Has Gold Mania Arrived?

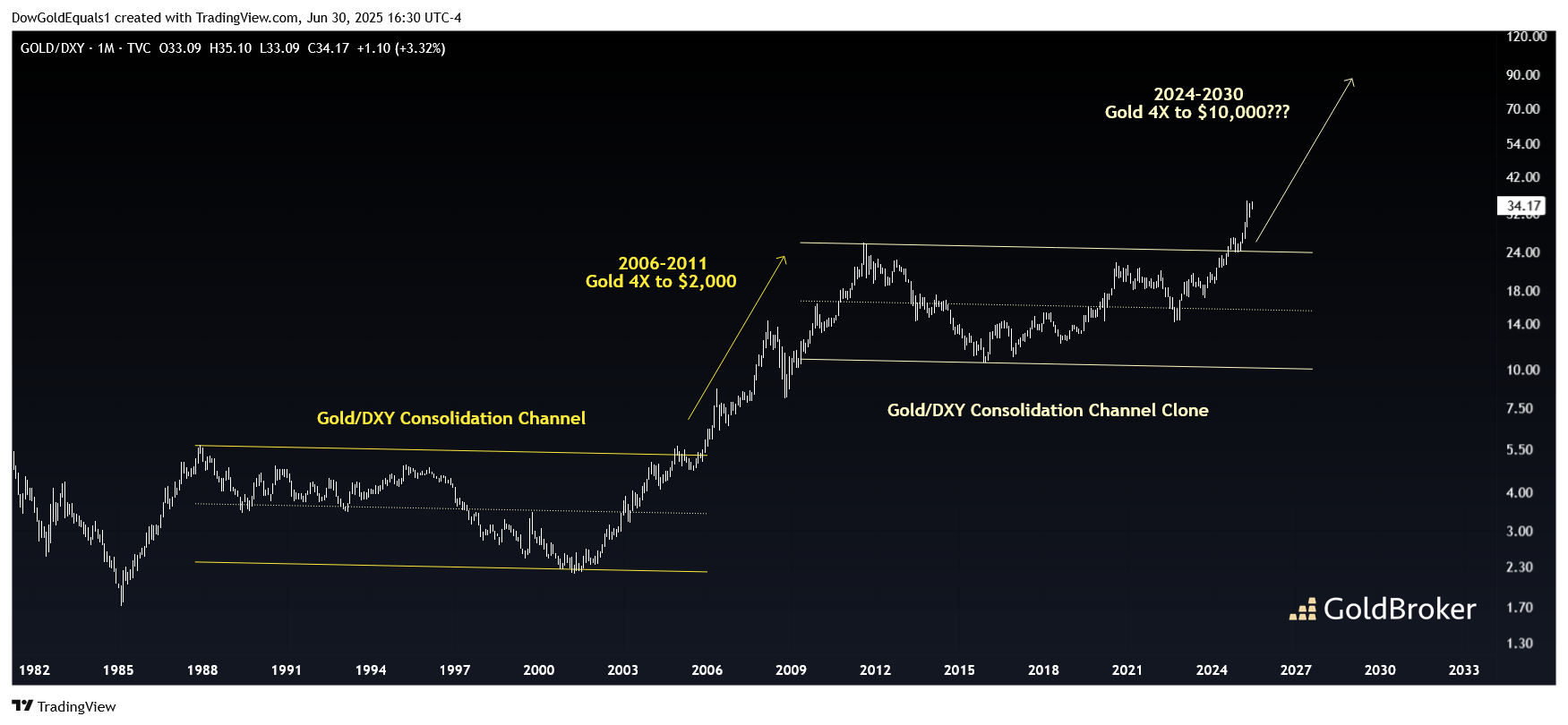

This week, we will look at a couple of gold ratio charts that suggest we may be entering into a mania phase in the yellow metal that could run for several years. The first is that of the gold price vs DXY. DXY itself is a ratio chart that compares the US Dollar to a basket of international currencies. When DXY is increasing, the US Dollar is gaining relative strength. For Gold to be in a bona fide bull market in US Dollar terms, we need to see it outperform DXY in addition to rising in nominal dollars. This is a fascinating chart that shows we have just exited a 15-year consolidation channel in impulsive fashion. Amazingly, this channel is a clone of the channel Gold/DXY carved out from the late-1980s until it blasted off in 2005. Back then, the breakout led to a 4X move in Gold over just six years. Given the recent breakout occurred in late 2024 around $2,500 Gold, a similar move would target $10,000 by the end of this decade!

