Inflation, The USDX, Real Yields: The Doom Trio Hangs Over Gold

Despite the reality check, investors keep up their buying spree. Meanwhile, problematic events are starting to gain on gold, silver, and mining stocks.

With reality rearing its ugly head recently, the S&P 500 and the GDXJ ETF have suffered mightily. Moreover, while I’ve been warning for months that investors underestimated the implications of rampant inflation, the chickens have come home to roost. To explain, I wrote on Oct. 26:

Originally, the Fed forecasted that it wouldn’t have to taper its asset purchases until well into 2022. However, surging inflation pulled that forecast forward. Now, the Fed forecasts that it won’t have to raise interest rates until well into 2023. However, surging inflation will likely pull that forecast forward as well.

Moreover, I added on Nov. 4, following the FOMC meeting:

With Fed Chairman Jerome Powell still searching for his inflationary shooting star, the FOMC chief isn’t ready to label inflation as problematic. “I don’t think that we’re behind the curve,” he said. “I actually believe that policy is well-positioned to address the range of plausible outcomes, and that’s what we need to do.”

The reality is: while Powell has taken the path of least resistance to help calm inflation (the taper), his inability to understand the realities on the ground leaves plenty of room for hawkish shifts in the coming months (interest rate hikes).

Thus, while Powell has shifted his stance materially and Fed officials now expect seven to 12 rate hikes in 2022, the financial markets initially ignored the repercussions. However, always late to the party, the consensus now fears that the medium-term outlook has lost its luster.

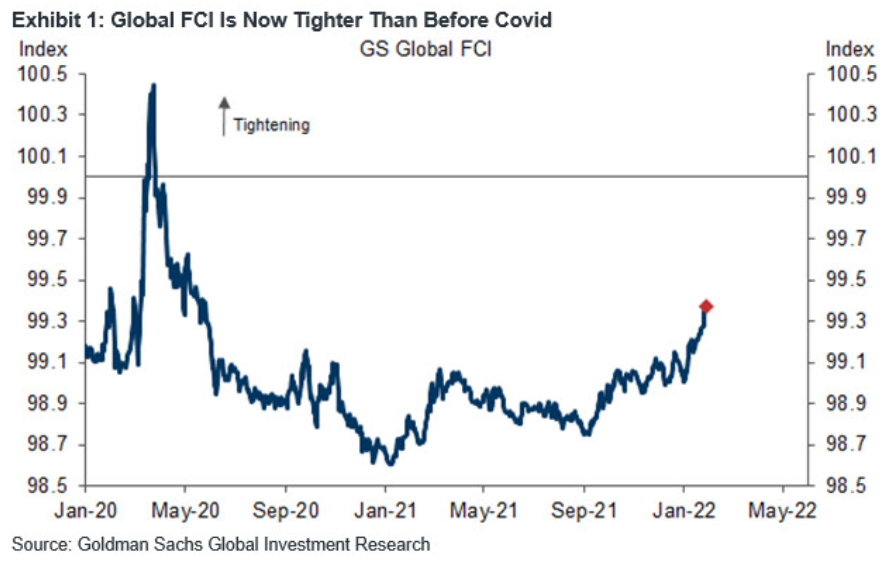

Please see below:

Source: CNBC

Likewise, while the fundamental implications have been loud and clear for months, sentiment doesn’t die easily. However, since reality is undefeated, the impact of evaporating liquidity is becoming too much to bear. To explain, I wrote on Feb. 2:

If you analyze the right side of the chart, you can see that the FCI has surpassed its pre-COVID-19 high (January 2020). Moreover, the FCI bottomed in January 2021 and has been seeking higher ground ever since. In the process, it's no coincidence that the PMs have suffered mightily since January 2021. Furthermore, with the Fed poised to raise interest rates at its March monetary policy meeting, the FCI should continue its ascent. As a result, the PMs' relief rallies should fall flat, like in 2021.

Likewise, while the USD Index has come down from its recent high, it's no coincidence that the dollar basket bottomed with the FCI in January 2021 and hit a new high with the FCI in January 2022. Thus, while the recent consolidation may seem troubling, the medium-term fundamentals supporting the greenback remain robust.

