Gold’s Inability To Pass The $2000 Mark Is A Very Bearish Clue

Gold and silver stocks have fallen in such a way that investors will rather understand why it is not worth taking a bullish stance on them.

Gold, silver, and mining stocks (major proxies for them) have all moved to new yearly lows during yesterday’s trading, and they are not back up (they’re rather flat) in today’s pre-market trading.

This is a significant bearish development, and it will finally convince many traders and investors that something is wrong with the bullish case for gold and the rest of the sector.

Why on earth would gold move to new yearly lows despite the ongoing war in Europe, the pandemic, and soaring inflation?

Because all of the above was already discounted in price, gold was still unable to move decisively above the $2,000 level. In fact, it failed to stay above its 2011 high, and that’s just gold. Silver and mining stocks were not even close to moving to their analogous price levels.

Gold’s failure to launch a proper rally was a massive indication that it’s not yet ready to move higher – it needs to decline massively first, which is what I’ve been writing for many months, but as new black swans kept popping up, gold was unable to complete its regular cyclical decline beforehand. So, it’s going now.

As real interest rates and the USD Index continue to climb, precious metal prices are likely to continue to decline – at least for several weeks. At some point, I expect gold, silver, and mining stocks to stop reacting to this bearish reality and show strength, thus indicating that the final long-term bottom is in. However, we are not there yet.

Based on analogies to how precious metals and mining stocks declined in the past, we have much lower to go, and we have much more money to make on our short positions. Speaking of which, if you are positioned in tune with what I’m describing as my general opinion in my Gold & Silver Trading Alerts, i.e., you are positioned to profit from a decline in junior mining stocks, you just made a lot of money yesterday, and in the last couple of weeks in general. This adds to the profits that you reaped on the preceding long position, which adds on top of the profits from the preceding short position. Congratulations!

After this lengthy introduction, let’s take a look at gold.

(Click on image to enlarge)

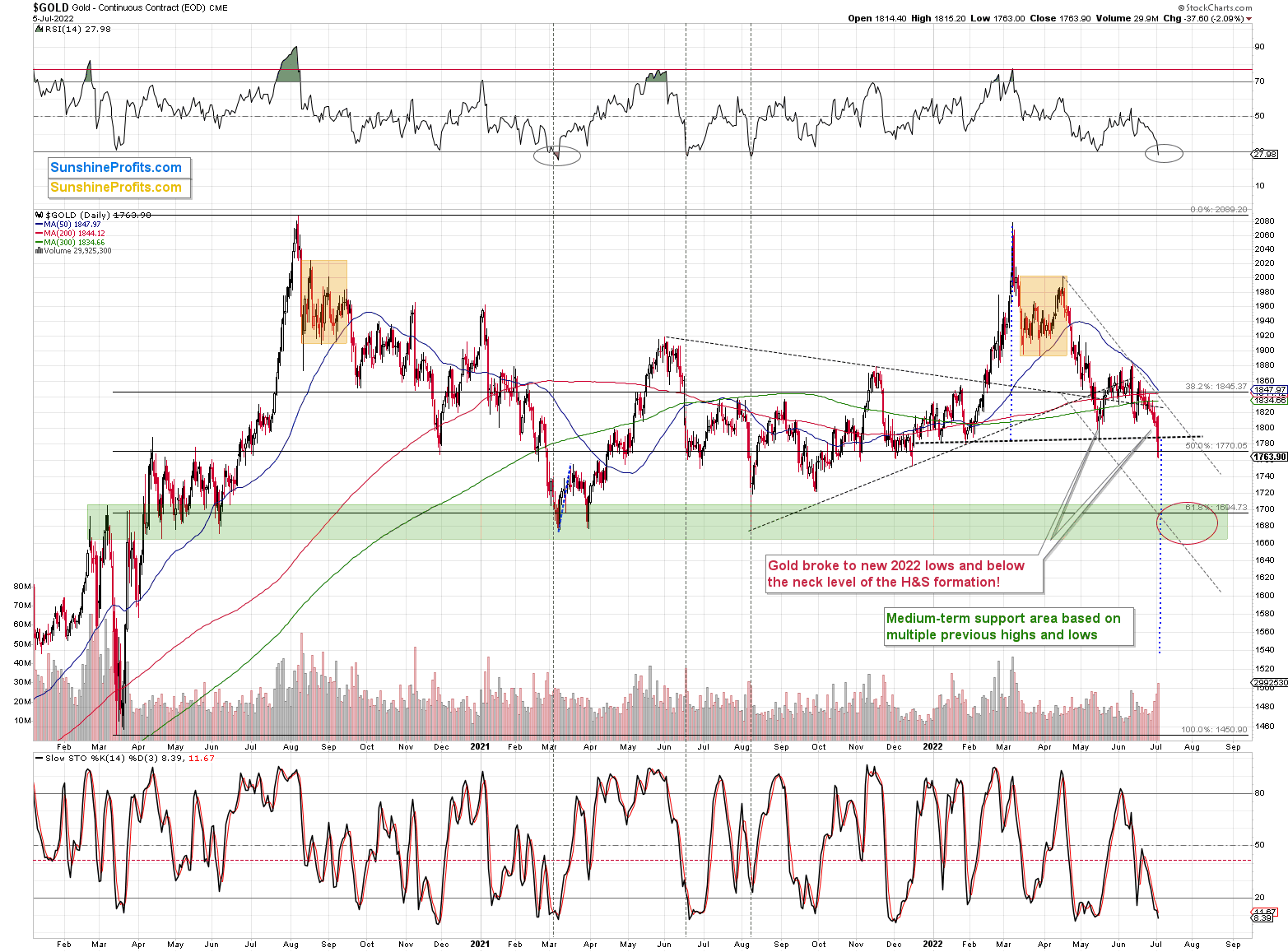

Gold just moved below the neck level of the previous head and shoulders pattern and also to new 2022 lows. The breakdown took place at a high volume, so it appears believable.

However, at the same time, the RSI moved below 30, which is a classic buy signal. I marked the previous similar signals with vertical dashed lines. In all three previous cases, gold was either bottoming or about to bottom.

In particular, the early-2021 situation appears similar, because the preceding price action is also similar. The failed attempt to rally above $2,000, the consolidation (marked with orange rectangles) and the subsequent decline that also included a consolidation are all present in both cases.

Back in 2021, gold continued to decline until it moved below $1,700, and while it doesn’t guarantee the same thing right now, the fact that both declines started from highs at very similar price levels makes it quite likely.

So, what’s likely to happen next? Well, I see two likely short-term outcomes:

- Gold corrects a bit, thus verifying the breakdown below the neck level of the H&S formation and the previous 2022 low,. and it then continues to decline after the correction.

- Gold slides to or slightly below $1,700 right away - or almost right away, but quite possibly this week.

In the case of scenario 1, junior miners would be likely to correct slightly as well and then slide.

In the case of scenario 2, junior miners would be likely to slide right away, possibly showing some kind of strength right before gold moves to its $1,700 target.

In both cases, I plan to keep the short positions intact until GDXJ or gold reaches its targets lower – I don’t plan to trade the rebound from scenario 1. Not all moves are worth trading, just like you’ll probably agree that Friday’s daily rally wasn’t worth trading. Those who attempted to trade it have probably missed or even were hurt by yesterday’s decline instead of profiting on it.

More By This Author:

Gold Stocks’ New Short-Term Lows Can Only Mean One ThingThe Fed Races Against the Clock. Will It Avert Hyperinflation?

Asset Prices Erupted Prior to Independence Day

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more