Is The Road To Recession In The American Economy Already Paved?

While investors orchestrated a relatively immaterial short squeeze on Jun. 21, the daily optimism did little to resolve the fundamental headwinds that helped foster the S&P 500's 2022 collapse. Moreover, with the GDXJ ETF not participating in the festivities, the junior miners have fallen off investors' wish lists. Therefore, while the former's price action may have been bullish, the medium-term realities are far from it.

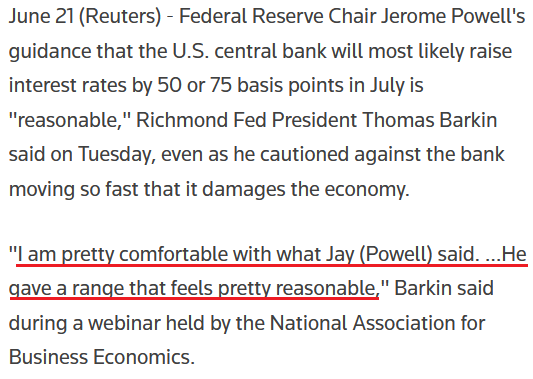

For example, Richmond Fed President Thomas Barkin said on Jun. 21:

"We are in a situation where inflation is high, it's broad-based, it's persistent, and rates are still well below normal. The spirit is, you want to get back to where you want to go as fast as you can without breaking anything."

As a result, Barkin is on board with Chairman Jerome Powell's call for a 50 or 75 basis point rate hike in July.

Please see below:

Source: Reuters

The Hangover

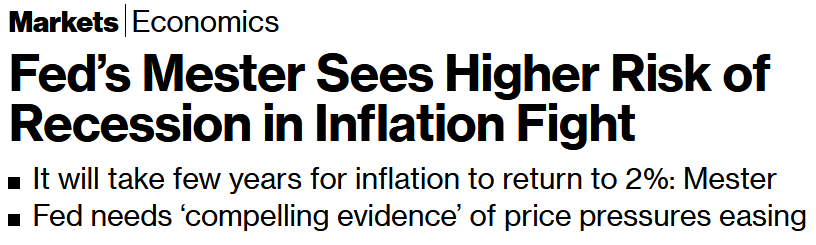

Likewise, Cleveland Fed President Loretta Mester said on Jun. 19 that “We at the Fed are very committed to using the tools at our disposal to bring this inflation under control and getting back to 2% is the No. 1 challenge in the economy now.”

Moreover, she also admitted:

“The recession risks are going up partly because monetary policy could have pivoted a little bit earlier than it did. We do have growth slowing to a little bit below trend growth and that’s okay.”

Thus, Fed officials are starting to acknowledge reality:

Source: Bloomberg

To that point, while “below trend growth” may be “okay” for now, further rate hikes will continue to pressure the U.S. economy. Moreover, all periods of unanchored inflation end in recession. For context, I wrote on May 26:

While 50 basis point rate hikes are likely to be done deals in June and July, a realization will only put the U.S. federal funds rate at 1.83%. With annualized inflation at 8%+, calming the price pressures with such little action is completely unrealistic. In fact, it’s never happened.

