Is Gold Resting Before The Next Phase Of Major Decline?

The situation in the precious metals market continues to develop in tune with my previous expectations, and the profits on our short position in junior miners have just increased (and this happened soon after we took profits from previous long positions).

Since the above is the case, practically everything that I wrote yesterday remains up-to-date, and thus, today’s analysis will serve as a quick update. Let’s start with the USD Index and my previous comments on it:

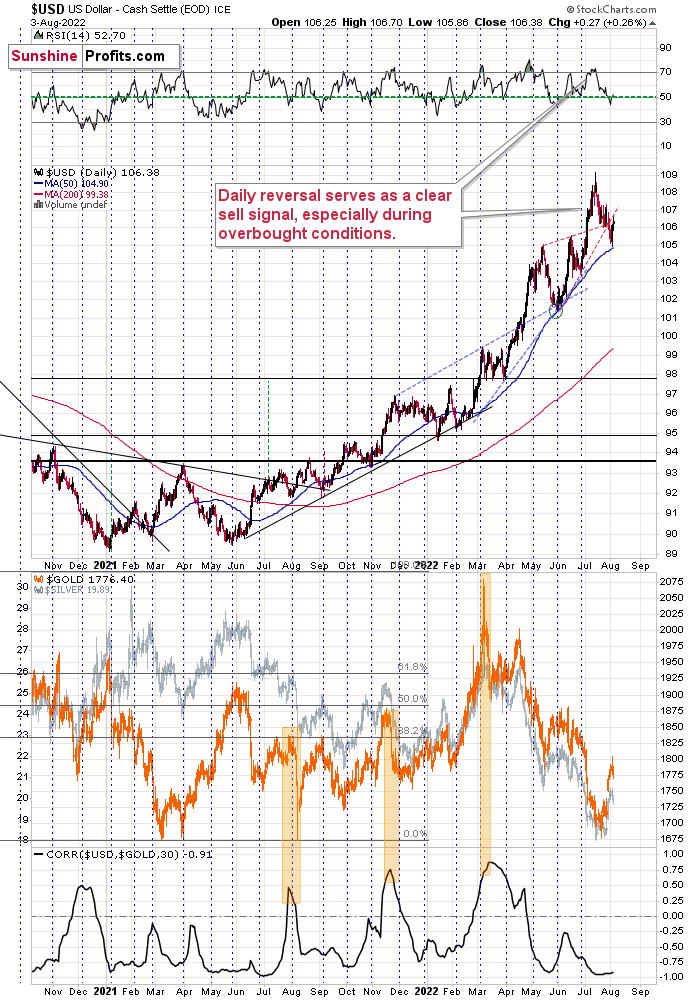

This move is in tune with what we saw at previous local bottoms. The RSI moved slightly below 50, and it’s the turn of the month – this combination was enough to trigger rallies in the U.S. dollar index.

Let’s keep in mind that the latter tends to form important bottoms close to the middle of the year.

So, the scenario in which the USD Index bottoms shortly (or that it just bottomed) seems quite likely.

There’s also the possibility that the USD Index keeps declining until it reaches the very strong support at about the 104 level – the previous long-term highs. Right now, it’s at about 105.5, which means that it could decline by another 1.5 index points or so. It doesn’t necessarily mean that gold, silver, and mining stocks would need to rally substantially if the above materialized. Conversely, since gold might now be reluctant to react to the USD’s lead and miners might be reluctant to react to gold’s lead, it seems that the possible upside for junior miners is very limited.

In other words, even if the big decline really picks up in a few weeks, I think that the risk-to-reward ratio already favors being on the short side of the precious metals sector. In particular, on the short side of junior mining stocks.

That’s exactly what happened.

The USD Index declined quite visibly yesterday [on Tuesday], almost reached its 50-day moving average, and then rallied back up – very close to the turn of the month.

Was that the final short-term bottom? It might have been, but it could still be the case that it moves to 104 in order to bottom there. However, even if that happens, it won’t change the fact that gold didn’t want to react to lower USDX prices recently, and thus the additional decline in the USDX would only be likely to trigger back-and-forth movement in gold, not a profound rally.

