How Not To Buy Gold

The corona crisis changed a lot of things. With the almost universal adoption of zero interest rates and massive quantitative easing programs throughout the globe, investors’ new found love of gold is high up on the list of changing portfolio choices.

This almost insatiable demand for gold is best illustrated by the explosion in the number of shares outstanding in the world’s largest precious metals ETF - the SPDR Gold Trust - symbol GLD.

(Click on image to enlarge)

On March 20th, at the peak of the corona crisis, there were 310 million shares of GLD outstanding. Over the next four months, investors added 119 million shares, representing $21 billion of gold bullion. Yes, you read that correctly. $21 billion.

Alternative forms of gold ownership

Although the SPDR Gold Trust is by far the most popular ETF for gold ownership, it is by no means the only option.

Some individuals remember the 1933 Executive Order 6102 when President Roosevelt made it illegal for Americans to hold gold. Worried about this possibility, some Americans prefer to hold their gold outside the United States. Switzerland is often a popular choice, but America’s cousin to the north never experienced gold confiscation, so Canada is another popular choice.

Canada has a few different gold ETFs. Blackrock and Sprott are two reputable ETF sponsors that offer compelling gold bullion ETFs. However, all else being equal, why buy an ETF from a private corporation when there is a government-issued ETF? Well, not directly, but the Canadian Gold Reserves exchange-traded receipt (symbol MNT on the Toronto Stock Exchange) is offered by the Royal Canadian Mint. Deep within the prospectus you will find language that indicates, by extension, these are obligations of the Government of Canada.

MNT is a well-designed ETF with a clear segregation of the trust’s gold assets with the ability to take physical delivery if you so choose. Although technically not an ETF, this redemption feature ensures any persistent discounts to NAV (Net Asset Value) would eventually be arbitraged away.

So, here is a gold product guaranteed by the Government of Canada that has an attractive redemption feature. What’s not to like? All else being equal, why wouldn’t you buy this product as opposed to one offered by a private corporation?

When a few were interested in investing in gold, this argument made complete sense. Given two equally priced alternatives, why not take the one with the better credit risk?

Well, that was then. Since the corona crisis, the demand for the Royal Canadian Mint’s gold product has sent the premium to NAV soaring.

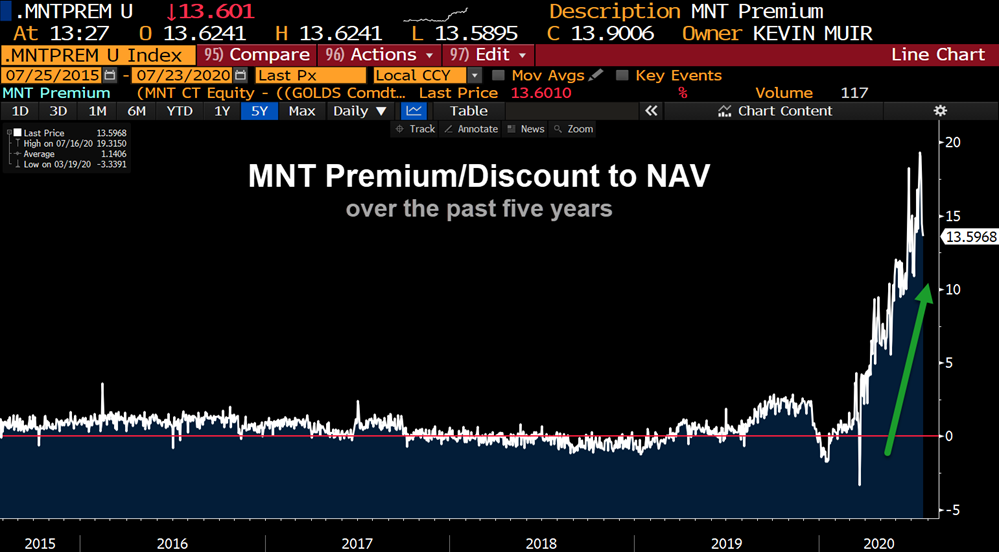

Here is a chart that I have created showing the approximate discount/premium to NAV over the past five years:

(Click on image to enlarge)

Over the past four months, the premium to NAV has exploded to as high as 19%.

