Indian Silver Disruption Lasting Far Longer Than Initial Reports

Image Source: Unsplash

The gold and silver prices are down slightly on Friday to close out what’s been a volatile week, although today’s losses are much smaller than some of the previous sessions of the past few days.

Gold futures are currently down $23, trading at $4,123.

The silver futures are down 32 cents on the day to $48.39.

And the silver spot price is down 34 cents to $48.60.

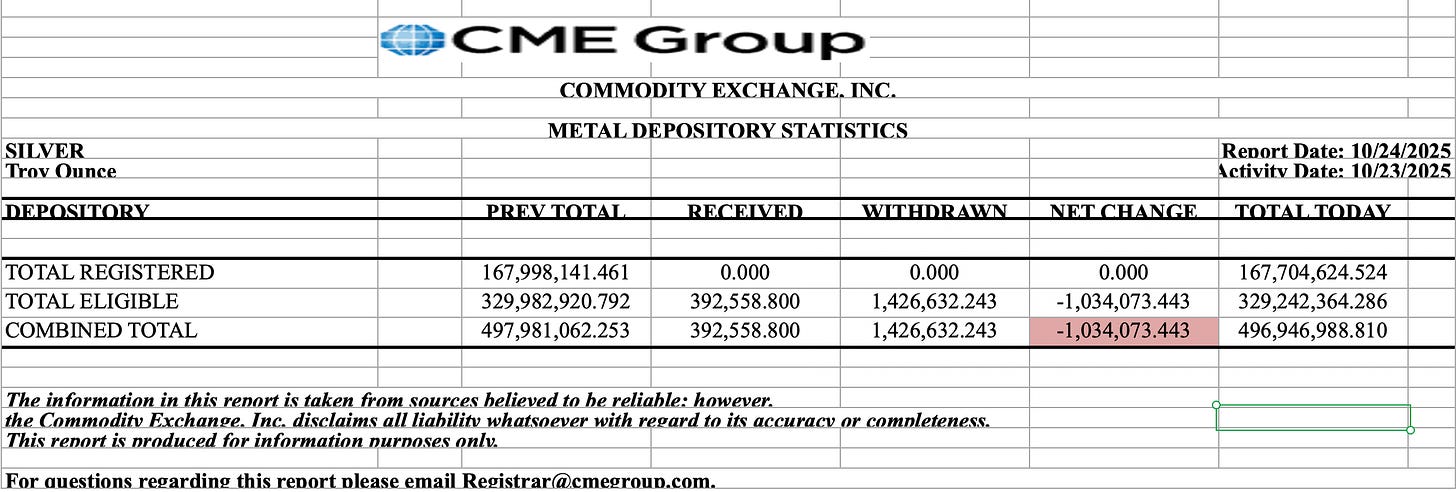

The silver spread between London and New York has continued to narrow, although as the lease rates have come down, metal has continued to leave the Comex.

Of course the key place to look right now, perhaps aside from the LBMA, is in India, where back on October 9th, aka ‘the day that the silver market broke’ (not just according to me, but to Bloomberg, and a handful of traders and market participants as well), when it was first reported that Indian ETFs had to halt new additions because of a silver shortage in India.

Market participants that Reuters had spoken with said that they believed the suspension was temporary in nature, and large amounts of silver were expected to arrive the following week.

It added that the suspension is temporary in nature and will continue only until further notice in this regard.

A large number of silver imports are expected to arrive next week, which will increase supply and bring premiums down to more normal levels, said a bullion dealer with a private bank in Mumbai.

But that was October 9th, today is October 24th, and there’s still been no relief.