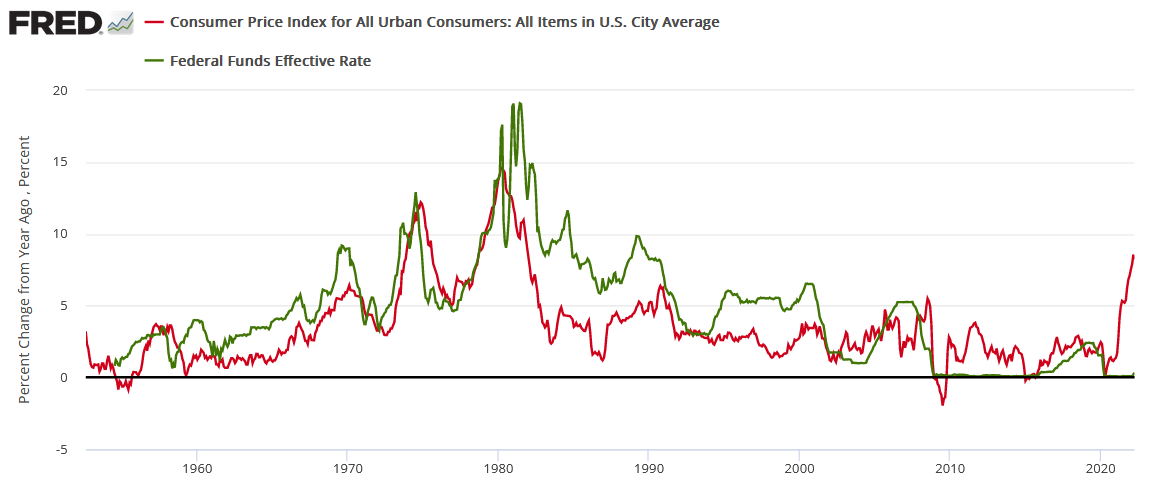

If you analyze the chart below, you can see that the U.S. federal funds rate (the green line) nearly always rises above the year-over-year (YoY) percentage change in the headline Consumer Price Index (the red line) to curb inflation. Therefore, investors are kidding themselves if they think the Fed is about to re-write history.

(…) The bottom line? Investors are running towards a cliff, and they don’t even know it. With nearly 70 years of history showing that unanchored inflation ends in a recession, the idea of doing so little and achieving a “soft landing” materially lacks credibility.

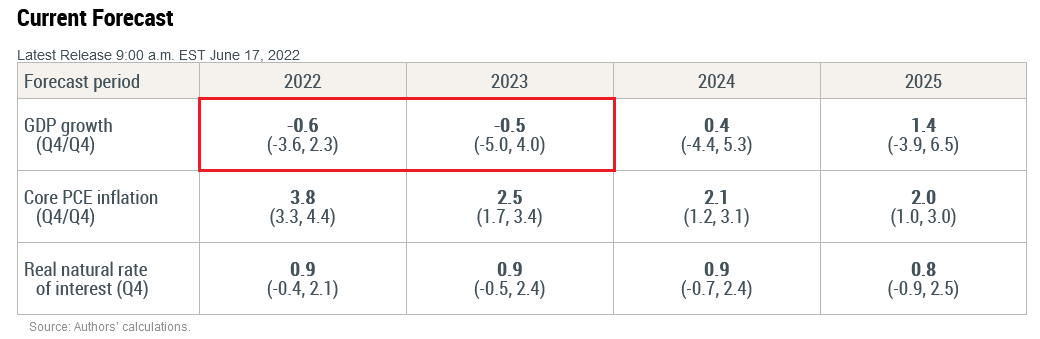

Supporting the thesis, Liberty Street Economics updated its dynamic stochastic general equilibrium (DSGE) model on Jun. 17. For context, the report includes “analysis from New York Fed economists working at the intersection of research and policy.”

Therefore, while the report was compiled by New York Fed researchers, “the views expressed are those of the authors, and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.”

In any event, an excerpt read:

“According to the model, the probability of a soft landing – defined as four-quarter GDP growth staying positive over the next ten quarters – is only about 10 percent. Conversely, the chances of a hard landing – defined to include at least one quarter in the next ten in which four-quarter GDP growth dips below -1 percent, as occurred during the 1990 recession – are about 80 percent.”

Likewise, the team expects negative GDP growth in 2022 and 2023; not only do they model an “80 percent” chance of a hard landing, but the downtrend is expected to continue for several months.

Please see below:

Source: New York Fed

Therefore, while short-covering and the algorithms helped spur a relief rally, the Fed’s rate hike cycle should upend investors’ optimism in the months ahead. As a result, the S&P 500 and the PMs are likely to be far from medium-term bottoms.

Fuel for the Hawkish Fire

While I warned for months that investors and the Fed underestimated the demand side of the inflation equation, consumers' resiliency highlighted why the pricing pressures would not subside. As a result, the Fed would have to hike interest rates, and the forecast proved prescient.

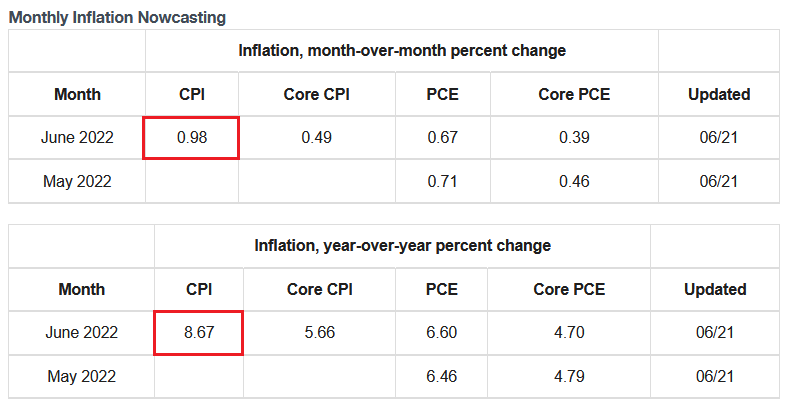

Furthermore, nothing has changed. With the Cleveland Fed updating its inflation "Nowcast" on Jun. 21, researchers expect the headline Consumer Price Index (CPI) to increase by 0.98% month-over-month (MoM) and 8.67% year-over-year (YoY) in June. Thus, the Fed is far from winning its war on inflation.