I provided an update on Apr. 13:

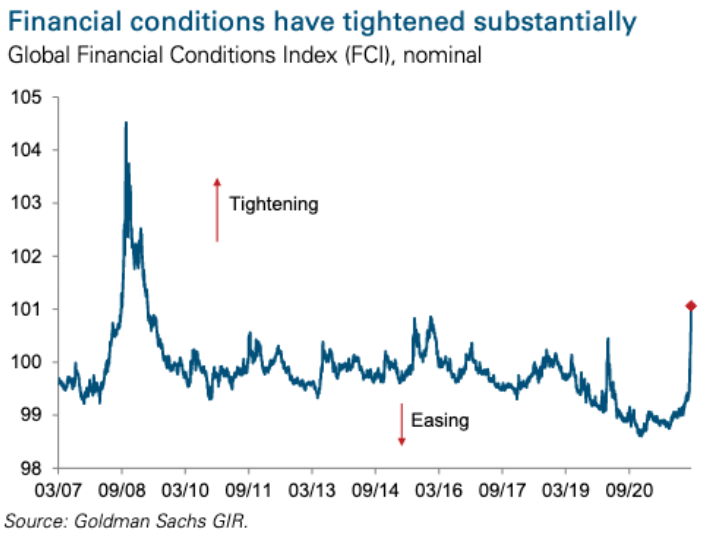

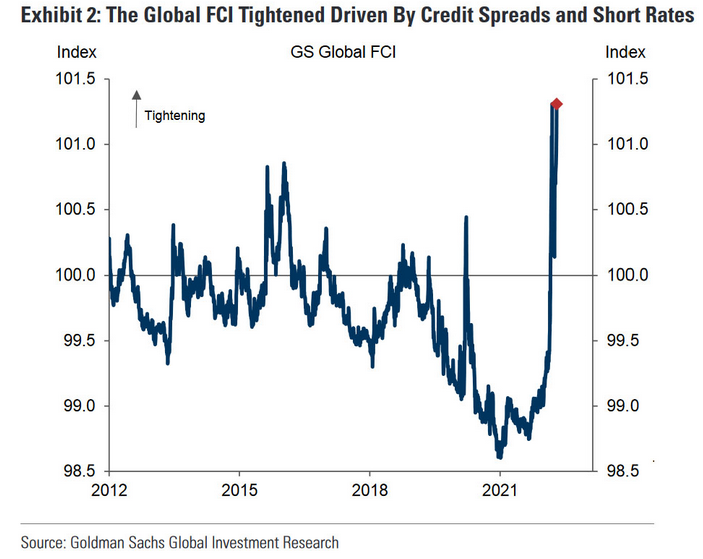

While the USD Index has surpassed 100 and reflects the fundamental reality of a higher FCI and higher real yields, the PMs do not. However, the PMs are in la la land since the FCI is now at its highest level since the global financial crisis (GFC).

Please see below:

Also noteworthy, the FCI made quick work of the March 2020 high from the first chart above. Again, Fed officials know that higher real yields and tighter financial conditions are needed to curb inflation. That’s why they keep amplifying their hawkish message and warning investors of what lies ahead. However, with commodities refusing to accept this reality, they’ll likely be the hardest-hit once the Fed’s rate hike cycle truly unfolds.

Surprise, surprise: after surpassing its March 2020 highs, the FCI has continued its ascent.

Please see below:

Who Could’ve Seen This Coming?

As a result, while the Russia-Ukraine conflict and misguided optimism disrupted our bearish timeline, the important point is that investors can only ignore technical and fundamental realities for so long. With a resurgent USD Index and rising real yields, which are profoundly bearish for the PMs, the latter have come down from their recent highs.

Moreover, with the general stock market's suffering adding to the GDXJ ETF's ills, the junior miners have underperformed their precious metals counterparts, which has been very beneficial for our short position.

However, the bearish medium-term thesis remains unchanged: inflation is problematic, the Fed is hawked up, and a higher USD Index and higher real yields should materialize in the coming months.

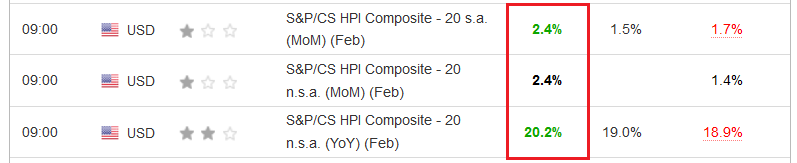

Case in point: while February's lagging data may not reflect the impact of rising mortgage rates, the S&P/Case-Shiller U.S. National Home Price Index surged by more than 20% year-over-year (YoY) on Apr. 26 and outperformed expectations (19%). As a result, the data is profoundly bullish for shelter inflation, which accounts for more than 30% of the headline Consumer Price Index's (CPI) movement.