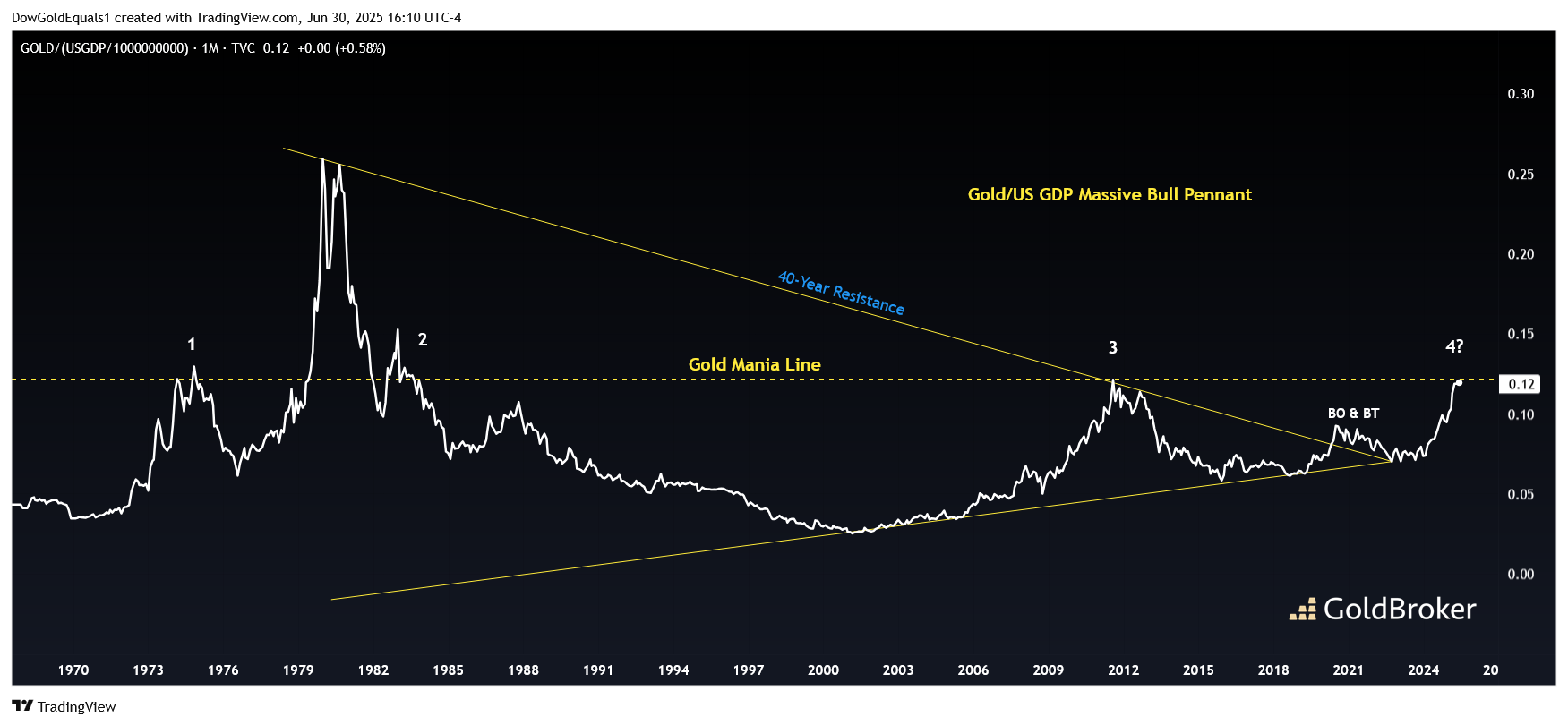

The second ratio chart is that of Gold vs US Gross Domestic Product. Again, for a run in Gold to mean anything relative to inflationary pressures, Gold must rise against US GDP and not merely in nominal dollars. I have defined the chart as a massive bull pennant that has seen a breakout, backtest and impulsive launch off the pennant apex over the past few years. The ratio now finds itself at where I have called a "Gold Mania Line." We can see that the ratio has flirted with this line throughout history and has been rejected 3 previous times. However, the one time the ratio escaped this heavy resistance was in 1979 when Gold managed a 3X move in just six months during its blowoff top. Should the ratio overcome resistance again, a similar move again targets approximately $10,000 gold, but in a much smaller time frame than our first chart.

Keep a close eye on both of these charts, as Gold Mania may have indeed arrived!

More By This Author:

China Accelerates Its De-Dollarization And The Internationalization Of Its Gold MarketWhen Banks, Governments And Major Funds Buy Gold "Off Market"

Fed Confirms Stagflation: A Major Catalyst For Gold In The Long Term

Disclosure: GoldBroker.com, all rights reserved.