Please see below:

Source: Cleveland Fed

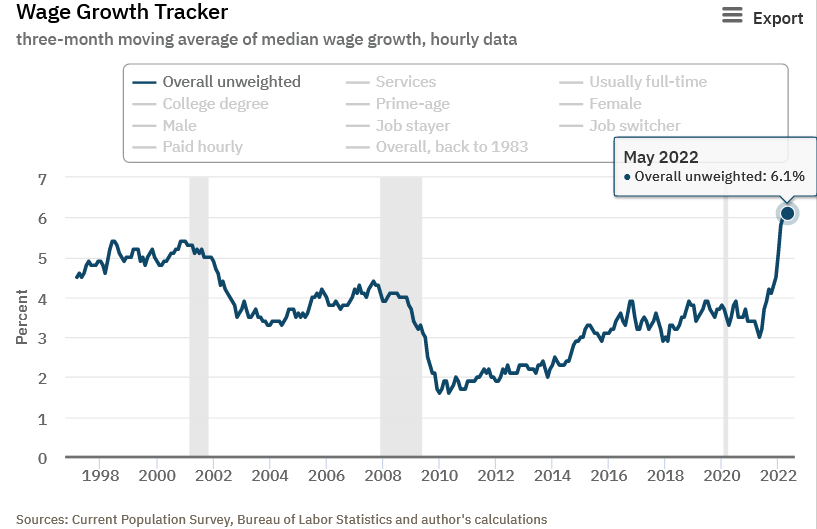

Second, the Atlanta Fed updated its wage tracker on Jun. 9. The data shows that consolidated wage inflation hit an all-time high in May.

Please see below:

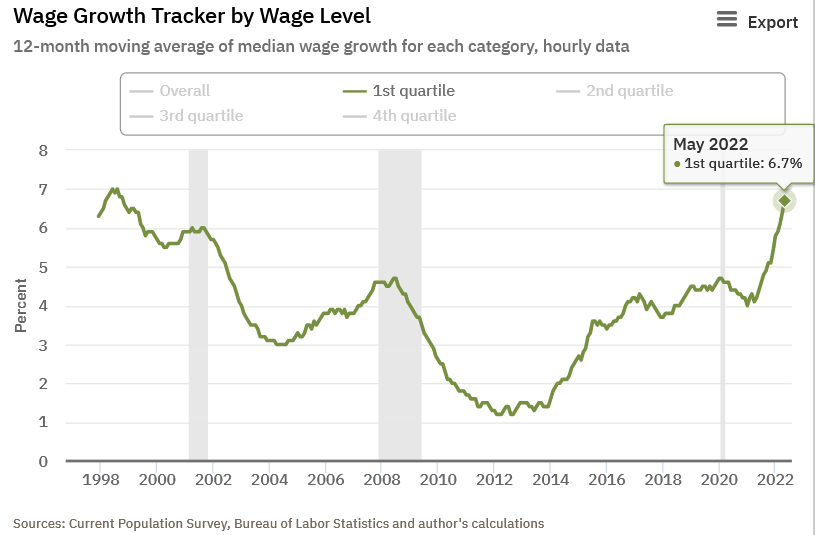

Moreover, the lowest-paid Americans outperformed, and the data highlights why consumer spending continues to fuel more price increases.

