How To Hedge Your Portfolio Against Skyrocketing Food Prices

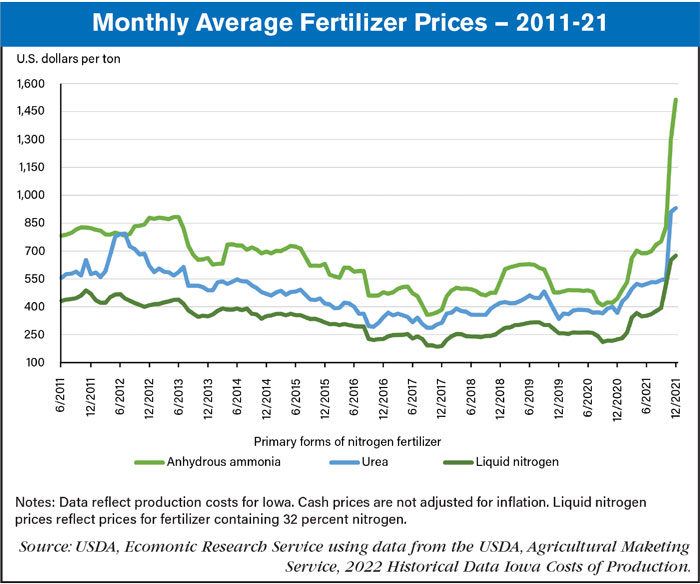

Did you know that fertilizer prices spiked in the U.S. market in late 2021, just ahead of 2022 planting season, according to the United States Department of Agriculture? This was before Russia invaded Ukraine.

Now, because of the Russian/Ukraine War, prices will continue to rise, since Russia produces almost ten million metric tons of nitrogen fertilizer per year as the fourth largest producer in the world.

Higher Fertilizer Prices

With higher fertilizer prices, you get higher wheat, corn, and soybean prices. With higher wheat, corn, and soybean prices, you get higher food prices in general. And you can also get food shortages, as well.

Higher Food Prices

I recently wrote about the soaring prices of items on Amazon and showed that many of these increases were due to food items. I described how dark chocolate candy rose by 148%, light tuna in water by 28%, multi-seed cheesy garlic crackers by 194%, sesame bars with honey and almonds by 134%, and on and on. This was all during a twelve-month period ending last November, and remember, this was before the war.

So, what is an investor to do? If you are willing to take a lot of risk, you can trade the futures market. But for those that prefer to stick with stocks and ETFs, there are still opportunities.

Individual Agricultural Funds

One way is by buying agricultural commodities exchange traded funds. There are ETFs and ETNs available for corn, wheat, soybeans, and several other agricultural products.

- The Teucrium Corn Fund (CORN), which invests in corn futures, has a market cap of $222 million, an expense ratio of 1.76%, and is up 29.79% year-to-date.

- The Teucrium Wheat Fund (WEAT) has net assets of $493 million. It has an expense ratio of 1.00%, and year-to-date is up 38%.

- The Teucrium Soybean Fund (SOYB) has a market cap of $64 million, an expense ratio of 1.16%, and is up 21.18% year-to-date.

Diversified Agricultural Funds

If you prefer to reduce your risk through diversification, you might want to consider Invesco DB Agriculture Fund (DBA), which invests in a basket of agricultural commodities futures. The market cap is $1.85 billion, the expense ratio is 0.85%, and the year-to-date total return is 11.2%.

Another diversified investment is the Elements Rogers International Commodity Index-Agriculture Total Return ETN (RJA), which is up 17.98% so far this year. The market cap is $153 million and the expense ratio is 0.75%.

Most of these funds are very volatile, very speculative, and can have both low volume and very wide spreads. Maybe one of these will help you offset the prices you pay at the supermarket.

Disclosure: Author didn’t own any of the above at the time the article was written, but the author does plan to put on a bullish option spread on CORN in the next few ...

more