Investors are mistakenly assuming that MNT is tracking the price of gold without checking before they place their buy orders. By doing so, they are overpaying for an asset that they can get significantly cheaper in other products. Sure, the credit in the other products is not quite as good, but the Government of Canada stamp of approval is not worth anywhere near this premium.

Not only that, investors now own a product that is subject to the vagaries of the premium to NAV instead of tracking the price of gold. There are days when gold is up and the MNT closes down due to the fact that premium has narrowed. MNT is no longer a safe asset issued by the Royal Canadian Mint that tracks the price of gold. It’s now a speculative vehicle that randomly moves up and down due to the nature of the order flow.

To get a better sense of this new phenomenon, I created a correlation analysis of the price of MNT versus the price of GLD priced in Canadian dollars. GLD tracks gold almost perfectly, and the trading sessions matched MNT, so it was the best option to conduct the analysis.

I plotted the last year, with the bottom panel showing the 20-day correlation coefficient.

(Click on image to enlarge)

Over the past couple of months, the correlation has plummeted to the point where the two assets are now slightly negatively correlated!

This means that MNT’s returns are not tracking the world’s largest gold ETF at all!

If you were the fortunate holder of MNT, you have experienced a lucky windfall. Your gold asset has significantly outperformed bullion and other gold ETFs due to the widening of the premium to NAV.

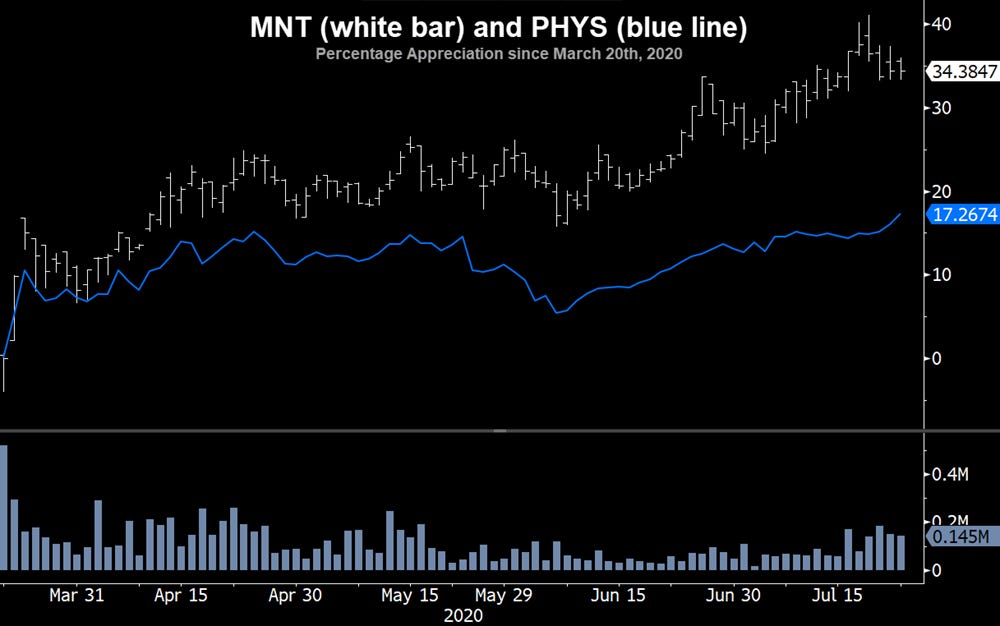

Here is a percentage appreciation chart of MNT versus PHYS - the Sprott Physical Gold ETF:

(Click on image to enlarge)

MNT is up over 34% while the PHYS is up only 17%. MNT has managed to double the performance!