Please see below:

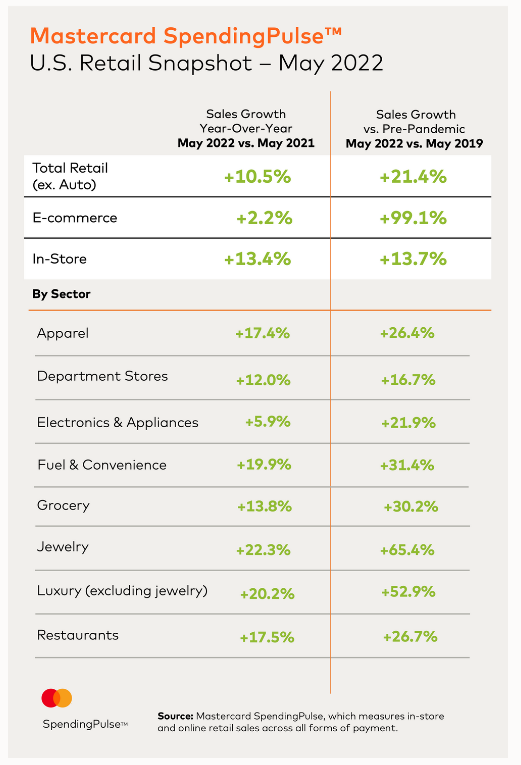

Speaking of which, Mastercard released its SpendingPulse retail sales report on Jun. 14. An excerpt read:

“Total U.S. retail sales excluding automotives increased 10.5% year-over-year in May, and 21.4% compared to pre-pandemic May 2019. This is outpacing the YoY monthly growth experienced thus far in 2022. In-store sales were a key driver, up 13.7% compared to pre-pandemic levels.”

U.S. Chief Economist Michelle Meyer said:

“The continued retail sales momentum in May aligns with the sustained growth rates we’ve seen so far this year. The consumer has been resilient, spending on goods and increasingly services as the economy continues to rebalance. That said, headwinds have become stronger – including gains in prices for necessities like gas and food, as well as higher interest rates."

Thus, while investors cry wolf about demand destruction, Mastercard’s data suggests otherwise. Moreover, the report highlights why more rate hikes are needed to cool inflation, and the prospect is bullish for the USD Index and U.S. real yields, and bearish for the PMs.

Please see below:

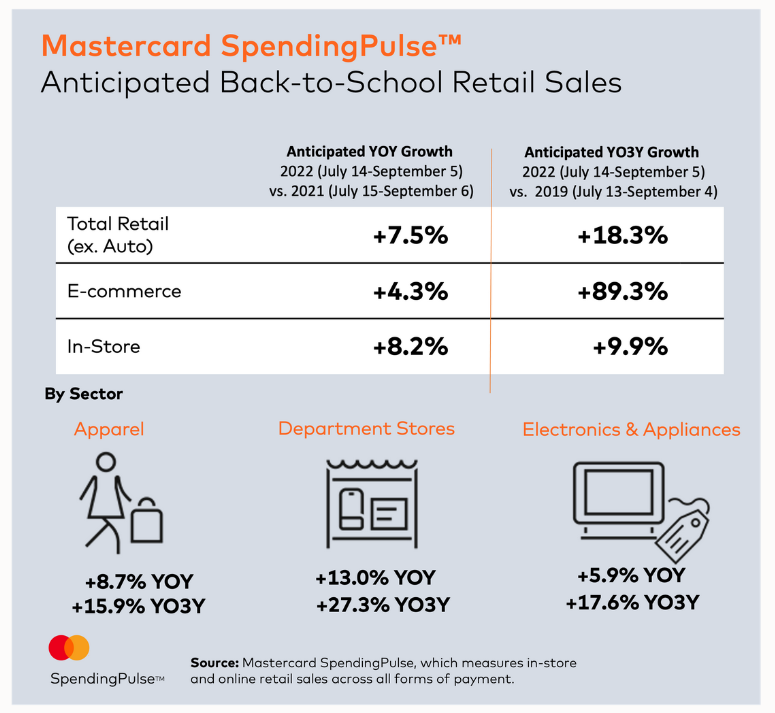

Likewise, Mastercard expects back-to-school sales to remain resilient in the months ahead. Therefore, such a realization will only add more fuel to the hawkish fire. The report stated:

“As we look ahead to the critical mid-July through Labor Day back-to-school period, U.S. retail sales are expected to grow 7.5% excluding automotive compared to 2021. Sales are anticipated to be up 18.3% compared to pre-pandemic 2019, with Department Stores expected to be a noteworthy winner as the sector continues its recent rebound.”