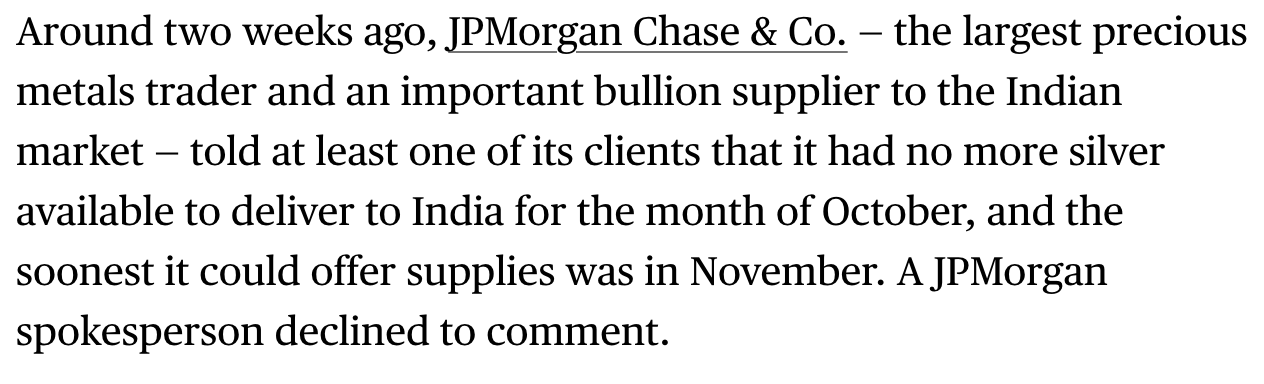

Also, as you may have heard me mention over the past week, this was what Bloomberg reported last Saturday.

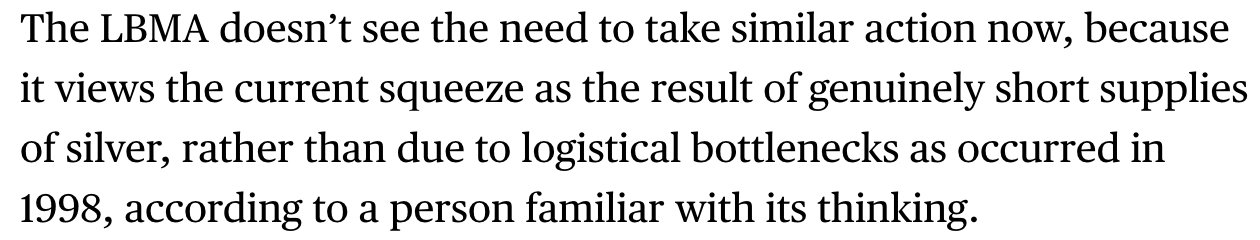

Bloomberg also added the following note about the LBMA, which if accurate, suggests that even they think this isn’t just a geographic dislocation, but a case of ‘genuinely short supplies of silver.’

Yet in the end, a week or two is now stretching to a month, and we’ll see if the silver that’s left the Comex is enough to meet the additional pent-up demand in India. Especially since they were in the middle of an historic buying mania when the shortage occurred, and it will be fascinating to see how much silver they consume when it does become available again.

