Gold Weekly Forecast: Strong USD To Pressure Under 1800 Before CPI

Image Source: Pixabay

- The gold price remains on the backfoot below the $1,800 mark.

- Fed tapering speculations may further exacerbate the bearish pressure.

- US CPI data will be a key event for gold next week.

The weekly gold price forecast suggests a bearish scenario as the US dollar gains traction from rising US bonds yields and speculation regarding the Fed’s tapering.

A calm start to the new week saw gold consolidate the gains of the previous week. XAU/USD fell 1.6% on Tuesday as risk-averse markets helped the dollar find support after the Labor Day holiday. It recovered a small portion of its losses on Thursday but lost nearly 2% for the week as a whole.

The market forecast for August exports was 17.1%, but the data showed a 25.6% increase. Furthermore, Eurostat reported that the Eurozone’s gross domestic product (GDP) increased 2.2% on a quarterly basis in the second quarter, beating analysts’ expectations of 0.6%. However, global stock market sentiment deteriorated despite the optimistic data. In turn, the US Dollar Index (DXY) rose 0.35%, causing XAU/USD to fall.

We look to begin the week with the US Consumer Price Index (CPI) released on Tuesday. Cleveland Federal Reserve Bank President Loretta Mester said on Friday that she saw risks of raising inflation forecasts and that she should begin tapering before the end of the year. Likewise, Rafael Bostick, president of the Atlanta Federal Reserve, said that the tapering would be appropriate at some point this year.

Investors may begin pondering a reduction in the Fed’s asset purchases if the consumer price index is stronger than expected, and vice versa. Consumer sentiment data from the University of Michigan will be released on Friday ahead of the Philadelphia Fed Manufacturing Review, released on Thursday.

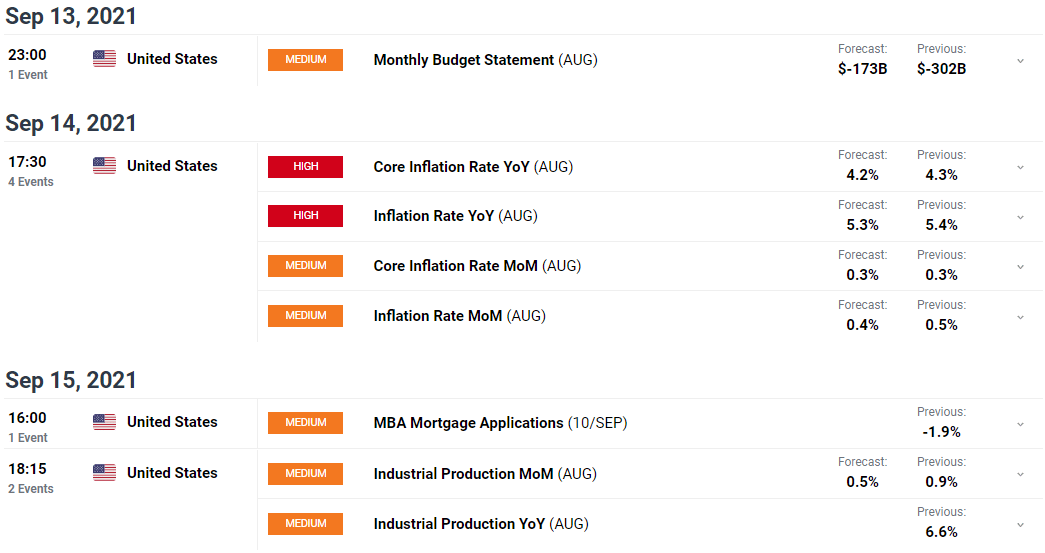

Key Events in The US During the Week of Sept. 13–17

The next week features yearly core inflation data, which is expected to slightly decline. However, a major surprise in numbers may trigger a big movement in the market.

Furthermore, retail sales data will be released on Tuesday, which is expected to slightly improve. Retail sales data is important as it is considered an indicator to gauge market activity. Finally, on Friday, Michigan Consumer Sentiment data is expected to release, which may support the US dollar.

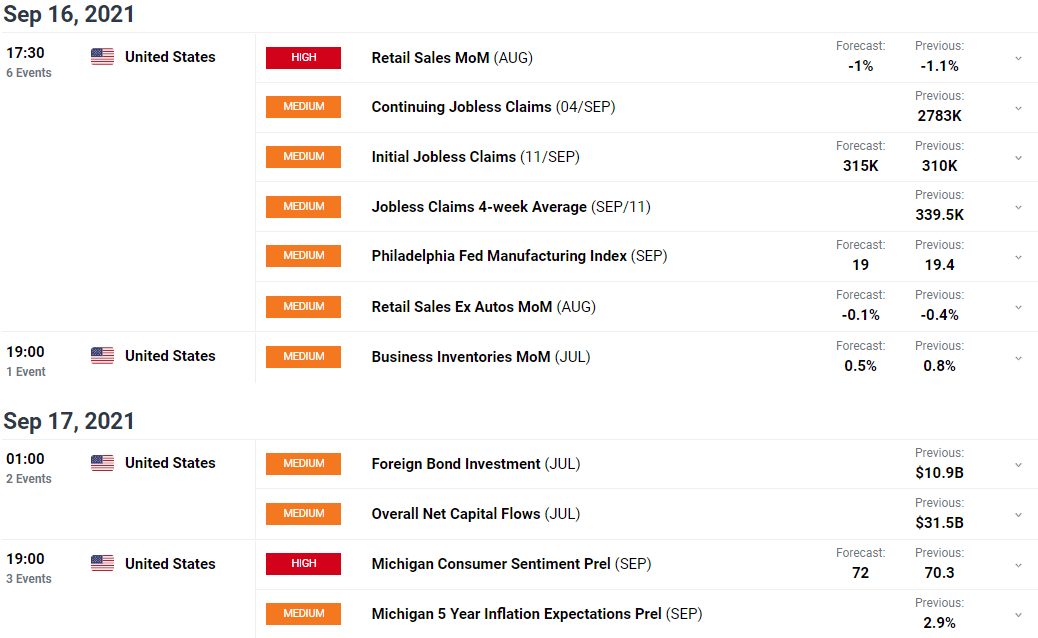

Gold Daily Chart – Weekly Forecast

Gold Weekly Technical Forecast: Bearish Dominance Ahead

The gold prices stayed below the key SMAs for the entire week. Tuesday’s widespread down bar came up with a very high volume and closed at the lows. The price formed a double top at $1,833 and has been falling since then. This could be a sign of a top-reversal pattern.

However, the price may attempt to test or break the double top in the coming week. On the downside, the price may test support levels at $1,772 ahead of $1,750.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more