Is It Time To Trade The DJIA For Silver?

(Click on image to enlarge)

This week, we will look at the ratio of the Dow Jones Industrial Average (DJIA) to silver. When the value of this ratio is high, investors prefer to be in stocks; when it is low, investors prefer to be invested in silver (and usually commodities in general). We'll start with a fairly broad view of approximately 30-years. Note the spike low in 2011 that represents silver's all time high price of $50 that also corresponded to when stocks were struggling coming out of the Global Financial Crisis. Since that low, the ratio has trended higher and is now getting fairly close to the all time high that occurred just prior to the Dot Com bust.

Interestingly, price may have been forming a bear flag since that 2011 low, though that may be premature to say. However, what is compelling is that price currently sits right on the pink descending resistance line and what happens next will likely be a key inflection point in the ratio. If resistance holds and repels the ratio lower, that would likely signal that silver is ready to take another leg higher.

(Click on image to enlarge)

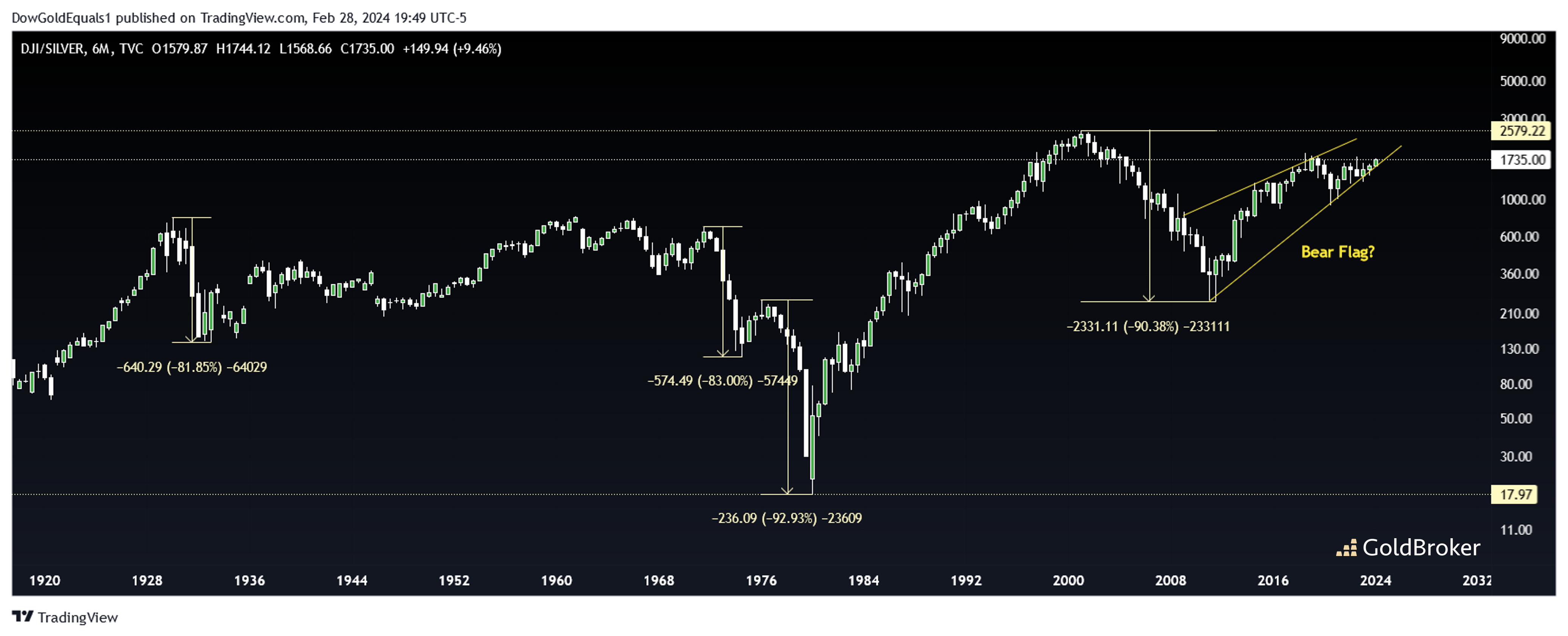

Zooming out further still, we'll look at 100 years of the DJIA/silver ratio. The first interesting thing to note is just how wild a range the ratio has been in - from a low of just 17.97 in 1980 to 2,579 in 2000. At a current ratio of 1,735, we are MUCH closer to the all time high than the all time low. For most of the last century, the ratio has been below 1,000, and in the past 100 years, there have only been six where the ratio finished the year higher than it is right now!

I also want to bring your attention to the ratio's propensity to crash from time to time. In fact, there have been four times when the ratio crashed 80% -90% over several year's time. If we are currently in a bear flag that breaks down, it is a big one indeed - one that from this broad perspective enables us to easily visualize how another 80%+ crash could be quite realistic. While a crash such as that would take several years to complete, it would likely lead to triple-digit silver prices.

More By This Author:

U.S. Recession: Markets No Longer Believe In It, Gold Sees Things Differently

War + Inflation = Gold

Commodities Set For Next Leg Higher, Silver May Outperform

Disclosure: GoldBroker.com, all rights reserved.