As far as gold is concerned, I previously wrote the following:

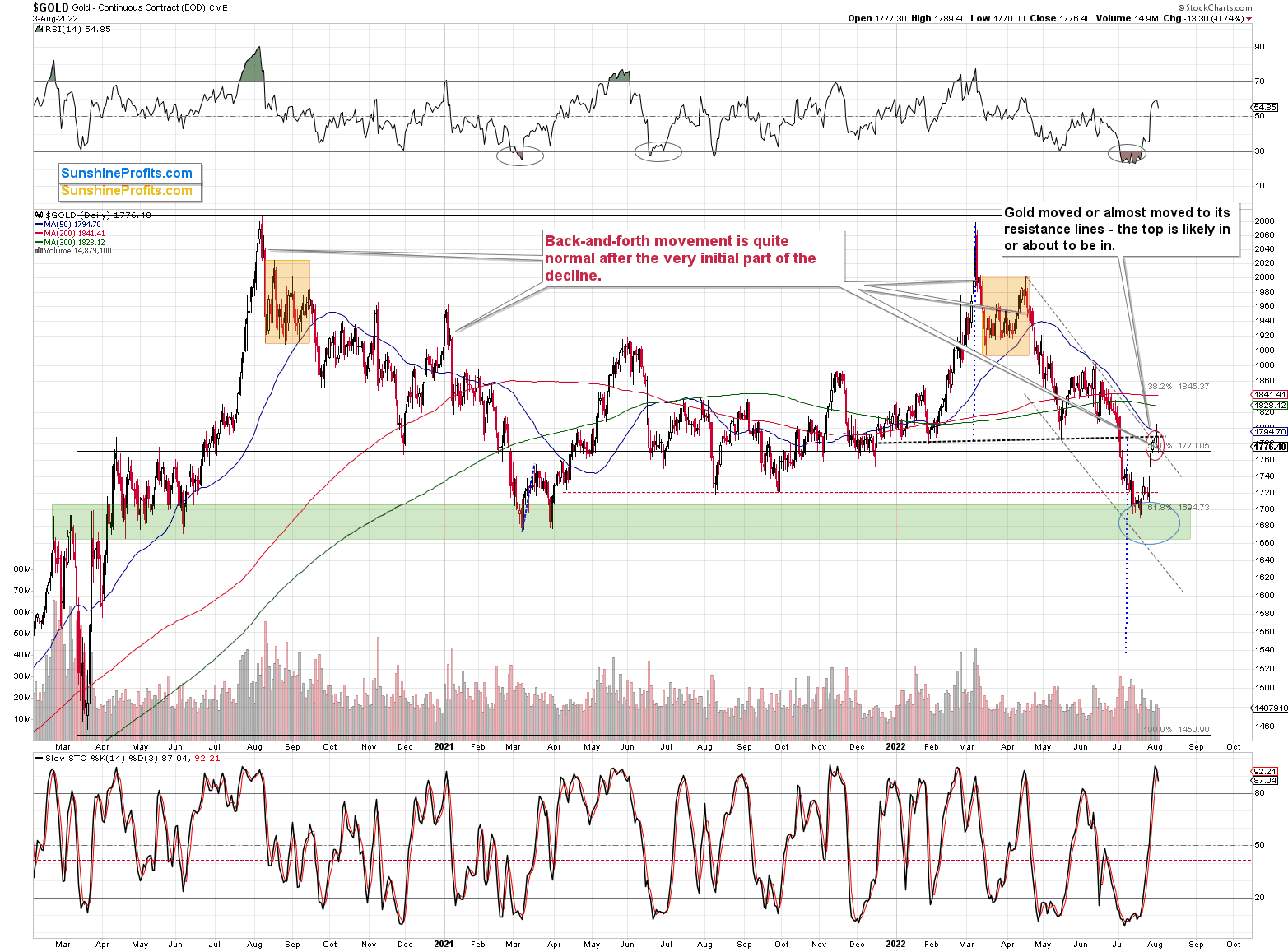

The above gold futures chart doesn’t fully show the extent of yesterday’s decline (the data will likely catch up after today’s session), but it does tell us that gold just verified the move back to the neck level of the previously broken head and shoulders pattern. A decline from here will have profoundly bearish implications because, based on this pattern, gold is likely to decline to at least $1,540.

Indeed, the above chart shows a decline in gold futures and some intraday back-and-forth movement. Please note that this kind of movement is what tends to take place right after the very first part of a bigger decline. I featured some of those cases on the above chart (pointers coming from the red comment box).

Consequently, what we see right now is bearish. Moreover, if we don’t see a decline today, it will be in tune with what we saw previously.