That’s all fine and good, but what happens if this premium collapses?

It’s easy to envision a situation where gold rallies another 5% or 10% and MNT actually declines. Or maybe gold sells off 15% and the bloom comes off the MNT premium and the total price declines by 32% as premium-to-NAV heads back to zero.

Investors should understand that they no longer own an asset that tracks gold. Period. Full stop.

Although MNT has clearly outlined this risk in the prospectus, I doubt most investors understand this nuance.

How does this play out?

You might ask yourself why isn’t this arbitraged away. Good question. Professional traders have shorted every single share of MNT they could get their hands on, but they have run out of supply. There are no more shares to be had, and in fact, many short sellers are having their supply recalled - causing the premium to spike higher as they are bought in.

We have recently seen this a similar situation in highly speculative SPAC plays, but it’s shocking that a gold trust is experiencing similar market behavior.

The real question is why doesn’t the Royal Canadian Mint issue more shares? After all, they earn money by administrating this trust, so it’s in their interest to have the assets under management as large as possible.

However, this is where the difference between private enterprise and government bureaucracy shows its true nature. Rest assured, if Sprott or Blackrock had that sort of demand for their product, they would issue shares as it would be in their best interest. Yet, the Royal Canadian Mint is a crown corporation and not driven by the profit motive. Therefore, this demand goes unanswered.

If the profit motive does not cause the Mint to fix this situation, why should we expect anything to change?