Please see below:

Source: Investing.com

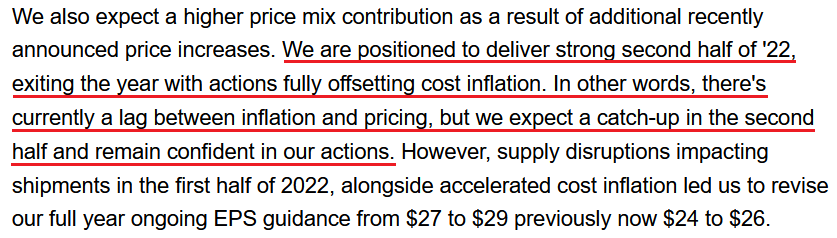

Also noteworthy, Whirlpool released its first-quarter earnings on Apr. 25. For context, the company manufacturers home and kitchen appliances like washing machines, dryers, refrigerators, and stand mixers. CEO Marc Bitzer said during the Q1 earnings call:

“As our industry and most other industries face historical levels of cost inflation, we observed over $400 million in the fourth quarter, or approximately a 10% increase in the cost of goods sold. Despite this, we delivered over 9% ongoing EBIT margins and over 16% EBIT margins in our North America business, again demonstrating the earnings strength of the region and the actions we took, transforming margins over the years.”

“We now expect higher levels of inflation to persist throughout the year and have increased our full-year cost inflation expectations by $600 million to $1.8 billion.”

However, is Whirlpool waiting for the Fed to solve the problem?

“Our first-quarter results demonstrate that we are a different Whirlpool, delivering structurally improved EBIT margins no matter the operating environment. We have the right actions in place to deliver a solid 2022, including our previously announced cost-based price increases of 5% to 18%, addressing inflation across the globe.”

To that point, due to the time lag between incurring costs and implementing price hikes, Bitzer said that more increases are scheduled for the back half of 2022.

Please see below:

Source: Whirlpool/Seeking Alpha

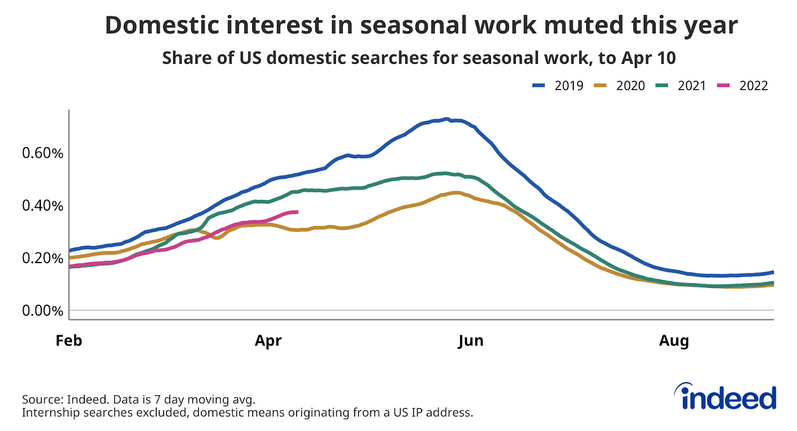

On top of that, Indeed released its latest State of the Labor Market report on Apr. 21. An excerpt read:

“Employer demand for seasonal work is growing in line with pre-pandemic trends, with summer job postings on Indeed soaring 40.1% above their February 1, 2022 baseline as of April 10 (…).”

“Seasonal postings on Indeed for spring and summer jobs comprise a variety of positions. Some of these jobs, like camp counselor and lifeguard, fit the traditional summer mold. But more general roles, like retail sales associate and cashier, make strong showings too.”

However:

“Domestic job seeker interest in seasonal jobs lags prior year trends. As of April 10, the 2022 share of domestic job seeker searches for seasonal work was respectively 27.6% and 16.9% below the comparable periods in 2019 and 2021.”

Please see below:

To explain, the blue and green lines above track U.S. citizens’ interest in seasonal work in 2019 and 2021 (before/after the height of the pandemic), while the pink line above tracks their current interest. As you can see, there is a clear underperformance.