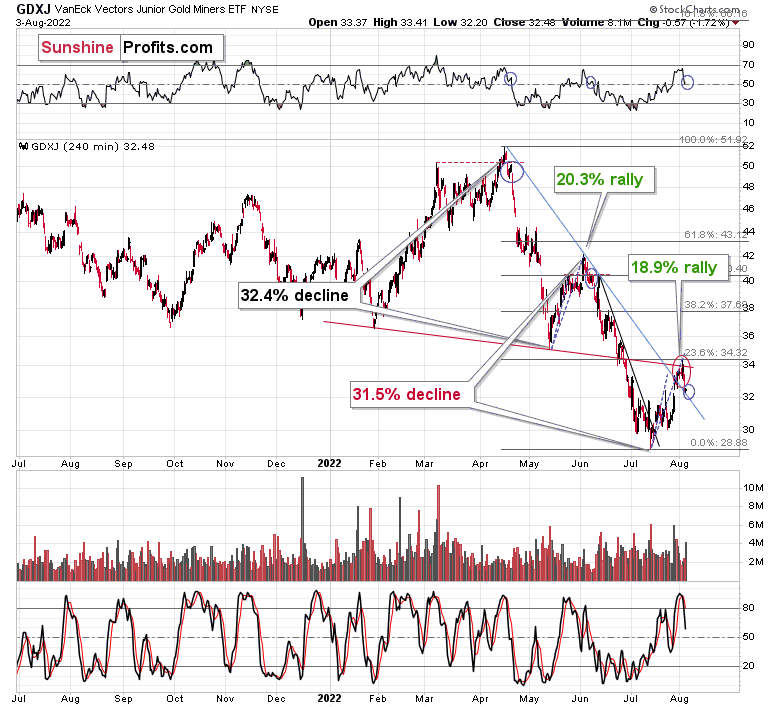

While the GLD ETF moved higher by 0.24% yesterday, the GDXJ ETF – a proxy for junior mining stocks – declined by 1.72% (in terms of the daily closing prices).

After moving to the 23.6% Fibonacci retracement level and above the neck level of the previously broken head and shoulders pattern, the GDXJ declined, and ended the day 1.34% higher, thus making our short positions profitable.

The stochastic indicator flashed a sell signal, and there were only a few times this year when that happened, while the RSI was very close to the 70 level. That was during the March, April, and early-June peaks. These were all important tops, and the two most recent ones were followed by significant short-term declines. It seems that we’re likely to see one once again.

This means that my previous comments on the above chart remain up-to-date.

What’s also quite interesting on the above chart is the similarity between the recent upswing and the one that we saw in May and early June. In fact, even the timing relative to the days of the month is similar.

The previous rally started right before the middle of May, while the current upswing began just before the middle of July. The previous one consisted of two smaller rallies, which I marked with blue dashed lines and copied to the current situation. The first part of the move that we saw in July was not as big as in May, but the timing of the reversals was almost identical.

The second small rally is also aligned – at least so far. If this self-similar pattern is to continue, junior mining stocks are likely to top any day now, and the same goes for other mining stocks, silver, and gold. In fact, perhaps they have just topped.

Please note that juniors paused at their declining support line, and this support could trigger a small upswing, but it’s likely to be too small to justify any changes in trading positions. In fact, a pause after the initial part of the decline is normal in the case of junior miners (just like it is for gold). I marked the previous similar cases with blue ellipses. We saw something similar (with RSI at similar levels) in mid-April and in early June. The declines resumed after a quick pause, and I expect something similar to happen again this time.

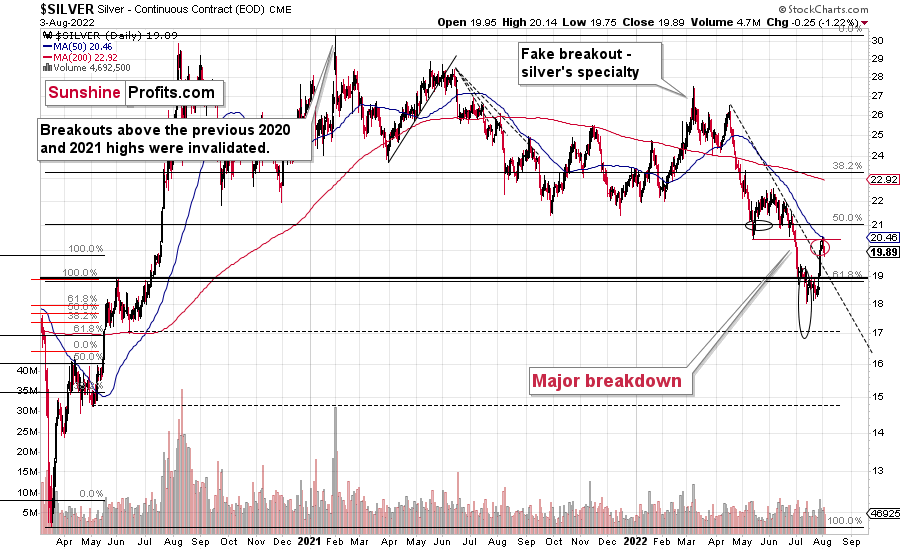

Please note how silver verified its breakdown below the $20 level and the May bottom.