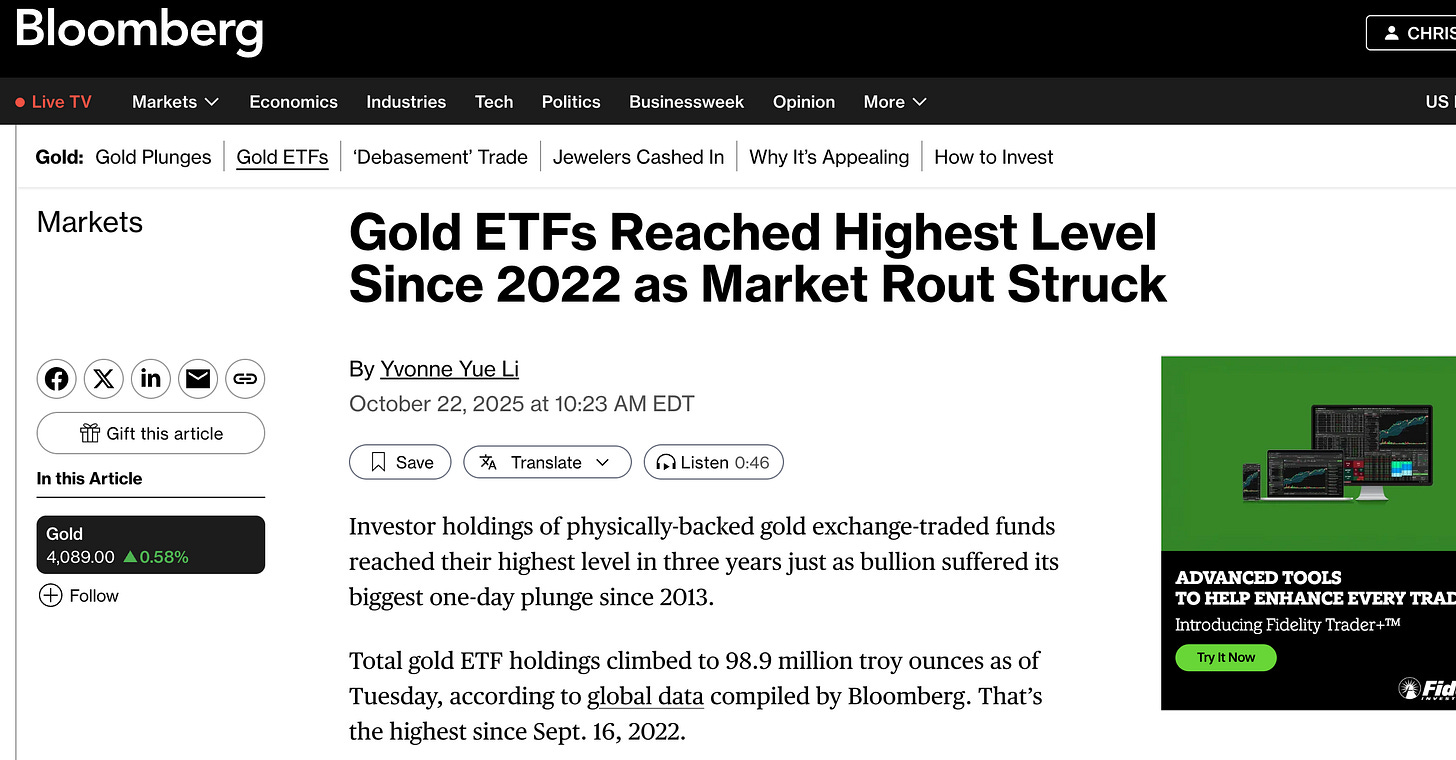

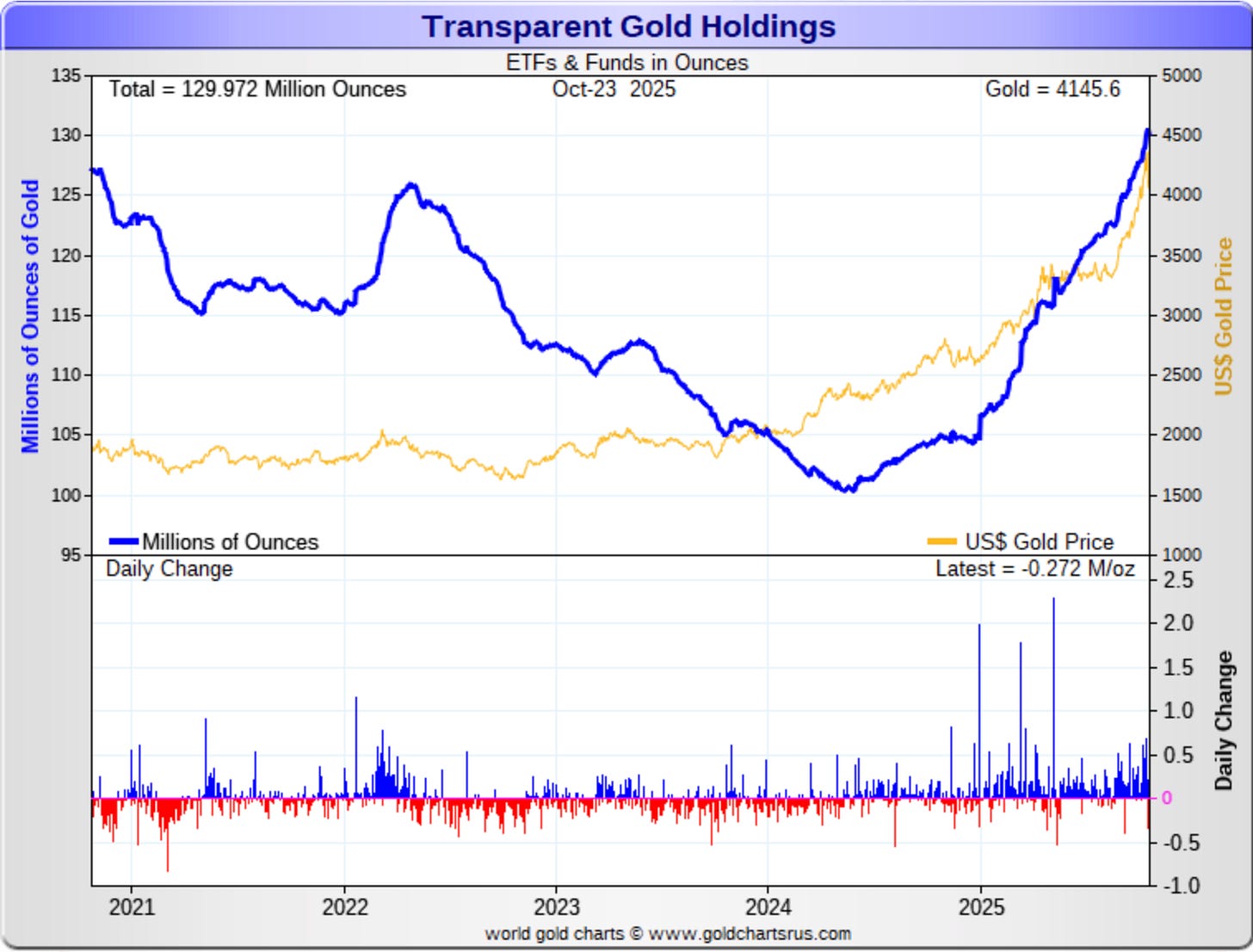

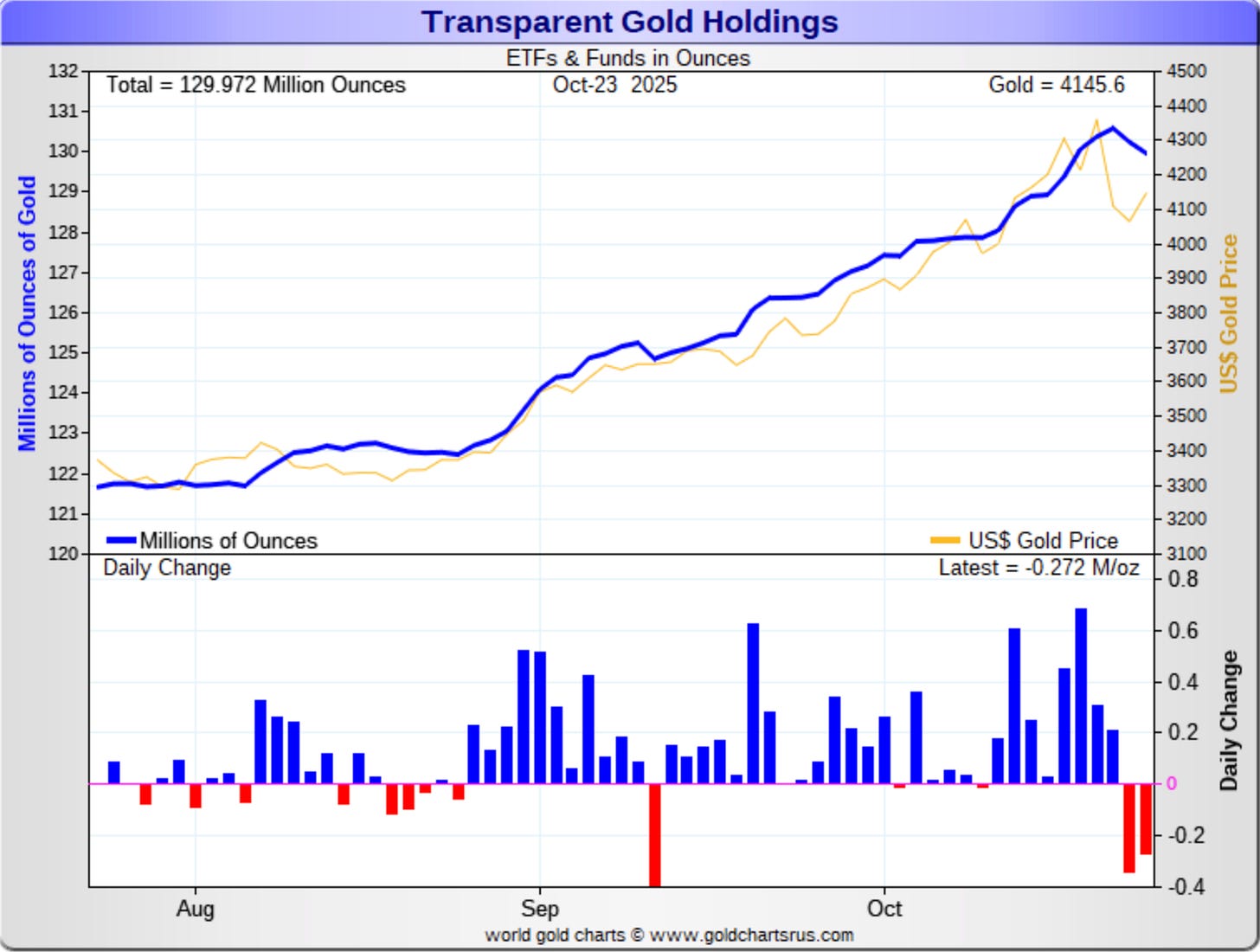

One of the other driving factors of the rally has been the continued gold and silver inflows into the ETFs, with Bloomberg noting how the gold ETFs reached their highest level since 2022.

In the next chart, you can see the daily gold ETF additions/subtractions, and how metal has continued getting added to the trust, even throughout the sell-off, until large withdrawals on October 22nd and 23rd.

