If Gold Read The Tea Leaves, It Would See The Shape Of A Bear

Despite increased war tensions, gold failed to break above $2,000. What’s worse, rising USDX and interest rates are already lurking on the horizon.

The precious metals just performed exactly as they were likely to. Despite the increase in war tensions, PMs and miners reversed instead of rallying, which indicated that the rally has probably run its course. Since the tensions can now (most likely) either decline or stabilize, gold and silver prices will presumably fall right away, or after a while, as the market starts paying attention to gold’s two key fundamental drivers:

- the USD Index

- the real interest rates.

Both are inversely correlated with the price of gold, and both are on the rise. It’s therefore most likely only a matter of time before gold declines, and the same goes for silver and mining stocks. In fact, silver and mining stocks are likely to fall harder than gold, as they’ve been very weak in recent years anyway. Let’s not forget that while gold moved above its 2011 highs, silver and miners are well below the 50% retracement from their respective 2011 highs.

Let’s check what gold did yesterday.

(Click on image to enlarge)

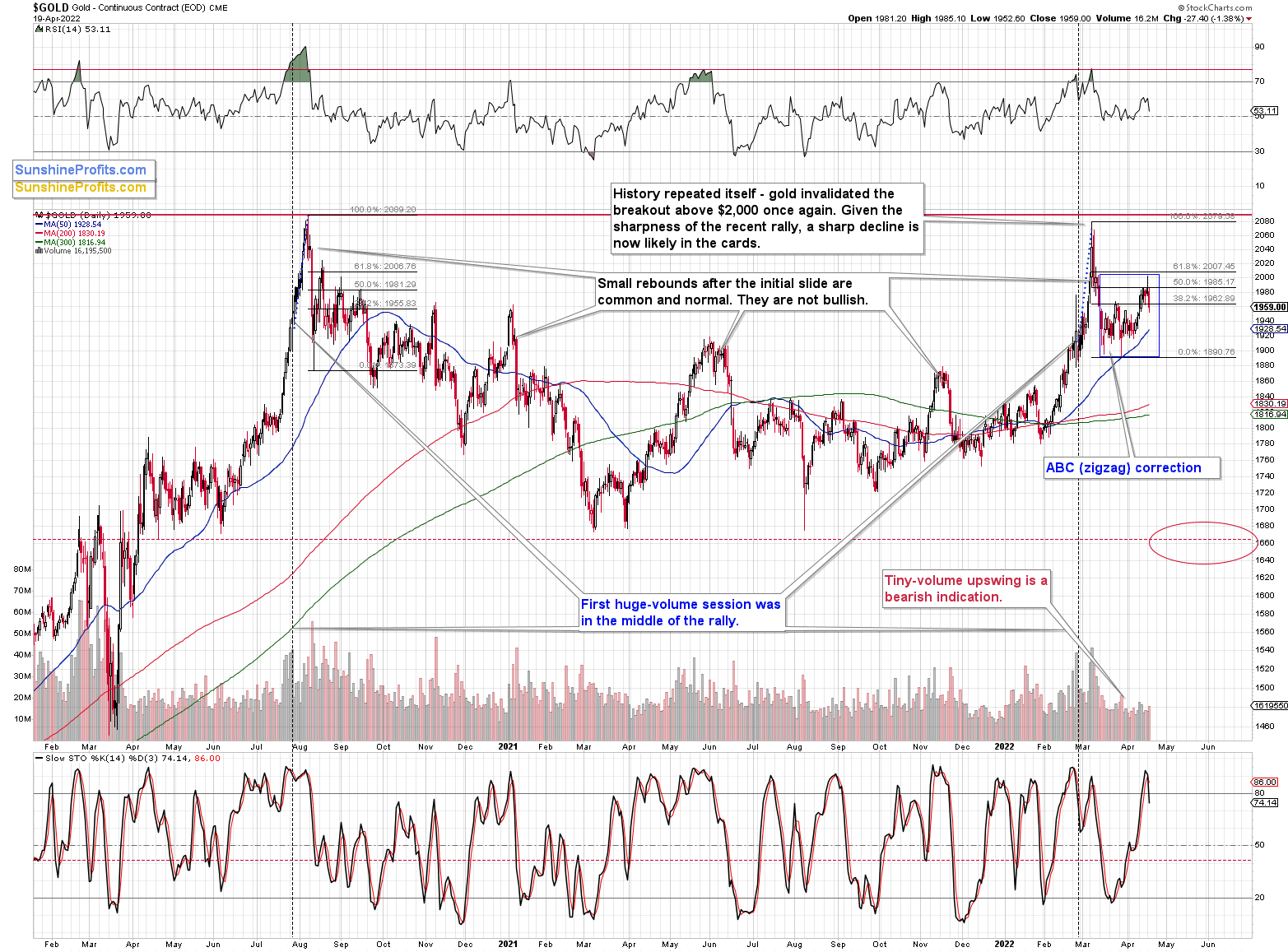

The gold price declined substantially, and it closed below its late-March 2022 high, thus invalidating the breakout above it. Instead of the breakout above $2,000, we saw the above. Instead of a bullish sign, we got a sell signal.