More importantly, the combination of normalized demand and insufficient supply is extremely inflationary. With demand “growing in line with pre-pandemic trends,” while supply is roughly 17% to 28% below comparable periods, it should put upward pressure on wage inflation. Moreover, remember what I wrote on Apr. 22?

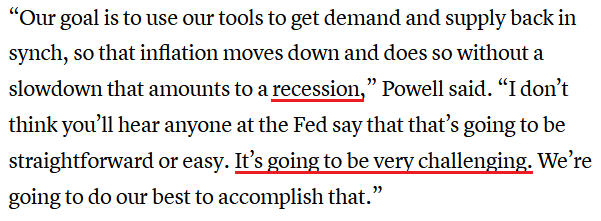

Powell said on Apr. 21 that the U.S. labor market is "too hot" and that the Fed needs to cool it down. "It is a very, very good labor market for workers," he said. "It is our job to get it into a better place where supply and demand are closer together."

As a result, he understands the problem. However, reducing 8.6% annualized inflation without impairing the U.S. labor market is like trying to hit a hole in one on the golf course.

Please see below:

Source: CNBC

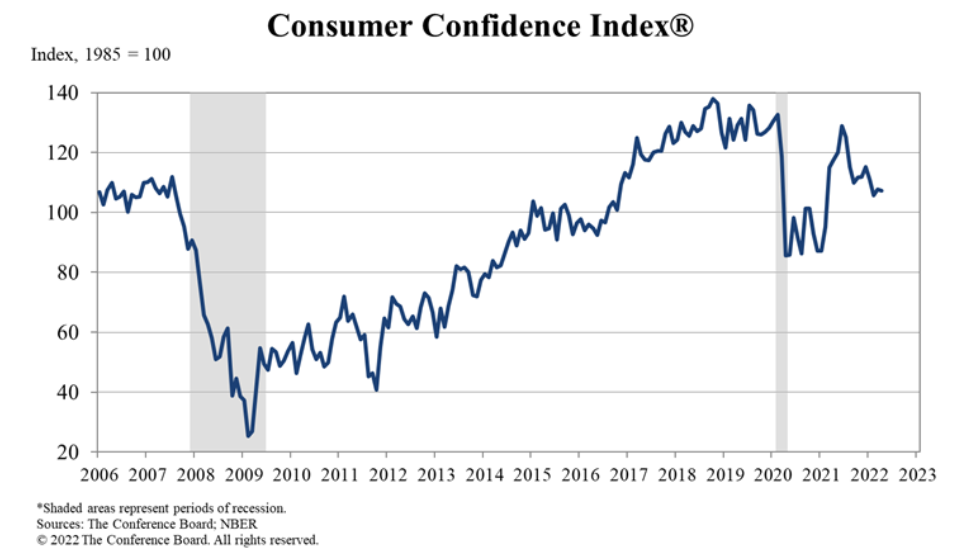

Finally, The Conference Board released its Consumer Confidence Index on Apr. 26. The headline index decreased from 107.6 in March to 107.3 in April, and Lynn Franco, Senior Director of Economic Indicators at The Conference Board, said:

“The Present Situation Index declined, but remains quite high, suggesting the economy continued to expand in early Q2. Expectations, while still weak, did not deteriorate further amid high prices, especially at the gas pump, and the war in Ukraine. Vacation intentions cooled but intentions to buy big-ticket items like automobiles and many appliances rose somewhat.”

All in all, the data is largely inconclusive, as there are some good and some bad results. However, since “concerns about inflation retreated from an all-time high in March but remained elevated,” more QE is far from the right medicine.

The bottom line? While I warned on Apr. 8 that when sentiment shifts, the PMs will confront one of the worst domestic fundamental environments since late 2018, the troublesome developments are catching up to gold, silver, and mining stocks. However, despite their recent drawdowns, the PMs are still trading well above their medium-term-trend-based fair values. Therefore, more pain should materialize over the medium term. It seems that we might see a sharp rebound in the near future, though (after PMs decline some more).

In conclusion, the PMs were mixed on Apr. 26, as mining stocks continued their material underperformance. Moreover, while investors will likely remain in ‘buy the dip’ mode until the very end, lower highs and lower lows should confront the S&P 500 and the PMs over the next few months. As a result, the medium-term outlook for the GDXJ ETF is profoundly bearish.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more