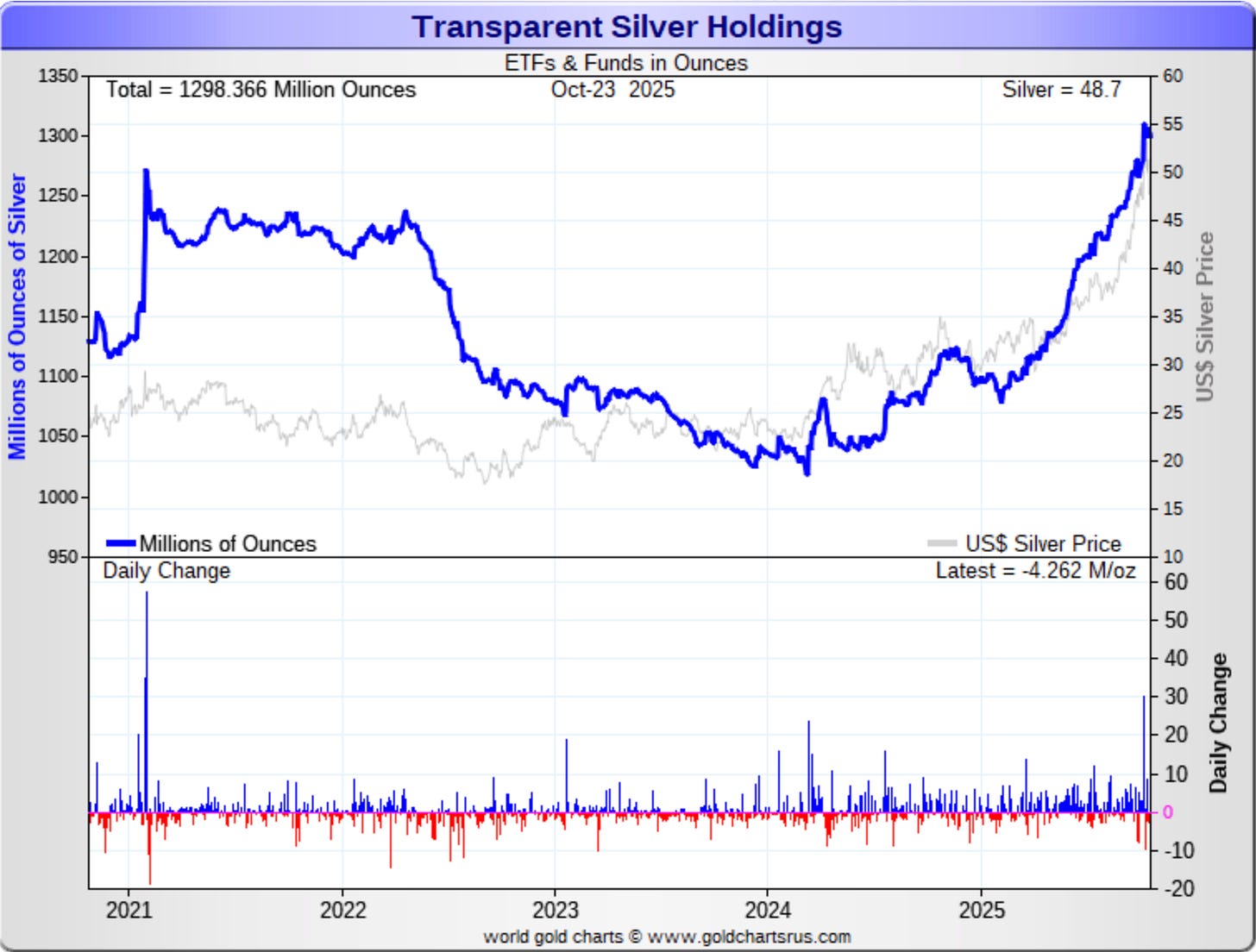

Here are the additions to the silver ETFs, where you can see they have surged this year as well.

