Here’s Why Rare Earths Are The Key To U.S. National Security In 2025

Image Source: Pixabay

Rare earths are no longer just a supply chain concern. They’re a frontline weapon in the new global power game.

The surrounding urgency has intensified in recent weeks.

On April 23, China and Russia announced plans for a joint nuclear-powered lunar base. This development reflects a longer arc of strategic competition. Control over critical materials, particularly rare earth elements, has become a defining geo-political leverage point, from tariff wars to the moon.

The International Lunar Research Station (ILRS) is set to be built by 2035 and operational by 2050. This base isn’t just a science project. It’s a strategic outpost in the race for extraterrestrial resources and dominance.

And while the move is a shot against the bow for the West, it also signals something else. You see, the lunar project will also rely heavily on rare earth technologies for power generation systems, propulsion and communication hardware.

This emphasis poses a direct challenge to U.S. influence not only in space, but across the broader landscape of national and energy security. That’s why rare earths are no longer a niche topic but central to who controls the next frontier.

Already, China serves as the sole supplier of some rare earth metals such as gallium, germanium and antimony that support Russia’s military as it fights a war in Ukraine. Chinese rare earth metals directly support Russian microelectronics and military applications that enable defense weapons systems like drones, aircraft and laser-guidance systems.

The Strategic Stakes: Rare Earths and U.S. Vulnerability

Let’s do a quick recap.

Rare earth elements (REEs) are essential to U.S. national security and energy independence. The U.S. government has identified 17 elements considered critical for infrastructure and technologies ranging from missile guidance systems to energy infrastructure.

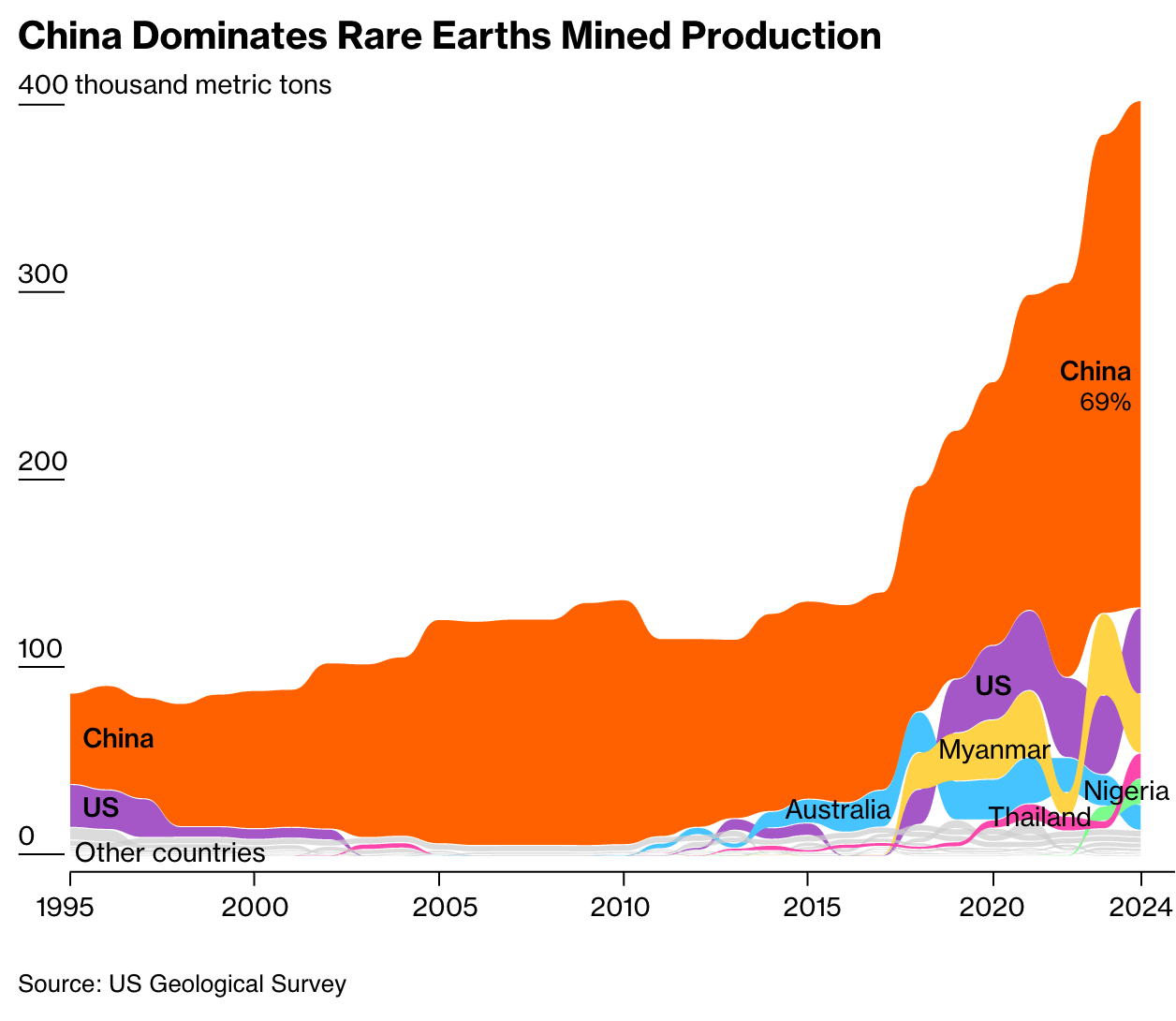

Today, China controls 69% of global rare earth mining, nearly 90% of rare earth processing, and over 90% of high-strength magnet production.

