Happy New Year: Is This A Gold Rally Or A USDX Rally?

Gold welcomed the first day of 2023 with a rally, but is it just a sideshow, with the USDX being the one to watch for strength?

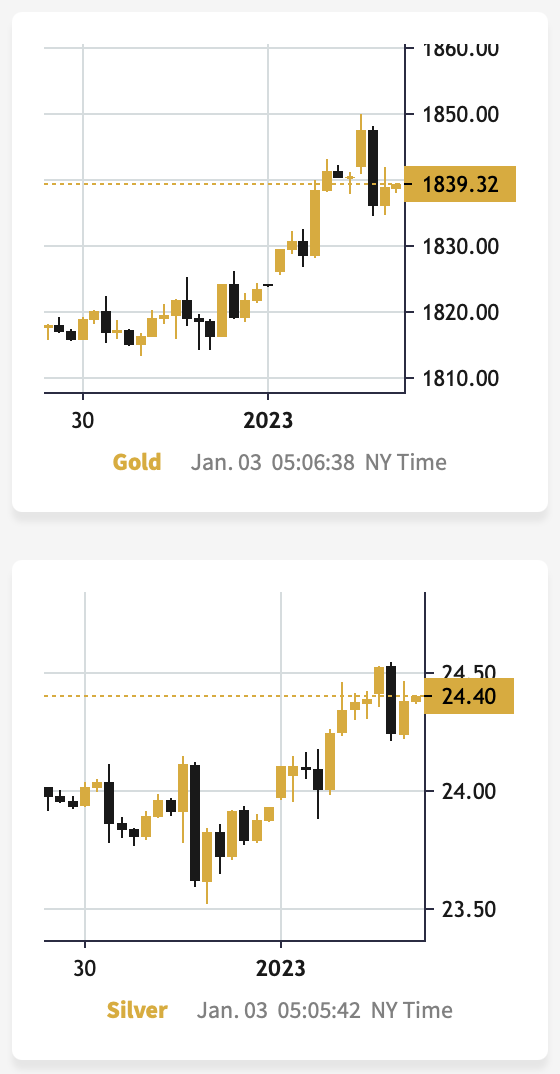

This gold rally is not that odd given that gold was declining most of the year, and some buyers probably wanted to harvest the tax savings by cashing in losses and they are buying back today (chart courtesy of https://GoldPriceForecast.com).

It doesn’t mean that the rally is here to stay. No, quite the opposite is likely.

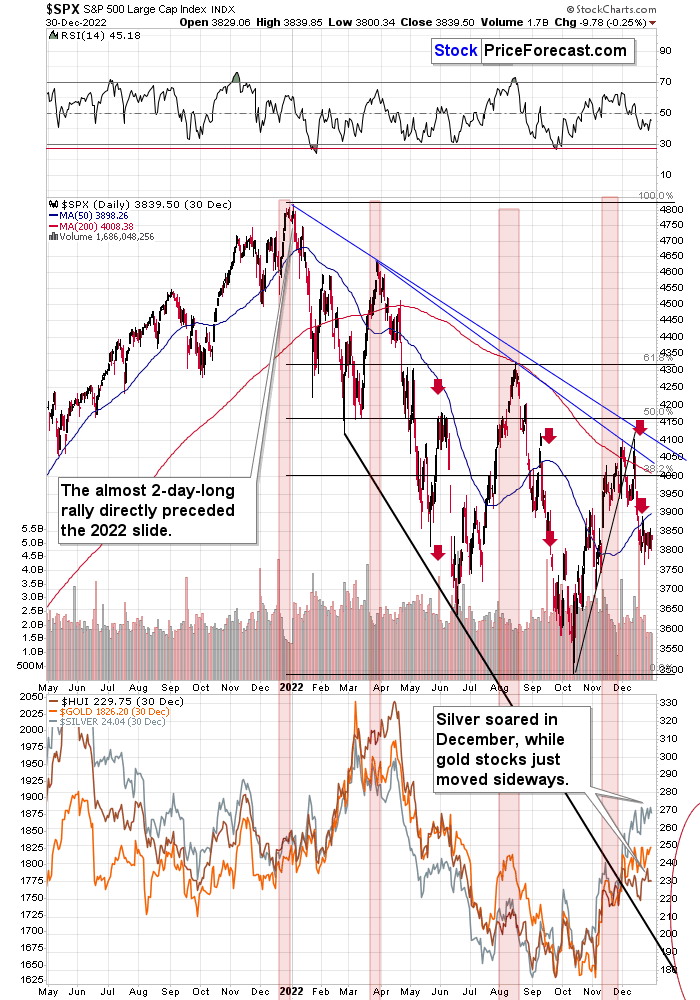

Do you remember the “January rally” that we saw in early 2022? It lasted less than two days. Stocks moved higher in the first session of the year, and they formed an intraday top during the second session of the year.

And then, the S&P 500 moved from about 4,800 to levels below 3,600.

So, looking at the early-January performance might be misleading.

The lower part of the above chart features gold, silver, and the HUI Index (a proxy for gold stocks). As you can see, silver outperformed gold strongly in December, while gold stocks did almost nothing, greatly underperforming gold. That’s a very powerful bearish indication for the following weeks. After all, that’s exactly what tends to happen close to market tops – silver outperforms, while gold stocks lag.