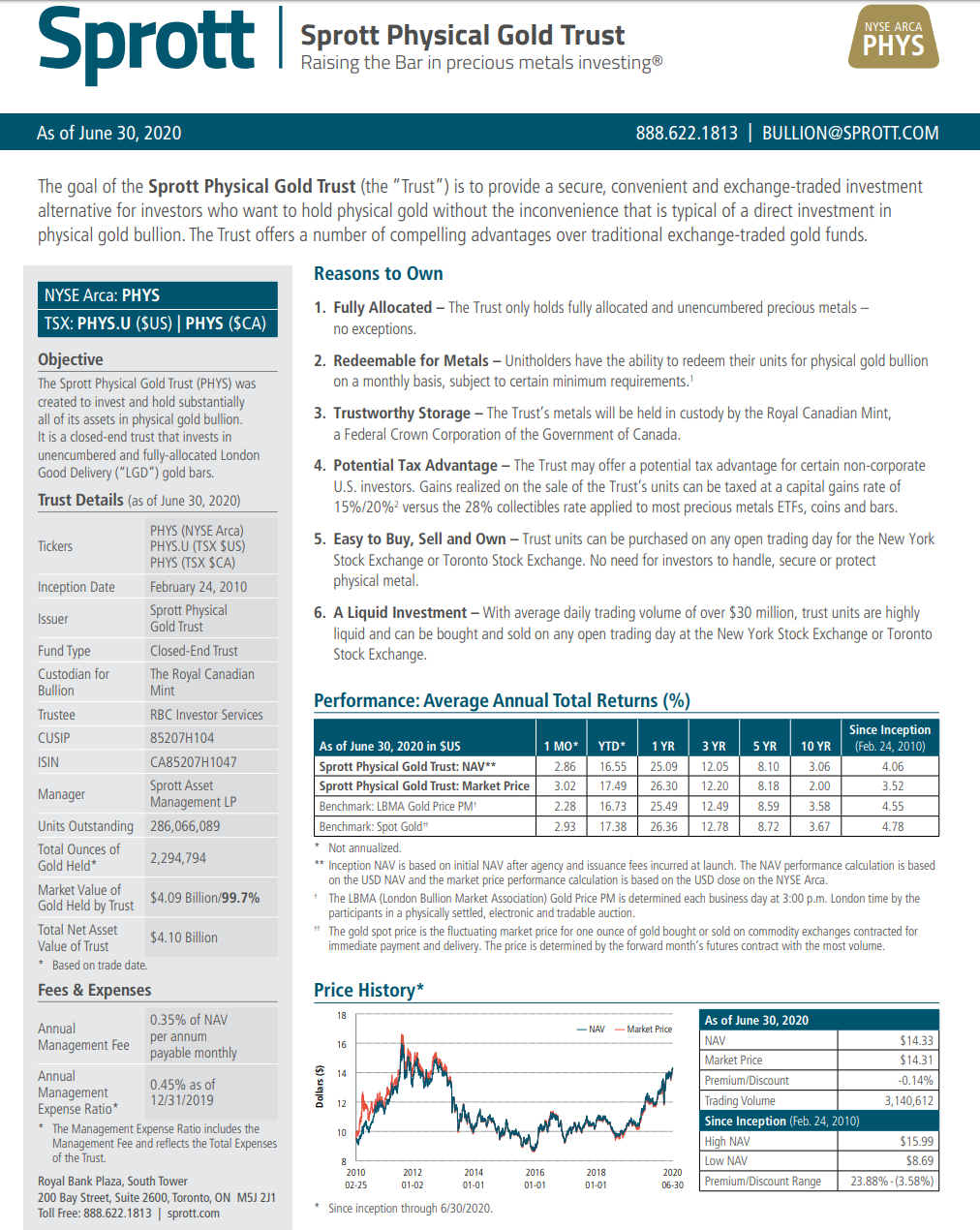

Well, there is a chance that investors wake up to the fact that they are significantly overpaying for what is in essence a commodity product. The Sprott Physical Gold Trust (PHYS) is similar to MNT. Like MNT, you can redeem it for the physical metal. Heck, it’s even stored at the Mint.

(Click on image to enlarge)

Most importantly, it tracks the price of gold!

There is the possibility that buyers will switch their gold holdings from MNT into PHYS. If you are a broker with client holdings in MNT, what better way to add value than to show them how you are selling an asset for $3.70 more than it’s worth (closing NAV on July 23, 2020, is 26.56 with MNT finishing on the Toronto Stock Exchange at $30.26) and replacing it with a similar product for NAV equivalent.

However, even if investors don’t change their habits, eventually the Royal Canadian Mint will realize that it’s not in their interest to have a product that doesn’t track gold. Not only that, does a bureaucrat want to explain why their product was so successful that it created a demand bubble that the Mint didn’t have the foresight to fill, but proceeded to watch the premium soar to 20%, 30%, or even higher, as retail investors bought what they thought was a “safe product” from the Royal Canadian Mint that would track the price of gold, only to find out later when the premium collapses, they didn’t own what they thought? Not a chance.

At the very least, the Royal Canadian Mint will issue warnings to investors to make sure they understand the risks they are entering into with the premium to NAV trading at these elevated levels.

It’s in no one’s interest to have the premium to NAV continue, so I suspect it won’t.

If you are a savvy investor and can find a borrow, then shorting MNT and buying another competing product with the idea that the spread will eventually normalize might be an interesting opportunity. However, if you are a natural holder of MNT, please be aware the price is no longer tracking the price of gold. You might choose to live with this risk. That’s your prerogative. Just be aware of what’s happening, as I suspect there are investors who are mistakenly assuming everything is situation normal with MNT, when it’s anything but.

Disclosure: The author holds a short position in MNT and a long position in PHYS. Positions can and will change without any notice.

Disclaimer: Nothing in this piece should be viewed as ...

more

I had not realized that owning gold was so complex. It does make sense but still it seems complicated. And I had forgotten about the rule that one can not have physical gold personally. There must be a lot more to it than just that part.

And once again, it looks like the rush to gold is propelled more by the lack of trust in the dollar.

Yes, investing in gold isn't for everyone. But it's still the best safe haven out there.

Highly recommended.

Great read.

Enjoyed.