The U.S., by contrast, produced just 45,000 metric tons of rare earth concentrate in 2024. That’s less than 12% of global output. Over 70% of domestic rare earth consumption in the U.S. relied on Chinese imports. That scale of dependency is no longer viewed as feasible.

As the White House underscored, in the wake of China halting exports of six heavy rare earth metals, and rare earth magnets:

"Critical minerals, including rare earth elements, are essential for national security and economic resilience... The United States remains heavily dependent on foreign sources, particularly adversarial nations, for these essential materials, exposing the economy and defense sector to supply chain disruptions and economic coercion.”

The Lunar Base and the New Race for Energy Dominance

Just as the U.S. is working toward hardening its energy security, it was no coincidence that China and Russia announced their lunar ambitions. However, behind the fanfare, the project is about more than space exploration or even nuclear power.

It's about setting up permanent energy systems, mining rare earths beyond Earth’s surface, and ultimately, building strategic communication outposts (like those China has planned for the far side of the moon) that could shape the next era of power and hegemony.

China has a history of using its rare earth dominance as a tool of strategic pressure. In 2010, China cut off rare earth exports to Japan during a maritime dispute.

It did it again in April 2025, when it halted rare earth exports as a way to hit back against the Trump administration’s sweeping tariff escalations. The flagship U.S. rare earth company, MP Materials, stopped its rare earth shipments to China, for processing, exposing just how fragile the U.S. rare earth supply chain is.

A lunar foothold would only expand Beijing’s leverage, moving the supply chain battleground for energy, communications to space.

For the U.S., the risk isn't just losing a modern space race, it's about falling behind in controlling the next generation of technology platforms. And, a new wrinkle would mean that its supply chains could be left behind as they would now increasingly extend into near-Earth orbit and beyond.

The 1960s Parallel: Energy, Space, and Power

This moment echoes the Cold War space race. In the 1960s, nuclear energy and advanced propulsion technologies determined global influence.

In 1961, in his famous Rice University speech on the nation’s space strategy, President John F. Kennedy told the world the U.S. would put a man on the moon, not because it was easy, but because it was hard, and because global leadership demanded it.

That space race wasn't just about exploration, then either. It was about proving which country and political philosophy could lead the future.

Today, the battle has shifted from rockets to resources.

Rare earths are the materials race that will determine who controls technology, energy, defense and advanced manufacturing.

Without a secure supply of rare earths, and processing, the U.S. risks falling behind in energy security, defense innovation and global technology innovation.

The Palisades Restart: A Signal for Energy Security

The race for rare earths isn’t limited to satellites and missile systems. It cuts straight into the heart of domestic energy security, too.

That's why the April 22, 2025, restart of the Palisades Nuclear Plant matters, and why energy resilience is now inseparable from the rare earth supply chain.

It's a sign that the U.S. is beginning to re-anchor its energy resilience. Palisades is expected to restore nearly 800 megawatts of power to the Midwest grid, enough to support hundreds of thousands of homes.

The Palisades plant isn’t alone. The famed Three Mile Island will also be restarted after once set to be decommissioned and shuttered. Now, it’s set to be reopened in a matter of years and will support the energy efforts that drive AI and innovative technologies forward.

But these infrastructure projects, like much of modern nuclear energy, rely heavily on rare earth elements for reactor components, energy storage, and grid stabilization systems.

The Race for REE Supply and Processing

The U.S. government has taken steps to build domestic rare earth production and processing capacity. Initiatives launched under both the Biden and recent ones by the Trump administration have begun to re-anchor investment into mining, separation, and magnet manufacturing.

Yet, progress has been slow. The U.S. still has no commercial-scale magnet production facilities. Even domestically mined rare earths are often sent overseas, primarily to China, for final processing.

The Palisades restart and the China-Russia lunar base project both deliver the same message: rare earths are no longer a luxury. They are a strategic necessity for energy security, national defense, and economic resilience.

For investors, exploring opportunities in the rare earth space could not only offer an advantage, but a long-term outlook to a sector set to take off. That’s why the mining sector has outperformed a majority of its industry peers so far this year.

That’s also why, for our Founders, we’re taking things to the next level this month.

We’ve been working hard behind the scenes on a huge new product that we’ll be launching this week. For our first recommendation, Founders will get a closer look at how one U.S. company is moving to close the rare earth gap. It’s one of many cutting-edge opportunities that we’re going to be researching and delivering for the Founders community on a monthly basis. We can’t wait to share it – and believe you’ll be as excited about it as we are.

If you're not yet a Founder, now is a great time to join.

More By This Author:

Powell’s Dilemma Reveals A Fed StalemateHere’s Why This Gold Run Is Just Getting Started

The Next Big Market Shift In Defense

Disclosure: None.