Investing In Forex Brokerage Earnings Growth

Gain Capital Holdings (GCAP - Trend Report) has been posting some impressive positive earnings surprises lately and they have shown some significant revenue growth. Analysts have moved estimates higher and that makes this stock a Zacks #1 Rank (Strong Buy), and today it is the Bull of the Day.

Trading Places

There has been a healthy amount of data pointing to the return of the retail customer. The market alienated a lot of people when it imploded on itself a few years ago during the financial crisis, but they look to be coming back.

GCAP has seen some steady progress in the growth of funded customer accounts lately and is poised to see more growth. What is really key is over the last two quarters, where account growth slowed, asset growth picked up. The translation here is that the customers have been making money . . . or adding cash to their accounts.

Company Description

Gain Capital Holdings provides trading services and solutions to retail and institutional customers worldwide. It specializes in global over-the-counter (OTC) markets, including spot foreign exchange (forex), precious metals, and contracts-for-difference (CFDs). The company operates FOREX.com, which enables its retail customers to access global OTC financial markets, including forex, precious metals, and CFDs on commodities and indices.

GCAP Beats Estimates

Has been crushing the number lately. The last three quarters have seen positive earnings surprises of 69%, 44% and 85% respectively. Those are some solid beats of the Zacks Consensus Estimate.

What really caught my eye was the positive revenue surprises. Not only is the company beating the bottom line in impressive fashion, but they are doing the same thing on the top line too. The last three quarters have seen positive revenue surprises of 25%, 21% and 14% respectively.

The most recent quarter saw revenue of $83M and that was $10M more than the Zacks Consensus Estimate of $73M. It was also much more than double the $32M in brought in for the same quarter from a year ago. That is what I call growth!

GCAP Sees Estimates Moving Higher

Over the last few months, GCAP has seen its earnings estimates move higher. The 2014 Zacks Consensus Estimate has moved from $0.90 in November to $0.95 in January and is now $1.01.

The 2015 numbers have also started to move higher. Over the same time period described above, the 2015 Zacks Consensus Estimate moved from $1.15 to $1.19 and is now $1.24.

Valuation

GCAP has a great valuation. The trailing 12 months PE is right in line with the industry average, but the more important forward PE is showing the stock trades at a discount to the industry average. The forward PE multiple for GCAP is 11.4x compared to 14.4x for the industry average. The other metrics that investors look to also show GCAP trading at a discount. Price to book of 1.9x is below the 2.1x industry average and the 1.7x price to sales multiple is well below the 3.6x industry average.

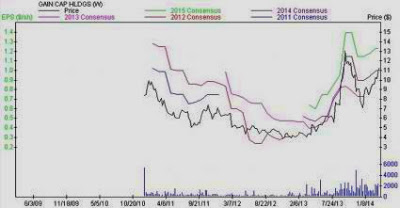

The Chart

The price and consensus chart shows how the earnings estimates have trended right along with the stock price for GCAP. This chart also shows that the estimates have recently turned higher and are pulling the stock price higher. If the patterns continue, this stock should reach a new 52 week high soon.

I'm not long or short any stocks listed in this article.