťáky.cz on Unsplash

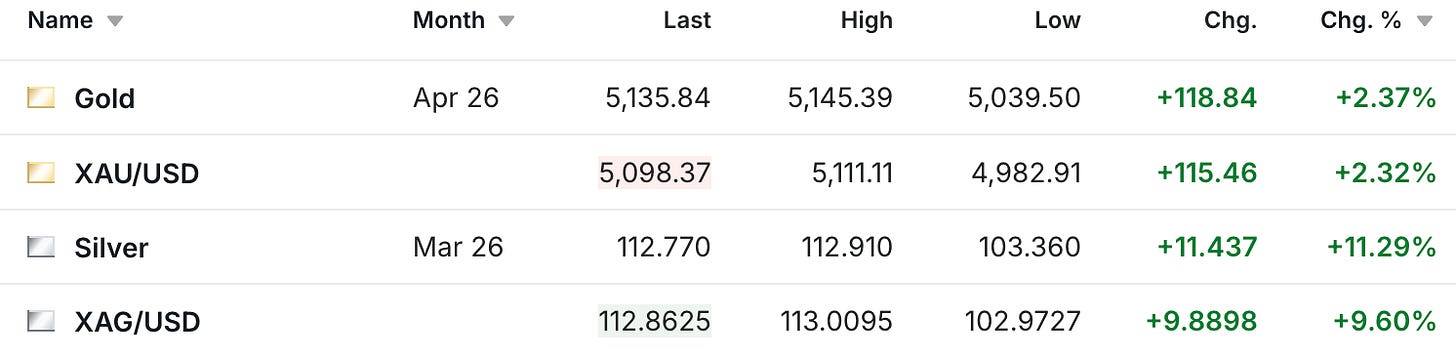

The precious metals history continued last night and into this morning, as the gold futures are now up $119, and have not only crossed the $5,000 mark, but also the $5,100 mark, to $5,136 (although part of that increase is also the switch to the April contract), while spot silver (XAG/USD in the chart below) is up another $9.89, and the silver futures (which settle before trading completes for the day on Friday) are up $11.47 to $112.77.

I’m about to head over to day two of the Vancouver Resource Investment Conference, where it sure is a different experience than the last time I was here in 2020. I ran into Keith Neumeyer, amongst others, yesterday, and it’s really just been amazing to see so many people who have waited so long for something, to finally have it arrive in such stunning fashion.

I mentioned on Friday how my thinking has gone from wondering whether we could be getting close to the long imagined point where a manufacturer like Apple or Samsung can’t get the metal they need for their products and there would be a scramble to pay up to get whatever they can, to now wondering if we haven’t already crosseed that point somewhere in the last two months, and the price action we’re seeing now is the reflection of that.

That’s what I was talking with people about throughout the day yesterday, and while I didn’t find anybody else who had already been thinking about that yet, I also didn’t find anyone else who disagreed. Although fortunately, the evidence doesn’t require my or anyone else’s opinion, and while it may be premature to draw a definitive conclusion just yet, I’m not sure how it’s possible to otherwise explain what we’ve just seen over the past two months where the silver price has doubled, right AFTER it took 45 years just to break through the $50 level.

I did record a video from the show last night where I laid out in detail the key data points that have led us to this moment, and why I’m increasingly feeling more confident that this is what’s actually playing out right now.

As you can see by the price in the thumbnail above, the rally has continued even further overnight to the current $112 level, and that sure does set us up for a fun trading week.

Silver in Shanghai is currently trading at $128.23, and while the Indian MCX exchange is closed for a holiday today, the price there closed at $115.12 on Friday in India while silver was trading at $101 in New York. All of which makes it intriguing to imagine what the pressure will be like in India when they reopen in about 10 hours.

Keep in mind that we’re also still awaiting the Supreme Court ruling on the Trump tariffs, which PolyMarket has at about a 31% chance to go in Trump’s favor, which means we still have a 69% chance of an outcome that Trump has said would leave us in a position where we’re simply ‘screwed.’ However, I don’t imagine that changes his feelings about wanting interest rates at 1% or lower, which you would have to think whoever he picks to be the next Fed chairman will be inclined to oblige.

Lastly, I also mentioned on Friday how Stefan Gleason of MoneyMetals.com, one of the larger and more reputable online bullion dealers, mentioned that in the past three to four weeks, the retail buying conditions have surpassed even what we saw during Covid.

More By This Author:

Silver Breaks $100 In New York As The Market Starts To Unravel GloballyBloomberg: 'Investor Demand For Silver Is Now Even Higher In India Than In October'

Silver's Now Up Almost 100% In Just The Past 2 Months, & That's After It Broke The $50 Level