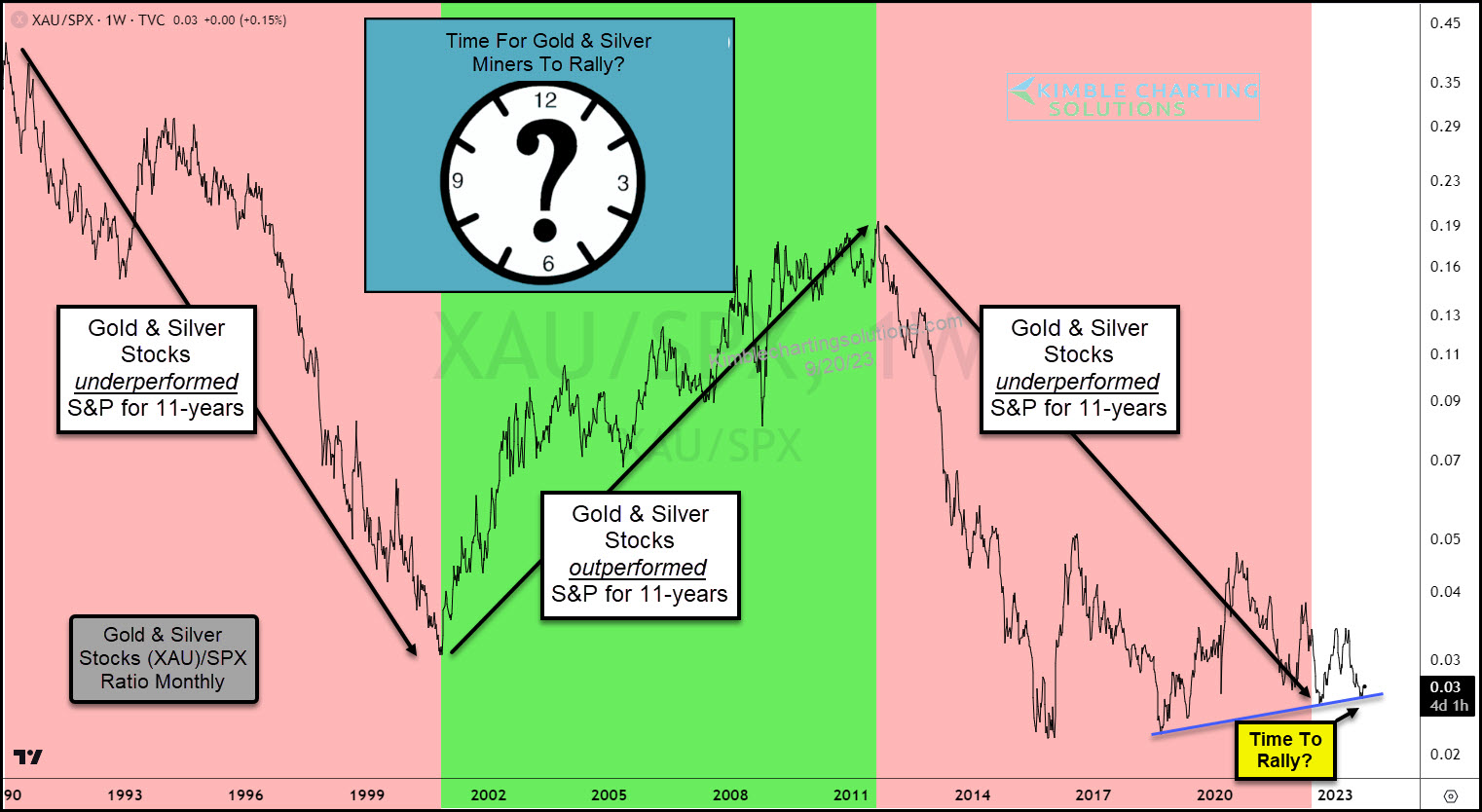

Is 11-Year Cycle Signaling Gold And Silver Miners Rally?

(Click on image to enlarge)

The price of gold is trading just off its all-time high while the price of silver is lagging. Together, they haven’t quite provided mining equities the boost they need to outperform the broad market.

But an 11-year cycle may be saying that gold and silver mining stocks are ready to rise again.

Today, we take a look at the performance of the Gold and Silver Miners Index (XAU) versus the S&P 500 Index by charting its performance ratio since 1990. The ratio is comprised of the $XAU Precious Metals Index / $SPX S&P 500 Index.

As you can see, since 1990 the ratio appears to be working on 11 year trends/cycles.

The latest cycle of underperformance has come to an end and the ratio is trying to hold near-term support.

Time for XAU and gold and silver mining stocks to start outperforming again? Stay tuned!

More By This Author:

Is Nvidia’s Stock Price Forming Monster Bearish Reversal Pattern?Cap Weight Vs Equal Weight Divergence, Sending Sell Signal Warning Signal?

Tech Stocks Near Major Decision Point: Something Has To Give Soon!

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.