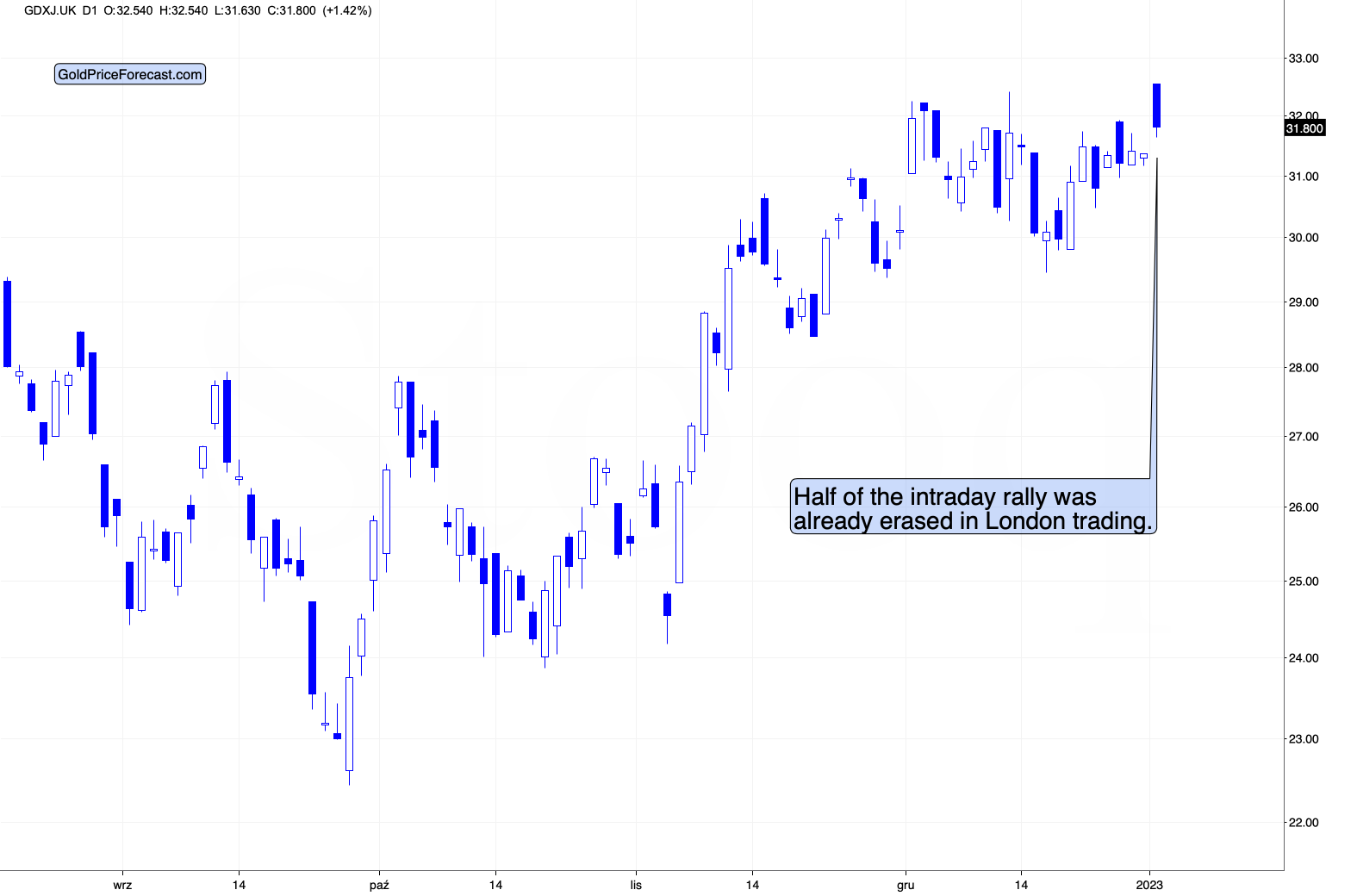

Speaking of mining stocks, did anything change in the case of junior mining stocks so far today?

(Click on image to enlarge)

No.

In today’s London trading (the U.S. markets are still closed while I’m writing this), the GDXJ opened relatively high, but it quickly erased about half of the upswing.

Is the 2023 top in junior mining stocks already in? It could be the case, especially if we focus on the first half of 2023. We might see a powerful rally in juniors in the second half of the year, but seeing a huge decline in the first half of the year is even more likely.

Of course, these are not the reasons for the decline per se – I listed multiple thereof (e.g., rising real interest rates) in my previous analyses.

The other key driver of gold prices (besides real interest rates) is the USD Index, and it just showed substantial strength today.

(Click on image to enlarge)

This comes after a breakout and a rather lengthy confirmation thereof. Therefore, this could be the start of another powerful rally.

Why doesn’t the “tax loss buyback” mechanism apply to the USD Index (as it does to gold or stocks)?

Because the USD Index is ultimately an index not an asset per se, and the index consists of individual currency exchange rates, most important of them being EUR/USD and JPY/USD. So, it’s the relative valuation of two currencies, not a single asset. If the above-mentioned mechanism applied to the U.S. dollar, it might as well apply to the euro, and to the Japanese yen. And in this case, the effects would cancel each other out in the case of the exchange rates.

Consequently, the rally in the USD Index might be the thing that is really happening today, while action in gold and the stock market might be just something temporary and of little meaning.

More By This Author:

The Gold Market: Is It Weird To Have Two Corrective Upswings Instead Of One?What Signals Do Gold, Silver, And Stocks Send To Investors?

Despite The War In Europe, Gold Remains Below Its 2011 High

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more