Has Trump Administration Already Started Devaluing The Dollar?

Image Source: Pixabay

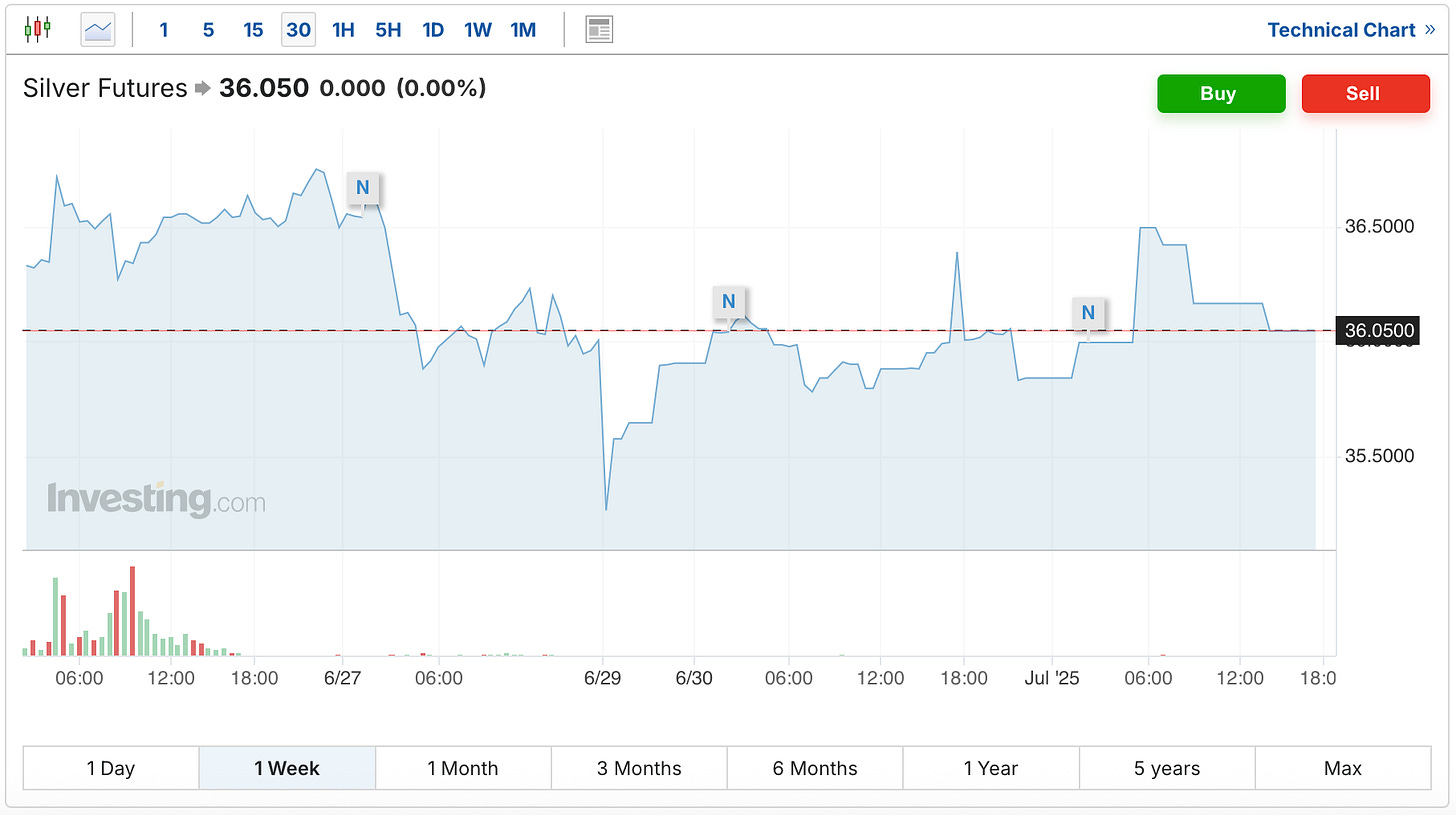

Tuesday was another positive day for the precious metals, as the gold price rose $52 (and is $64 above Tuesday’s low), while the silver futures were up 20 cents.

That leaves the gold price back up to $3,349.

And after today's rally, silver is back over the $36 level at $36.05.

The dollar index continued its now stunning descent, falling another 19 basis points down to 96.30.

As a reminder, the dollar index was over 110 back in January, and is now down 12.45% since then.

Which is a pretty stunning move for the dollar, and as I was thinking about it this morning, an interesting thought came to mind.

To be clear, what I'm about to suggest is somewhat speculative. Although if you recall, about a month ago, we discussed how a fund manager named Michael McNair wrote about how he was seeing signs that the Trump Administration may already be implementing the strategy laid out in the Economic Council of Advisers Chairman Steven Miran's ‘User's Guide to Restructuring the Global Trading System.’

So given that the dollar has basically fallen off a cliff pretty much since the exact moment that the Trump team walked into office, and given how Trump picked someone for the chairman position just a month after that person wrote that paper, that frequently referred to how ‘the overvalued dollar’ was the main problem with the global trading system, is it possible that they are indeed already implementing what almost every member of the economic cabinet has already said they want (a lower dollar)?

That's a pretty big move in the dollar index in a pretty short period of time. And again, just to be clear, this is my own speculation, rather than anything I can point to as hard evidence. But the Trump administration has repeatedly said what it wants a lower dollar, and now just six months later, here we are.

Fortunately, I was able to check in with Michael, and I believe he’ll be sharing some updated thoughts soon. I’ll report back when that's available, and I still believe that we will be able to schedule an interview with him at some point as well.

But if there’s not a connection between the Trump team and the dollar’s decline, it sure seems like one heck of a coincidence.

Now in terms of what we may be able to see more overtly in our near future, I did record a conversation with Tom Luongo that was posted today, where he explains why he thinks the Fed will cut 50 basis points at its meeting in July.

Which is of course, different than what most in the markets are expecting or forecasting. Although keep in mind that when everyone was expecting the Powell pivot as soon as the Fed started raising interest rates a few years ago, Tom was the only one I heard who was saying that it wasn't coming anytime soon. And he turned out to be exactly correct.

So, in case you'd like to know more about what he's seeing, you can watch that one. And I’ll look forward to continuing our conversation again tomorrow.

More By This Author:

Fed To Cut 50 Basis Points In JulyGold & Silver Recover From Quickly From Sunday Night Crash

Gold & Silver Fall Sharply On China Trade News