Please see below:

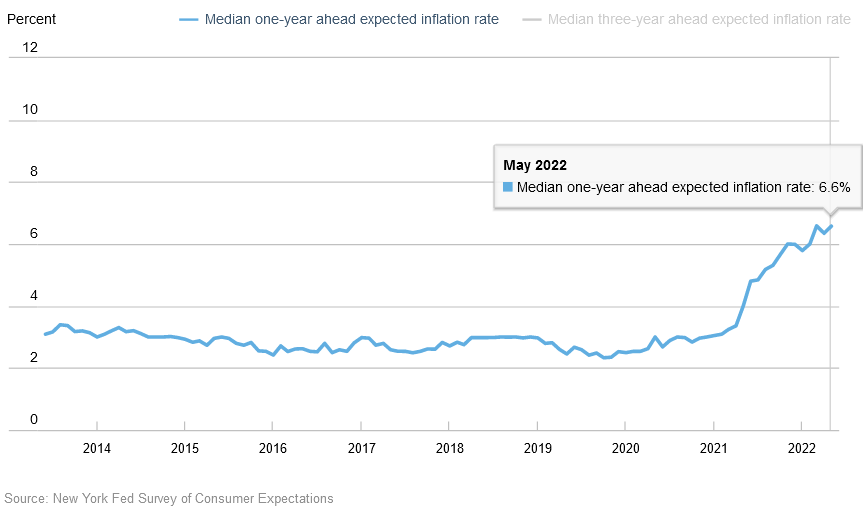

As further evidence, the New York Fed released its Survey of Consumer Expectations on Jun. 13. The report revealed:

“The one-year ahead median inflation expectations increased from 6.3% to 6.6% in May, tying the highest reading of the series since the inception of the survey in June 2013. In contrast, the median three-year-ahead inflation expectations remained unchanged at 3.9%.”

Please see below:

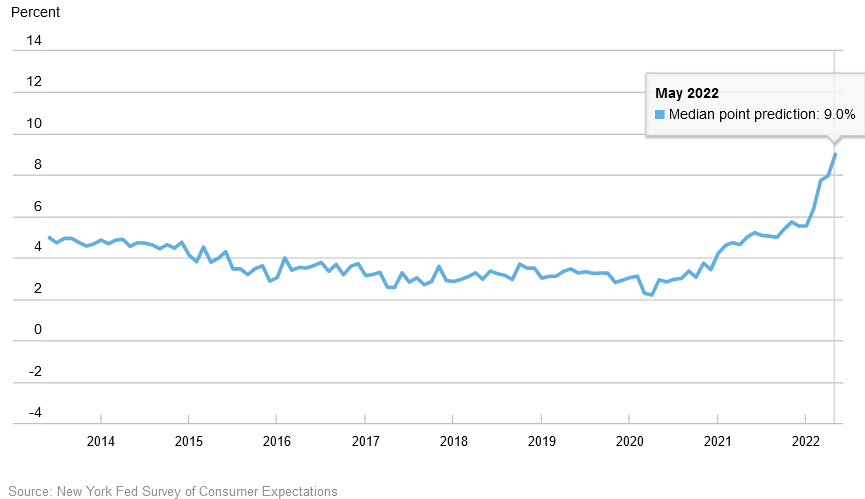

More importantly:

“Median household nominal spending growth expectations increased sharply to 9.0% from 8.0% in April. This is the fifth consecutive increase and a new series high. The increase was most pronounced for respondents between the age of 40 and 60 and respondents without a college education.”

Please see below:

Also noteworthy:

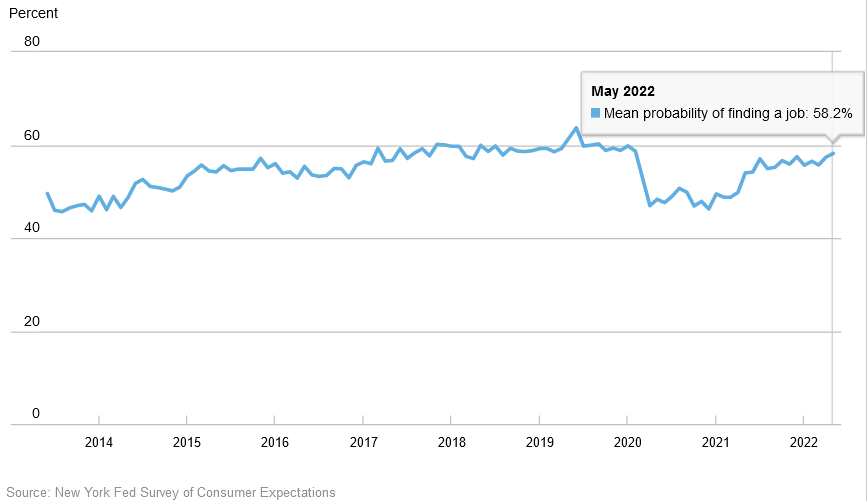

“The mean perceived probability of finding a job (if one’s current job was lost) increased from 57.4% in April to 58.2%, its highest value since February 2020. The increase was driven by respondents over 40, those without a college education and those with lower household incomes (under $50,000).”

