Higher Corn & Bean Stocks Hit Prices Vs Smaller Wheat Crop Firms Price

Market Analysis

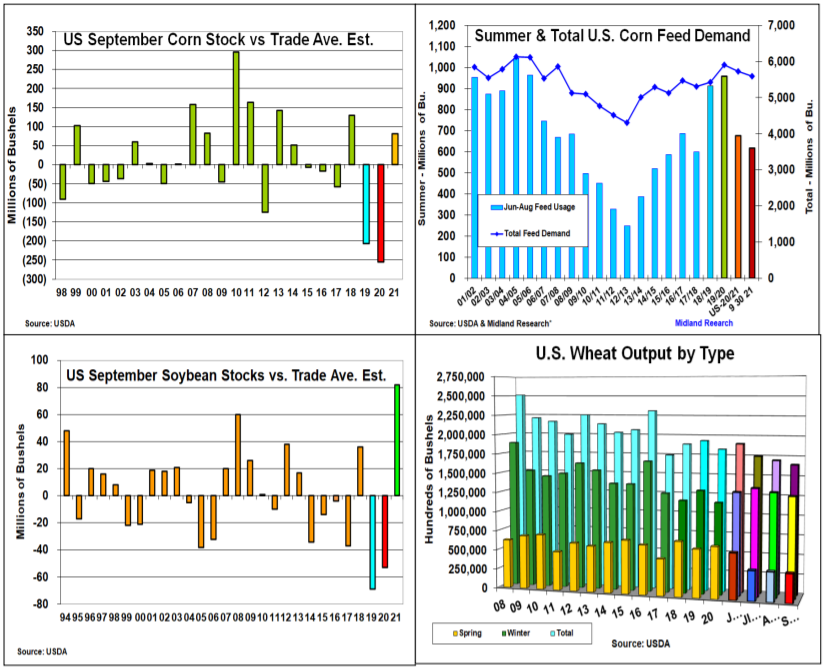

The USDA Quarterly Stocks and Small Grains reports had some divergent surprises for the markets. The USDA’s larger-than-expected 2020 US soybean crop increase and a smaller 2021 US wheat crop sent prices in different directions. Last year’s US corn crop was also reduced by 70 million bu, but corn’s ending stocks rose 81 million bu over expectations to 1.236 billion on likely smaller summer feed demand.

The USDA adjusted 2020’s harvested area downward by 160,000 acres & lower its yield by 0.6 bu to 171.4 bu. This decreased last year’s crop to 14.112 billion bu. Despite this smaller crop, corn’s ending stocks rose 49 million bu from the current forecast. With ethanol & export demand generally known, this suggests smaller hog numbers & higher summer corn prices reduced last quarter’s feed demand to 616 million vs last year’s 957 million level. A drop in the USDA’s 2020/21 feed demand to 5.6 billion from the current 5.725 billion bu seems likely on Oct 12 S&D update.

The USDA’s 81 million higher 2020 soybean crop was the biggest surprise in the USDA data. The combination of 283,000 larger harvested area and 0.8 bu higher US yield advanced last year’s crop to 4.216 billion bu. With limited change in the crush and export levels, these added bushels passed thru the balance sheet. This produced the highest difference in stocks vs the trade in our records since 1989. These larger supplies represent about a 1 bu larger yield for 2021 crop pressuring prices into the close. This fall’s US yields & S America’s planting season will remain price factors, but the size of China’s soybean demand is the elephant in the room.

US wheat’s smaller 2021 crop wasn’t a surprise. However, the big cut wasn’t in spring wheat (-12 million). Instead, the largest decrease was in W wheat with a 42 million drop. NASS sliced 28 million from Hard Red, 5 million from Soft Red & 9 million from PNW’s White wheat. This 51 million smaller 2021 crop was the primary factor for wheat’s smaller 1.78 billion stocks vs the trade’s 1.852 billion forecast.

What’s Ahead:

Soybean supplies have loosened, but US wheat and corn stocks remain near historic lows. Going forward, US fall yield reports, overseas demand, particularly from China, and the impact of the current building La Nina weather pattern on S America’s planting and 2022 prospects remain major price factors. Looking to add 10-15% sales to 20-25% levels at $12.90-13.10, $5.70-85 & $7.65-85 KC wheat prices.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more