We also got another from the stochastic indicator that not only moved below its signal line but also below the 80 level.

Moreover, let’s not forget that it all happened in tune with what we saw back in 2020, after gold’s major top.

Back then, gold retraced slightly more than 61.8% of the decline. Although this time it retraced slightly less, both cases are still very similar.

Consequently, this month’s recent upswing was not really bullish – it was a natural part of a bigger bearish pattern.

(Click on image to enlarge)

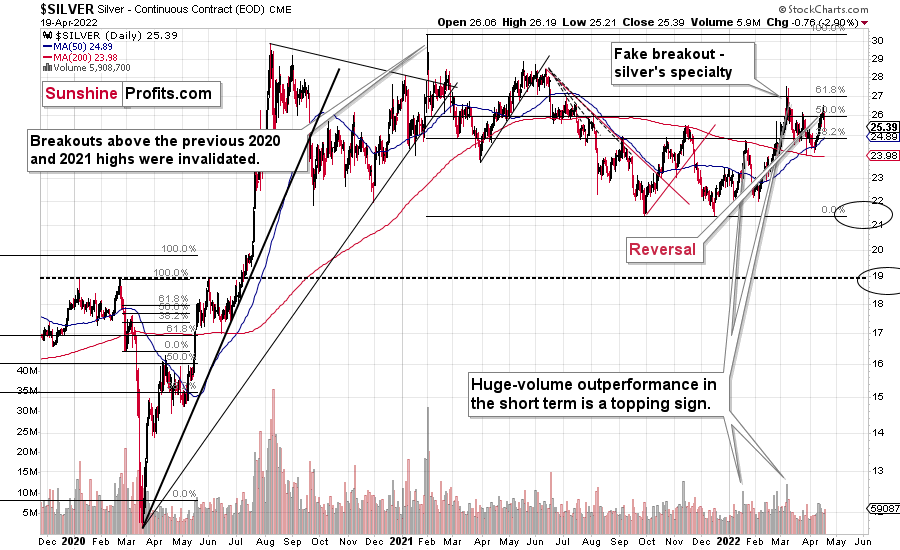

Just as gold reversed on Monday, so did silver. It also outperformed gold on a very short-term basis, which served as another bearish confirmation.

Silver’s outperformance of gold is often a sell signal, especially when it’s accompanied by mining stocks’ weakness, and we saw the latter too.

(Click on image to enlarge)

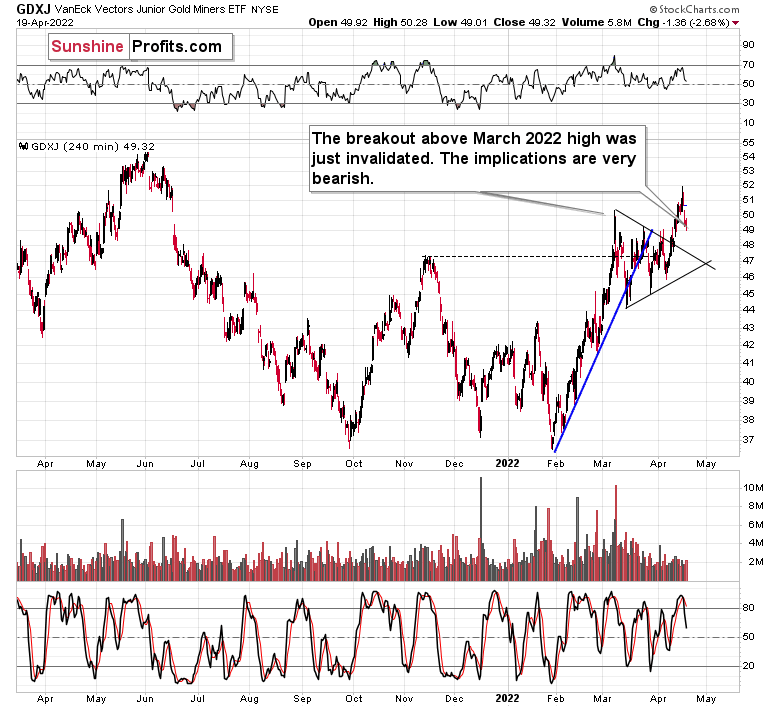

During yesterday’s trading, silver and junior miners were down rather similarly, but the latter had also been down on Monday, while silver had ended the session in the green.

Also, miners just invalidated their breakout above the March 2022 high in terms of the closing prices. No wonder here – the attempt to rally above the previous highs was accompanied by rather a weak volume, suggesting that it would fail.

It did, and that’s a sell sign on its own.

Consequently, the current outlook for the precious metals market appears bullish in the long run but bearish in the medium- and short term.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more