This is a textbook example of what breakdown verification should look like.

Also, as you may recall, silver and mining stocks (in particular, junior mining stocks) tend to be influenced by the performance of the general stock market.

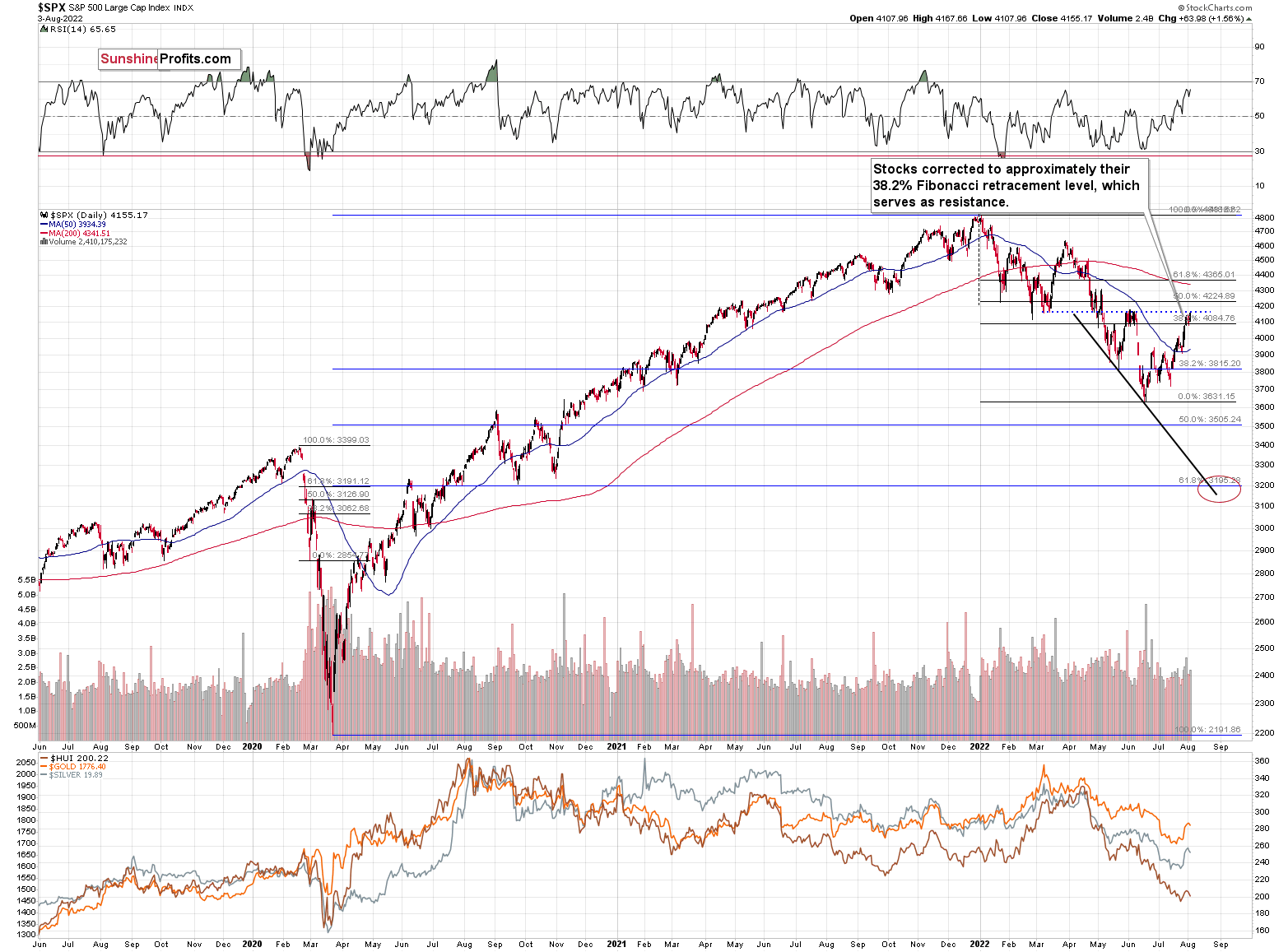

Interestingly, the S&P 500 index has just moved to its previous highs and March lows. This resistance might cause this rally to end. Consequently, silver and miners might get another bearish push soon (not necessarily immediately, though).

More By This Author:

Don’t Be Misled By Gold’s Recent UpswingInterest Rates Rose, But The Result Is Bullish For The GDXJ

The Markets Hold Their Breath Awaiting The Fed’s Decision

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more