As a result, when Americans are confident about their employment prospects and wages are rising rapidly, the cocktail is profoundly inflationary. Moreover, when you add on Americans' bloated bank accounts, it's no wonder inflation proved much longer-lasting than many expected. To explain, I wrote on Dec. 23:

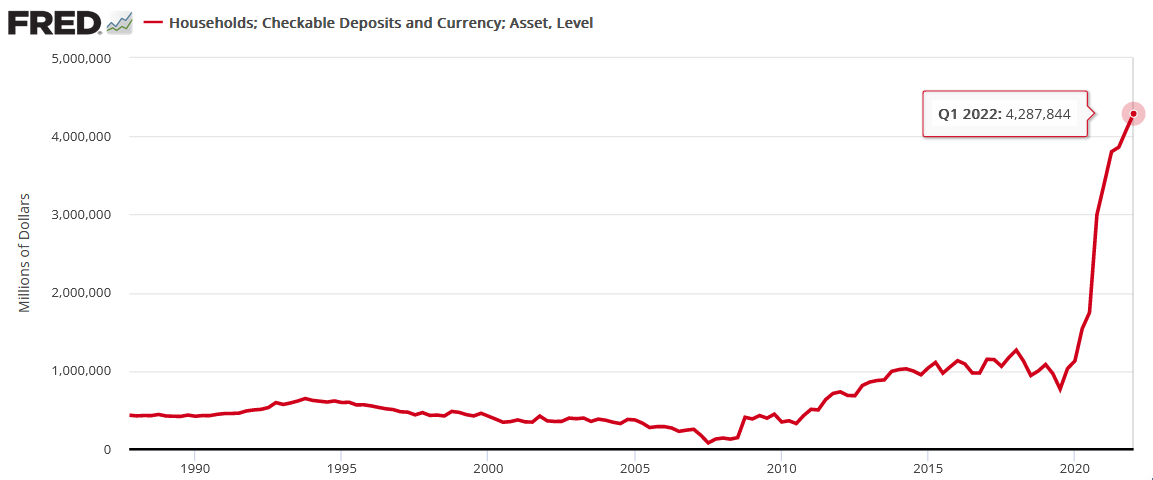

While the fiscal spending spree may end, U.S. households are flush with cash. U.S. households have nearly $3.54 trillion in their checking accounts. For context, this is 253% more than Q4 2019 (pre-COVID-19) (…).

While some investors expect a dovish 180 from the Fed, they shouldn’t hold their breath. With U.S. economic growth still resilient and the U.S. consumer in much better shape than some portray, the Fed can raise interest rates without crashing the U.S. economy. As a result, Powell will likely stick to his hawkish script and forge ahead with rate hikes in 2022.

I updated on Jun. 10:

While the prediction proved prescient, U.S. households, on aggregate, are still flush with cash. For example, the Fed released its Financial Accounts of the United States report on Jun. 9. It revealed that U.S. households have nearly $4.288 trillion in their checking accounts as of the end of Q1. Moreover, the figure is 5.1% higher than Q4:2021.

For the sake of objectivity, the data lags by roughly two months. However, with the metric at an unprecedented all-time high, U.S. consumers still have plenty of spending power. As a result, more hawkish policy is needed to create the demand destruction necessary to tame inflation.

Please see below:

The Bottom Line

Despite the S&P 500’s daily optimism, the Fed’s catch-22 is worsening by the day. With GDP growth slowing and the U.S. housing market suffering mightily from higher interest rates, signs of stress are present. In contrast, with U.S. consumers continuing their spending spree, inflationary demand keeps shifting from one category to the next. Thus, the Fed is stuck trying to balance these competing forces. However, the road to recession has likely already been paved, and material re-pricings are necessary for assets to reflect their fundamental values.

In conclusion, the PMs were mixed on Jun. 21, as silver and the GDX ETF ended the day in the green. However, with the Fed hawked up and rate hikes on autopilot for the foreseeable future, the PMs’ medium-term outlooks are profoundly bearish. As a result, summer swoons should be on the horizon.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more