Gold/Silver Miners Are Two-Thirds Through Their Best Quarter Ever

Image Source: Pixabay

Well-run miners — i.e., those that maintain or grow production while controlling costs — have had a great 2025 so far. Here are a few posts covering the previous quarter’s stellar earnings reports:

Huge Gold Miner Earnings Season Begins This Week

Killer Q2 Earnings: Why It's Good to Own the Leaders

Biggest and Smallest Royalty Companies Both Set Records in Q2

Q2 Earnings: Two Portfolio Companies Make Dramatic Progress

Q3: Gold/Silver Miners’ Best Quarter Ever?

Q3, which runs through the end of September, is two-thirds done, with gold at an all-time high and silver up dramatically. The result: Another spectacular earnings season, in which the miners become even more prominent on the momentum charts of generalist investors and traders.

These stocks are already outperforming the underlying metals. In the following chart, GDX is an ETF that holds the big gold miners, while GLD and SLV track gold and silver prices, respectively.

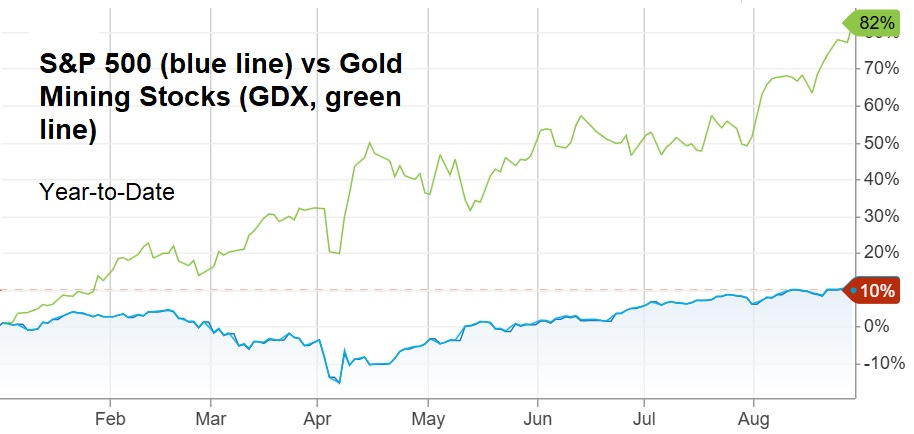

The miners are also outperforming the broader stock market:

How Much Better?

As this is written, both gold and silver are spiking:

As a result, the gold/silver miners are now making more money than they did in Q2. If the metals hold at today’s levels, Q3 will shatter records.

Q3 will also mark the third straight dramatic sequential gain for many of these miners. So their breakout isn’t an aberration; it’s a trend. Momentum traders are already paying attention, and FOMO is building. Fun times for gold bugs!

More By This Author:

US Treasuries Have Crossed The Rubicon

Exploding Inventory Is (Finally) Cutting Home Prices

If You Want To Fix Housing, Start With The Family