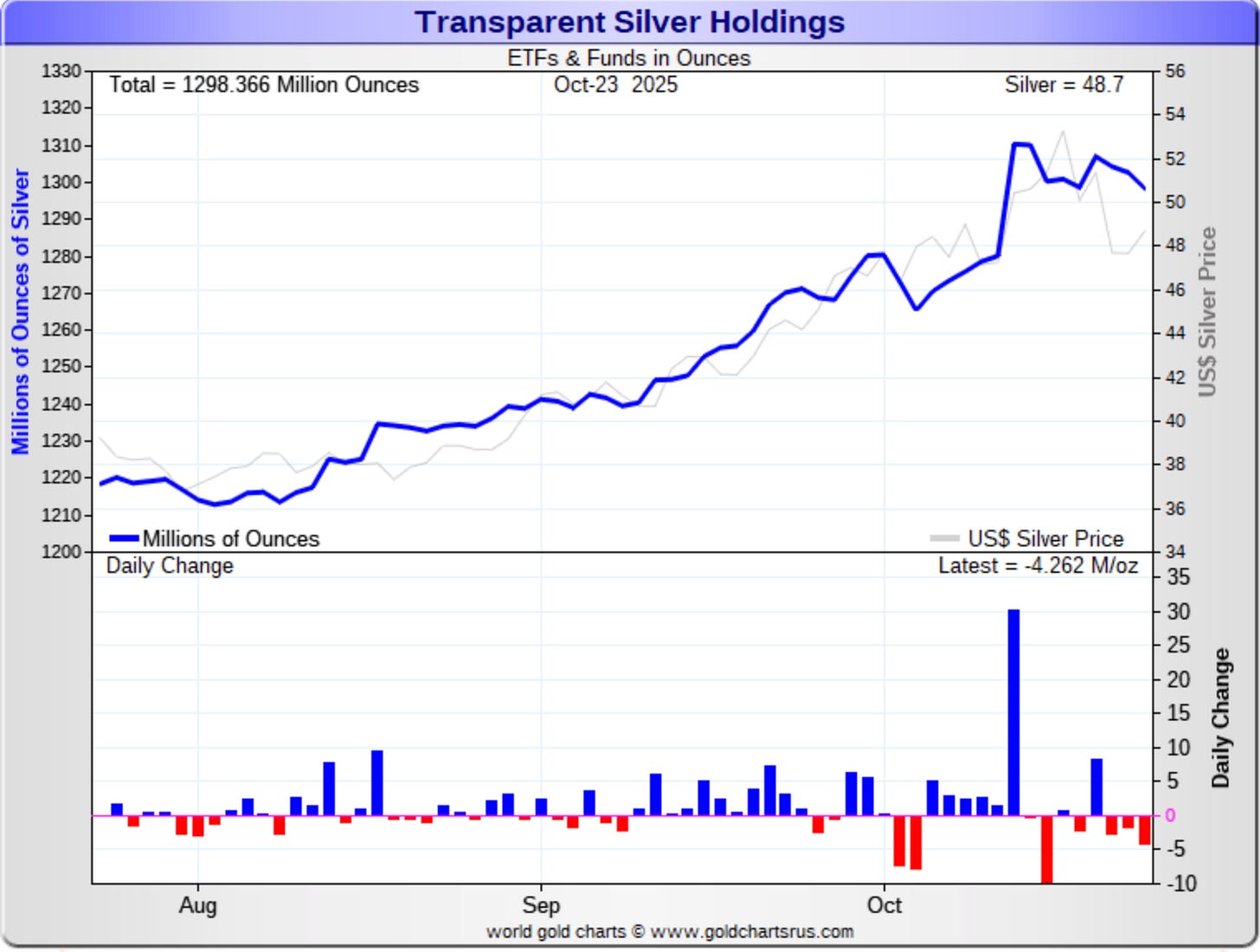

And here’s a close-up look at the daily inflows on the bottom of the next chart, where there have been some withdrawals in the last week, yet still a lot of metal going into the trusts in net over the past few months.

There was also a report out earlier this week that the LBMA is interested in launching gold futures.

Peter Zoellner, whose organisation represents bullion trading banks, told the Financial Times on Wednesday that previous efforts to launch gold futures in London had been premature but added the global market would benefit from having “two or three places with decent liquidity”.

“I think it makes sense that the gold market can trade on different venues,” Zoellner told the newspaper. “Sometimes people start something a bit too early. Maybe we are in a different situation.”

I suppose if they want their own gold futures, knock yourself out. Although it just struck me as bizarre timing to be bringing it up now, when they just got caught with their pants down in the silver market after not having enough metal.

Of course, earlier this year, the gold market also had delays at the Bank of England, where they ended up telling customers that it would take 4-8 weeks to get their collateral.

So if the LBMA launches gold futures, hopefully they have it thought out a bit more than some of the other London activity of late.

The last note for this week is another one that you may have heard about, although as I’ve thought more about it, I do think it’s worthy of taking note of.

We’re hearing more about the 60/20/20 portfolio, which is an update to the traditional 60/40 stock/bond portfolio, but the 60/20/20 is now advocating a 20% allocation to precious metals.

In a seismic shift, Morgan Stanley CIO Michael Wilson recently came out with an investment strategy that includes a 20 percent allocation to gold.

Now a Sprott executive has followed suit, telling a mainstream financial network’s audience that investors should consider shifting from the traditional 60/40 portfolio to a 60/20/20 allocation.

This isn’t typical messaging on mainstream financial networks.

Historically, the conventional wisdom on Wall Street was a 60/40 portfolio, with 60 percent of the holdings in equities and 40 percent in fixed-income investments, primarily bonds. The theory is that these asset classes balance each other, with stocks strengthening in a strong economy and bonds creating a hedge during downturns.

However, bonds have lost their safe-haven status in recent months. Last spring, at the height of tariff uncertainty, gold and silver rallied as bonds sold off. Gold and silver seem to be the last safe havens standing.

Given the changing market dynamics, Wilson said investors should consider a 60/20/20 strategy, swapping half of the bond portfolio for gold to serve as a “more resilient” inflation hedge.

Maybe this doesn’t sound like a big deal, but for those who are unfamiliar, there is a large group-think mentality on Wall Street, where if you’re a trader, and you do what everyone else is doing, but it goes bad, at least you can say that everyone else was doing it. Maybe not the best strategy, but nonetheless that’s how it often goes on Wall Street.

So it’s intriguing to think about how it could play out if the 60/20/20 portfolio does continue to pick up steam, especially at the same time when ‘the debasement trade’ is becoming more common in Wall Street parlance.

We’re seeing these shifts happen day after day, and as they happen, sometimes the prices go up, and sometimes they go down. But throughout all of the volatility, if you can see the underlying factors that are almost impossible to change, and why they will necessarily force money out of the bond market and into safer havens, it helps to weather the volatility.

Hopefully, all of this leaves you set for a wonderful and relaxing weekend with both gold and silver still in near-record territory. And I’ll look forward to checking back in with you on Monday.

More By This Author:

Gold & Silver Recover After Selloff, While Silver Keeps Leaving ComexSilver On Way Back Down To Low $40s Or $30s?

Why Gold And Silver Got Slammed Yesterday