Indexes Close Higher Following Intense Week Of Volatile Trading

Indexes closed the day higher after an intensely volatile last full week of January, as investors digest the Fed meeting, a slew of big-name earnings, and a historic comeback for the Dow. Chevron (CVX) is weighing heavy on the blue-chip index today, after reporting a disappointing earnings. Apple (AAPL) is providing some stability, however, and helped boost the blue-chip index to its best day of 2022 and tech-heavy Nasdaq to triple-digit gains. Meanwhile, the S&P 500 remains on track for its worst month since March 2020, but all three indexes managed a win for the week.

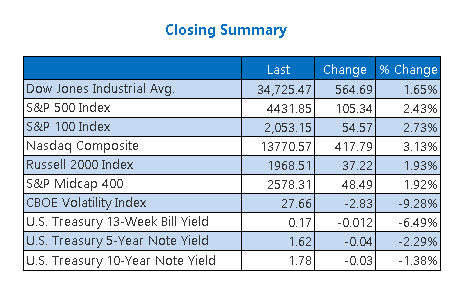

The Dow Jones Average (DJI - 34,725.47) climbed 564.69 points or 1.7% for the day. Visa (V) led the gainers today, adding 10.6%, and Caterpillar (CAT) paced the laggards with a 5.2% drop. For the week, the Dow added 1.3%.

The S&P 500 Index (SPX - 4,431.85) moved 105.3 points higher, or 2.4%, while the Nasdaq Composite (IXIC - 13,770.57) tacked on 417.8 points, or 3.1%, for today's session. For the week, the indexes added 0.7% and 0.02%, respectively.

Lastly, the CBOE Volatility Index (VIX - 27.66) shed 2.8 points, or 9.3% for the day, and 4% for the week.

OIL LOGS IMPRESSIVE DAILY, WEEKLY WINS

Oil logged an impressive six-week win streak today, alongside a daily close that settled at a seven-year high. Tensions surrounding Ukraine and Russian continue to add support to the increase in prices. March-dated oil added 21 cents, or nearly 0.2%, to settle at $86.82 per barrel. On the week, Oil added 2%.

Gold futures did not fare as well, however, marking their worst week in six, weighed down by the Fed's imminent rise in interest rates. The now most-active contract, April-dated gold, dropped $8.40, or 0.5%, to close at $1,786.60 per ounce. For the week, Gold shed 2.5%, its largest such decline since November.

Disclaimer: Schaeffer's Investment Research ("SIR" or "we" or "us") is not registered as an investment adviser. SIR relies upon the "publishers' ...

more